Analysis of Oil Market Dynamics and Future Prospects

Examining the Key Factors Driving Oil Prices and Market Stability Amidst Global Geopolitical and Economic Influences | That's TradingNEWS

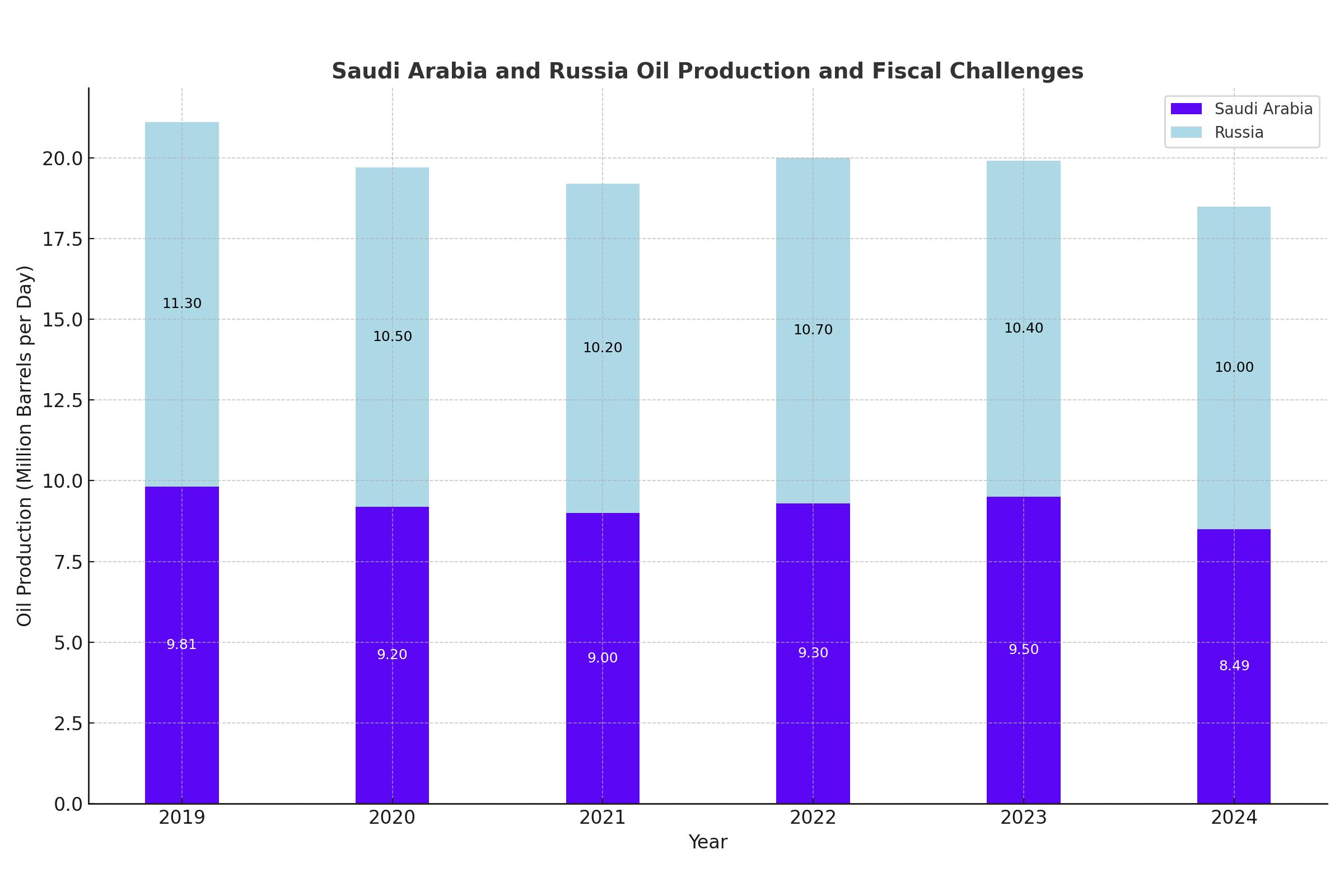

Saudi Arabia's Production Limits and Fiscal Challenges

Saudi Arabia, despite its low lifting costs of $1-2 per barrel, faces significant constraints in increasing its oil production sustainably. Historically, Saudi Arabia has averaged 8.267 million barrels per day (bpd) of crude oil production from 1973 to May 2024. The kingdom's capacity to push production much above 10 million bpd without damaging its wells remains doubtful. For instance, after briefly hitting 12 million bpd in April 2020, production quickly fell back to 8.49 million bpd.

Geopolitical and Economic Pressures on Russia

Russia's economic stability heavily relies on its oil and gas exports, particularly amidst ongoing geopolitical tensions. During the first 100 days of the Ukraine conflict, Russia earned nearly $100 billion from these exports. However, as global oil prices declined, Russia's margin shrank, and its fiscal breakeven Brent oil price surged to $115 per barrel. This price is significantly above the average price of around $60 per barrel set by international sanctions.

OPEC+ Production Cuts and Global Implications

OPEC+ has extended its 3.66 million bpd production cuts to the end of 2025, with an additional 2.2 million bpd cuts until September 2024. Despite these measures, Brent crude prices have struggled to break the $90 per barrel mark. Both Saudi Arabia and Russia, key players in OPEC+, need higher oil prices to balance their budgets, but further production cuts risk destabilizing global demand, especially from key export markets like the US.

US Political and Economic Considerations

The US is in a pre-election period, and keeping oil prices stable is crucial for President Joe Biden. Historically, every $10 increase in oil prices results in a 25-30 cent rise in gasoline prices per gallon, impacting consumer spending by over $1 billion annually for every 1 cent increase. With presidential approval ratings closely tied to gasoline prices, maintaining stable oil prices is politically advantageous for the incumbent administration.

Market Reactions and Hurricane Season

Oil traders have become increasingly focused on weather patterns, with the Atlantic hurricane season starting early this year. Hurricane Beryl, reaching Category 5, has already impacted Jamaica and is heading towards the US-Mexico coast. These weather events add to the geopolitical risk premium, pushing ICE Brent to $87 per barrel.

Technical Analysis of WTI Crude Oil

West Texas Intermediate (WTI) crude oil has formed a symmetrical triangle pattern on the weekly chart, indicating potential for significant price movements. The price has tested the upper trendline near $84 per barrel, with key resistance levels at $93 and $120. On the downside, support levels are around $60 and $43, marking crucial points for investors to watch.

Impact of Summer Demand and Supply Fears

Increased demand due to the summer driving season and ongoing geopolitical tensions have driven oil prices higher. WTI crude recently rose above $84 per barrel, marking a nine-week high. The American Automobile Association (AAA) forecasts a 5.2% increase in holiday travel for the July 4th weekend, indicating robust demand.

Global Market Movements and Strategic Investments

Saudi Arabia is investing heavily in natural gas, with Saudi Aramco signing contracts worth over $25 billion for the Jafurah gas field. This move is part of a broader strategy to use more gas in power generation, reducing reliance on oil. Meanwhile, the US has paused its Strategic Petroleum Reserve (SPR) replenishment due to high bid prices, affecting future supply dynamics.

Geopolitical Tensions and Economic Sanctions

Geopolitical tensions, particularly between Israel and Lebanon, continue to influence oil prices. Additionally, the US has proposed new talks with Venezuela regarding oil sanctions, potentially impacting global supply. Venezuela's oil production remains under 1 million bpd due to ongoing sanctions, despite government claims of reaching this target soon.

Conclusion: Future Market Outlook

The oil market is poised for continued volatility, influenced by geopolitical tensions, economic policies, and seasonal demand patterns. Both Saudi Arabia and Russia face significant challenges in balancing their budgets and sustaining production levels. Meanwhile, the US political landscape and upcoming elections add further complexity to the market dynamics. Investors should monitor these factors closely to navigate the evolving oil market effectively.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex