Amazon's Q2 Earnings Preview: Analyzing NASDAQ:AMZN's Growth

Evaluating Amazon's Technological Advancements and AWS Revenue Trends Ahead of the Anticipated Earnings Call on August 1st | That's TradingNEWS

Comprehensive Analysis: NASDAQ:AMZN's Strategic Positioning and Future Outlook

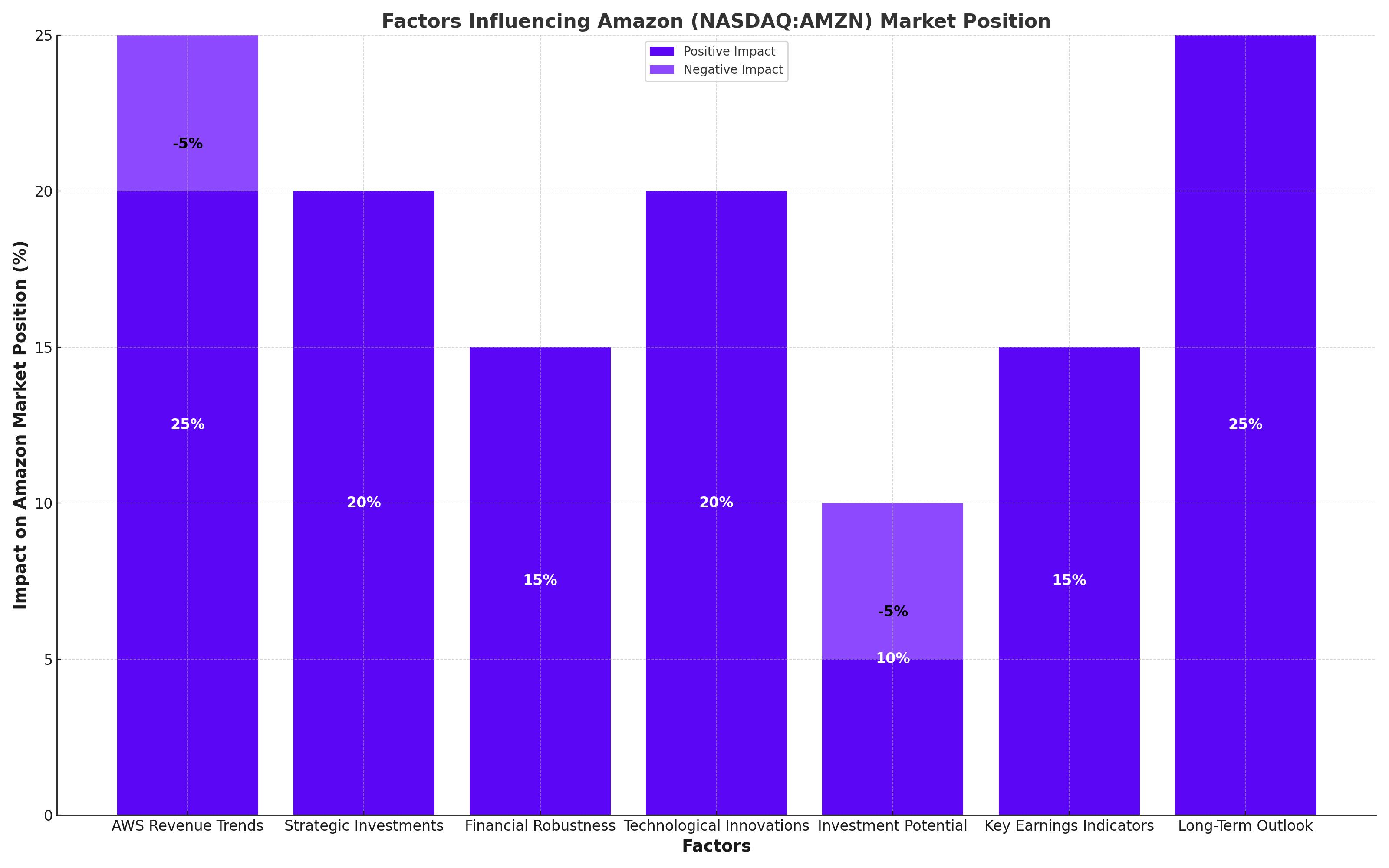

Amazon.com Inc. (NASDAQ:AMZN) has shown notable resilience and growth throughout 2024, with a commendable year-to-date increase of 20% in its stock value, despite experiencing a 7% decline in July. The anticipated release of Q2 earnings on August 1st is poised to provide investors with critical insights into Amazon's adaptation to the evolving technological landscape, especially in artificial intelligence (AI) and its flagship cloud computing service, AWS.

Detailed Review of Amazon Web Services (AWS)

Revenue Trends and Strategic Investments

AWS stands at the forefront of Amazon’s revenue generation strategy, contending with major players like Microsoft Azure and Google Cloud. Amazon's proactive strategy in AI through a $4 billion investment in the AI startup Anthropic underscores its commitment to maintaining a competitive edge. Here’s a breakdown of AWS’s recent revenue figures, showing a promising trend towards growth acceleration:

- Q1 2024: $25.0 billion

- Q4 2023: $24.2 billion

- Q3 2023: $23.1 billion

- Q2 2023: $22.1 billion

- Q1 2023: $21.4 billion

This upward trajectory suggests a revitalization in AWS’s growth, an essential aspect for shareholders to consider during the upcoming earnings discussion.

Financial Robustness: Cash Flow Analysis

Amazon's robust financial health is evidenced by an impressive 82% increase in operating cash flow over the trailing twelve months, as of March 31st. This financial vigor supports Amazon's extensive investments in strategic, high-growth areas such as generative AI, semiconductor developments, and enhancements in logistical operations.

Strategic Direction and Technological Innovations

Amazon’s heavy investment in AI, notably its partnership with Anthropic, is a strategic move to bolster its technological arsenal against competitors. The company’s efforts to integrate AI across its platforms, from AWS to consumer-facing services, are designed to not only enhance service delivery but also to open new revenue streams, particularly in advertising and digital content.

Investment Potential and Stock Viability

Amazon’s stock (NASDAQ:AMZN) experienced a minor setback with a 7% dip in July 2024, which could be perceived as a strategic entry point for investors. This decrease contrasts with the 20% increase witnessed earlier in the year, highlighting potential market volatility and opportunities for price averaging strategies. The core of Amazon’s investment appeal lies in its AWS sector, which demonstrated a robust 17% growth in Q1 2024 from Q1 2023, pushing revenues to $25.0 billion up from $21.4 billion. This growth trajectory suggests a recovery from previous flat growth periods and highlights AWS’s accelerating revenue, marking a critical factor for long-term investment consideration.

Key Indicators to Watch in the Upcoming Earnings Call

Investors should focus on several critical aspects during the earnings call:

- The impact of AI investments on AWS’s performance and overall growth.

- Continuity and expansion of revenue streams across consumer services and advertising sectors.

- Developments in strategic initiatives, particularly the integration of AI and technological advancements.

Long-Term Strategic Outlook

Amazon's strategic positioning within the technology sector suggests a robust trajectory influenced by its innovative capabilities in AI, cloud computing, and consumer services. The company's significant investments in AI are not just enhancing its current offerings but are also setting the stage for future technological integration across various sectors including e-commerce, cloud technology, and digital advertising.

Conclusion: NASDAQ:AMZN as a Long-Term Investment

Given the strategic initiatives, financial health, and market positioning, Amazon presents a compelling investment opportunity. The anticipated growth in AWS, coupled with innovative leaps in AI and operational efficiencies, underpins a positive long-term outlook for the stock. Investors are advised to closely monitor Amazon’s financial performances and strategic direction, as outlined in the upcoming earnings report, to make well-informed investment decisions.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex