Amazon (NASDAQ:AMZN): Undervalued at $145, Massive Growth Potential

Despite a 50% YTD surge, Amazon’s true value remains untapped as AWS and e-commerce thrive | That's TradingNEWS

NASDAQ:AMZN Surges with Record-Breaking Momentum: Unveiling the Growth Drivers and Challenges Behind Amazon’s Dominance

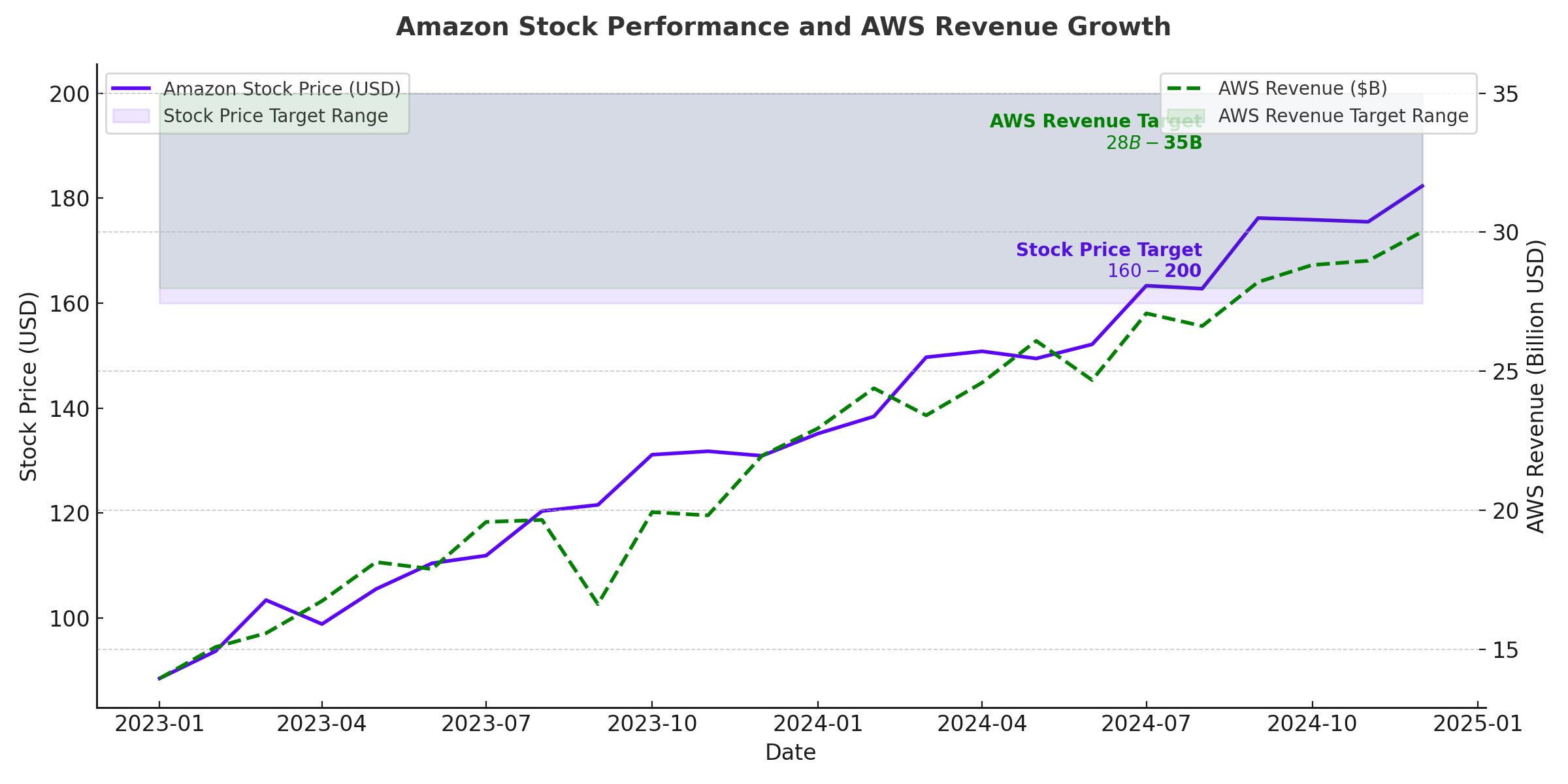

Amazon (NASDAQ:AMZN) has emerged as a formidable force in the stock market in 2024, with its shares surging nearly 50% year-to-date (YTD). This phenomenal performance underscores the resilience and innovation fueling its multi-faceted operations. In just the last two months, Amazon’s stock has soared by 25%, buoyed by its stellar Q3 earnings, record-breaking holiday sales, robust AWS growth, and strategic investments in next-gen technologies. As investors weigh its valuation against its growth trajectory, the question remains: does Amazon still represent a buying opportunity, or is the rally overextended? Let’s dive into the intricate details behind its performance, dissecting every angle to unveil the complete picture.

Q3 FY2024 Earnings: Shattering Expectations Across Key Metrics

Amazon’s Q3 FY2024 earnings were a masterclass in exceeding market expectations. Net sales reached $143.1 billion, marking an 11% year-over-year (YoY) growth and surpassing the high end of its guidance range. Operating income soared by an impressive 55% YoY to $17.4 billion, underscoring the company’s improved cost efficiencies. However, the highlight was Amazon’s diluted earnings per share (EPS), which climbed 52% YoY to $1.43, delivering the biggest earnings surprise in four quarters.

Much of this success can be attributed to the resurgence of its e-commerce operations and the continued dominance of AWS. With e-commerce accounting for over 82% of Amazon’s net sales in the first nine months of 2024, the company demonstrated its ability to capitalize on shifting consumer behaviors and macroeconomic trends. On the other hand, AWS solidified its position as Amazon’s profit engine, driving both revenue and margin expansion.

Record Holiday Sales Fuel E-Commerce Dominance

The holiday shopping season has historically been a critical period for Amazon, but 2024 stands out as a landmark year. Between November 21 and December 2, Amazon recorded its largest-ever sales for this period, thanks to an aggressive push in early promotions and expanded same-day delivery services. These efforts, combined with the introduction of ultra-low-price deals through initiatives like “Amazon Haul,” set the stage for unparalleled consumer engagement.

Data from Adobe Experience Cloud revealed an 8.4% YoY increase in U.S. holiday spending, substantially higher than the 4.9% growth observed in 2023. Amazon’s innovations, particularly in logistics and delivery, played a pivotal role in capturing this growth. For instance, the company’s expanded network of same-day delivery services not only boosted consumer satisfaction but also strengthened its competitive edge during the fiercely contested Black Friday and Cyber Monday events.

AWS: Powering Profitability and Innovation

AWS remains the crown jewel in Amazon’s portfolio, contributing $27.5 billion in Q3 net sales, a 19.1% YoY increase. More importantly, AWS achieved a record-high operating margin of 38.1%, fueled by cost controls and extended server lifecycles. This underscores the platform’s ability to deliver consistent growth while maintaining profitability.

A key driver behind AWS’s success is its focus on artificial intelligence (AI). The introduction of Bedrock and Trainium technologies has revolutionized AWS’s offerings. Bedrock enables developers to deploy AI models effortlessly on Amazon’s infrastructure, while Trainium provides a cost-effective alternative to Nvidia GPUs for machine learning tasks. Together, these innovations have positioned AWS as a leading platform for AI development, attracting clients ranging from startups to Fortune 500 companies.

Moreover, having proprietary AI technologies gives Amazon greater control over its infrastructure costs. For example, Trainium chips are not only more affordable than external GPUs but also enhance operational efficiency. This dual benefit of cost savings and innovation underscores AWS’s pivotal role in driving Amazon’s long-term growth.

Labor Challenges: The Persistent Thorn in Amazon’s Side

While Amazon’s financials paint a picture of resilience, the company continues to grapple with labor issues, particularly in its e-commerce segment. Recent strikes across 20 countries, organized under the “Make Amazon Pay” campaign, highlight the growing discontent among its workforce. Additionally, the International Brotherhood of Teamsters (IBT) has issued a December 15 deadline for Amazon to negotiate better terms for workers, adding another layer of pressure.

These challenges are further compounded by political scrutiny. Senator Bernie Sanders, for example, has criticized Amazon for its worker injury rates, particularly during peak sales periods like Prime Day. While these issues have yet to significantly impact Amazon’s operations, they represent a persistent risk, especially as e-commerce continues to contribute a larger share of the company’s profits.

Capital Expenditures: Investing in the Future

Amazon’s aggressive capital expenditure strategy reflects its commitment to staying ahead in the technology arms race. In Q3, the company’s capex reached $22.6 billion, nearly doubling the $12 billion spent in the same period last year. Much of this investment is directed toward AI infrastructure for AWS, with additional spending on logistics and content creation.

While such high levels of capex have weighed on free cash flow (FCF) growth, they are expected to deliver long-term benefits. For instance, early investments in AI infrastructure position AWS to capitalize on the rapidly growing demand for generative AI services. Furthermore, management has guided for $75 billion in capex for FY2024, implying a 65.1% YoY increase in Q4 alone. This level of investment underscores Amazon’s commitment to innovation, even if it comes at the expense of short-term profitability.

Valuation: A Premium Worth Paying?

At a forward P/E ratio of 44.1x, Amazon’s valuation may seem steep compared to peers like Alphabet (22.1x) and Apple (32.9x). However, when viewed through the lens of its PEG ratio (0.34x), the stock appears attractively priced relative to its earnings growth. Moreover, Amazon’s five-year average P/E of 178.1x suggests that there is still considerable room for upward valuation adjustments.

What sets Amazon apart is its diversified revenue streams. While e-commerce accounts for the majority of its sales, AWS contributes a disproportionate share of its profits. This dual-engine model provides a level of stability and growth potential that many of its peers lack. Additionally, Amazon’s operational efficiencies and robust cash flow generation make it a compelling investment, even at current valuations.

The Road Ahead: Navigating Risks and Opportunities

As Amazon looks toward Q4 and beyond, several factors will shape its trajectory. On the positive side, record holiday sales, AWS growth, and strategic investments in AI position the company for sustained success. However, labor challenges and high capex levels remain key risks. Management’s ability to navigate these challenges while capitalizing on growth opportunities will be critical.

Analysts expect Amazon’s FY2024 net income to reach $54.15 billion, translating to a forward P/E of 39.6x for 2025. Given the company’s operational strengths and market dominance, these projections appear achievable. Moreover, Amazon’s focus on innovation and efficiency ensures that it remains well-positioned to capture future growth.

In conclusion, Amazon’s stellar performance in 2024 underscores its resilience and adaptability. While challenges remain, the company’s strong financials, innovative technologies, and strategic investments make it a compelling buy for long-term investors. For real-time updates and insights, visit Trading News.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex