Analysis of Bitcoin (BTC): Market Volatility and Strategic Insights For July

Exploring Bitcoin's Recent Market Movements, Key Indicators, and Future Outlook For July

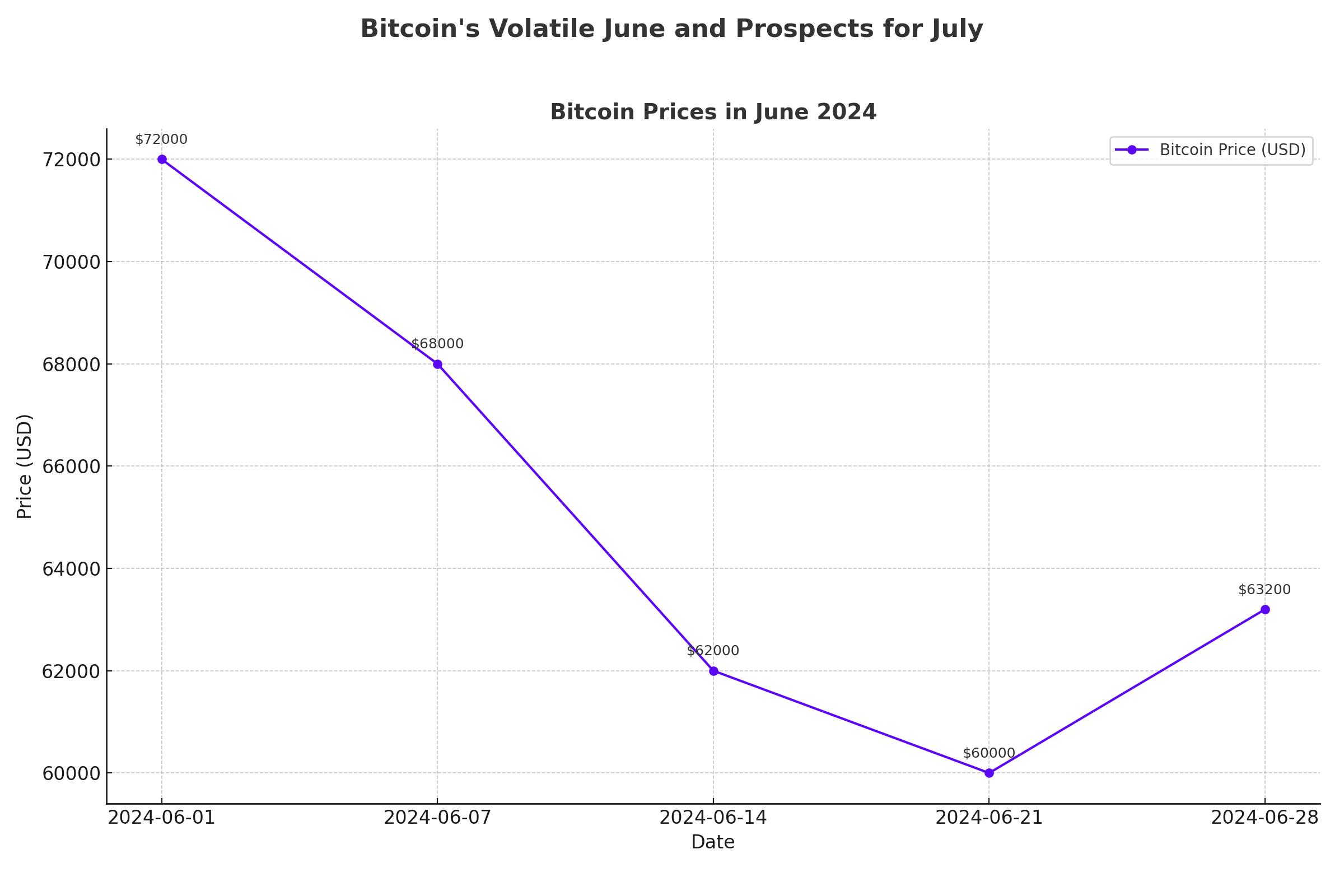

Bitcoin's Volatile June and Prospects for July

June was a month of significant volatility for Bitcoin (BTC), with the price fluctuating dramatically. After reaching a high of $72,000 and dropping to a low of slightly over $58,000, Bitcoin ended the month with a 7.12% decline. As we move into July, early indications suggest a potential recovery, with Bitcoin trading around $63,200, reflecting a 4% increase over the past day.

Bullish Indicators and Market Sentiment

The recent price action indicates a possible bullish trend. Bitcoin has broken above a falling wedge pattern, trading at $63,400 with a positive outlook. Key indicators support this bullish sentiment:

- On-Chain Data: Miners' selling activity has decreased significantly, from an average daily rate of 8,592.14 BTC last week to 1,849 BTC, indicating reduced selling pressure.

- Funding Rates: Positive funding rates have risen from 0.0093 to 0.0098, showing a dominance of long positions.

- Open Interest: Future's open interest in Bitcoin has increased from $30.97 billion to $32.11 billion, suggesting new money entering the market and potential for further price gains.

Market Influences and Social Media Impact

Michael Dell’s recent Twitter poll highlighted Bitcoin’s ongoing societal intrigue. With 43.1% of 64,035 votes favoring Bitcoin over AI and other options, this reflects its enduring allure among digital enthusiasts. This social media buzz can drive market sentiment and trading behaviors.

Technical Analysis: Breaking Key Resistance Levels

Bitcoin’s price movement is currently testing significant resistance levels. If BTC closes above the $63,956 resistance, it could aim for the next target at $67,147. Momentum indicators like the Relative Strength Index (RSI) and the Awesome Oscillator need to move above their neutral levels to confirm bullish momentum. A failure to sustain above these levels might result in a pullback to $58,375.

Broader Crypto Market Trends

The broader cryptocurrency market has seen a positive shift, with the total market cap increasing by 4.21% to $2.34 trillion. Major cryptocurrencies like Ethereum (ETH) and Solana (SOL) have also shown significant gains, suggesting a positive outlook for the crypto sector.

Detailed Price Analysis

- Bitcoin (BTC): Currently trading at $63,316.81, up 4.17% in the last 24 hours. The price fluctuated between $60,630.05 and $63,712.78.

- Ethereum (ETH): Increased by 3.91% to $3,495.66, with a range of $3,354.51 to $3,516.05.

- Solana (SOL): Rose by 6.58% to $147.43, with lows of $137.14 and highs of $148.65.

- XRP: Experienced a 1.51% increase to $0.4782.

Strategic Insights and Predictions

Bitcoin’s current trading pattern indicates a potential bullish breakout if it sustains above key resistance levels. Positive funding rates, decreasing miner selling pressure, and increasing open interest all point towards a bullish outlook. However, if Bitcoin fails to maintain its position above critical support levels, it could face downward pressure.

Conclusion: Investment Outlook

Based on the current data and market trends, Bitcoin (BTC) shows signs of a potential bullish move, supported by strong on-chain metrics and positive market sentiment. Investors should monitor key resistance and support levels closely. Despite the inherent volatility, Bitcoin’s strategic positioning and market dynamics suggest a cautiously optimistic investment outlook for the coming weeks.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex