Bitcoin Approaches $70K: Will the Rally Continue or Pull Back?

With BTC close to $70,000, traders are on edge. Here’s why key resistance levels, institutional moves, and market volatility could shape Bitcoin’s next big move | That's TradingNEWS

Bitcoin Price Nears $70,000: Is It a Buy, Sell, or Hold?

BTC Eyes Key Resistance Levels as Market Anticipates New Highs

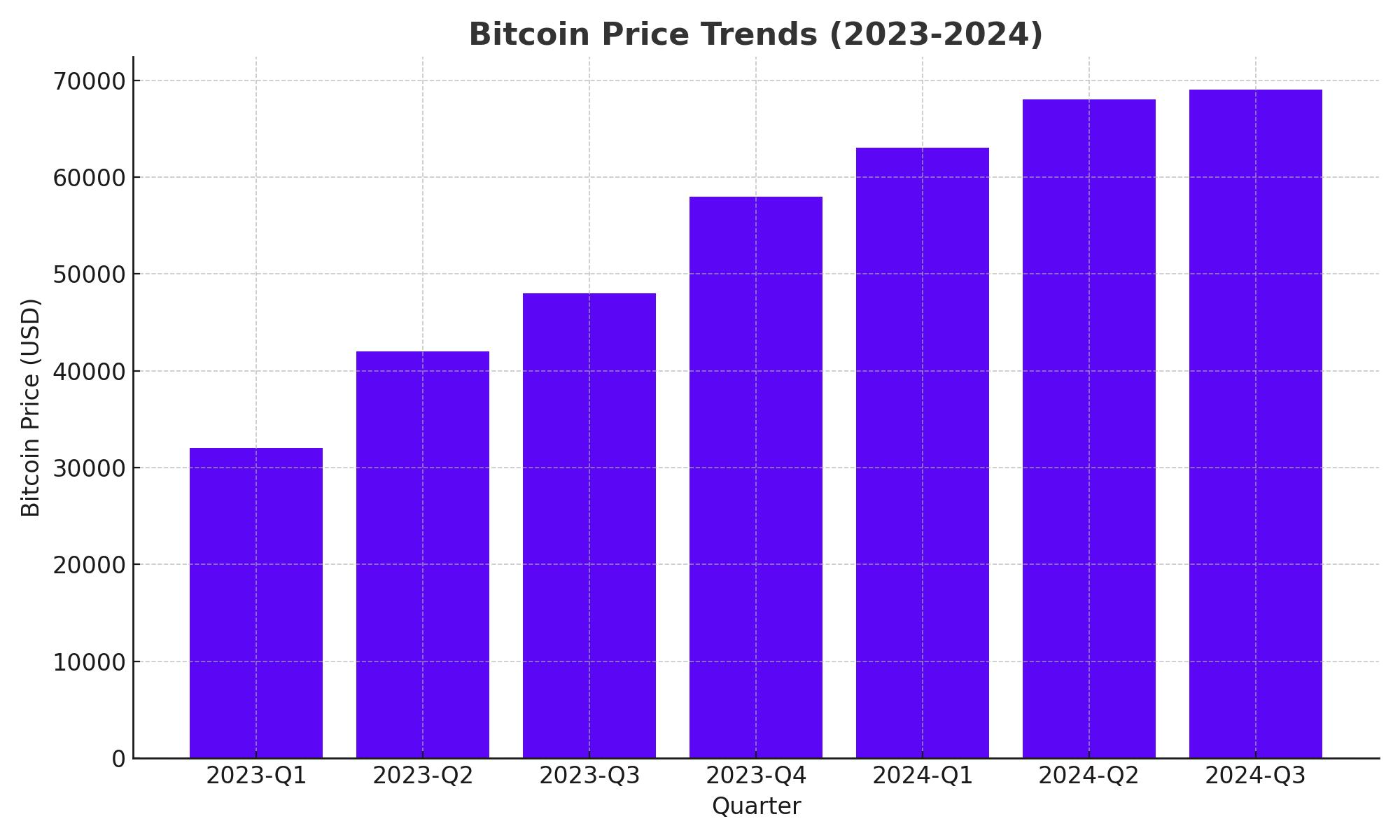

Bitcoin’s price movement this week has kept traders on edge, with the flagship cryptocurrency hovering around the $68,000 mark after failing to decisively break through the $70,000 resistance level. At the time of writing, BTC/USD is trading at approximately $68,112, slightly up by 1% after touching a weekly low of $66,000. But what’s driving this volatility, and is Bitcoin gearing up for another rally, or are we seeing signs of a pullback?

Market Sentiment: A Balancing Act Between Bulls and Bears

Bitcoin has seen a remarkable 200% surge since its 2022 lows, largely driven by institutional interest and major corporate investments. Companies like Tesla, which holds around 11,509 BTC (valued at $776.9 million), remain pivotal to Bitcoin's price trajectory. Tesla's recent decision to move its Bitcoin holdings to new wallets sparked speculation that the company may be preparing for an over-the-counter sale. However, blockchain analytics firm Arkham suggested that this could simply be a wallet rotation, with no sale in sight.

BTC’s short-term movements are currently tied to broader market risk aversion. Traders remain cautious, watching for key events like Tesla’s Q3 earnings and the upcoming U.S. presidential election, both of which could act as catalysts for Bitcoin’s next significant move.

Bitcoin’s Key Technical Levels: Can BTC Break $70,000?

After briefly testing the $70,000 resistance earlier in the week, Bitcoin has failed to maintain its upward momentum. Analysts suggest that $70,000 remains a psychologically critical level, and a successful break above it could lead to new all-time highs of $73,777—the level last seen in March 2024.

On the downside, $66,000 has emerged as a key support level. A drop below this could send BTC back to $62,055, a crucial 61.8% Fibonacci retracement level, marking a potential near-term correction.

The Relative Strength Index (RSI), currently sitting at 60, suggests that bullish momentum is gaining traction after rebounding from the neutral 50 mark. A break above $70,000 would likely ignite further buying interest, pushing the price towards $73,777 and potentially setting the stage for BTC to challenge $80,000 in the months ahead.

Election and Fed Policy: A Tipping Point for Bitcoin?

Political uncertainty surrounding the upcoming U.S. presidential election is creating additional volatility in the crypto market. The potential return of Donald Trump to the White House is seen by some analysts as bullish for Bitcoin, with expectations of a more crypto-friendly regulatory environment. Trump has previously voiced support for Bitcoin and even proposed creating a U.S. Bitcoin strategic reserve, predicting that Bitcoin's price could surpass gold.

Moreover, next week’s U.S. personal spending report and the Federal Reserve’s decision on interest rates are also critical. Traders are closely watching how inflation data and rate cuts will impact Bitcoin. As it stands, interest rate hikes have historically created headwinds for speculative assets like BTC, but the Fed’s next move could determine the direction for the broader crypto market.

Institutional Moves: BlackRock’s Influence and Tesla’s Wallet Shift

Institutional interest continues to play a significant role in Bitcoin's current market dynamics. BlackRock's ETF applications and major investment in cryptocurrencies have fueled optimism that Bitcoin will break out of its consolidation phase. With BlackRock leading the charge, many expect institutional flows to push Bitcoin to new highs over the next year.

Meanwhile, Tesla’s recent Bitcoin wallet movement is being closely scrutinized. As the fourth-largest corporate holder of Bitcoin, Tesla's handling of its $776.9 million in BTC could provide a strong signal to the market. If Tesla were to offload a portion of its holdings, it could lead to a short-term correction. Conversely, maintaining or increasing its BTC stake could serve as a bullish indicator.

Bitcoin Options Expiry and the Impact on Market Volatility

With Bitcoin options worth $4.2 billion set to expire this Friday, traders are bracing for heightened market volatility. Historically, large options expiries have acted as major catalysts for short-term price swings, and this week could be no different. If Bitcoin can maintain its current support levels, the options expiry could provide the fuel for a renewed rally.

Conversely, failure to hold key support could accelerate a decline towards $62,000, with volatility spikes amplifying market movements.

Macroeconomic Factors: Interest Rates and Inflation’s Impact on BTC

Bitcoin's status as a store of value has gained prominence amid rising inflation and central bank policies. While inflation is a concern for traditional assets, Bitcoin has been viewed by some as a hedge. However, the interplay between rising Treasury yields, a strengthening U.S. dollar, and a potential slowdown in Federal Reserve rate cuts could challenge Bitcoin’s narrative as an inflation hedge.

As Treasury yields remain elevated at 4.2%, many analysts predict that Bitcoin could face headwinds in the coming months if the Fed adopts a more cautious stance on rate cuts. Historically, tightening monetary policy has dampened demand for risk assets, and Bitcoin could be impacted if inflationary pressures persist.

What’s Next for Bitcoin? A Bullish Breakout or Bearish Correction?

Bitcoin is at a critical juncture. The next few weeks will be pivotal in determining whether BTC can overcome the $70,000 barrier and resume its upward trajectory, or if market conditions will force a deeper correction. With institutional involvement, geopolitical risks, and the looming U.S. election all in play, Bitcoin traders should prepare for heightened volatility.

For now, Bitcoin’s immediate focus remains on whether it can clear $70,000. Breaking this key level could pave the way for new highs, while failure to do so may signal the start of a broader consolidation phase. With a strong support zone at $66,000, Bitcoin bulls will be hoping that this is just the beginning of the next leg up.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex