Analysts - Sell MSTR, Buy on Bitcoin Optimism ?

While some market analysts recommend selling MicroStrategy stock, burgeoning optimism in Bitcoin's potential recovery and growth presents a compelling case for investment | That's TradingNEWS

The Cryptocurrency Turbulence and Public Firms' Stock Performance

The recent downturn in the cryptocurrency market has had a cascading effect on publicly listed companies deeply entrenched in this sector. MicroStrategy (NASDAQ: MSTR), alongside other prominent firms like Coinbase and Marathon Digital, has witnessed substantial declines in stock values due to volatile digital currency prices. Over the past month, the crypto economy shed approximately $420 billion in market value, reflecting a stark reduction in investor confidence and a bearish trend across associated assets.

For an in-depth analysis, visit MicroStrategy's real-time stock chart here.

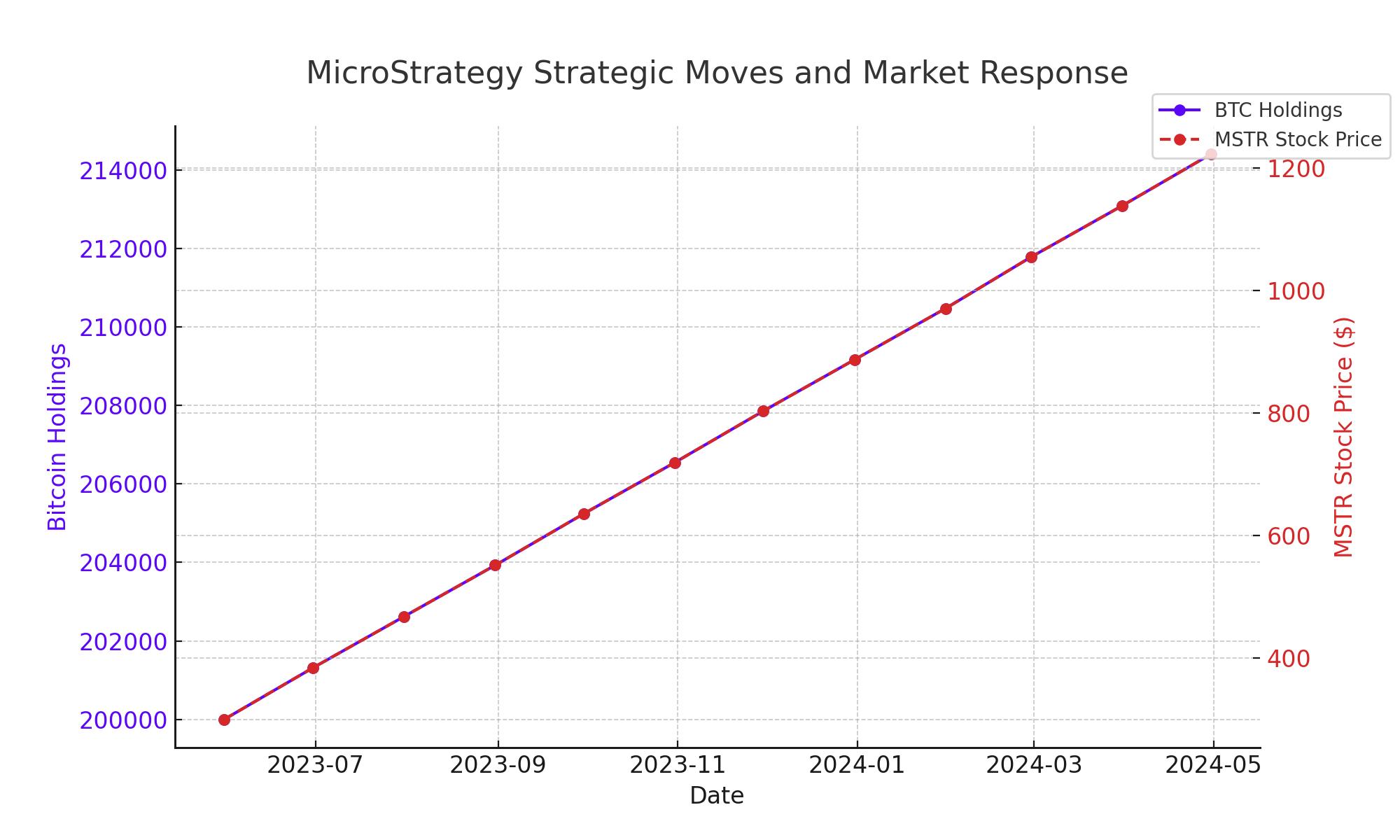

MicroStrategy's Strategic Moves and Market Response

Amidst this market upheaval, MicroStrategy has aggressively increased its bitcoin holdings, now totaling 214,400 BTC. However, this bold strategy hasn't shielded the company from the market's downturn, with MSTR stock plunging by 45.19% over the same period. This significant decline in share price is mirrored in the broader trends affecting all crypto-related stocks, but is particularly poignant for MicroStrategy given its high-profile bitcoin investments.

Check out the insider transaction details and stock profile for more insights here.

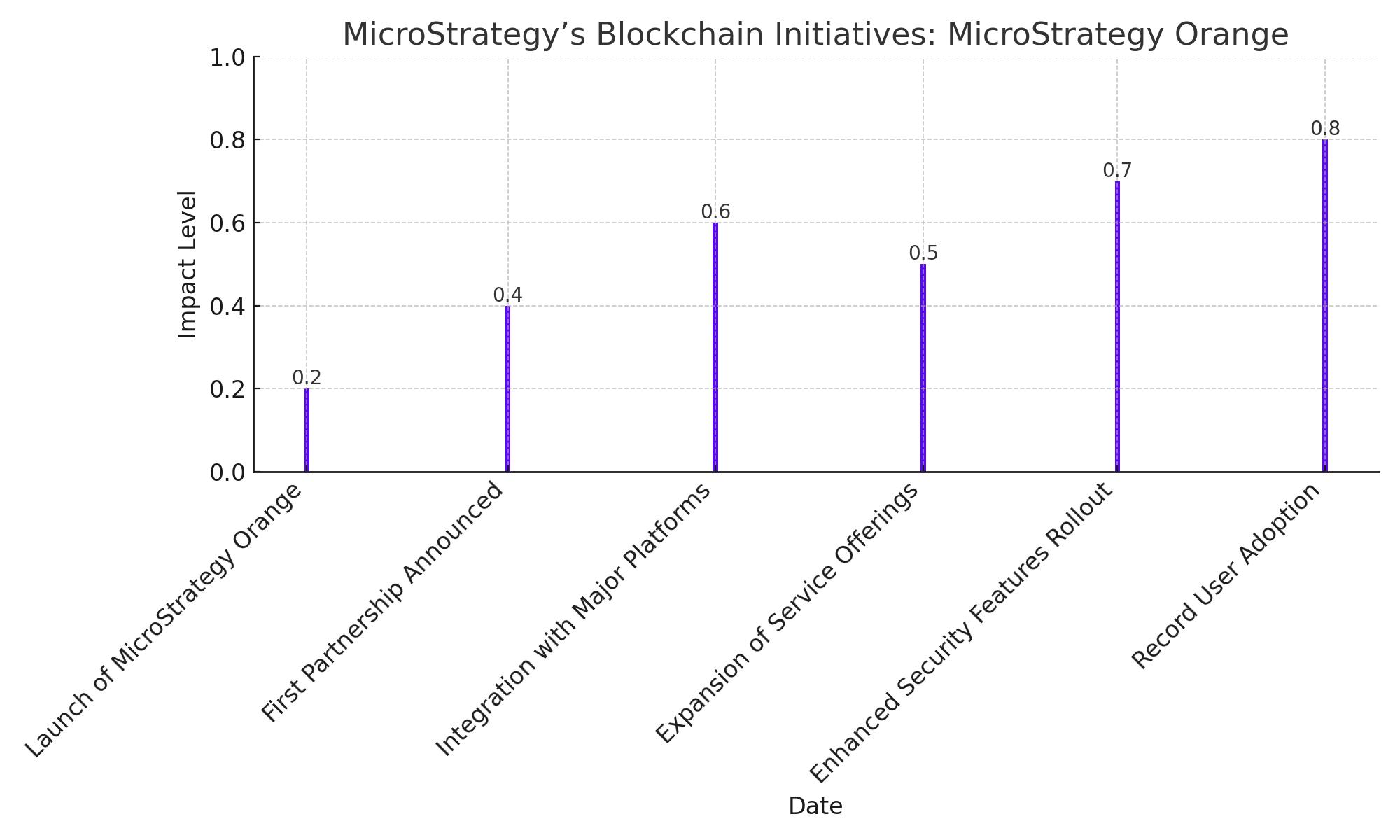

Analyzing MicroStrategy’s Bold Blockchain Endeavors

MicroStrategy has also ventured beyond mere cryptocurrency investment. At its recent Bitcoin For Corporations conference, Executive Chairman Michael Saylor introduced "MicroStrategy Orange," a new decentralized identity service operating on the Bitcoin network. This initiative marks a significant pivot in the company’s strategy, aiming to leverage the blockchain for creating decentralized identifiers that operate independently of sidechains, enhancing security and operational efficiency.

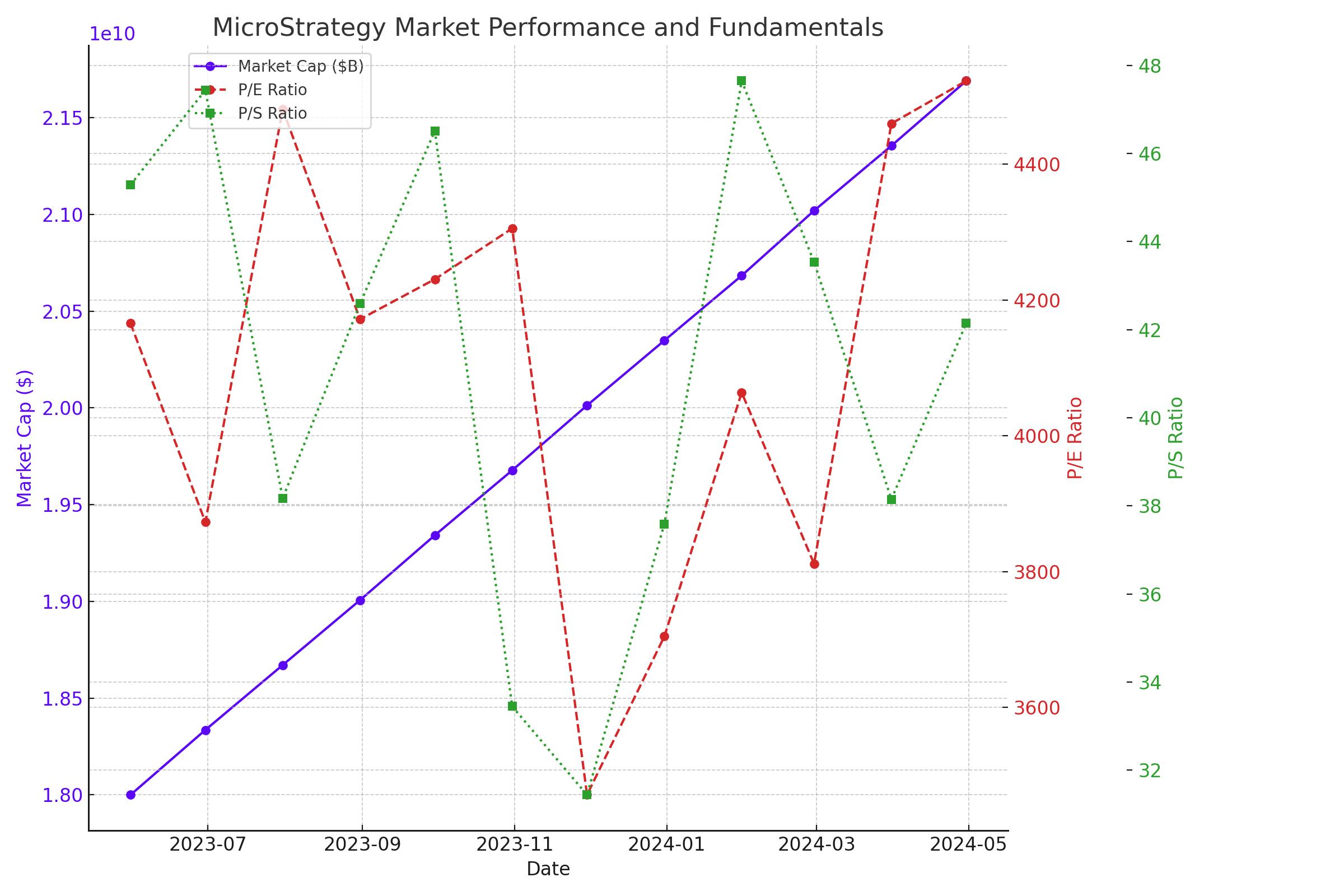

MicroStrategy's Market Performance and Fundamentals

MicroStrategy has faced significant market turbulence influenced by the broader cryptocurrency market downturn.

As of the latest trading session, MSTR's stock price stood at $1,222, demonstrating a sharp decline from a high of $1,723 earlier in April.

The volatility is largely due to its substantial bitcoin holdings, which amount to 214,400 BTC, acquired at an average price of $35,180 per Bitcoin.

For further details, you can monitor MicroStrategy's real-time stock performance here.

Financial Metrics and Market Cap Analysis

As of the end of Q1 2024, MicroStrategy's market capitalization reflected significant fluctuations:

- Current Market Cap: $21.69 billion

- Enterprise Value: $25.23 billion

- Price/Earnings (P/E) Ratio: Highly volatile, with a current trailing P/E of 4,120, indicating a speculative premium on the stock.

- Price to Sales (P/S): 43.02, significantly higher than the industry average, suggesting an overvaluation based on sales.

- Debt Levels: The company's total debt stands at $3.62 billion, with a high debt-to-equity ratio of 150.73%, highlighting substantial financial leverage.

These financial indicators underscore the high-risk, high-reward nature of MicroStrategy's investment strategy centered around bitcoin.

Operational and Strategic Challenges

MicroStrategy's latest quarterly results have laid bare the challenges of its bitcoin-centric strategy:

- Net Loss: The company reported a net loss of $53.1 million in Q1 2024, starkly contrasting with the previous year.

- Revenue Decline: There was a 5.5% decrease in revenue from the previous year, totaling $115.2 million.

- Impairment Losses: The significant digital asset impairment losses, which stood at $191.6 million for the quarter, reflect the volatility and risk inherent in its bitcoin investments.

CEO Michael Saylor's Perspective on Bitcoin as a Strategic Asset

Michael Saylor, MicroStrategy's Executive Chairman, has been a pivotal figure in redirecting the company's strategy towards Bitcoin. He contends that Bitcoin surpasses traditional assets like bonds, stocks, or gold due to its inherent characteristics as a digital asset without an issuer. This unique attribute establishes Bitcoin as a global asset, unbounded by the usual constraints that affect conventional securities.

Saylor points out the comparative advantages of Bitcoin, especially in contrast to bonds, which have recently yielded negative real returns. In his view, Bitcoin serves as an effective hedge against inflation and acts as a crucial instrument for capital preservation in today's digital-driven economic landscape. He highlights Bitcoin's absence of ties to any specific national economy or government, positioning it as a universally accessible asset.

This strategic shift has transformed MicroStrategy from a traditional enterprise software provider into an investment entity heavily focused on Bitcoin. This transformation is rooted in Saylor's belief in Bitcoin's potential to act as a stable reserve asset, despite the known volatility in the cryptocurrency markets. As a result, MicroStrategy's operational model and financial health are now intricately linked to the fluctuations of Bitcoin's market value, embedding a high degree of market risk into the company's financial strategy.

Through Saylor's leadership, MicroStrategy has invested heavily in Bitcoin, holding approximately 214,400 BTC, which were acquired at an average price of $35,180 per Bitcoin. This substantial investment aligns with Saylor's long-term vision of Bitcoin's role as a cornerstone of digital asset investment, reflecting his commitment to leveraging MicroStrategy as a platform for advocating and increasing Bitcoin adoption in the corporate sphere.

Investment Concidiration

MicroStrategy's investment strategy, heavily tied to Bitcoin, has rendered its stock performance volatile. Following a cryptocurrency market downturn, MicroStrategy's stock (NASDAQ: MSTR) declined by 45.19% this month, reflecting broader sector challenges. The company holds 214,400 BTC, acquired at an average price of $35,180 each, which has contributed to significant financial exposure and risk.

The company's market capitalization stands at approximately $21.69 billion, with a strikingly high P/E ratio of 4,120, suggesting a speculative premium. Additionally, a high debt level of $3.62 billion with a debt-to-equity ratio of 150.73% emphasizes the financial leverage risks. Given these factors, the "sell" recommendation is based on the potential for high volatility and uncertain returns, anchored by the unpredictable swings in Bitcoin's market value.

Optimistic Outlook for Bitcoin and Strategic Implications for MicroStrategy

The recent fluctuations in Bitcoin’s price, particularly the dip below $58,000, reflect the typical volatility of the cryptocurrency market rather than a long-term bearish trend. With several indicators pointing towards a potential rebound, the outlook for Bitcoin remains optimistic, suggesting a favorable scenario for investors in MicroStrategy (NASDAQ: MSTR), given its substantial Bitcoin holdings.

Bitcoin’s Positive Market Dynamics

On-chain metrics like Coin Days Destroyed (CDD) indicate that long-term holders remain confident, suggesting a buildup towards a potential price surge. The Market Value to Realized Value (MVRV) ratio, currently at -9.5%, often precedes market rallies, indicating that many investors may be accumulating Bitcoin in anticipation of higher prices.

Technical Patterns Supporting Growth

Bitcoin’s maintenance of a bullish flag pattern suggests a potential breakout, with a target price of $92,505. The current support at $57,444, if sustained, could propel the price towards initial resistance at $73,700, and possibly to new highs. This technical assessment aligns with a growing accumulation phase, presenting a robust case for a market upturn.

Economic Factors and Investor Sentiment

The broader economic conditions, especially the Federal Reserve’s interest rate policies, play a crucial role in Bitcoin’s valuation. The Fed’s recent decisions to hold interest rates have generally supported growth in alternative assets like Bitcoin. A continuation of this policy could further stabilize and potentially enhance Bitcoin’s value.

Why MicroStrategy Stock Is a Buy

MicroStrategy’s aggressive strategy of increasing its Bitcoin reserves, now totaling 214,400 BTC acquired at an average price of $35,180 each, positions the company to significantly benefit from any upward movements in Bitcoin’s price. With Bitcoin’s fundamentals appearing strong and technical indicators suggesting an impending price rise, MicroStrategy’s stock could see substantial gains. The company’s deep integration with Bitcoin provides it with a unique leverage point to capitalize on cryptocurrency’s growth trajectories, making it an attractive option for investors optimistic about Bitcoin’s future.

That's TradingNEWS

Read More

-

QDVO ETF: 11% Yield And AI Heavyweights Keep This Fund Near Its $30.40 Peak

26.12.2025 · TradingNEWS ArchiveStocks

-

XRPI at $10.66 and XRPR at $15.13 as XRP ETFs Build $1B+ Exposure Around $1.84 XRP-USD

26.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Near $4.34 Tests How Strong The $4.00 Winter Floor Really Is

26.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: 156 Range Trapped Below 158 as BoJ 0.75% Hike Clashes with Fed Cuts

26.12.2025 · TradingNEWS ArchiveForex