Berkshire Hathaway's Market Position and Future Outlook

Unveiling the Financial Resilience and Growth Prospects of Berkshire Hathaway in 2024 | That's TradingNEWS

Strategic Analysis of Berkshire Hathaway's Market Position and Future Outlook

Berkshire Hathaway's Market Resilience

Berkshire Hathaway Inc. (NYSE: BRK.A, BRK.B), helmed by the legendary Warren Buffett, has consistently been a bastion of stability in tumultuous markets. As we advance into 2024, the prevailing economic uncertainty and interest rate volatility present a scenario where Berkshire’s conservative yet robust approach could lead to outperformance, especially against the backdrop of an overly optimistic S&P 500 (SPY) forecast.

Interest Rates and Economic Impact

The ongoing interest rate increases, representing the fastest tightening cycle in decades, prompt a reevaluation of economic norms. Historically, higher rates were commonplace, contrary to the low-interest-rate environment experienced by younger generations. These rate hikes, though seemingly beneficial in curtailing inflated asset prices and addressing housing market disparities, might have delayed consequences.

Fed's Dot Plot and Market Expectations

The Federal Open Market Committee’s dot plot, projecting future Fed Funds rates, suggests rate cuts in 2024. However, market reactions to these cuts could diverge from expectations, as seen previously where rate hikes coincided with a rising S&P 500. The current market sentiment, veering towards 'extreme greed,' and the NASDAQ 100's exceptional performance amidst rate hikes, indicate potential market over-optimism.

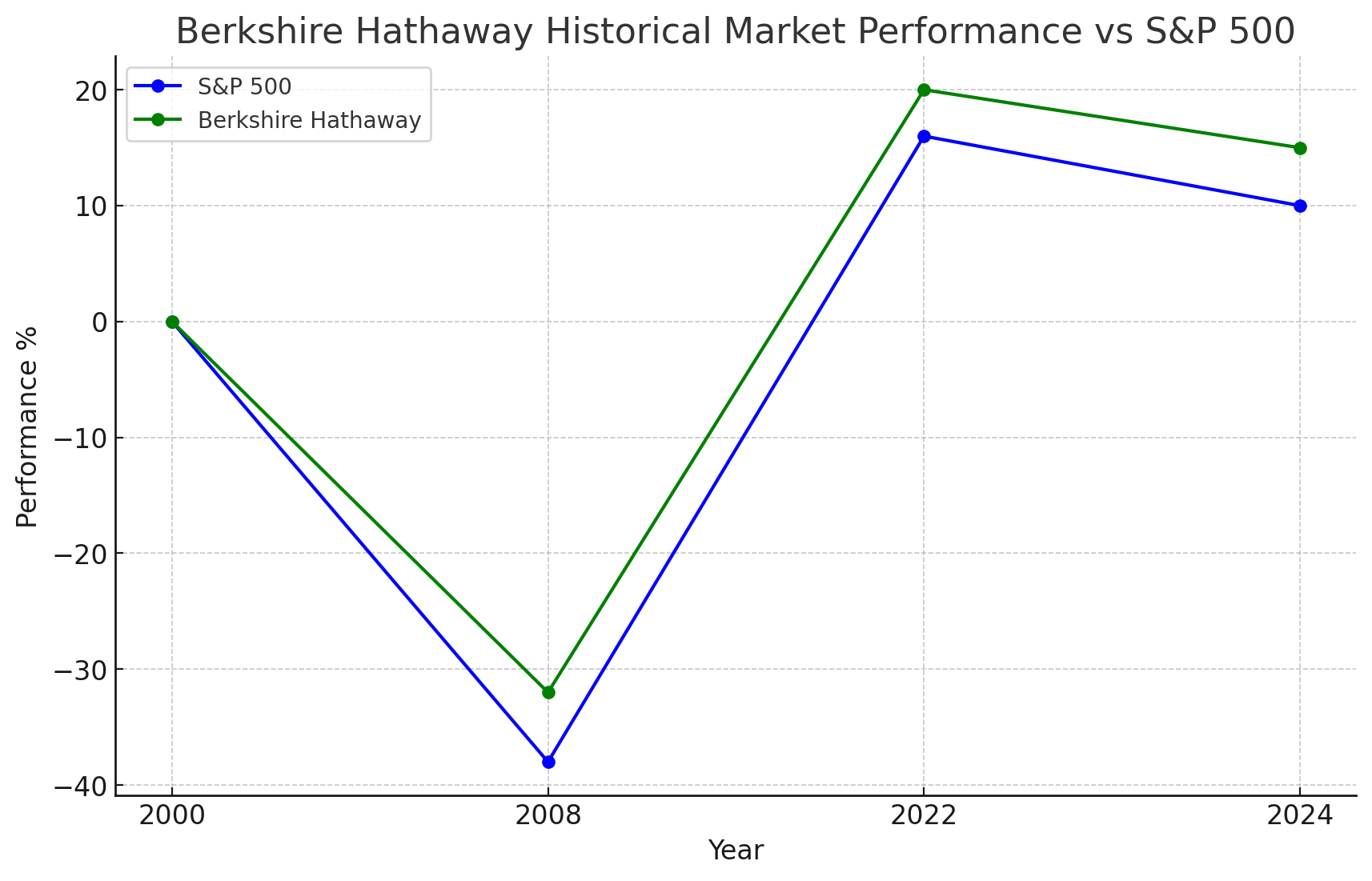

Berkshire's Historical Market Performance

Berkshire Hathaway’s track record during economic downturns reveals its resilience and potential to outperform the S&P 500. This trend was evident in 2022 and during earlier crises at the beginning of the century. The firm's strategy, focused on risk management and wealth preservation, has proven effective in safeguarding investments during challenging times.

Valuation and Investment Perspective

Berkshire Hathaway's valuation, particularly its price-to-book ratio, remains within a historically reasonable range, though not at bargain levels. The firm's diverse investment portfolio, spanning insurance, railroad, utilities, manufacturing, and significant holdings in major corporations like Apple, provides a stable foundation for continued growth and value generation.

Insurance Segment Analysis

Berkshire’s insurance operations, leveraging the concept of 'float,' have been pivotal in fueling acquisitions and investments. The firm’s insurance subsidiaries, including GEICO and BHPG, exhibit varied performance with GEICO facing challenges amid inflationary pressures. The underwriting profitability across these segments, combined with the investment income generated, contributes significantly to Berkshire’s overall financial health.

Diverse Business Operations

Berkshire’s portfolio extends beyond insurance to include significant investments in the railroad industry (BNSF), utilities, and manufacturing. BNSF, in particular, benefits from high entry barriers and consistent cash flow generation. The utilities segment, marked by investments in renewable energy, and the manufacturing division, with its array of industrial and consumer products, add layers of diversity and stability to Berkshire’s business model.

Investment Portfolio and Future Growth

The investment segment, heavily weighted towards Apple, represents a substantial portion of Berkshire’s assets and income. This segment's performance, combined with the cash flows from the diverse business operations, provides ample opportunities for future acquisitions and investments, further enhancing Berkshire’s value proposition.

Balance Sheet Strength

Berkshire's balance sheet, characterized by a strong cash position and diversified assets, offers a cushion against market downturns. The firm’s ability to generate consistent cash flows, even in challenging economic conditions, underscores its financial strength and strategic agility.

Conclusion: Navigating 2024 with Caution

As we step into 2024, Berkshire Hathaway stands out as a potentially safer investment choice, given the market’s high expectations and uncertain economic climate. The company’s proven track record, diverse business operations, and strong balance sheet position it well to navigate the complexities of the current financial landscape. For investors seeking stability and long-term value creation, Berkshire Hathaway represents a prudent choice in an otherwise optimistic market.

For real-time stock information and insider transactions on Berkshire Hathaway, refer to the following links: BRK.B Real-Time Chart and Insider Transactions.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex