Apple's Latest Earnings Overview

Apple Inc. (NASDAQ:AAPL) recently disclosed its fiscal second-quarter results, showcasing a mix of challenges and triumphs. Despite a notable 10% decline in iPhone sales, Apple surpassed Wall Street expectations with its overall revenue and earnings per share. The tech giant announced revenues of $90.75 billion, down 4% year over year but slightly above the forecasted $90.01 billion. Earnings per share stood strong at $1.53, against an anticipated $1.50.

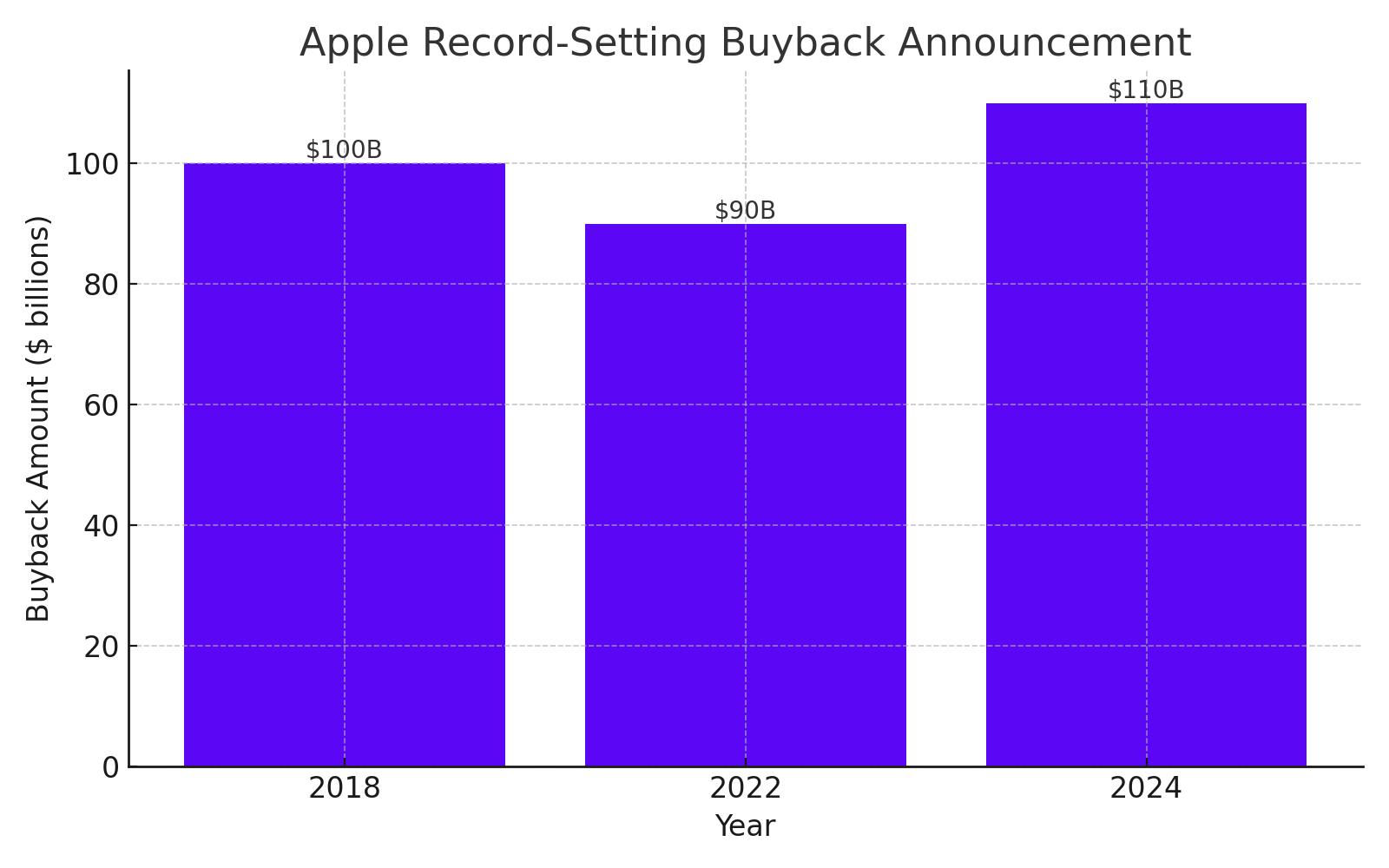

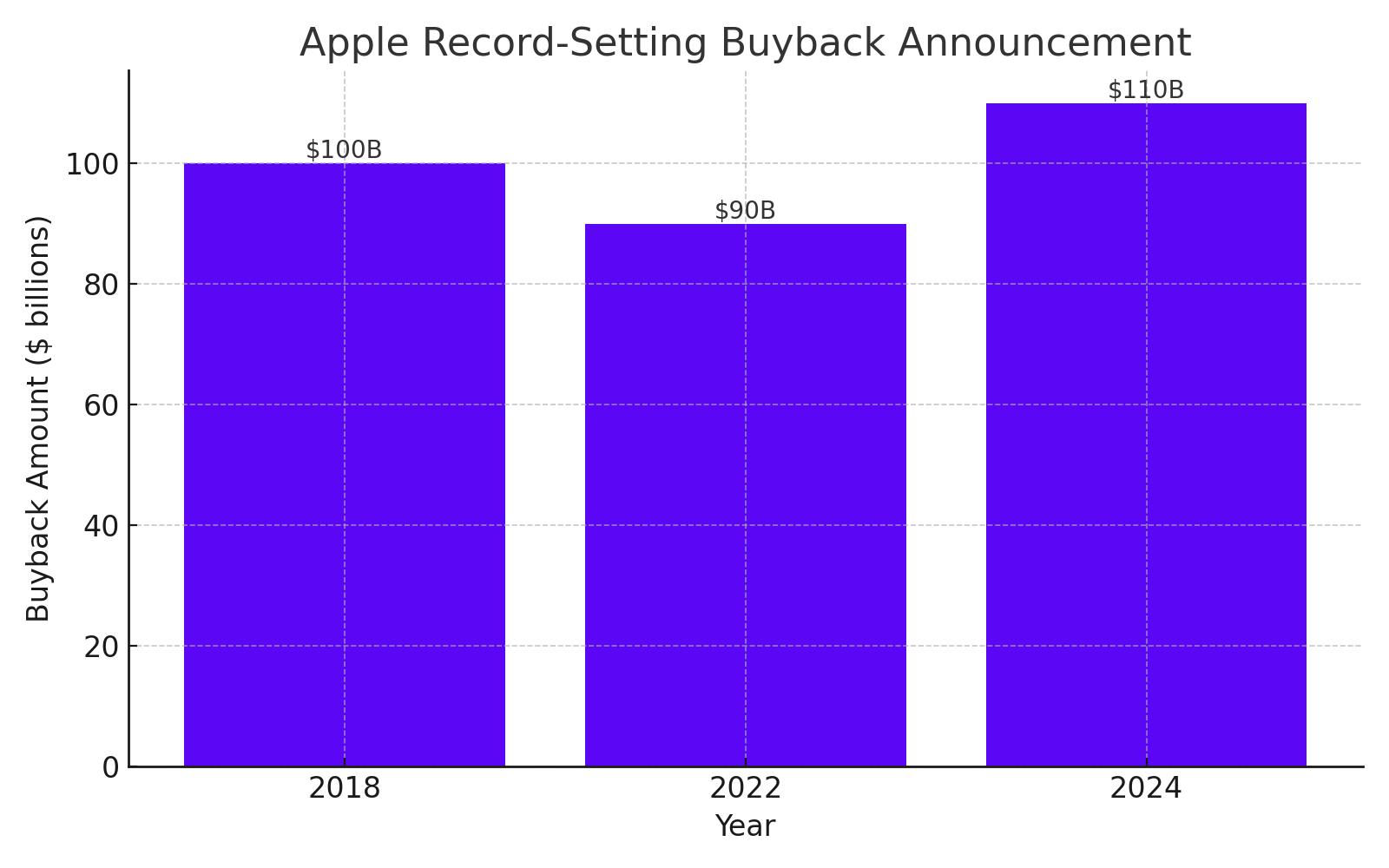

Record-Setting Buyback Announcement

In a move underscoring its financial robustness and commitment to shareholder value, Apple declared an unprecedented $110 billion stock repurchase plan. This strategic decision marks the largest share buyback in U.S. corporate history, topping its previous high from 2018 when the company repurchased $100 billion in stock. This aggressive buyback strategy not only reflects Apple’s robust cash flow but also aims to enhance shareholder returns amidst market volatility. For more insights on Apple's financial maneuvers and insider transactions, visit Apple's Stock Profile.

Market Reaction and Investor Sentiment

Post-announcement, AAPL stock witnessed a significant uptick, surging 6.25% to $183.84 per share in premarket trading, a level not seen since February. This surge reflects investor optimism, buoyed by Apple’s aggressive capital return strategy and its potential to drive up earnings per share by reducing the share count.

Tech Giants Embrace Share Buybacks

In the realm of technology giants, share buybacks have become a favored strategy for deploying excess capital and enhancing shareholder value. Apple's recent announcement of a staggering $110 billion buyback is the largest in U.S. history, underscoring this trend. This move follows a pattern seen across the tech industry, with major players like Alphabet and Meta actively engaging in substantial repurchases. Alphabet has consistently bought back $70 billion worth of shares annually for the last three years. Meanwhile, Meta carried out a $50 billion buyback in 2024 and a $40 billion buyback in 2023, highlighting the scale at which these corporations are willing to return value to shareholders.

Analyzing the Strategic Implications of Apple's Record Buyback

Apple’s decision to initiate a $110 billion share buyback raises significant discussions regarding the strategic management of capital amid rapid technological changes and economic uncertainties. Such buybacks serve to reduce the total number of shares available in the market, potentially boosting the earnings per share (EPS) and thus enhancing investor appeal. However, these financial maneuvers also invite scrutiny over whether they are the best use of a company’s surplus funds, especially when considering long-term growth and innovation.

Notably, Apple’s buyback comes at a time when its core product, the iPhone, has experienced a 10% decline in sales. This downturn raises concerns about the company's current business trajectory and whether repurchasing shares might mask deeper underlying issues within its primary revenue streams. By reducing the number of outstanding shares, Apple could indeed be seen as bolstering key financial ratios, yet it also prompts a deeper analysis of its long-term strategic objectives and market positioning amidst evolving industry dynamics.

Navigating Forward: Apple's Financial Health and Market Strategy

With $110 billion allocated to repurchases, Apple not only reinforces its financial health but also shows confidence in its business model amidst global economic uncertainties. This strategy may support the stock price in the short term, however, the long-term effects will depend on Apple's ability to sustain innovation and growth, particularly as it explores new opportunities in artificial intelligence and expands its services division.

Performance of Core Products and Services

Despite the decline in iPhone sales, Apple's broader ecosystem continues to exhibit robust performance, particularly in the Services sector which saw a 14% increase year-over-year, achieving a record high of $23.87 billion. This sector now accounts for a larger slice of Apple's revenue pie, indicating a strategic diversification away from reliance solely on hardware sales. Services like Apple Music, iCloud, and the App Store are becoming pivotal in driving the company's valuation and profitability.

Financial Metrics and Market Response

Apple's financials remain strong, with a net income of $23.64 billion, slightly down from the previous year but still impressive given the global economic pressures. The company's ability to maintain a high gross margin at 47%, with Services gross margin at a remarkable 75%, underscores its efficiency and premium market positioning. After the announcement of the buyback and positive earnings, AAPL stock responded positively, reflecting renewed investor confidence in the company’s financial health and strategic direction.

Apple's Strategic Buyback: A Bullish Signal for Investors

Apple's announcement of a record $110 billion share buyback not only reflects its robust financial health but also signals strong confidence in its future growth prospects, making it a compelling buy for investors. The buyback is set against a backdrop of solid financial performance, with Apple closing at $183.78 after hours, reflecting a minor increase of 0.23%. Notably, the stock reached a high of $187.00, demonstrating its potential to test previous limits.

Financial Highlights and Market Performance

Apple's market capitalization stands impressively at $2.83 trillion, supported by a price-to-earnings ratio of 28.51, showcasing its premium valuation in the technology sector. The company’s dividend yield remains modest at 0.52%, emphasizing its growth-oriented return strategy over high dividend payouts. Over the past year, Apple's stock has fluctuated between a high of $199.62 and a low of $164.08, indicating significant volatility but also the resilience and upward potential of its share price.

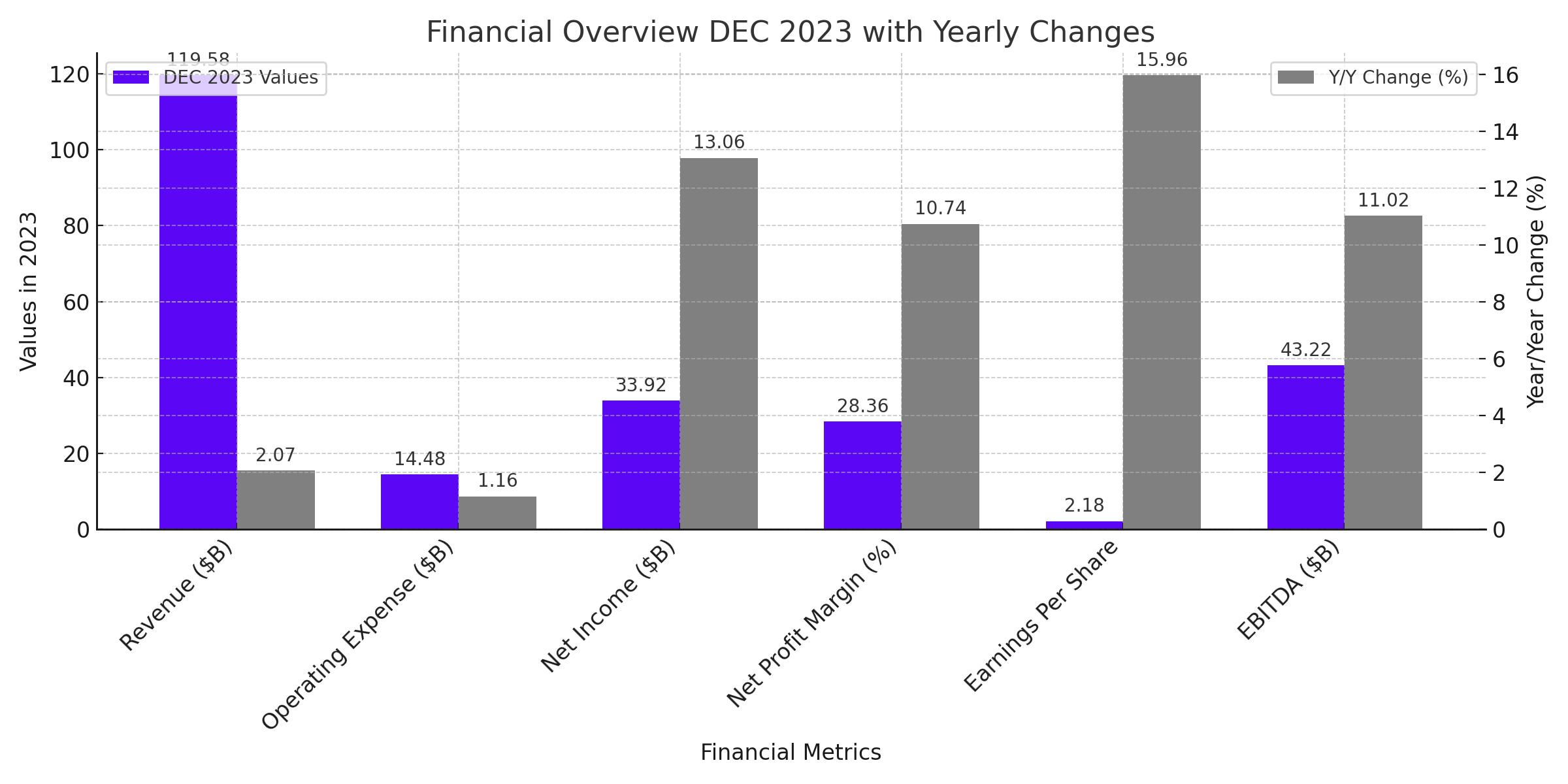

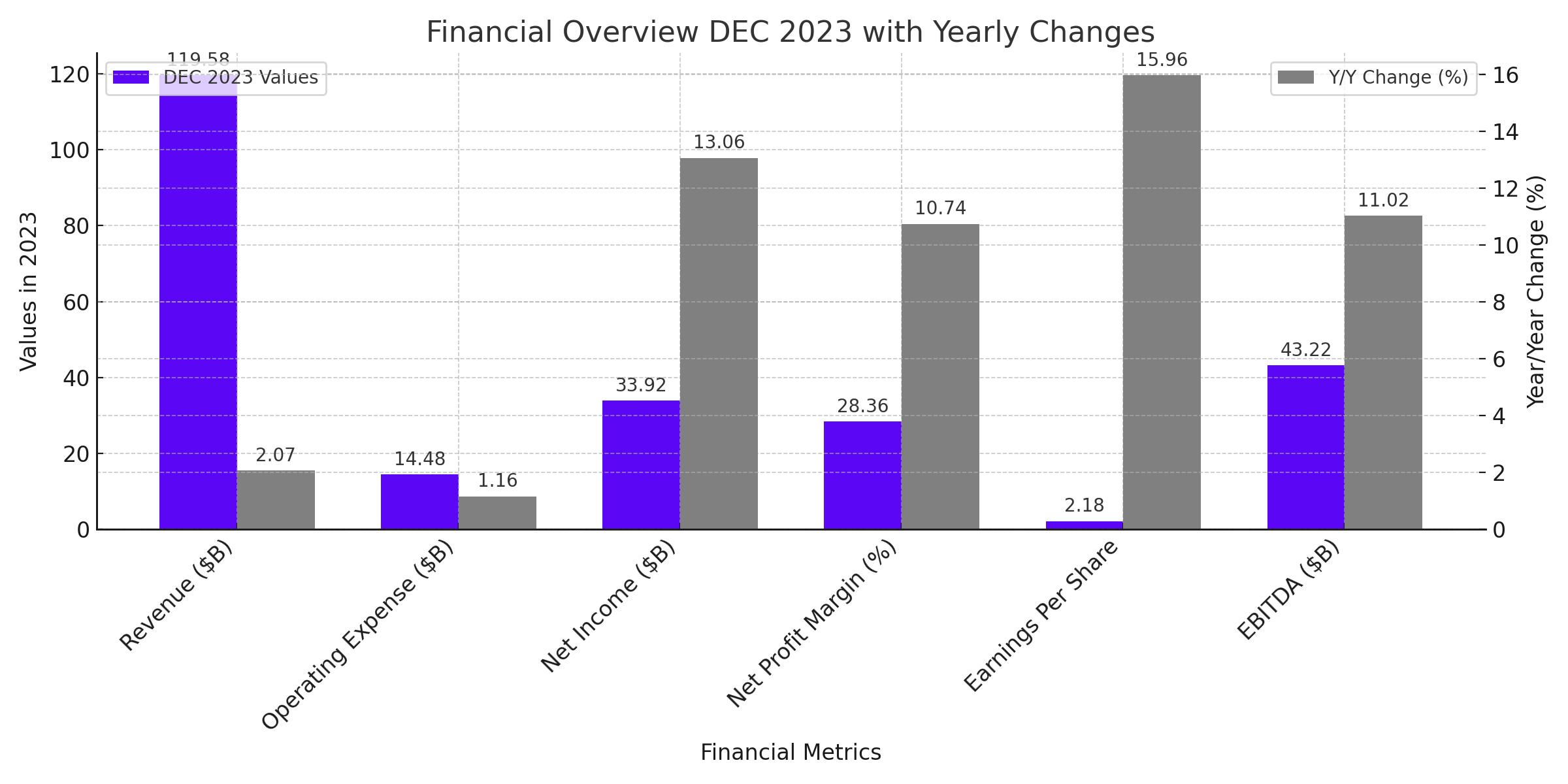

In December 2023, Apple reported a revenue increase of 2.07% year-over-year, reaching $119.58 billion. This revenue growth, coupled with a 13.06% increase in net income to $33.92 billion, underscores Apple’s operational efficiency and profitability. The company’s earnings per share also saw a remarkable increase of 15.96%, indicative of its strong financial management and shareholder value focus.

Quaterly Period

Operational and Strategic Expansions

Apple's operational success is mirrored in its substantial free cash flow growth of 15.21%, amounting to $33.20 billion. This financial flexibility has enabled Apple to invest heavily in research and development while also funding its expansive buyback program. The strategic allocation of $1.93 billion in investing activities, showing a 233.36% increase, highlights Apple’s aggressive expansion and innovation strategies, particularly in emerging technologies and markets.

Is NASDAQ:AAPL Stock a Buy ?

For investors, the magnitude of Apple’s buyback make the stock as a strong buy signal , suggesting that Apple views its stock as undervalued. This action is expected to enhance earnings per share over time, making the stock more attractive in terms of earnings yield. Moreover, Apple’s continued investment in its product and service portfolios, along with its expansion into new markets, provides a balanced growth outlook that supports long-term capital appreciation.