Analysis - Is iShares U.S. Oil & Gas ETF BATS:IEO a Buy ?

Unpacking the Performance, Financial Health, and Strategic Positioning of the iShares U.S. Oil & Gas ETF in a Dynamic Market Environment | That's TradingNEWS

Investment Outlook for BATS:IEO

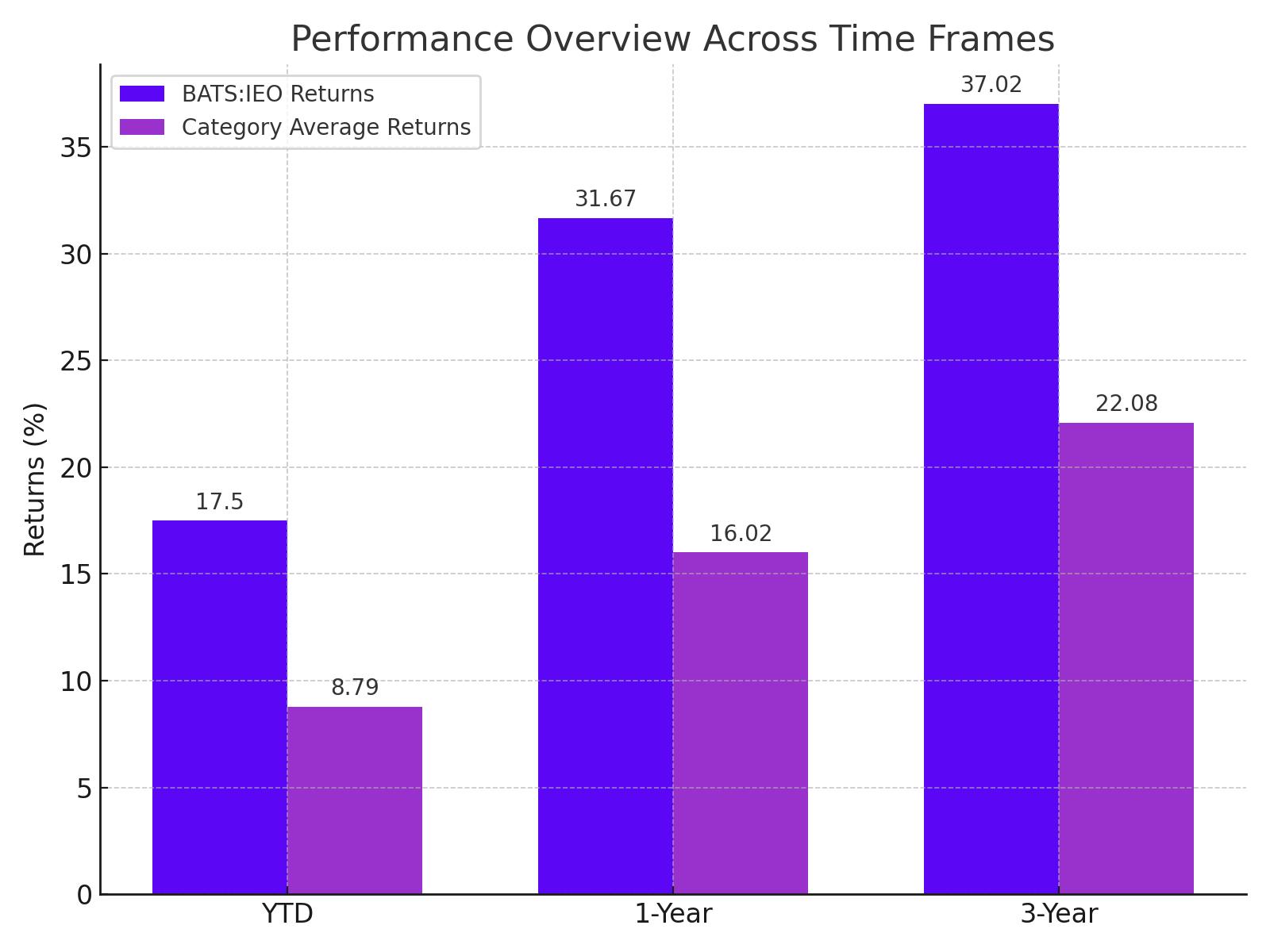

The iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) demonstrates compelling investment potential amidst a volatile market landscape, underpinned by a strategic focus on high-growth sectors within the oil and gas industry. The ETF's performance has notably outpaced its category averages across various time frames, signaling robust sector momentum and the efficacy of its focused investment approach.

Market Performance and Strategic Positioning

BATS:IEO has exhibited impressive returns, with a Year-To-Date (YTD) daily total return of 17.50%, significantly outperforming its category average of 8.79%. Over a one-year period, the ETF reported a return of 31.67%, again surpassing the category average of 16.02%. This trend is consistent over three years, where BATS:IEO achieved a 37.02% return compared to 22.08% for its peers. Such performance highlights the ETF's effective market positioning and the successful identification of high-return opportunities within the exploration and production sector.

Financial Health and Dividend Yield

The ETF's financial health remains solid with net assets totaling $770.07 million. It maintains a reasonable expense ratio of 0.40%, aligning with investor expectations for cost-efficient fund management. The dividend yield of 2.44% is also attractive, particularly when juxtaposed with the broader market yields, offering a steady income stream to investors alongside capital appreciation potential.

Volatility and Risk Considerations

Despite the strong returns, BATS:IEO carries inherent risks typical of the energy sector, characterized by high volatility and exposure to geopolitical and market dynamics. The ETF's beta of 0.65, however, suggests lower volatility relative to the market, which might appeal to more conservative investors seeking exposure to energy without the corresponding high risk typically associated with this sector.

Technical Analysis and Future Outlook

Technically, BATS:IEO has sustained a bullish trend, breaking past significant resistance levels. The ETF has managed to hold above these levels, suggesting a potential for continued upward movement. Given the global economic recovery and increasing energy demands, coupled with constrained supply, the ETF is well-positioned to capitalize on rising oil prices.

Investment Recommendation: Buy

In conclusion, based on BATS:IEO's strong past performance, strategic market positioning, and robust financial health, the recommendation is to Buy. Investors should consider this ETF as a viable component of a diversified investment portfolio, particularly for those looking to leverage potential growth in the oil and gas sector. It is advisable to monitor global energy trends and market conditions regularly to ensure alignment with investment objectives. For ongoing updates and more detailed analysis, investors should refer to the TradingNews Real-Time Chart for BATS:IEO.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex