Arista Network Stock NYSE:ANET Analysis: Review and Investment Insights

Comprehensive examination of Arista Networks' technical indicators, financial health, industry positioning, and strategic recommendations to determine if NYSE:ANET is a buy, sell, or hold | That's TradingNEWS

Arista Networks, Inc. (NYSE:ANET) Analysis: Detailed Review and Investment Insights

NYSE:ANET Technical Analysis

Arista Networks (NYSE:ANET) has been a focal point for investors due to its significant market movements. Recently, the stock pulled back from a high of $307 to around $240, which many traders consider a buying opportunity. Technical indicators, such as the Relative Strength Index (RSI) and Chaikin Money Flow (CMF), suggest that the stock is under accumulation, indicating potential upward movement once market conditions stabilize.

- Support Levels: $240 has shown strong historical support.

- Resistance Levels: The $307 mark acts as a significant resistance level.

For a live update on the stock’s performance, you can check here.

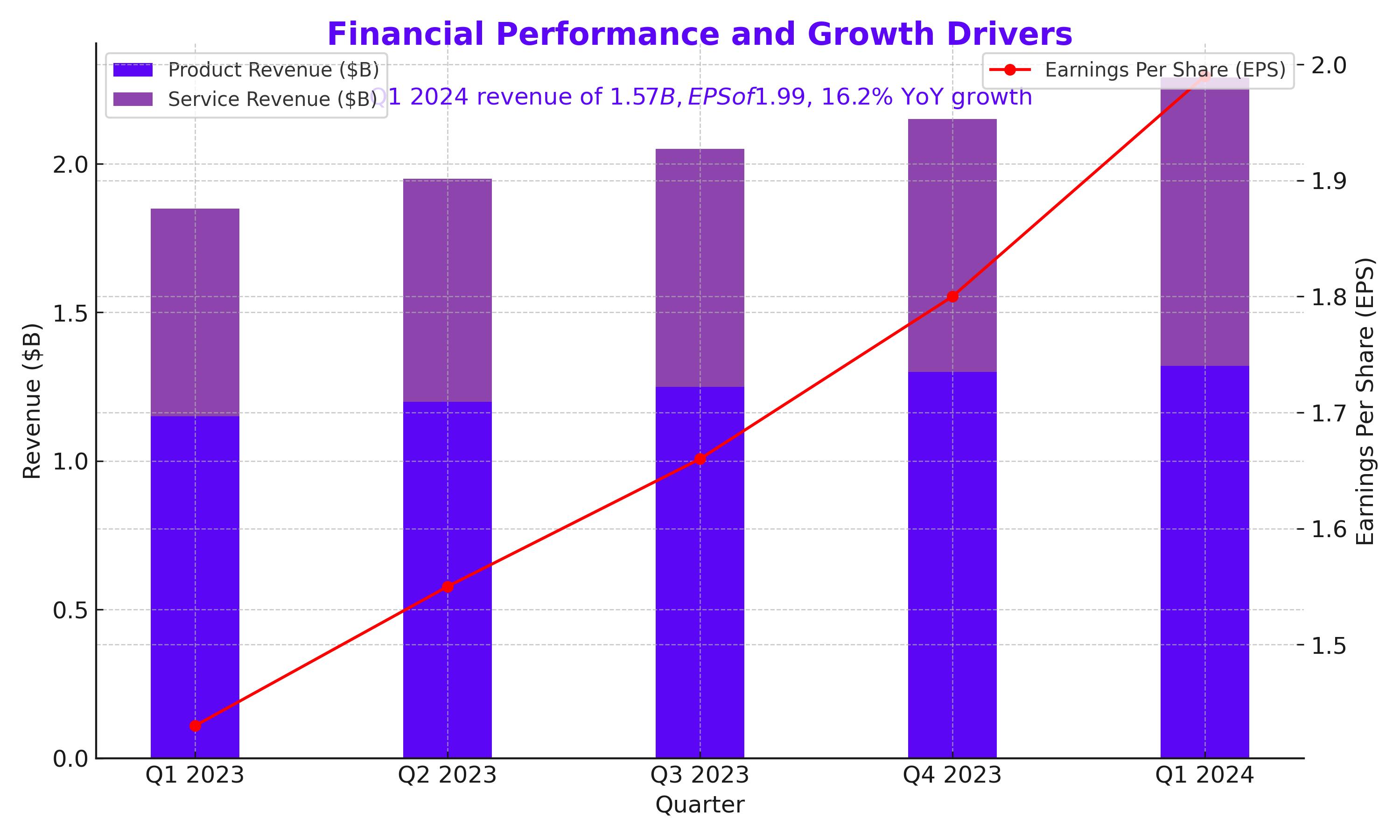

Financial Performance and Growth Drivers

Revenue and Earnings Growth

In its recent earnings report, Arista Networks demonstrated robust financial health. The company reported Q1 2024 revenues of $1.57 billion, reflecting a 16.2% year-over-year growth, and an adjusted EPS of $1.99, marking a 39.1% increase. These results underscore the company’s strong market position and growth trajectory.

- Product Revenue: $1.32 billion (+12.8% YoY)

- Service Revenue: $970 million (+35.2% YoY)

Gross and Operating Margins

Arista's gross profit margins for its products were at 60.7%, an increase of 4.2% year-over-year, while service margins stood at 80%, up by 1.2%. Operating margins also improved to 47.4%, highlighting efficient cost management and strong pricing power.

Net Cash Position

Arista’s balance sheet is solid, with a net cash position of $5.44 billion, up 63.3% from the previous year. This strong cash position provides a buffer and flexibility for strategic investments and growth initiatives.

Industry Position and Competitive Landscape

Market Share and Competitiveness

Arista holds a significant share in the ethernet switching market, positioning itself as a leader alongside major competitors like Cisco and Juniper Networks. Its products cater primarily to hyperscalers and cloud-based enterprise customers, with Meta Platforms (NASDAQ:META) and Microsoft (NASDAQ:MSFT) each contributing over 10% of its total revenues in FY2023.

Strategic Partnerships and Customer Concentration

The company’s strategic partnerships with Meta and Microsoft have bolstered its revenue streams. Meta’s planned FY2024 capex of $37.5 billion and Microsoft’s capex exceeding $50 billion underscore the substantial investment in AI and data center infrastructure, which Arista stands to benefit from significantly.

Valuation Metrics and Market Comparison

Valuation Analysis

Arista’s stock is currently trading at a forward P/E ratio of 37.04x, a premium compared to its peers like Cisco (12.80x) and HP Enterprise (9.33x). This premium valuation reflects the market’s confidence in Arista’s growth prospects but also suggests limited margin of safety.

- Market Cap: $103.16 billion

- Enterprise Value: $98.75 billion

- Trailing P/E: 45.85

- Forward P/E: 41.67

Analyst Price Targets

Analysts have set a range of price targets for ANET, from a low of $220.00 to a high of $389.00, with an average target of $323.77. The stock’s current price of $329.21 is near this average, indicating that it is fairly valued based on current analyst expectations.

Insider Transactions and Institutional Holdings

Insider Activity

Insider transactions can provide valuable insights into the company’s prospects. Over the past twelve months, insiders have sold $225.18 million worth of shares, a significant increase of 87.6% sequentially. This selling activity could be a signal of the stock being overvalued at current levels.

For detailed insider transaction data, you can refer here.

Institutional Holdings

Approximately 69.86% of Arista’s shares are held by institutions, reflecting strong institutional confidence in the company’s future prospects.

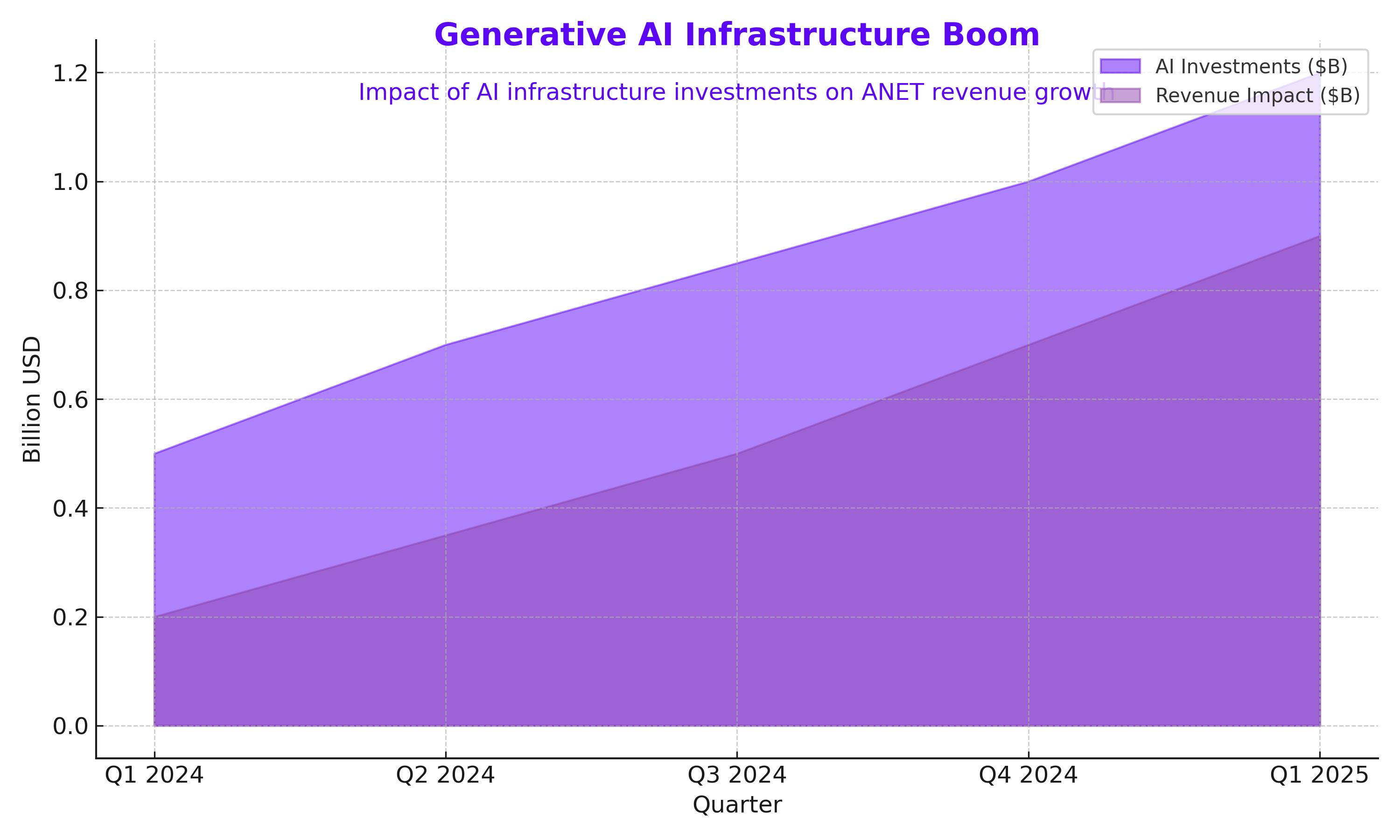

Future Outlook and Strategic Analysis

Generative AI Infrastructure Boom

Arista Networks is well-positioned to benefit from the ongoing boom in generative AI infrastructure. The company’s advanced networking solutions are critical for the data centers of major tech giants, and with AI-related capex increasing, Arista’s growth trajectory looks promising.

Earnings Projections and Growth Estimates

For FY2024, analysts estimate an EPS of $7.92 and revenues of $6.71 billion, with projections for FY2025 showing further growth to an EPS of $8.99 and revenues of $7.79 billion. These estimates underscore the company’s robust growth potential in the near term.

Strategic Recommendations

Given Arista’s strong financial performance, strategic industry positioning, and positive growth outlook, the stock appears to be a solid investment. However, considering its premium valuation and recent insider selling, potential investors might want to wait for a pullback to around $240 for a better entry point, aligning with fair value estimates.

Arista Networks (NYSE:ANET) is fundamentally strong, but the recent premium valuation suggests caution. Waiting for a price pullback to the $240 level would provide a better risk-reward r atio. This strategy aligns with historical support levels and allows for potential upside as the stock rebounds from this key support.

atio. This strategy aligns with historical support levels and allows for potential upside as the stock rebounds from this key support.

Industry Trends and Market Drivers

Generative AI and Data Center Growth

Arista Networks is set to benefit significantly from the generative AI and data center expansion. The company’s core products—AI Ethernet switching and advanced network operating systems—are in high demand among hyperscalers like Meta Platforms (NASDAQ:META) and Microsoft (NASDAQ:MSFT). These tech giants are massively increasing their capital expenditures to support AI and cloud infrastructure, which bodes well for Arista’s future revenue streams.

- Meta's FY2024 CapEx: $37.5 billion (+33.4% YoY)

- Microsoft's FY2024 CapEx: Over $50 billion, with potential investment of $100 billion by 2030.

Financial Performance Analysis

Revenue and Earnings Growth

Arista’s Q1 2024 performance was impressive, with revenue hitting $1.57 billion, marking a 16.2% year-over-year growth. The adjusted EPS of $1.99 represented a 39.1% increase, showcasing the company's ability to scale profitably.

Profit Margins

Arista’s gross profit margins have been robust, with product margins at 60.7% and service margins at 80%. These margins reflect efficient operations and strong pricing power in a competitive market. Operating margins have also improved to 47.4%, contributing to the company’s healthy financial profile.

Cash Flow and Balance Sheet Strength

Arista’s asset-light business model has resulted in a strong balance sheet. The company has a net cash position of $5.44 billion, an increase of 63.3% year-over-year, and operates with zero debt. This financial flexibility allows Arista to invest in growth opportunities and weather economic uncertainties.

Future Revenue Projections

Analysts project continued growth for Arista, with FY2024 revenues estimated at $6.71 billion and FY2025 revenues at $7.79 billion. The consistent revenue growth is underpinned by the increasing demand for advanced networking solutions from major tech companies and cloud service providers.

Valuation Metrics

Premium Valuation and Market Comparison

Arista’s forward P/E ratio of 37.04x is high compared to peers like Cisco (12.80x) and HP Enterprise (9.33x). This premium valuation indicates market confidence but also suggests limited margin of safety. However, the company’s strong cash position and growth prospects justify a higher multiple to some extent.

Forward Valuation Estimates

- Fair Value Estimate: $242.20 (based on LTM adjusted EPS of $7.48 and 1Y P/E mean of 32.39x)

- Long-Term Price Target: $335.20 (based on FY2026 adj EPS estimates of $10.35)

Risks and Considerations

Customer Concentration

A significant portion of Arista’s revenue comes from a few large customers, including Meta and Microsoft. While these relationships are beneficial, they also pose a risk if any of these customers reduce their spending or switch to competitors.

Market Competition

Arista competes with major players like Cisco and Juniper Networks. The competitive landscape requires continuous innovation and strategic partnerships to maintain market share.

Insider Selling

Recent insider selling, totaling $225.18 million over the past twelve months, raises concerns about the stock being overvalued. This insider activity warrants caution and supports the strategy of waiting for a pullback before investing.

Technical Analysis and Market Sentiment

Technical Indicators

Technical indicators show mixed signals. The Relative Strength Index (RSI) indicates that the stock may be overbought, while the Moving Average Convergence Divergence (MACD) has flashed a sell signal, suggesting potential short-term weakness.

Market Sentiment

Despite these technical indicators, market sentiment remains positive due to Arista’s strong growth prospects and strategic position in the AI and data center markets. Institutional investors hold 69.86% of the shares, reflecting confidence in the company’s long-term potential.

Arista Networks (NYSE:ANET) Investment Decision: Buy, Sell, or Hold?

Given Arista Networks' strong financial performance, with Q1 2024 revenues at $1.57 billion (16.2% YoY growth) and adjusted EPS of $1.99 (39.1% YoY increase), the stock shows solid fundamentals. However, the current premium valuation (forward P/E of 37.04x) and significant insider selling ($225.18M in the past 12 months) suggest caution. With technical indicators pointing to potential short-term weakness, the recommendation is to hold. Waiting for a pullback to the $240 support level provides a better risk-reward ratio before considering a buy. For more details on ANET.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex