Apple Stock - Why NASDAQ:AAPL Is a Buy ?

From aggressive pricing strategies in China to pioneering AI advancements, delve into how Apple (NASDAQ:AAPL) is shaping its trajectory and responding to global market challenges in 2024 | That's TradingNEWS

NASDAQ:AAPL: A Comprehensive Financial Review and Future Outlook

Current Performance of Apple (NASDAQ:AAPL) In 2024, Apple has demonstrated resilience in a fluctuating market, managing to enter the green for the first time this year, despite the broader tech rally led by peers excluding Tesla (NASDAQ: TSLA). Apple's recent financial movements reveal a nuanced picture of insider confidence and strategic profit-taking, juxtaposed against broader market dynamics.

Insider Transactions and Shareholder Confidence

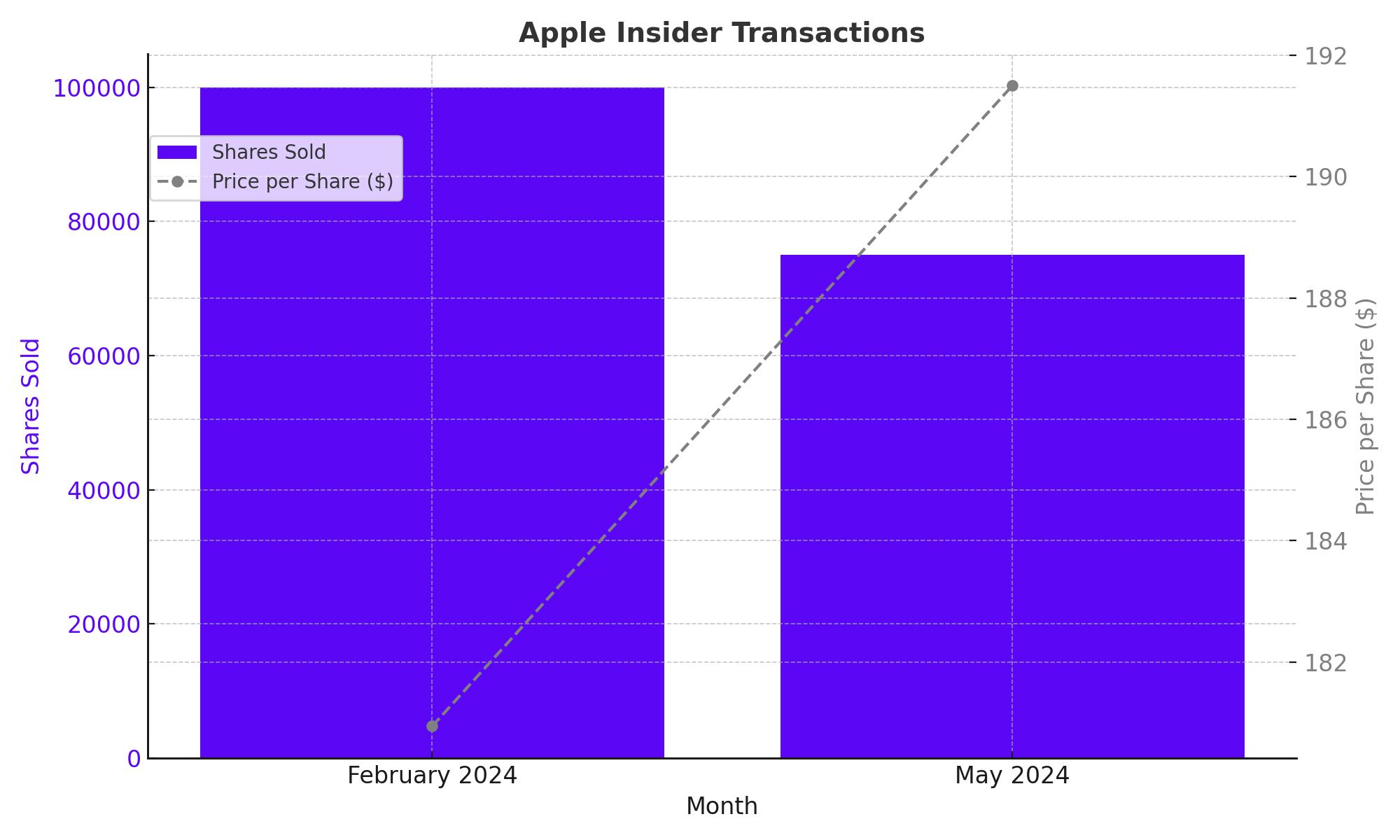

A significant indicator of internal confidence in Apple's prospects comes from the pattern of insider transactions. With only three insider sales recorded this year, the data suggests a strong belief among Apple's insiders in the company’s future trajectory. Notably, Arthur Levinson, Apple’s Chairman, executed two major sales: 75,000 shares at $191.5 in May and 100,000 shares at $180.94 in February, culminating significant profits from these transactions. Such moves likely reflect strategic profit-taking rather than a lack of faith in Apple's future, considering the minimal number of sales overall.

For detailed insights and further insider transactions, visit Apple's stock profile on TradingNews.

Apple's Recent Market Performance

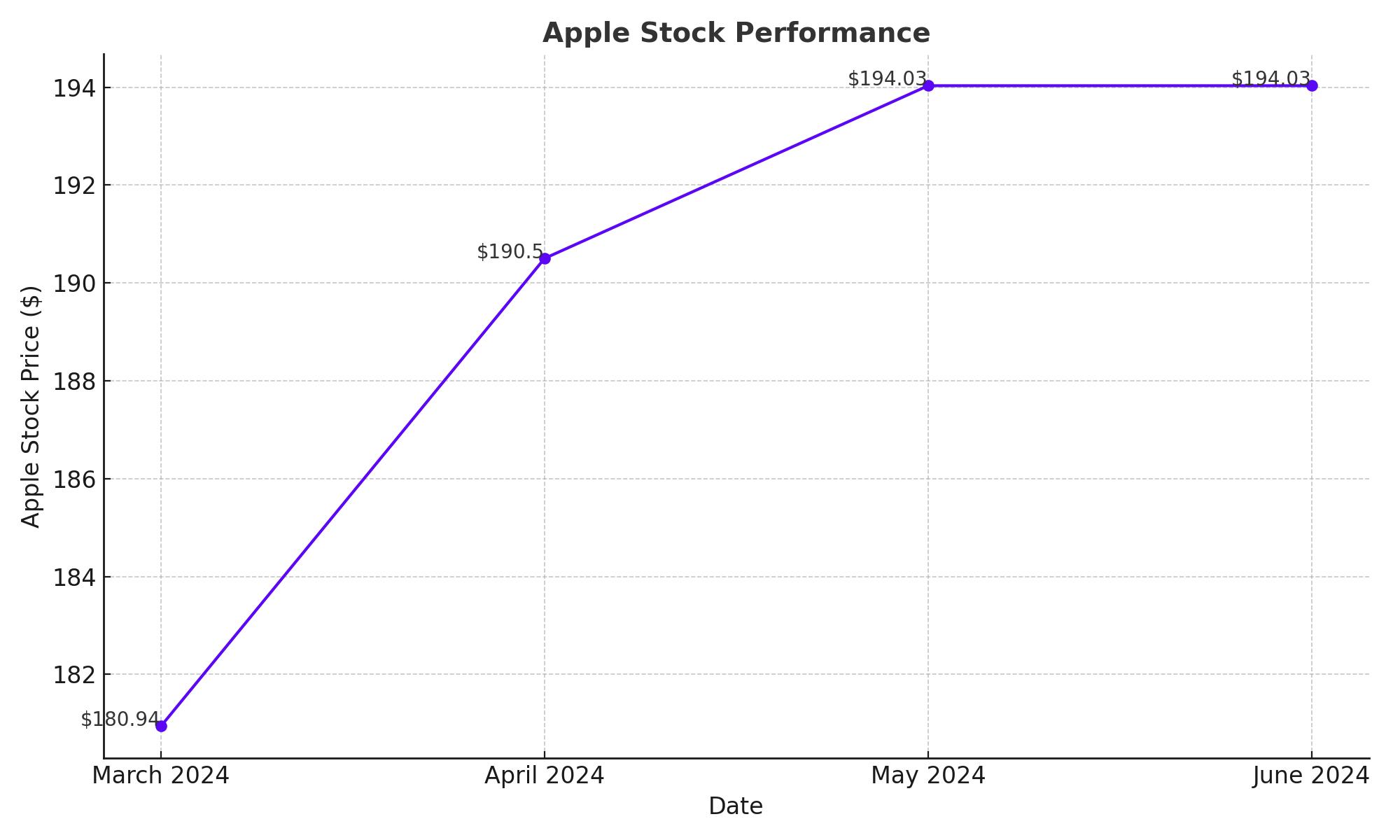

Apple's stock has shown promising recovery signs, marked by a 0.93% increase in the latest trading session, closing at $194.03. This gain is part of a broader positive trend observed over the past month, where Apple’s valuation increased by 6.53%. This recent uptick suggests that the market is reacting positively to Apple’s strategic pricing adjustments and market positioning, particularly in critical regions like China.

Market Strategy and Pricing Dynamics in China

In a strategic pivot to regain its foothold in the competitive Chinese market, Apple significantly reduced iPhone prices, initiating discounts up to 23% on platforms like Alibaba's Tmall and JD.com. This aggressive pricing was timed around China's "618" shopping festival, aligning with increased consumer spending habits. The result was a notable 52% surge in iPhone shipments in April, a dramatic increase from the 12% growth observed in March. By undercutting prices, Apple not only boosted its immediate sales figures but also positioned itself to reclaim market share lost to local competitors like Huawei, which had previously seen a 70% increase in sales due to the successful launch of its Mate 60 series.

Outlook and Strategic Considerations for NASDAQ:AAPL

Apple's forward-looking strategy appears robust, anchored by its strong brand presence and continuous innovation. The recent pricing adjustments in China are expected to stabilize the iPhone market, potentially leading to sustained sales momentum. Furthermore, Apple's commitment to R&D, which saw nearly $8 billion spent in the last quarter alone, coupled with strategic marketing, sets the stage for potential growth in both product lines and service offerings. Market analysts will closely monitor Apple's financial performance in upcoming quarters to gauge the effectiveness of these strategies in a recovering global economy, particularly as Apple prepares to introduce more AI-integrated products at its upcoming WWDC2024 event.

Market Activities and Future Prospects

Innovation and Product Development

Apple continues to push the boundaries of innovation, as evidenced by its recent launch of the powerful new iPad Pro, equipped with the M4 chip. This launch is part of Apple's broader strategy to integrate AI technology across its product lines, enhancing user experience and functionality. The anticipated introduction of iOS 18, rumored to be enriched with generative AI capabilities, signifies Apple's commitment to maintaining technological leadership. Such innovations are likely to resonate well with the consumer base, driving further adoption and brand loyalty.

Financial Performance and Shareholder Value

Despite facing a turbulent economic environment, Apple's financial health remains solid. The company reported a slight dip in revenue by 4.3% year-over-year in its last fiscal quarter, yet managed a modest increase in adjusted EPS. This resilience underscores Apple's effective management and operational efficiency. With a significant cash reserve and a substantial buyback program, Apple is well-equipped to navigate market uncertainties and continue delivering shareholder value. The strategic buyback plan not only reflects confidence in the company's future but also supports the stock price by reducing share count.

Competitive Landscape and Market Position

Apple's market strategy, particularly in the high-stakes Chinese market, reflects its acute awareness of competitive dynamics. The recent price reductions are a tactical move to compete with local tech giants while retaining premium branding. Moreover, Apple's sustained market share leadership in the global tablet market, commanding a 32% share as of Q1 2024, demonstrates its dominance and the effectiveness of its market penetration strategies.

Why NASDAQ:AAPL Is a Buy ?

As Apple (NASDAQ:AAPL)navigates through the fiscal year of 2024, its strategic responses to evolving market conditions and competitive landscapes are set to define its financial and operational trajectory.Armed with a meticulously planned innovation pipeline, Apple has demonstrated proactive agility in adapting to market fluctuations, presenting a compelling reason for investors to consider buying into its robust growth strategy. Recent strategic price adjustments in key markets—such as the up to 23% price cuts on platforms like Tmall and JD.com during China's "618" shopping festival—have already begun to yield positive results, with a 52% surge in iPhone shipments in April following these reductions.

Financially, Apple continues to uphold a robust strategy, underscored by a significant investment in research and development nearing $8 billion in recent quarters, showcasing its commitment to maintaining technological leadership. Moreover, Apple's buyback program, enhanced by a substantial cash reserve, reflects a strong vote of confidence in the company's future prospects, underpinning its stock price and shareholder value.

Looking ahead, Apple's market position is poised for further strengthening as it leverages its innovations in AI and other emerging technologies anticipated at the forthcoming WWDC2024. With its strategic financial maneuvers and sustained efforts in R&D, Apple is well-equipped to enhance its key financial metrics, ensuring a resilient and promising future for its investors and stakeholders. The focused execution of its business strategies and adaptations to consumer demands and technological advancements will be pivotal in securing its competitive edge and driving growth in the evolving global tech landscape.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex