Coinbase CEO Criticizes SEC, Explores Opportunities in UAE Amid US crypto Regulatory Uncertainty

Armstrong Maintains US Commitment While Seeking International Expansion in Crypto-Friendly UAE

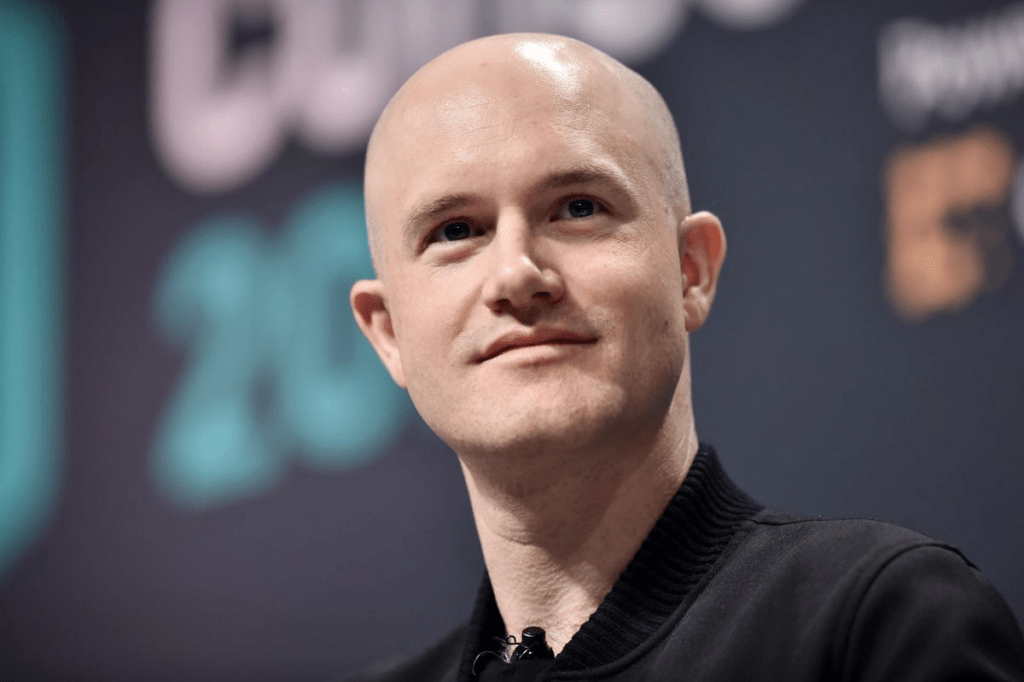

Brian Armstrong, CEO of leading cryptocurrency exchange Coinbase, has reiterated his criticism of U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler while emphasizing that Coinbase will not relocate its headquarters from the United States. Armstrong's comments come amid ongoing regulatory uncertainty for the cryptocurrency industry in the U.S., which has seen companies like FTX and Terra fail and crypto prices plummet, leading to significant investor losses.

The SEC has accused Coinbase and other crypto companies of selling unregistered securities to investors, a claim which Coinbase disputes. Armstrong argues that the SEC is an outlier in this regard, with Gensler taking a more anti-crypto stance for unknown reasons. He believes Gensler's actions are not geared towards regulating the industry but curtailing it, with lawsuits creating an unhelpful environment for the U.S. crypto sector. However, Armstrong sees this as an opportunity for Coinbase to gain clarity from the courts, which could benefit the industry and the U.S. more broadly.

While Armstrong has previously suggested that Coinbase might be forced to move its headquarters overseas, he has now walked back on this statement. He noted that the U.S. is currently lagging in its regulatory approach compared to the European Union and the United Kingdom, both of which have adopted more comprehensive and welcoming crypto legislation.

Despite this commitment to maintaining a U.S. presence, Coinbase is actively seeking to increase its international investments. Armstrong and Nana Murugesan, Coinbase's VP of International & Business Development, are currently in the United Arab Emirates (UAE) to explore potential strategic opportunities in the region. The UAE has been an increasingly attractive destination for cryptocurrency businesses, thanks to its clear regulatory framework, dedicated crypto regulator, and strong investor and customer protections.

Coinbase is working with Abu Dhabi Global Market (ADGM) regulators to secure licensing for Coinbase International Exchange, a crypto derivatives trading platform launched in Bermuda. The company is also seeking additional licenses and partnerships in Dubai, as the Virtual Assets Regulatory Authority (VARA) develops a retail framework for virtual assets.

Coinbase's lawsuit against the SEC aims to address questions regarding the application of securities laws to digital assets. A court has ordered the SEC to respond to the complaint within 10 days. Coinbase Chief Legal Officer Paul Grewal cites the Petition Clause as a means to protect individuals' rights to appeal to courts and other government-established forums for legal dispute resolution, urging Gensler to comply and respond to the complaint.

Armstrong has praised the UAE's forward-thinking approach to cryptocurrency regulation, recognizing it as the first dedicated crypto regulator worldwide with a clear rule book. He also commended the UAE's business-friendly environment and robust customer protections, and is reportedly enjoying his visit to the country.

With over 11% of the population in the Middle East, Africa, and India owning cryptocurrency, the UAE serves as a strategic hub for crypto adoption. Coinbase's efforts to engage with policymakers, regulators, and clients in the region highlight the company's interest in expanding its global reach while remaining committed to the U.S. market.

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex