Bitcoin Analysis: Highs, Lows, and Market Dynamics

Bitcoin Price Trends Amidst High Interest Rates and Inflation Data | That's TradingNEWS

Bitcoin Price Analysis: Highs, Lows, and Market Dynamics

Bitcoin Price Trends Amidst High Interest Rates and Inflation Data

The price of Bitcoin experienced minimal movement on Monday, reflecting ongoing concerns about high interest rates ahead of key U.S. inflation data. Bitcoin fell 0.3% over the past 24 hours, settling at $68,760.3 by 01:04 ET. This price movement keeps Bitcoin within a trading range it has maintained over the last two months. Broader cryptocurrency prices also remained subdued as traders leaned towards the dollar, dampening optimism for Federal Reserve interest rate cuts this year.

Ethereum's Surge: Boost from SEC Approval

Conversely, Ethereum (ETH) emerged as a standout performer, rallying 4.4% to $3,913.79, nearing a two-month high. This surge followed the SEC's approval of applications from major exchanges to list ETFs directly tracking Ether's price. This approval is expected to trigger a significant rally in Ether, similar to the impact seen with Bitcoin ETFs earlier this year.

Altcoins and Market Sentiment

Altcoins, however, remained largely muted due to concerns about prolonged high U.S. interest rates. XRP and Solana (SOL) fell 2% and 0.8%, respectively, while meme tokens Dogecoin (DOGE) and Shiba Inu (SHIB) shed 4.3% and 1.6%, respectively. The market focus this week is on the PCE price index data, the Federal Reserve’s preferred inflation gauge, which will influence expectations for future interest rates.

Liquidity and Resistance Levels

Bitcoin saw strong performance, briefly surpassing $69,500 before consolidating. Analysis by Daan Crypto Trades indicated liquidity buildup around the $68,300 and $69,800 levels, suggesting these are key areas to watch in the short term. Keith Alan of Material Indicators emphasized the importance of Bitcoin flipping $69,000 to support, marking it as a crucial resistance level.

Bitcoin's Consolidation and Future Projections

Market Dynamics Post-Halving

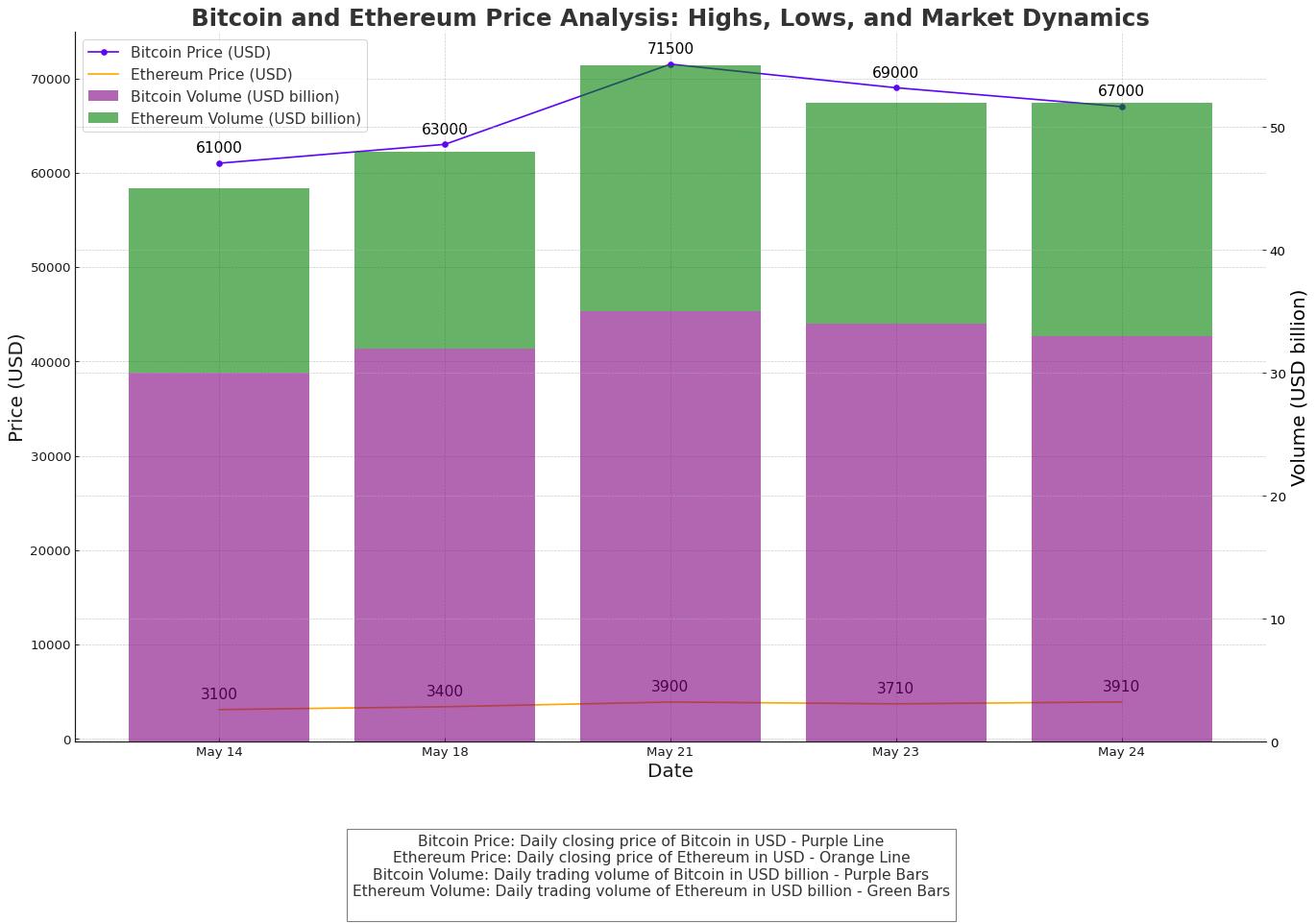

Despite breaking out to $71,500 post-halving, Bitcoin faced resistance and continued consolidation, predicted to last several more weeks between $60,000 and $70,000. The primary cryptocurrency saw significant volatility recently, climbing from around $61,000 on May 14 to over $71,000 on May 21. However, a price correction brought it back below $67,000 on May 24, with Bitcoin stabilizing between $68,500 and $69,300.

Bullish Sentiments and Future Price Targets

Many analysts maintain a bullish outlook for Bitcoin. Titan of Crypto anticipates a breakout past the $69,000 resistance zone, potentially pushing Bitcoin to new all-time highs between $173,000 and $224,000. Fibonacci extensions support this forecast, aiding traders in identifying key price levels for potential swings.

Ethereum's Performance and Market Expectations

Recent Price Movements

Ethereum, the second-largest digital asset by market capitalization, saw its price jump from $3,100 on May 21 to over $3,900 on May 23. This increase was driven by the SEC's approval of spot ETH ETFs, despite a brief plunge below $3,700. Currently trading at approximately $3,910, Ethereum has gained 4% daily and 36% over two weeks.

Analyst Projections

Analysts predict further growth for Ethereum, with Rekt Capital noting historical price movements that suggest a rally towards $4,000. The asset's strong performance above the $3,250-$3,500 range indicates regained bullish momentum.

Ripple (XRP) and Legal Developments

Price Trends and Predictions

Ripple's XRP experienced volatility, fluctuating between $0.50 and $0.54, and currently trading around $0.52. Despite modest gains, analysts like JAVON MARKS foresee a bullish breakout due to XRP nearing a major convergence point and favorable RSI patterns.

Impact of Legal Battles

A significant factor affecting XRP's price is the ongoing lawsuit between Ripple and the US SEC. The outcome of this legal battle, which has been in trial for over three years, could significantly impact XRP's future value.

Bitcoin's Historical Trends and Future Outlook

Predictions and Market Sentiment

Bitcoin has a history of price volatility, with some analysts like BitQuant predicting a rise to $80,000 by the end of May and $95,000 in June. This forecast is based on current market trends and technical signals.

Divergent Analyst Views

Opinions are divided, with analysts like Michael Von de Poppe suggesting Bitcoin might stay between $67,500 and $68,000, and Willy Woo being cautiously optimistic about future highs. Despite differing views, the overall sentiment remains bullish.

Challenges and Opportunities

Market Volatility and External Factors

Bitcoin's future growth faces significant challenges from market volatility, regulatory changes, and economic fluctuations. Rapid price swings, influenced by investor sentiment and macroeconomic events, necessitate vigilance and strategic diversification. Regulatory shifts and technological advancements can drastically impact market dynamics, while global economic conditions and geopolitical events further add to the uncertainty. Investors must diversify portfolios and stay informed to mitigate risks effectively

Long-Term Potential

Despite current stagnation, historical data from previous Bitcoin halvings suggest significant long-term gains. Analysts like Cathie Wood of Ark Invest forecast Bitcoin reaching $1 million by 2030, driven by the success of new spot Bitcoin ETFs and sustained high returns.

Conclusion

Bitcoin and Ethereum continue to captivate investors with their potential for significant gains, despite facing short-term challenges. Strategic approvals, market trends, and historical data point towards a bullish future for these leading cryptocurrencies, offering promising opportunities for investors willing to navigate the inherent market risks.

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex