American Express Eyes Apple Card Partnership: A Strategic Leap in Fintech

Exploring the implications of American Express potentially acquiring the Apple Card portfolio from Goldman Sachs, and how this move could significantly enhance Amex's market position and value | That's TradingNEWS

American Express' Apple Card Opportunity: A Game Changer in Credit Card Services

Background: Goldman Sachs' Setback, Amex's Potential Gain

Goldman Sachs' partnership with Apple, incorporating the Apple Card and Apple Card Savings Account, is reportedly under scrutiny, with Apple considering a shift away from Goldman Sachs. This situation arises from Goldman Sachs' reported losses exceeding $1 billion since 2020. The termination of this partnership, part of Apple's "Project Breakout" strategy to internalize financial services, aligns with its ambition to develop its own payment processing technology.

The Strategic Fit for American Express

American Express (Amex) emerges as a strong contender to replace Goldman Sachs in the Apple Card partnership, aligning with its recent focus on younger, tech-savvy consumers. Amex's success in attracting millennials and Generation Z, who comprise over 60% of its new consumer accounts globally, makes it a suitable match for Apple's customer base. Moreover, Amex's dual role as a bank and credit card company offers comprehensive credit card processing capabilities, which could be transformative in partnership with Apple.

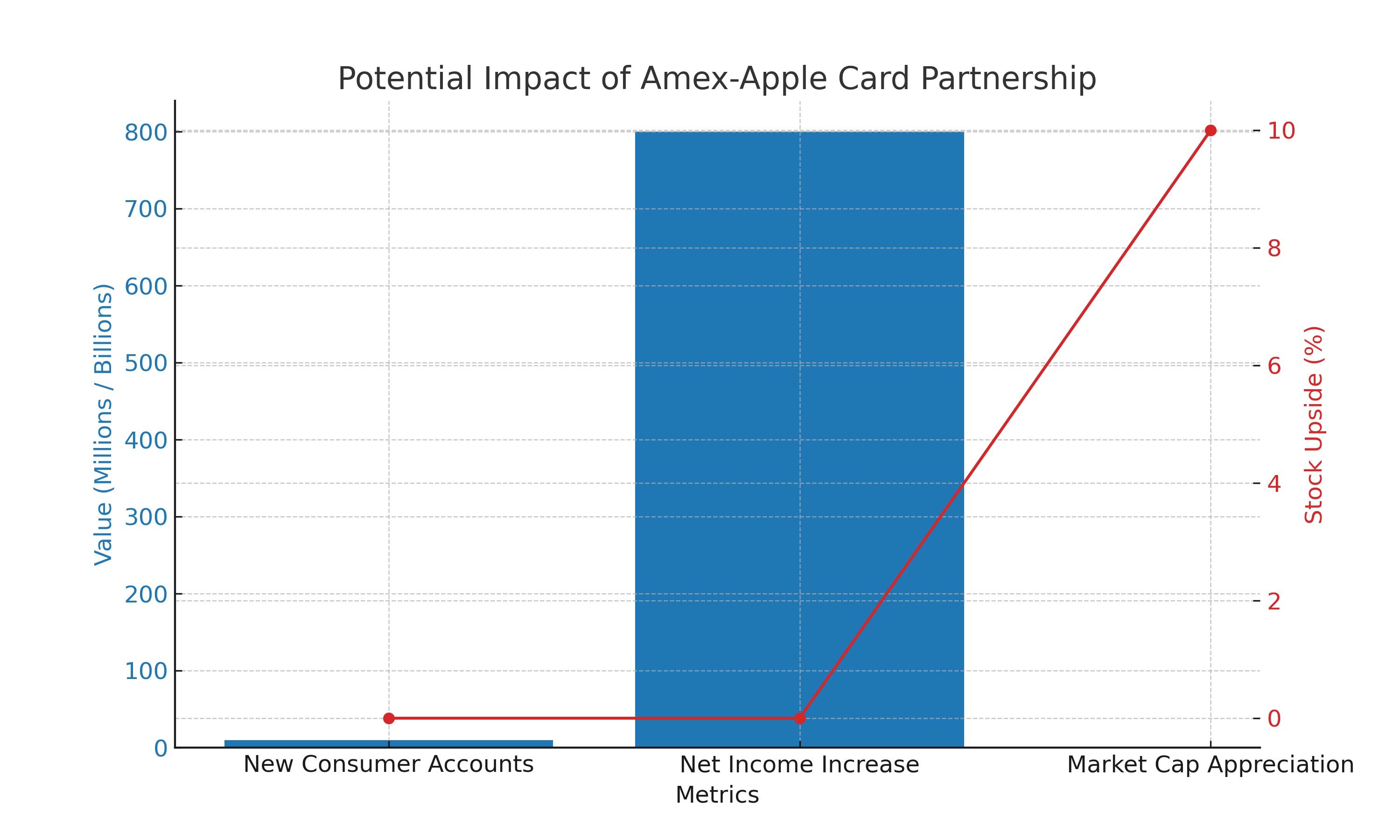

The Potential Impact of the Partnership

Should Amex secure the Apple Card partnership, it stands to significantly expand its reach into the Gen Z demographic, which aligns well with Apple's tech-oriented customer base. With an estimated addition of 10 million new consumer accounts (the number of Apple Card accounts with Goldman Sachs), Amex could see an estimated increase of $800 million/year in net income. This potential growth could lead to a market cap appreciation of roughly $12 billion, translating into a ~10% upside in Amex's stock.

Valuation and Market Position

Despite the potential partnership, American Express already appears undervalued. With a Forward Non-GAAP P/E Ratio of 15.00, lower than competitors like Mastercard and Visa, and a Return on Equity (ROE) of 30.80% significantly higher than the sector median, Amex shows potential for further stock appreciation. Its PEG Ratio (GAAP, FWD) at 1.09, lower than the sector median, suggests that its growth is not fully reflected in its current stock price.

Risks and Challenges

While the opportunity is significant, there are risks. Amex's perceived limited acceptance compared to Visa or MasterCard could challenge the partnership's success. Additionally, integrating and branding the Apple Card under the Amex umbrella might pose branding challenges.

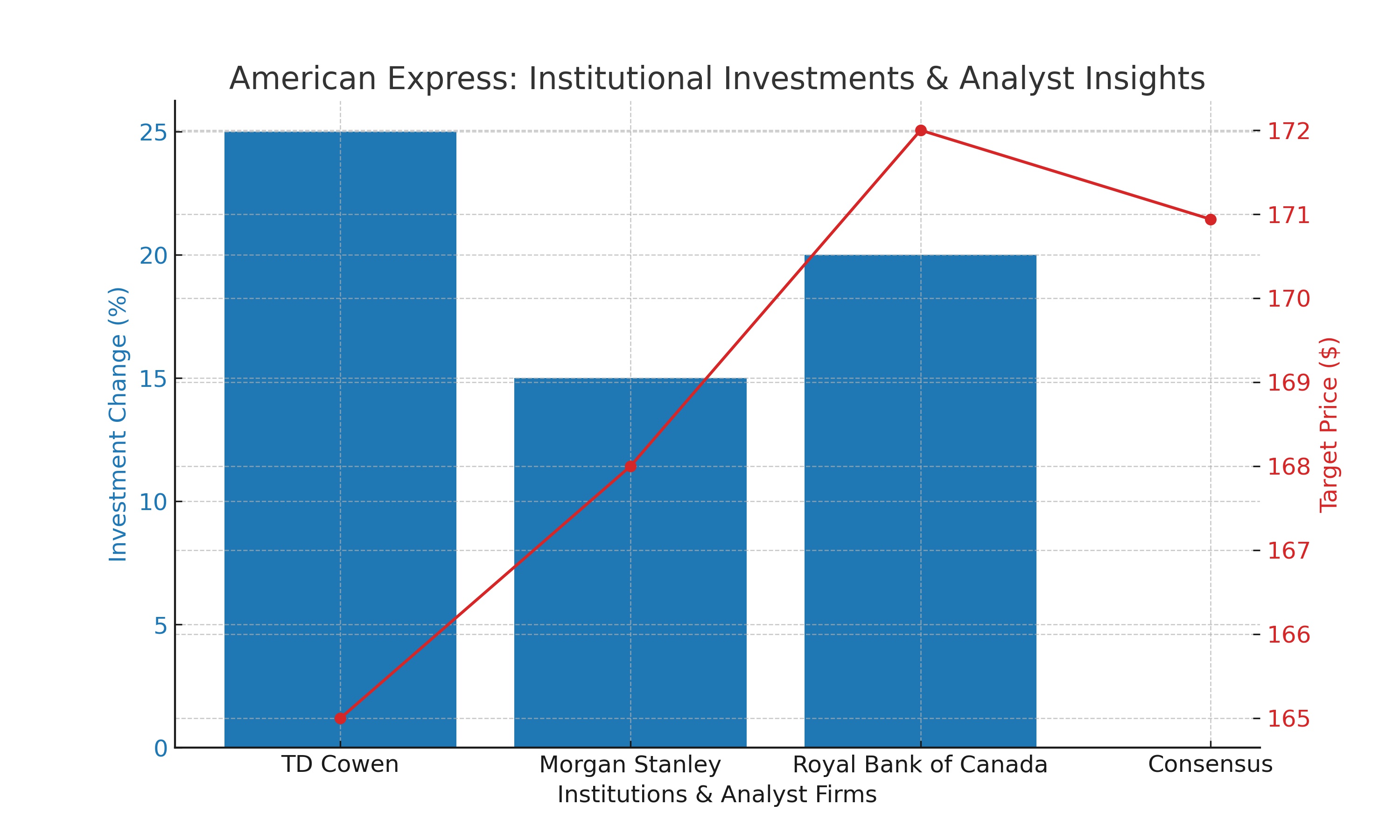

Recent Institutional Investments and Analyst Insights

National Bank of Canada FI's increased stake in American Express by 25.0% in the 3rd quarter, reflecting growing investor confidence. Other significant investments by Moneta Group Investment Advisors LLC and Bank Julius Baer & Co. Ltd Zurich further underscore investor interest in Amex. Analyst ratings, including those from TD Cowen, Morgan Stanley, and Royal Bank of Canada, generally indicate a positive outlook for American Express, with a consensus target price of $170.94.

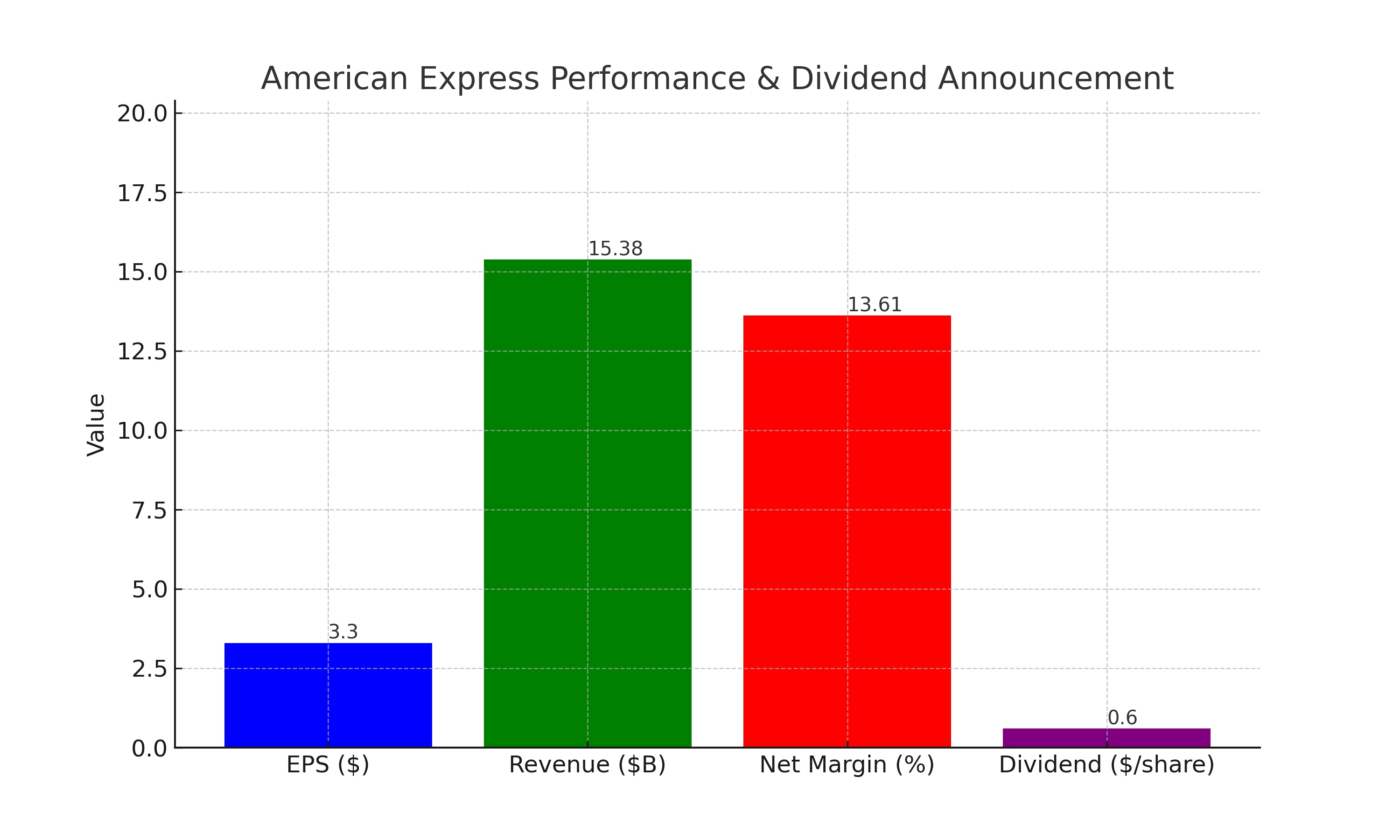

Financial Performance and Dividend Announcement

American Express reported strong quarterly earnings, with a $3.30 EPS for the quarter, surpassing estimates. With a revenue of $15.38 billion and a net margin of 13.61%, the company's financial health remains robust. The recent dividend announcement, with a $0.60 dividend per share, further highlights its stability and commitment to shareholder returns.

NYSE:AXP Dividends and Fiancnail Peformance

Insider Transactions and Executive Confidence in American Express

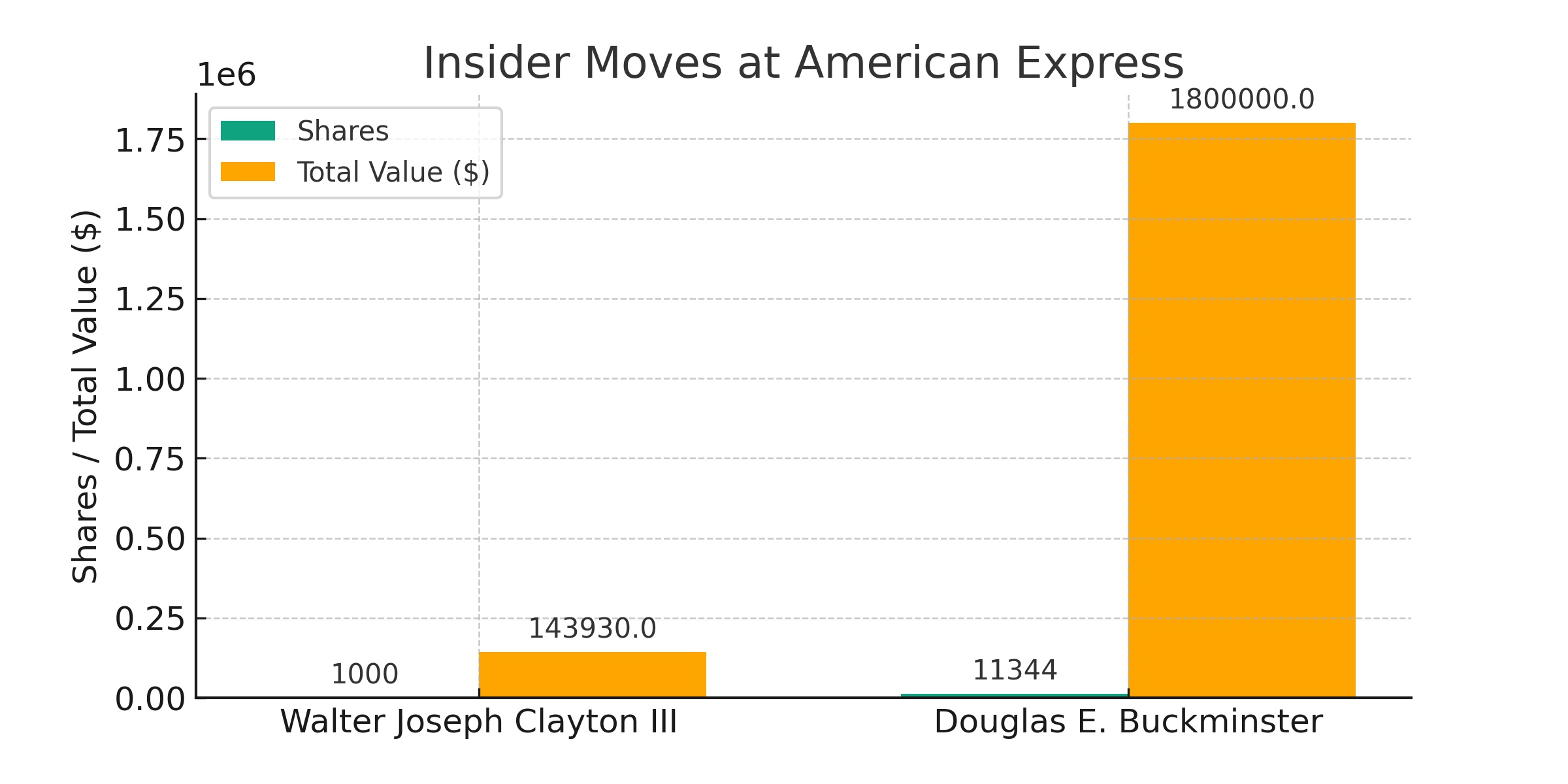

Analyzing Insider Moves at American Express

The insider activity at American Express (NYSE:AXP) provides valuable insights into the confidence levels of its top executives. Director Walter Joseph Clayton III's recent purchase of 1,000 shares at an average price of $143.93 per share, totaling $143,930, and Vice Chairman Douglas E. Buckminster's sale of 11,344 shares at an average price of $158.87, totaling over $1.8 million, reflect varied perspectives within the company's leadership. These transactions, detailed in filings with the Securities & Exchange Commission, indicate an intricate balance of optimism and strategic financial management among the company's insiders.

Understanding Insider Confidence

The divergence in insider activity, with both buying and selling, is not uncommon in large corporations like American Express. While Clayton's purchase may signify a belief in the company's undervalued stock and long-term growth potential, Buckminster's sale could be part of personal financial planning or portfolio diversification strategies. It's essential to contextualize these actions within the broader scope of American Express's market positioning and future strategy.

Conclusion

The recent insider activity at American Express, comprising both stock purchases and sales by key executives, offers a nuanced view of the company's internal confidence and future prospects. While these actions provide valuable insights, they should be considered as part of a broader evaluation of American Express's market position, competitive landscape, and strategic initiatives. Investors should continue to monitor insider transactions alongside other financial and market indicators to make informed decisions. For ongoing updates and detailed insights into American Express's performance and insider activities, refer to TradingNews.com and its American Express stock profile.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex