Bank of America Stock Analysis: Growth and Valuation

Understanding BAC's Competitive Edge, Financial Performance, and Preferred Shares Opportunities | That's TradingNEWS

Bank of America: Analyzing Recent Performance and Future Prospects

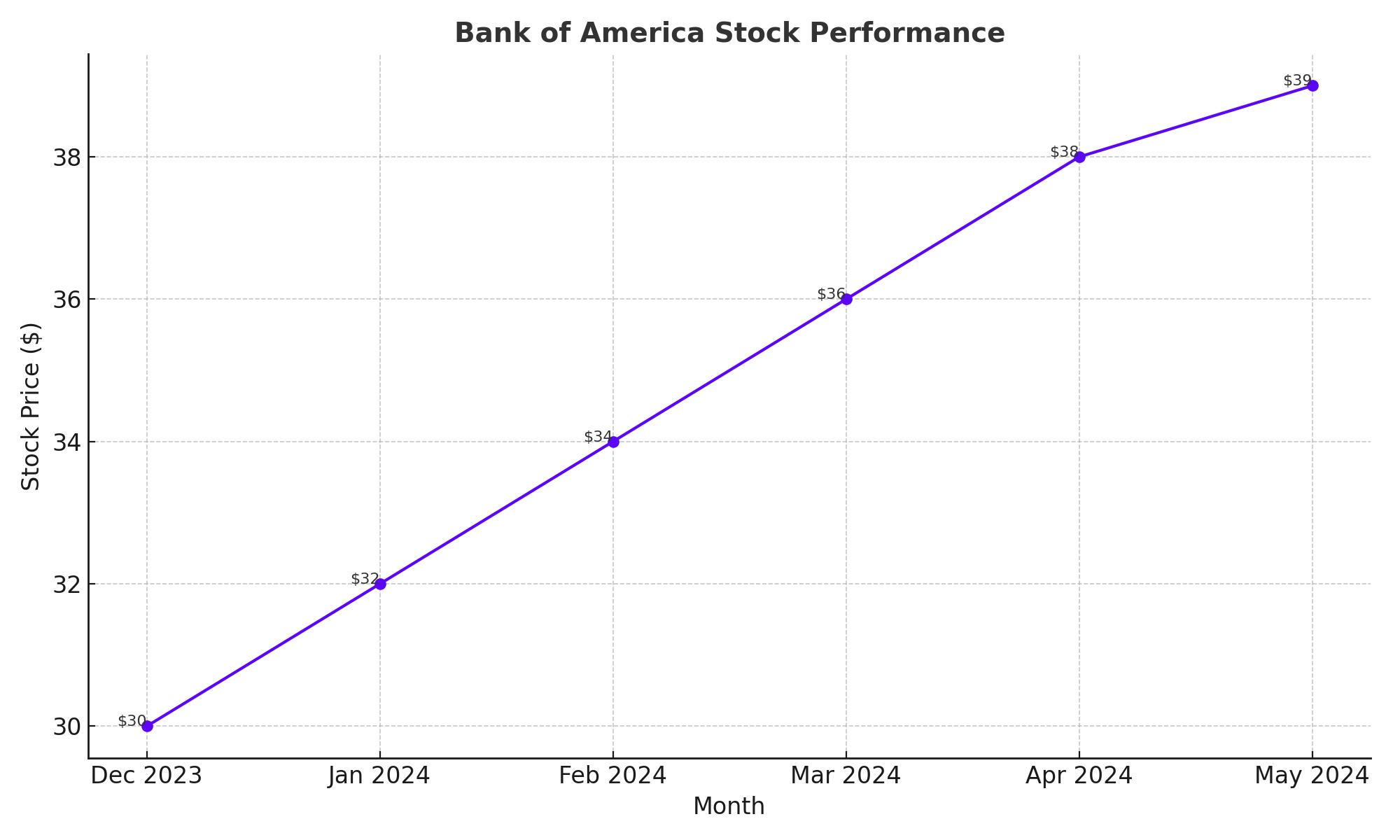

NYSE:BAC Stock Performance

Shares of Bank of America NYSE:BAC have surged 30% in the past six months, outpacing the S&P 500. Investors are optimistic about potential interest rate declines, which could boost the bank's lending growth.

Growth Potential and Market Position

Bank of America reported $99 billion in revenue in 2023 and holds $3.2 trillion in assets as of March 31, 2024. Despite its massive scale, the company's growth has been modest, with total revenue increasing at a compound annual rate of 1% from 2013 to 2023. The bank's deposit base stands at $1.9 trillion, and its loan book has seen slight declines in recent months.

Competitive Advantages of NYSE

Valuation Analysis

Bank of America trades at a price-to-earnings ratio of 13.5, higher than six months ago and above the trailing five-year average. The price-to-book (P/B) ratio is 1.2, indicating that the stock is not undervalued compared to historical metrics. Given the current valuation, some investors may question whether the stock can outperform the S&P 500 over the next five years.

Financial Highlights

Bank of America's Q1 2024 results showed net interest income increased slightly, and non-interest income also rose while non-interest expenses decreased by nearly 3%. The pre-tax income was $7.26 billion, including a $1.32 billion loan loss provision. After taxes and preferred dividends, the net income attributable to common shareholders was $6.14 billion, or $0.76 per share.

Impact of FDIC Special Assessment

Bank of America faced a $700 million pre-tax impact from the FDIC special assessment, which affected the reported net income. Excluding this, the underlying net income was approximately $0.83 per share. The bank used about 8% of its net income to cover preferred dividends, demonstrating the safety of these payouts.

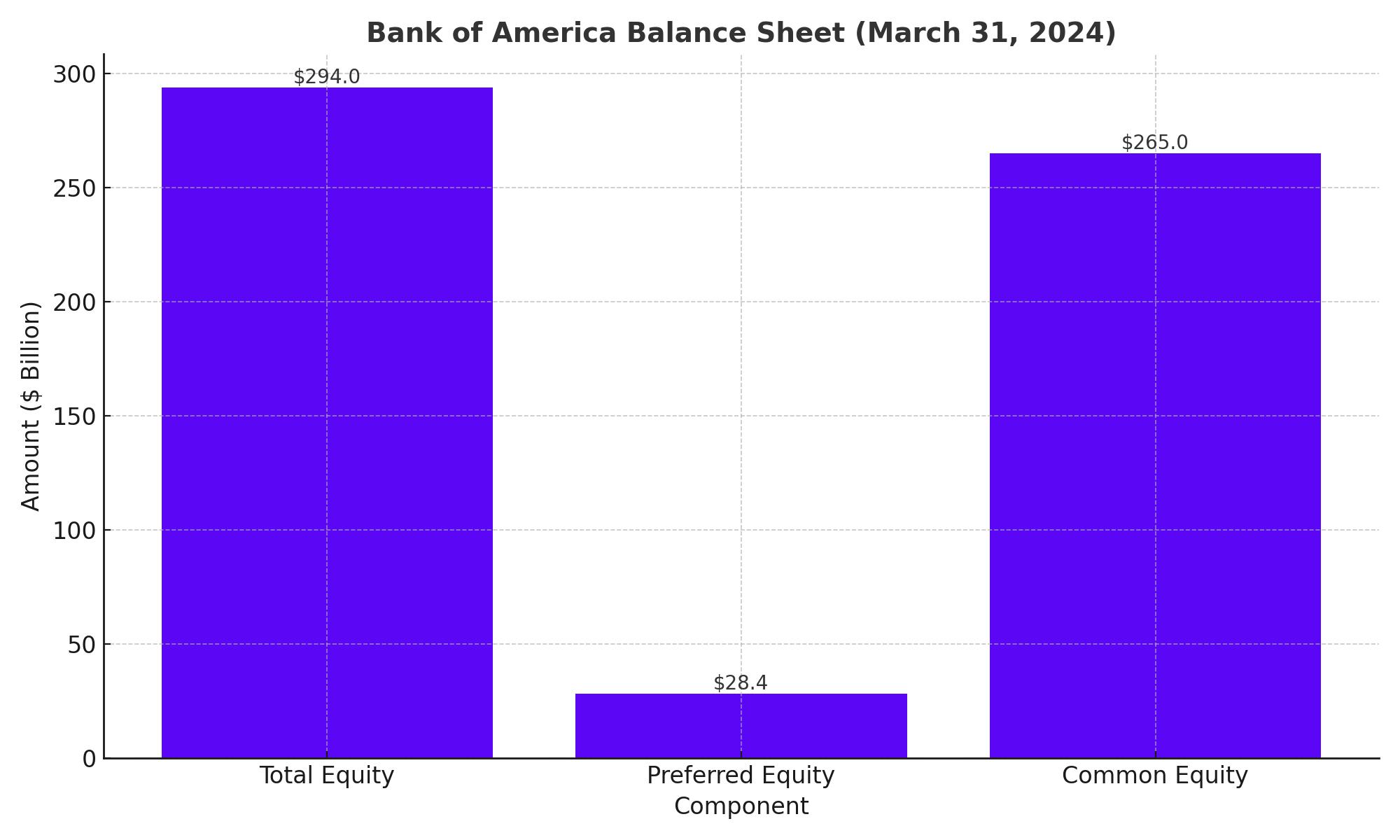

Balance Sheet Strength

The total equity on the balance sheet was just under $294 billion as of March 31, 2024, with $28.4 billion in preferred equity and $265 billion in common equity. The substantial common equity provides a strong cushion for preferred shareholders.

Preferred Shares Overview

Bank of America offers various preferred shares, with the Series HH preferred shares trading at $24.57 per share and yielding approximately 5.98%. These shares have a fixed dividend of $1.46875 per share annually. The Series L preferred shares, trading at $1,163 per share, yield around 6.25% and are not callable, making them an attractive option for income-focused investors.

Investment Thesis

While Bank of America's common shares are appealing at lower price levels, the preferred shares, particularly the Series L, offer a higher yield and are less affected by market volatility. Investors seeking stable income might find these preferred shares more attractive compared to the common stock.

For real-time stock performance and further details, visit the Bank of America stock profile.

Conclusion

Bank of America's recent performance and financial strength make it a robust player in the financial services sector. The bank's competitive advantages, solid balance sheet, and attractive preferred shares offer compelling investment opportunities, despite the current high valuation of its common stock.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex