Apple Inc. (NASDAQ:AAPL): Navigating Growth, Margins, and Market Challenges

Apple Inc. (NASDAQ:AAPL), one of the most valuable companies in the world, continues to demonstrate resilience through its product innovation and high-margin service offerings. While its Q4 FY2024 earnings showcased a solid performance, challenges such as uneven geographic growth and over-reliance on the iPhone require deeper scrutiny. With the stock trading near record highs and analysts divided on its outlook, this analysis provides a detailed examination of Apple’s current position, financial metrics, and future prospects.

Robust Earnings and Key Metrics in Q4 FY2024

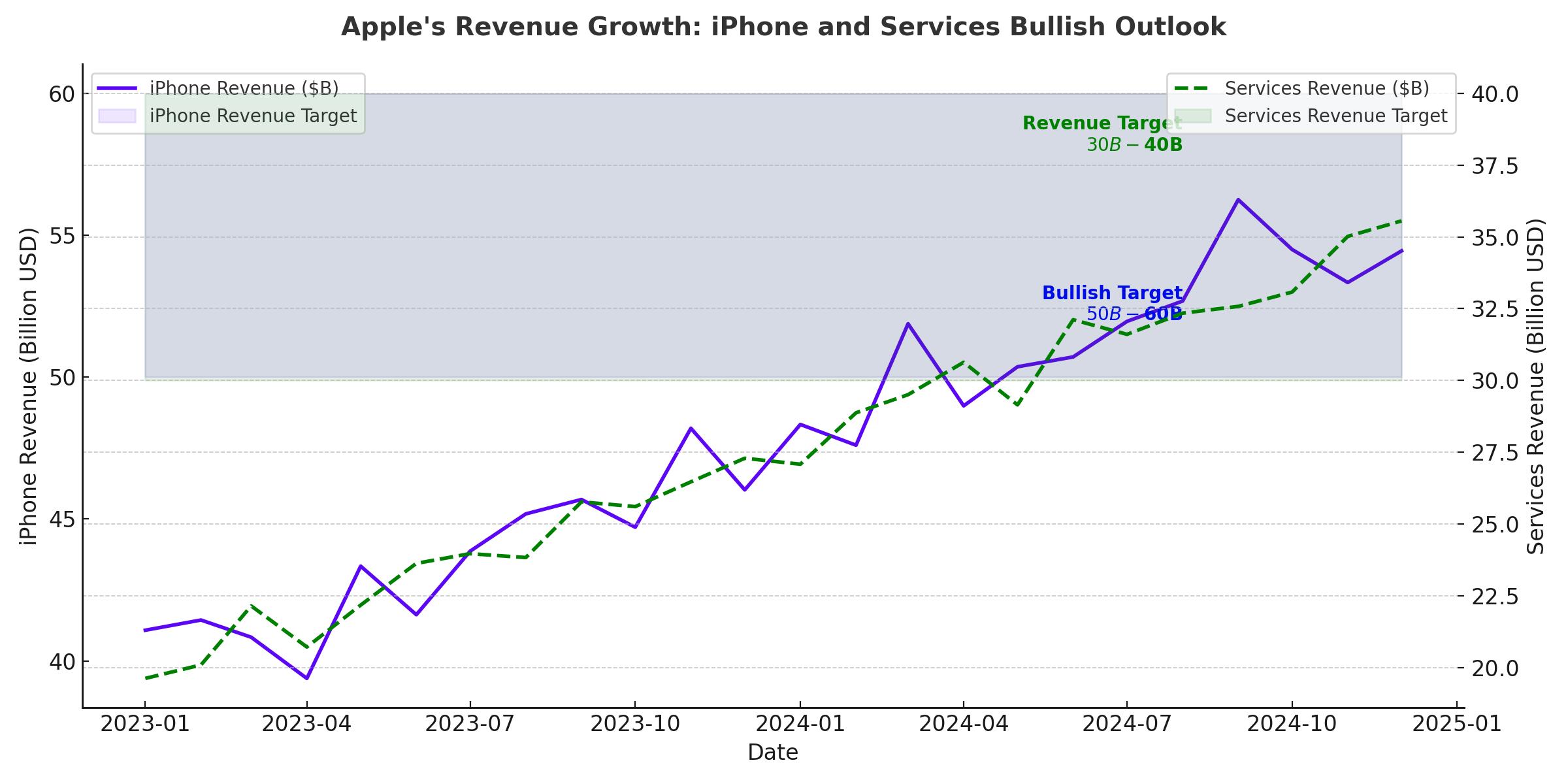

Apple reported revenues of $94.93 billion in Q4 FY2024, marking a 6% year-over-year growth. Earnings per share (EPS) came in at $1.64, beating Wall Street estimates. The iPhone generated $46.2 billion in revenue, growing 6% year-over-year, and accounted for nearly half of Apple’s total sales. Services, a cornerstone of Apple’s growth strategy, contributed $25 billion, up 12% annually, achieving a gross margin of 74%. This performance underscores the company’s ability to leverage its massive installed base of over 2 billion active devices to drive recurring revenues.

While iPad sales grew by 8%, and Mac revenue rose 2%, wearables, home, and accessories saw a 3% decline. Despite this, the Apple Watch achieved record-high installations, with over half of purchases coming from first-time buyers, demonstrating the continued stickiness of Apple’s ecosystem.

Geographic Performance Highlights Regional Disparities

Apple’s geographic revenue performance remains uneven. In the Americas, revenue grew 7% to $41 billion, supported by robust demand. Europe showed an 11% increase, driven by a strong product mix and higher services penetration. However, in Greater China, revenue stagnated at $15 billion, representing a 0.3% decline. This weakness reflects competitive pressures from local brands like Huawei and Xiaomi, as well as broader economic challenges in the region.

Emerging markets like India and Brazil delivered double-digit growth, albeit from smaller revenue bases. For instance, iPad sales surged in India, bolstered by Apple’s retail expansion and the rising middle-class consumer segment. However, these gains are not sufficient to offset the stagnation in larger markets like China, raising questions about Apple’s ability to sustain global revenue growth.

Services Segment Drives Margin Expansion

Apple’s services segment, which includes offerings such as iCloud, Apple Music, and the App Store, continues to be a significant driver of profitability. The segment’s 74% gross margin far exceeds the 36.3% margin of its hardware products. With over 1 billion paid subscriptions, the services segment is poised for further growth, especially as Apple integrates new technologies like generative AI into its offerings.

Innovations like the Apple Vision Pro, a spatial computing device, and Apple Intelligence, an AI-powered enhancement for its ecosystem, are expected to generate incremental revenue. These initiatives not only solidify Apple’s position as a leader in consumer technology but also create new monetization opportunities within its existing user base.

Profitability and Shareholder Returns

Apple maintained a consolidated gross margin of 46.2% in Q4 FY2024, supported by a favorable mix of high-margin services and hardware. Operating cash flow reached $26.8 billion, enabling $29 billion in shareholder payouts, including $25 billion in share buybacks. Over the past five years, Apple’s operating cash flow has grown by 47%, while its diluted share count has decreased by 12%, highlighting its commitment to returning value to shareholders.

Looking ahead, gross margins are expected to remain between 46% and 47% for the December quarter. However, rising costs for memory components like NAND and DRAM could pressure margins in the near term.

Valuation and Peer Comparison

Apple’s forward price-to-earnings (P/E) ratio of 31.78x places it in the lower half of the MAG-7 technology cohort, below peers like NVIDIA (45.86x) and Tesla (134.33x). However, its price-to-book ratio of 62.36x is the highest in the group, reflecting the market’s confidence in Apple’s brand and intangible assets.

While Apple’s valuation metrics are elevated, its return on capital employed (ROCE) of 135% over the past five years justifies its premium. Analysts project an 11.4% compound annual growth rate (CAGR) in EPS through FY2029, driven by share repurchases and margin expansion, supporting the case for continued stock appreciation.

Risks: Over-Reliance on the iPhone and Regional Challenges

Apple’s dependence on the iPhone, which accounts for approximately 50% of its revenue, remains a key risk. Supply chain efficiencies have reduced lead times, but this could also signal tepid demand rather than operational improvements. Additionally, rising NAND and DRAM prices could impact profitability in the coming quarters.

China’s stagnation poses another significant challenge. Although Apple held the top two smartphone positions in urban China, overall revenue in the region remained flat. Emerging markets like India show promise, but their smaller revenue contributions limit their ability to offset weaknesses in larger markets.

Strategic Innovations and Future Growth

Apple’s focus on AI and spatial computing positions it for long-term growth. The Apple Vision Pro, with over 2,500 native spatial apps, is targeting enterprise and creative professionals, while Apple Intelligence enhances device functionality across its ecosystem. These innovations not only add value to Apple’s hardware offerings but also create new revenue streams in enterprise and consumer markets.

Apple’s health-related features, such as sleep apnea notifications on the Apple Watch, further demonstrate its ability to address niche consumer needs, driving deeper engagement within its ecosystem.

Final Thoughts on NASDAQ:AAPL

Apple’s Q4 FY2024 results highlight the company’s resilience and ability to adapt to changing market conditions. While challenges like over-reliance on the iPhone and regional revenue disparities persist, the company’s strong cash flow, high-margin services, and innovative product pipeline position it well for future growth. Based on its current valuation and growth prospects, NASDAQ:AAPL remains a compelling investment. For real-time updates and insider activity, visit NASDAQ:AAPL Real-Time Chart and AAPL Insider Transactions.