Analysis of Microsoft (NASDAQ:MSFT): AI, Cloud Services, and Revenue Projections

Microsoft's Strategic Investments in AI and Cloud Services Drive Robust Revenue Growth and Long-Term Market Leadership | That's TradingNEWS

Comprehensive Analysis of Microsoft Corporation (NASDAQ:MSFT)

Microsoft Corporation (NASDAQ:MSFT) continues to be a dominant force in the technology sector, significantly impacting global markets through its diverse range of products and services. With strategic investments in artificial intelligence (AI) and cloud computing, Microsoft has solidified its market position and offers substantial growth prospects. This analysis delves into recent developments, financial performance, and strategic initiatives of Microsoft, assessing its future outlook amidst current market dynamics. For real-time updates on MSFT, visit MSFT Real-Time Chart.

Strategic AI Integration and Partnerships

OpenAI Collaboration and Advancements

Microsoft's partnership with OpenAI is a cornerstone of its AI strategy. The collaboration integrates OpenAI’s GPT models into Microsoft’s product suite, including Office, Dynamics, and Azure. For instance, OpenAI’s GPT-4 model boasts 1.8 trillion parameters, surpassing competitors like Google’s Gemini 1.0 Ultra, which has 1.56 trillion parameters. This partnership enhances Microsoft’s AI capabilities, giving it a competitive edge in the technology landscape.

Impact on Microsoft’s Product Segments

In Office Products, the integration of OpenAI’s AI models into Microsoft 365 through Copilot has revolutionized productivity software. This integration provides real-time data processing and advanced functionalities, making Microsoft 365 a preferred choice for businesses. In Dynamics, Copilot for Dynamics, powered by GPT-4, offers enhanced customer relationship management (CRM) and enterprise resource planning (ERP) capabilities. This native integration provides seamless AI functionalities, distinguishing Microsoft Dynamics from competitors. Azure Cloud, through Azure OpenAI Service, allows seamless integration of OpenAI’s models, positioning Microsoft as a leader in the cloud services market. This strategic move supports Azure's growth, significantly contributing to Microsoft's revenue.

Financial Performance and Growth Metrics

Q3 2024 Earnings Highlights

Microsoft reported impressive financial results for Q3 2024, with revenues reaching $62 billion, marking a 17% year-over-year (YoY) growth. The company's operating income surged by 23% to nearly $28 billion, while net income increased by 20% to $21.9 billion. These figures underscore Microsoft's robust financial health and strategic growth.

Segment Performance

- Cloud Computing (Azure): Generated $35.1 billion in revenue, a 23% YoY growth. The segment's expansion is driven by the increasing demand for cloud services and AI integration.

- Productivity and Business Processes: Including Office 365, reported $19.6 billion in revenue, up by 12% YoY. Microsoft 365 consumer subscribers grew to 80.8 million, reflecting strong market demand.

- Personal Computing: Reported revenue of $15.6 billion, a 17% YoY growth, with significant contributions from Xbox content and services, which grew by 62% following the Blizzard acquisition.

Innovative Ventures and Product Developments

Copilot+ PCs and NPU Integration

Microsoft’s innovation in AI extends to hardware with the development of Copilot+ PCs. These devices integrate Neural Processing Units (NPUs) capable of performing over 45 trillion operations per second. This advancement enhances AI processing capabilities, making Copilot+ PCs up to 20 times more powerful and 100 times more efficient for running AI workloads. This innovation positions Microsoft as a leader in AI-powered computing devices.

Investment in AI and R&D

Microsoft has invested approximately $13 billion in OpenAI, underscoring its commitment to AI advancements. The company’s research and development (R&D) expenditure has been increasing, reflecting its focus on innovation. In 2023, Microsoft’s R&D expenses totaled $24.5 billion, up from $20 billion in 2022. This substantial investment in AI and other cutting-edge technologies ensures that Microsoft remains at the forefront of technological innovation.

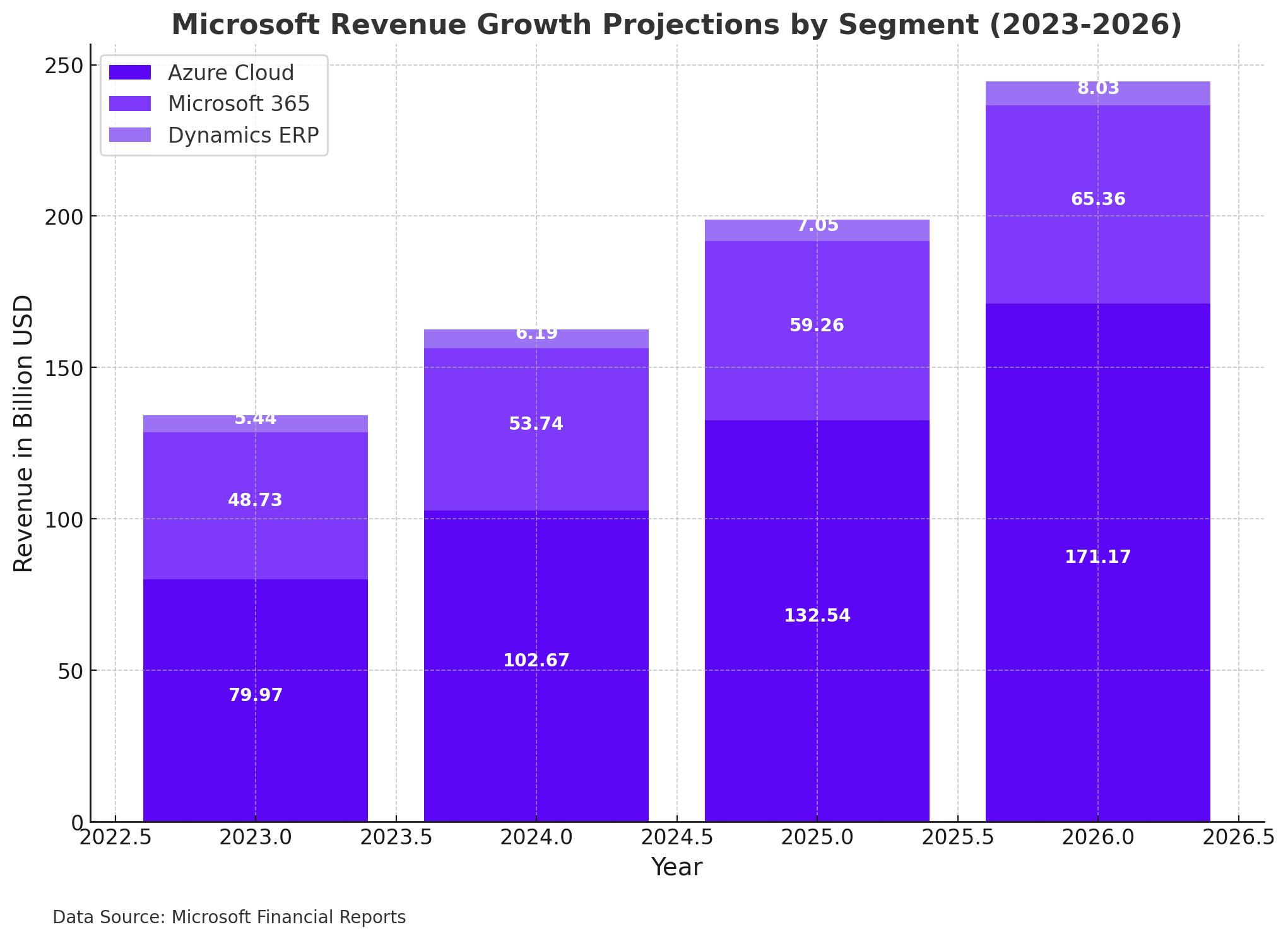

Revenue Growth Projections

Azure Cloud (Server Products)

Microsoft's Azure Cloud segment is expected to maintain strong growth, driven by the integration of AI models and expanding cloud services. The company’s competitive factor score in the cloud market, bolstered by its superior AI integration, suggests a revenue growth projection of 39.44%. With a current revenue base of $79.97 billion in 2023, this translates to projected revenues of $102.67 billion in 2024, $132.54 billion in 2025, and $171.17 billion in 2026.

Microsoft 365 Productivity (Office Products)

The productivity software segment, encompassing Microsoft 365, is projected to grow by 10.3% annually. With 2023 revenues at $48.73 billion, projections estimate revenues to reach $53.74 billion in 2024, $59.26 billion in 2025, and $65.36 billion in 2026. This growth is driven by the increasing adoption of AI-enhanced productivity tools and the expanding subscriber base.

Dynamics ERP (Dynamics)

The Dynamics ERP segment is also set for significant growth, with a projected annual growth rate of 13.9%. From a revenue base of $5.44 billion in 2023, this segment is expected to generate $6.19 billion in 2024, $7.05 billion in 2025, and $8.03 billion in 2026. The seamless integration of GPT-4 into Dynamics provides Microsoft with a competitive edge in the ERP market.

Investment Outlook for NASDAQ:MSFT

Long-Term Prospects

Given the bullish outlook on AI and cloud computing, Microsoft is well-positioned to outperform the broader market. The company’s strategic investments and integration of advanced AI models across its product suite provide a solid foundation for long-term growth. With robust financial health and a diversified revenue stream, Microsoft is poised to capitalize on emerging market trends and maintain its leadership position in the technology sector.

Risks and Considerations

While the growth prospects for Microsoft are promising, the company is not without risks. The price volatility of underlying commodities and geopolitical uncertainties can impact performance. Additionally, regulatory changes and increased competition from other tech giants like Google and Amazon pose potential challenges. However, Microsoft’s diversified approach and strong balance sheet help mitigate these risks, offering balanced exposure to the sector.

Conclusion

Microsoft Corporation (NASDAQ:MSFT) stands out as a robust investment option, benefiting from strategic positioning, strong financial performance, and innovative product developments. The company's substantial investments in AI and cloud computing, coupled with its diversified revenue streams, provide a solid foundation for long-term growth. With a promising outlook supported by major financial players and strong sector fundamentals, NASDAQ:MSFT is poised for sustained growth. The ETF’s diversified approach, solid dividend yield, and exposure to financially strong companies make it an attractive choice for investors seeking exposure to the technology sector. As global demand for AI and cloud services continues to rise and market dynamics remain favorable, NASDAQ:MSFT offers a compelling investment opportunity for both long-term growth and income generation.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex