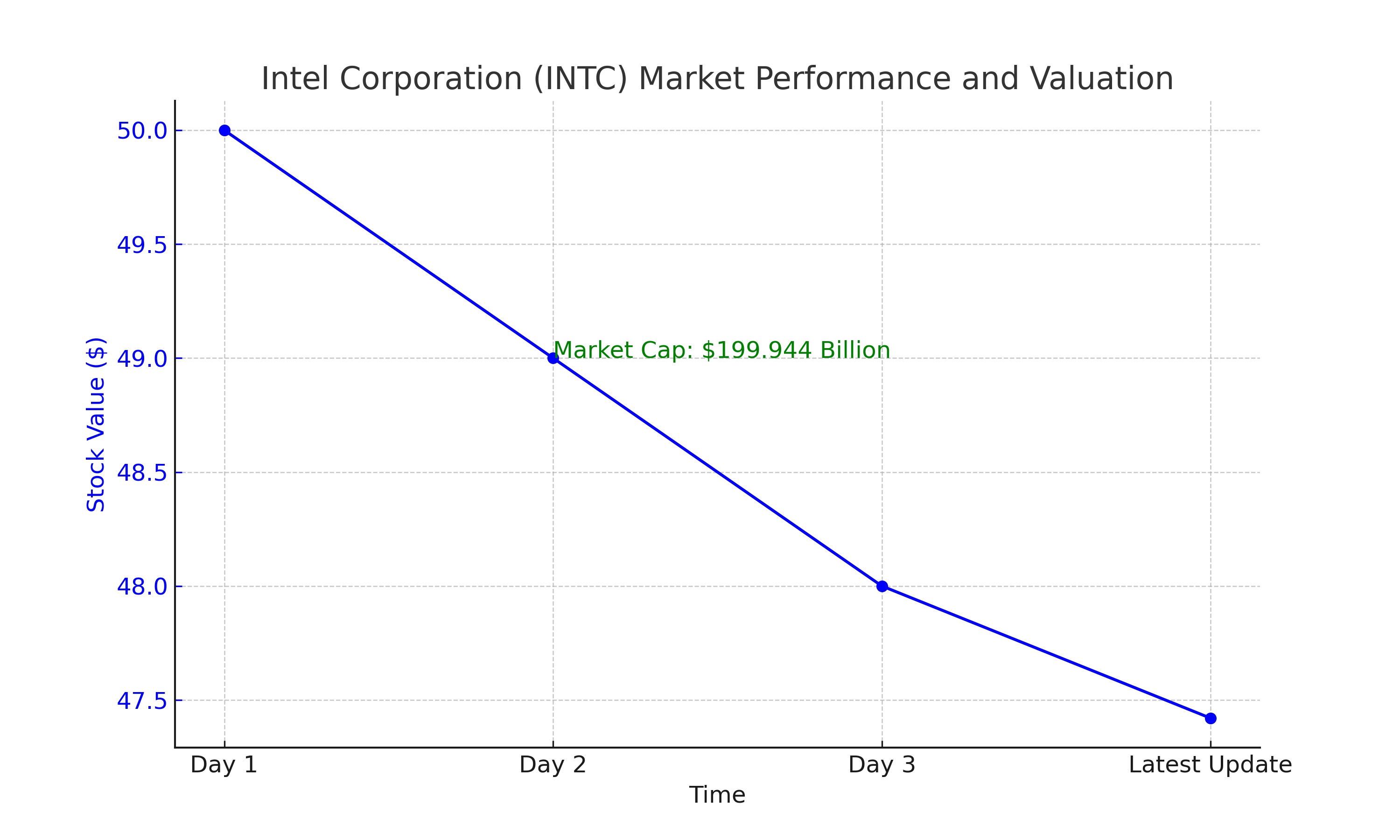

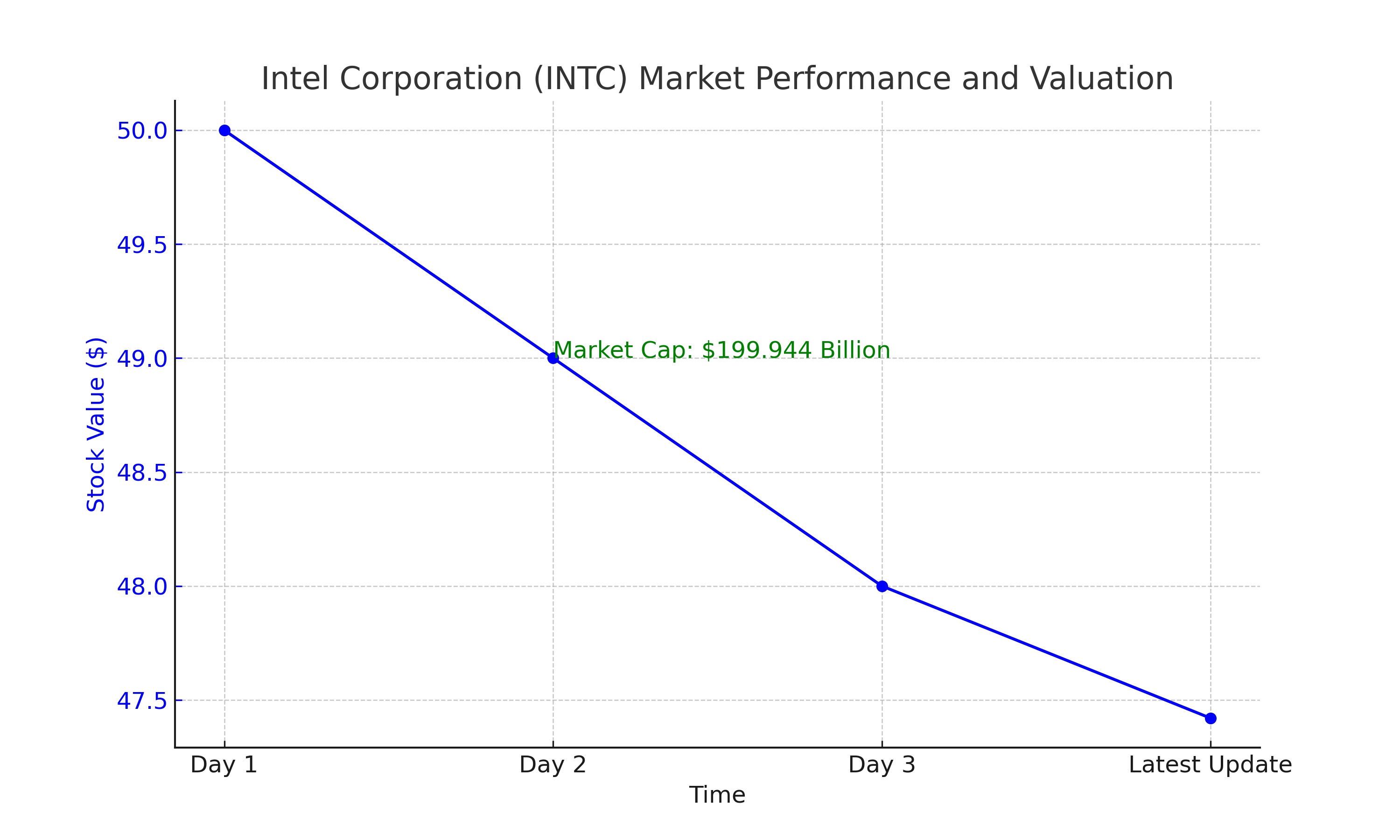

Market Performance and Current Valuation

NASDAQ: INTC has showcased a fluctuating journey, marked by a notable decline of 1.30% in its stock value, settling at $47.42 as of the latest update. The company's market capitalization stands robust at $199.944 billion, reflecting its significant presence in the technology sector. However, it's vital to delve deeper into Intel's financial health and market performance to gauge its future trajectory.

Financial Health: A Closer Look at Intel's Numbers

Intel's financial standing is a mixed bag. The company's TTM (Trailing Twelve Months) EPS (Earnings Per Share) is currently at a concerning -0.39, indicating challenges in profitability. This is further underlined by a negative profit margin of -3.11% and an operating margin of 5.71%. Such figures suggest operational and profitability struggles, which could be attributed to heightened competition and investment in R&D (Research and Development).

Revenue and Earnings Analysis

The tech giant's revenue is a critical indicator of its performance. Intel reported a revenue of $52.86 billion TTM, showing a quarterly revenue decline of -7.70%. However, the forward-looking projections are more optimistic, with estimated revenues increasing to $53.96 billion in 2023 and further to $61.13 billion in 2024. This potential growth could be fueled by advancements in AI and data center sectors.

Debt and Liquidity

Intel's total debt of $48.88 billion raises concerns about its leverage and financial flexibility. The total debt-to-equity ratio stands at 46.25%, highlighting a reliance on debt financing. However, Intel's current ratio of 1.53 suggests adequate liquidity to meet short-term obligations.

Dividend Analysis

Intel offers a forward dividend yield of 1.04%, indicating a potential for steady income for investors. The payout ratio of 75.26% should be monitored to ensure that dividends are sustainable in the long run.

Insider and Institutional Holdings

Insider holdings in Intel are minimal at 0.06%, while institutional holdings are substantial at 65.97%. This suggests confidence from larger investors but a lack of significant insider investment, which can be a nuanced signal in evaluating company confidence.

Intel and the AI Market: Potential Growth Catalyst

Intel's AI focus, particularly in B2B segments, positions it strategically in the growing AI market. The introduction of 5th Gen Intel Xeon Scalable processors and investment in foundry services are promising moves. However, Intel's financial struggles cast a shadow over its potential growth in this dynamic sector.

Stock Valuation and Investment Considerations

Intel's P/E ratio is currently N/A, complicating valuation assessments. The forward P/E of 26.53 indicates expectations of future earnings growth. However, this needs to be balanced against the backdrop of Intel's negative net margins and intense competition in the semiconductor industry.

Future Outlook: Earnings and Revenue Projections

Looking forward, Intel's estimated EPS shows potential recovery, with a forecasted rise from $0.95 in 2023 to $1.88 in 2024. Revenue estimates also indicate growth, potentially driven by the reviving PC market and burgeoning AI chip demand. These factors suggest a possible turnaround for Intel, aligning with analysts' expectations of a 10% annual earnings growth over the next five years.

Competitive Landscape: Intel Versus Peers

Intel's performance relative to its peers like AMD, Nvidia, and others is a critical factor. While Intel has shown some recent gains, its overall growth and profitability metrics lag behind key competitors. This competitive analysis is essential for investors considering Intel in the context of the broader semiconductor market.

Risks and Challenges

Intel faces significant challenges, including:

- Intense competition from companies like AMD and Nvidia.

- The need for substantial investment in new technologies.

- Managing a high level of debt.

- Navigating a volatile global semiconductor market.

Strategic Moves and Innovations

Intel's strategic investments, such as the $25 billion investment in a new foundry in Israel and its focus on the AI market, are critical steps towards future growth. The company's efforts in edge computing and AI with its new processors could provide a competitive edge.

Conclusion: Intel's Path Forward

Intel Corporation (NASDAQ: INTC) stands at a crossroads, with potential growth in AI and data centers being weighed against financial challenges and intense competition. The company's future success will hinge on its ability to innovate, manage its finances effectively, and capitalize on emerging market trends. Investors should closely monitor Intel's strategic moves, financial health, and market dynamics before making investment decisions.

That's TradingNEWS