Oil Stocks Show Resilience and Growth Potential Amid Oil Prices Forcasts

Forecasts Indicate a Bright Future for Oil Stocks, Highlighting Companies Like Noble Corp. Transocean | That's TradingNEWS

Trading News - The arena of the global energy market is dynamic, to say the least, but amidst the rapid changes, the potential and prominence of oil stocks continue to shine through. A detailed exploration of the recent market trends brings offshore drilling companies, particularly Noble Corp. (NYSE:NE) and Transocean (NYSE:RIG), into sharp focus. These companies' oil stocks have demonstrated an upward trajectory that financial experts are suggesting is worth attention.

Several industry figures and financial analysts have projected a bright future for these oil stocks, emphasizing the strong financial positions of the respective companies and their readiness to capitalize on the significant role of oil in the global energy mix. As we delve deeper into this narrative, it is important to understand the various facets that contribute to the positive outlook on oil stocks.

A key insight into the future trajectory of oil stocks comes from the oil service industry leader, Schlumberger (NYSE: SLB). The company's comprehensive analysis of the offshore opportunities in the oil stock market underlines the promising future for these investments. Schlumberger's forecast suggests that major oil companies could inject up to $500B into new projects between 2022 and 2025, underlining the significant role oil stocks are set to play in investment portfolios in the coming years. Reinforcing the resilience of oil stocks, Schlumberger highlights that 85% of offshore fields can sustain profitability even if oil prices drop to as low as $50 per barrel.

This fact in itself serves as a robust testament to the inherent strength of oil stocks, reinforcing their importance in investment portfolios and their potential for growth in the coming years. As we look at the performance of individual oil stocks, several companies exhibit promising indicators.

Oil Stocks are Primed for a Surge Amid Increasing Oil Demand >>MORE

Among the oil stocks to watch, Barclays analyst David Anderson singles out Noble Corp. He points to the company's "enormous recontracting opportunity" over the next two years, coupled with its clean balance sheet and a robust buyback program currently in progress. The positive indicators associated with Noble Corp.'s operations make it a potentially prosperous oil stock that investors should not overlook.

As we broaden our perspective to encompass the overall landscape of the oil and gas sector, Deloitte provides an optimistic outlook for oil stocks. The firm's prediction for a strong 2023 provides an additional pillar of support for the growth prospects of oil stocks. This positive prognosis is based on the fact that an overwhelming 93% of executives surveyed in the oil and gas sector reported a positive outlook for 2023. This sentiment signals a healthy prognosis for oil stocks, which should undoubtedly capture the interest of savvy investors.

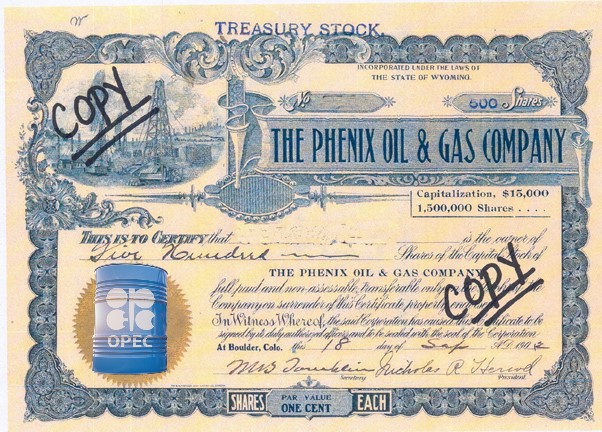

Despite the daunting prospect of a global recession and various macroeconomic uncertainties, oil stocks have exhibited a commendable degree of resilience. The stability in crude oil prices has been instrumental in maintaining this resilience. Thanks to the significant production cuts made by the Organization of Petroleum Exporting Countries (OPEC), Russia, and other allies, oil stocks have been able to weather the storm of economic uncertainty.

This stability in oil prices, achieved through calculated production cuts, suggests a possible increase in profitability for oil stocks as they navigate through a recovering global economy. Such stability provides a robust foundation for the future growth of oil stocks, an aspect that potential investors should take into account.

Adding to the narrative surrounding the promising future of oil stocks are the forecasts from Goldman Sachs. The well-established financial services firm has raised its price forecast for Brent crude oil, predicting a rise to $95 per barrel by December 2023, and further to $100 per barrel by December 2024. These upward revisions of Brent crude oil prices, backed by the analysis from Goldman Sachs, indicate potential growth in oil stocks, particularly if the US economy manages to avoid a severe recession.

As the world gradually recovers from the impacts of the COVID-19 pandemic, a resurgence in economic activities is likely to lead to an increase in the demand for oil. According to the International Energy Agency (IEA), a surge in global crude oil demand is expected during the second half of 2023. The agency further projects that the demand-supply imbalance during this period could lead to an increase in oil prices, creating a favorable environment for the growth of oil stocks.

In conclusion, the current landscape of the energy sector might seem to be shifting towards greener sources, but that does not necessarily undermine the potential of oil stocks. The strong financial footing of oil companies and encouraging forecasts, paired with the resilience of oil stocks amidst complex market dynamics, underscore the growth potential in the oil sector. The story of oil stocks is far from over. On the contrary, it holds many fascinating possibilities for investors worldwide, making these stocks a promising option to consider for diverse investment portfolios.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex