Investing in NL Industries: A Financial Performance and Growth Analysis

Unveiling the Potential of NL Industries: A Resilient Investment Choice Amid Market Cycles

NL Industries (NYSE:NL): A Worthy Addition to Your Portfolio?

NL Industries, a company with a historical pedigree and rich industry reputation, presents a compelling investment opportunity in the current financial climate. This article will delve into various aspects that make NL Industries a potentially lucrative choice for investors, including the firm's fundamentals, revenue growth, and financial performance.

The Historical Context and Market Position

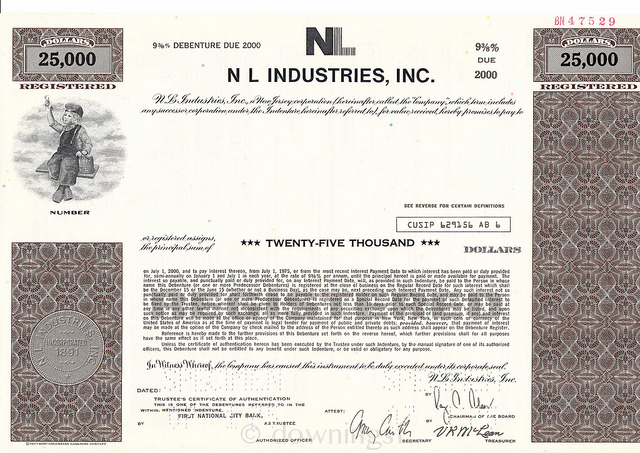

Once known as the National Lead Company and a part of the original Dow Jones Industrial Average, NL Industries has an impressive legacy dating back to the late 1800s. Over the years, the company has diversified its portfolio into machined metals, marine industry hardware, and security products. The company is now valued at $270.4 million and has a diverse array of offerings that stretch across various sectors, making it resilient in the face of market fluctuations.

NL Industries: Financial Resilience and Consistent Dividends

Although NL Industries may seem like a risky bet due to its cyclical manufacturing trends and modest market cap, its resilient performance tells a different story. Despite a 22% drop in the last 12 months, it has rebounded with a staggering 120% increase in the last 36 months, outpacing the S&P 500's returns during the same period.

Notably, NL Industries offers a strong dividend yield of 5.1%, indicative of its commitment to returning value to shareholders. Moreover, it has announced a quarterly dividend of 7 cents per share, providing an additional incentive for dividend investors.

Analyzing NL Industries’ Financial Performance

Digging deeper into NL Industries' financial data, the company has shown a promising trend of growing annual gross profits, which has increased from $24 million in 2012 to $49 million in 2022. This impressive growth trajectory reflects NL Industries’ ability to increase profitability and manage its operational efficiency effectively over the past decade.

Despite a recent 21% dip in its share price, the company’s value has soared by 108% over the past three years. As the market sentiment does not always reflect a company's underlying business performance, this discrepancy might present a unique opportunity for potential investors to buy into NL Industries.

Revenue Growth and Market Potential

One of the key drivers behind NL Industries' share price growth is its revenue growth, which has been steadily increasing by approximately 14% per year. This rate indicates a healthy expansion in its business operations, suggesting potential for further upward momentum in the future.

Moreover, the company's highest closing stock price stands at $15.08 (as of June 9, 2011), a significant increase from the current share price of $5.73 (as of June 1, 2023). This gap represents an immense growth potential for the company, given its strong financial performance and the robust demand for its diversified product offerings.

Final Thoughts: An Opportunity Worth Considering

The future prospects of NL Industries look bright, given its resilient financial performance, consistent dividend yield, and robust revenue growth. While the company's share price has seen fluctuations in recent quarters, the underlying business fundamentals remain strong, indicating that the recent dip in share price might indeed represent a potential buying opportunity.

Investors considering NL Industries should pay heed to Trading News' analysis and the aforementioned factors. The company's positive outlook and a history of outperforming the market, despite cyclical economic trends, make it an attractive investment option. Potential investors should take note of the upcoming ex-dividend date this Friday to be eligible for the next dividend payout.

Despite the recent dip in NL Industries' share price, its overall growth trajectory and the strong fundamentals demonstrate that it could be a valuable addition to any portfolio. However, like with any investment, a thorough examination of the company's performance trends and growth prospects is crucial before making an investment decision.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex