Amazon’s Q2 2024 Earnings Expose a Mixed Bag: Can AWS Power Through Retail Struggles?

With AWS driving profits and retail facing hurdles, is Amazon Stock (NASDAQ: AMZN) poised for a rebound, or are storm clouds on the horizon? | That's TradingNEWS

(NASDAQ: AMZN)Stock Analysis – Is Amazon Still a Buy After Recent Earnings ?

Mixed Q2 2024 Earnings for NASDAQ:AMZN

Amazon (NASDAQ:AMZN) experienced a significant drop of around 9% in its share price following the release of its Q2 2024 earnings report on August 1, 2024. While the company managed to outperform expectations on earnings per share (EPS), posting $1.26 versus the anticipated $1.03, its revenue fell short at $147.98 billion compared to the forecasted $148.76 billion. Furthermore, Amazon’s guidance for Q3 2024 projected revenue between $154 billion and $158.5 billion, slightly below the consensus estimate of $158.2 billion. Despite this dip, major indices like the S&P 500 and NASDAQ have shown resilience, buoyed by positive economic indicators and a recent signal from the Fed on potential interest rate cuts.

Segment Performance Breakdown

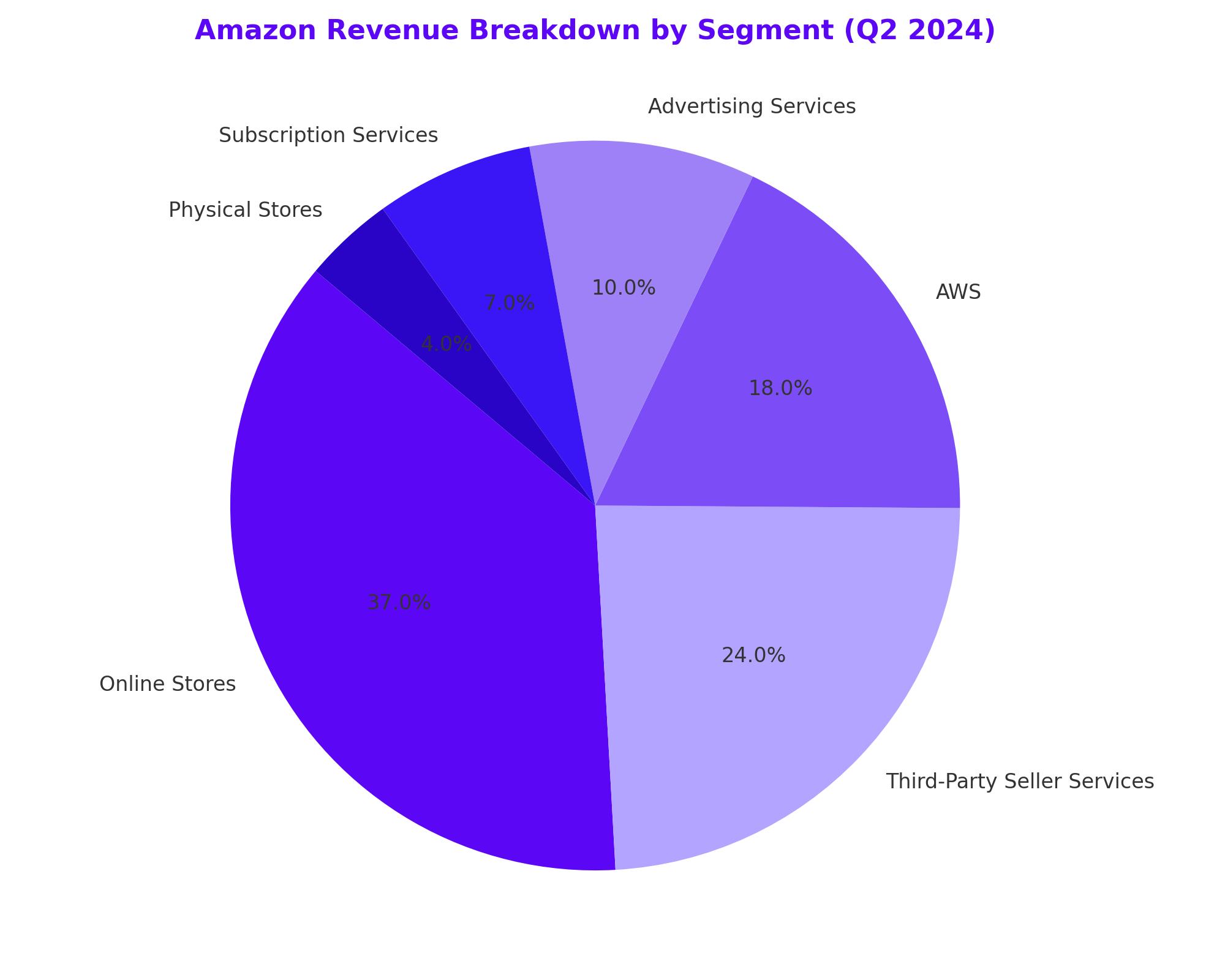

Amazon’s revenue streams are diverse, with contributions from online stores, physical stores, third-party seller services, advertising services, subscription services, Amazon Web Services (AWS), and other ventures. In Q2 2024, the most significant revenue contribution came from online stores, which accounted for 37% of total revenue, followed by third-party seller services at 24%, and AWS at 18%.

Retail Segments Show Weakness:

Amazon’s performance in its online and physical stores segments has been lackluster. Online sales grew by 6% year-over-year (YoY) and only 1% quarter-over-quarter (QoQ), while physical store sales increased by 4% YoY and remained flat QoQ. CEO Andy Jassy attributed this sluggish growth to consumers trading down on price, particularly for higher-ticket items like electronics, reflecting broader economic uncertainties. This trend is consistent with reports from other major retailers like Home Depot and Lowe’s, which have also noted a cautious consumer environment.

However, despite the current challenges, Amazon’s market position remains strong. The company is the second-largest retailer globally, behind Walmart, and holds a dominant 40% share of the U.S. e-commerce market. Concerns about Amazon losing market share to competitors like Walmart, Temu, and Shein are valid but possibly overstated. Amazon’s robust logistics infrastructure, extensive delivery network, and its powerful Prime membership program, which boasts over 200 million members, are significant competitive advantages that are difficult for rivals to replicate.

Amazon (NASDAQ: AMZN) AWS: A Beacon of Strength For Company's Stock Growth

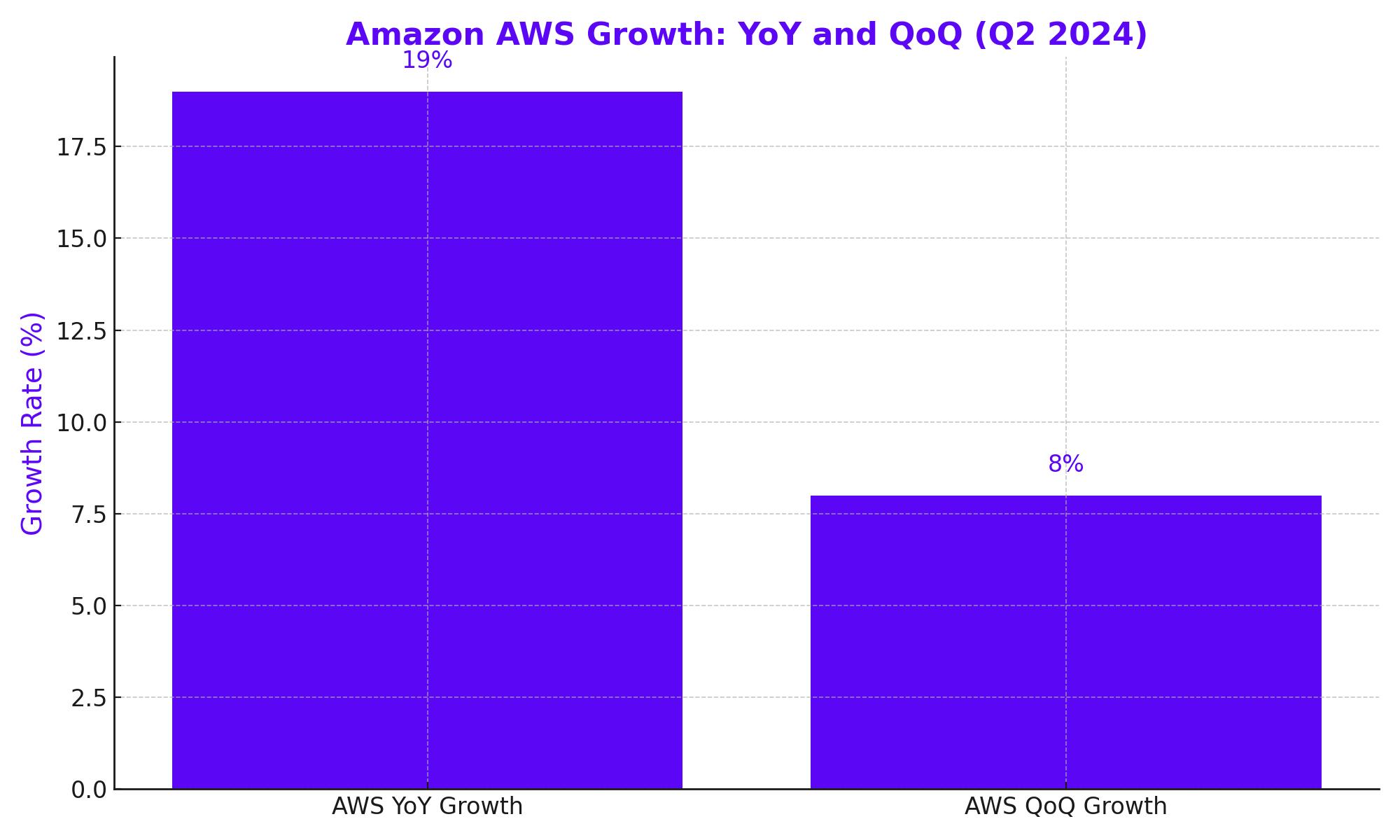

AWS continues to be a critical growth driver for Amazon. In Q2 2024, AWS revenue grew by 19% YoY and 8% QoQ, showcasing strong demand despite the competitive landscape. AWS maintains its leadership in the cloud market, holding a 32% market share compared to Microsoft Azure’s 23% and Google Cloud’s 12%. The segment also saw a notable expansion in operating margins, which increased from 24% in Q2 2023 to 35% in Q2 2024, driven by a reacceleration in cloud contracts and the growing adoption of AI workloads.

Amazon’s significant investment in AI, including a $4 billion stake in Anthropic, is expected to further strengthen AWS’s offerings, positioning it well for future growth in AI-driven services. With AWS generating approximately $105 billion in annual revenue, its continued success is vital for Amazon’s overall profitability.

Challenges in Third-Party Seller Services and Advertising

One area of concern is the decelerating growth in Amazon’s third-party seller services and advertising segments. Third-party seller services, which contribute 24% of Amazon’s revenue, saw YoY growth decline from 18% in Q2 2023 to 13% in Q2 2024. Feedback from third-party sellers indicates that rising costs, particularly in fulfillment by Amazon (FBA) services, are pushing some sellers towards competitors like eBay and Shopify. This could potentially weaken Amazon’s marketplace network effects, a key strength that has driven its e-commerce dominance.

Similarly, Amazon’s advertising revenue growth, which was once a highlight, has slowed to 20% YoY, down from mid-20% levels in previous years. Given that a substantial portion of this revenue comes from third-party sellers, further declines in seller participation could impact this segment’s future performance.

Valuation and Outlook

Amazon’s current forward P/E ratio stands at 31x, which is competitive within its industry but slightly lower than its historical averages. When evaluated using a forward PEG ratio of 1.6x, Amazon appears undervalued compared to peers like Walmart (3.5x) and eBay (2.4x). Furthermore, a discounted cash flow (DCF) analysis suggests an implied share price of $220.1, representing a 24% upside from current levels. This valuation hinges on continued operating margin expansion and stable revenue growth, both of which seem achievable given Amazon’s current trajectory.

However, the slowing growth in key segments like third-party seller services and advertising remains a risk. If these trends persist, they could temper Amazon’s overall growth prospects. Conversely, AWS’s strong performance and Amazon’s strategic investments in AI and logistics could offset these challenges, supporting long-term value creation.

Conclusion: Is Amazon Stock (NASDAQ: AMZN) a Buy, Hold, or Sell?

Given the mixed signals from Amazon’s recent earnings report, the stock presents both opportunities and risks. While the slowdown in retail segments and third-party services is concerning, AWS’s robust growth and expanding margins provide a strong foundation for future earnings. Amazon’s valuation, when viewed through a forward PEG lens, suggests the stock is undervalued, particularly compared to its peers.

For investors with a long-term horizon, Amazon (NASDAQ:AMZN) remains a Buy. The company’s strong positioning in e-commerce and cloud services, combined with its ability to innovate and adapt, make it a compelling investment. However, it will be crucial to monitor the performance of its third-party seller and advertising segments in upcoming quarters, as these could be key determinants of the stock’s future trajectory.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex