Potential Solution to Treasury Market Liquidity Amid Economic Uncertainty

Addressing Liquidity Challenges with a New Trading Approach While Navigating Recession Fears and Inflation Concerns

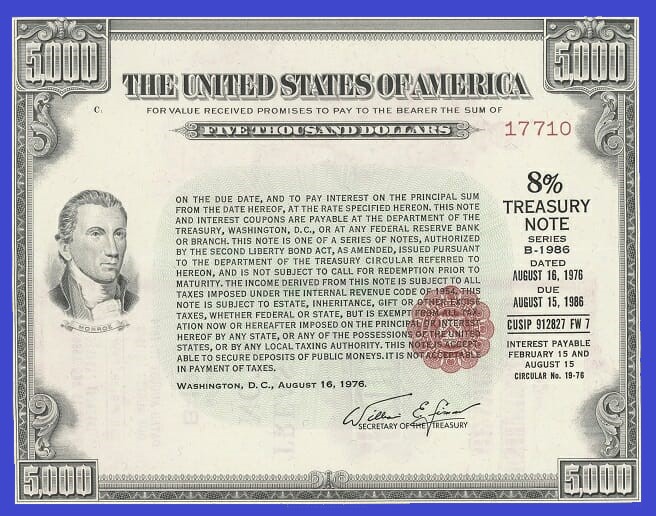

The Treasury market is currently facing a liquidity problem, which has been exacerbated by regulatory changes implemented after the 2008 financial crisis. One potential solution to this issue, known as "all-to-all" trading, could increase trading volume and reduce bond yields. This innovative approach would enable any market participant to interact directly with another without the need for intermediaries, a system more akin to how the stock market operates. Traditionally, banks have acted as dealers for buyers and sellers in the Treasury market.

The Inter-Agency Working Group, which consists of officials from the Federal Reserve, Treasury, SEC, and CFTC, is currently evaluating the advantages and disadvantages of implementing all-to-all trading in the Treasury market. Prior to 2008, banks could manage large trade flows from Treasury investors without needing to augment their capital. However, post-crisis regulations mandated higher capital requirements, making it difficult for banks to expand their balance sheets in response to large trades.

The Treasury market's growth after 2008 further complicated matters. As the government introduced substantial stimulus measures to revive the economy, debt levels soared. Deficit spending rose in response to the COVID-19 crisis, with marketable US debt reaching nearly $23 trillion, a significant increase from $5 trillion in 2008. Although this debt was intended to bolster economic recovery, it inadvertently weakened the market's liquidity, particularly when Treasury traders attempted to execute large trades during moments of financial stress.

The ICE BofA MOVE Index, which measures expected fluctuations in Treasuries based on one-month options, has fallen almost 40% since its peak in mid-March 2023. The same week, two-year Treasury yields concluded just below 4.2%, a slight increase from the previous week. Swaps traders have raised the likelihood of the Fed implementing a quarter-point hike in May, followed by another in June, to approximately 20%. This expectation stems from the economy's resilience and the continued distance of inflation from the central bank's 2% target.

Darrell Duffie, a Stanford professor, highlighted that the inability of dealers to manage the large volume of Treasury sales during March 2020 led to a significant decline in market depth. Consequently, all-to-all trading has emerged as a viable alternative, offering market resilience by reducing reliance on dealers. Duffie, who has previously advised the Chicago Federal Reserve, anticipates tremendous growth for the Treasury market with the implementation of all-to-all trading.

However, uncertainty lingers in the market due to various factors. Traders have increased bets on the Fed raising interest rates in both May and June, which could postpone the central bank's long-awaited pause. Concerns are also mounting regarding the resolution of the debt limit dispute in Washington and the potential impact on the economy if banks reduce lending to boost investor confidence.

According to Duffie, the adoption of all-to-all trading would likely facilitate electronic trading platforms, encouraging trades of any size and opening the doors to algorithmic and high-frequency trading. As more traders participate, costs will decrease, further attracting participants. Duffie also predicts that increased liquidity will lead to reduced transaction costs, causing asset prices to rise and Treasury security yields to decrease, thereby allowing the government to fund US deficits more affordably.

This change may also have implications for stock prices, which generally increase when bond yields decline. For example, the S&P 500 experienced a downturn last year as yields increased due to Fed rate hikes, and stocks rallied earlier this year when yields fell. However, the introduction of all-to-all trading could also attract less rational investors to Treasury markets, potentially promoting a gambling mentality for some trades.

Despite the recent relative stability in the two-year US Treasury yields, many bond traders remain cautious, as they do not expect this calm to last.

Silicon Valley Bank, for example, triggered fears of a banking crisis and led to heightened volatility in the market, particularly for two-year US Treasury yields, which are highly sensitive to expected changes in interest rates. This event has left investors balancing between the possibilities of a recession, a soft landing, or any scenario in between, further contributing to the uncertainty in the market.

Michelle Girard, head of US at NatWest Markets, expressed concerns about the potential for a credit crunch that could severely constrain consumers. She anticipates a recession later this year due to tightening monetary policy but expects inflation to remain above the Fed's target, preventing rate cuts until 2024. Consequently, Girard believes that 10-year Treasury yields may not fall significantly further, despite swaps traders pricing in rate cuts later this year.

Benchmark 10-year yields currently trade just below 3.6%, down from a high of 4.1% earlier in the year and around 60 basis points less than those on 2-year notes. The gap has narrowed since reaching a low of minus 111 basis points on March 8, the most profound inversion since the early 1980s, as the failure of Silicon Valley Bank and two other lenders fueled recession concerns.

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities, commented on the volatility experienced in the two-year note market, attributing it to the actions of the Fed and other central banks. He noted that the Fed is attempting to separate financial stability from monetary policy, with these efforts potentially colliding in May.

In conclusion, the all-to-all trading proposal for the Treasury market could offer a way to address the liquidity problem and potentially lead to increased trading volume and reduced bond yields. However, numerous factors contribute to the ongoing uncertainty in the market, including concerns about recession, inflation, and the potential impacts of tightening monetary policy. The implementation of all-to-all trading may provide some relief, but bond traders and investors must remain vigilant and adaptable to the ever-changing landscape of the Treasury market.

C- the writer read Bloomberg

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex