Bitcoin Breaks $60K: How Rate Cuts, ETFs, and Whale Activity Are Driving BTC’s Next Bull Run

Fed Rate Cuts and Institutional Demand Set the Stage for Bitcoin's Explosive Growth | That's TradingNEWS

Bitcoin's Market Surge: The Power Behind BTC (BTC)

Federal Reserve Rate Cuts and Bitcoin’s Price Action

Bitcoin (BTC) has been rallying as it breached key psychological levels, notably crossing above $60,000 in recent trading sessions. This breakout came just days before the U.S. Federal Reserve’s long-awaited interest rate decision. Historically, Bitcoin performs strongly in response to rate cuts, especially since lower interest rates weaken the dollar, driving more liquidity into risk assets like BTC.

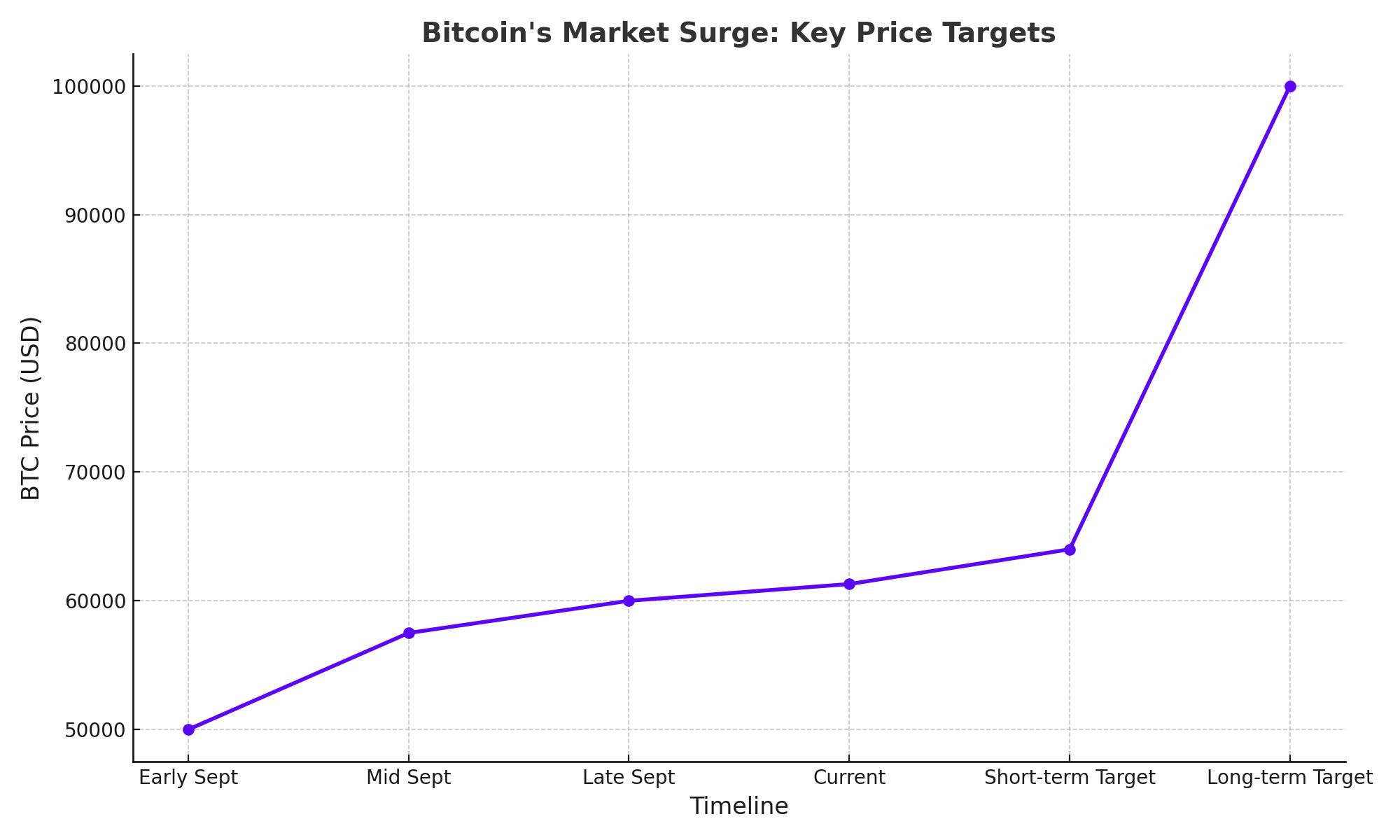

In recent weeks, the cryptocurrency fluctuated between $50,000 to $60,000, only to break above the $60K barrier after sustained bullish momentum. Bitcoin’s brief retracement to $57,500 earlier in the week didn’t last long. Bulls regained control, pushing the price to $61,300, its highest level in three weeks.

Interest Rate Cuts: BTC’s Big Opportunity

Fed Chairman Jerome Powell hinted that the central bank is poised to cut interest rates by 25 basis points. Such a move would mark a shift toward a more dovish policy, signaling the beginning of liquidity injections into the markets. This anticipated rate cut has already lifted market sentiment. BTC could potentially reach a target range of $64,000 in the near term, particularly if the Fed maintains this dovish stance over multiple meetings.

Cryptocurrency investors are eagerly awaiting any announcements from the FOMC meeting, with the likelihood of Bitcoin moving sharply in reaction. A half-point cut could propel BTC significantly, with analysts like Anthony Scaramucci predicting that BTC could soar as high as $100,000 by the end of the year.

ETFs and Institutional Support: Renewed Interest in Bitcoin

One of the key drivers behind Bitcoin's recent rally has been institutional investment. After two weeks of outflows, Bitcoin ETFs saw fresh inflows, signaling renewed investor confidence. BlackRock’s iShares Bitcoin Trust recorded its first day of inflows since mid-August, helping to break a negative trend that had weighed on Bitcoin's price.

Institutional adoption continues to grow, and despite regulatory uncertainty, Bitcoin’s dominance has climbed to over 57%, its highest level since April 2021. This is indicative of Bitcoin’s resilience as the leading digital asset, with hedge funds and corporations like MicroStrategy consistently buying up large amounts of Bitcoin. MicroStrategy, for example, purchased an additional $1.1 billion worth of BTC between August and September.

Retail and Whale Activity

On the retail front, there has been an influx of new buyers taking advantage of Bitcoin’s price dips. Short-term holders show strength, with only 4.46% in a loss position, signaling strong market resilience. On the other hand, long-term holders are experiencing diminished profit margins, with only 58% still in profit, down from 74% earlier this year. This suggests that while long-term investors remain committed, they are closely watching Bitcoin’s future movements.

Whale activity has also been noteworthy. Older whales are maintaining their positions, but newer whales and Binance traders have shown increasing buying interest. This collective demand from both retail and whale investors indicates Bitcoin’s market is primed for potential price growth, especially as the Fed loosens its monetary policy.

The Global Economic Impact on BTC

While the U.S. Federal Reserve plays a critical role in shaping Bitcoin’s near-term outlook, global factors are also influencing the market. In Australia, the central bank’s decision to shift focus to wholesale central bank digital currencies (CBDCs) hints at a broader acceptance of blockchain technology. With this evolution in monetary policy, Bitcoin could benefit as countries seek to explore the potential of decentralized assets.

Moreover, ongoing global liquidity concerns could lead to even higher BTC prices. Analyst Tomas predicted that a temporary drop in U.S. bank reserves, coupled with the end of Quantitative Tightening (QT), could lead to a liquidity injection that would boost Bitcoin’s value.

Short-Term Market Sentiment and Long-Term Bullish Trends

In the short term, technical indicators such as the TD Sequential have flashed a sell signal for BTC, which might signal a temporary correction. The Relative Strength Index (RSI) and Stochastic RSI indicate overbought conditions, suggesting that Bitcoin could experience some pullbacks. However, these corrections are likely to be short-lived, as Bitcoin’s price remains in a broader uptrend.

On the macro scale, Bitcoin’s performance is expected to improve heading into Q4, traditionally the strongest quarter for Bitcoin’s price action. With the Fed’s dovish policy set to last into 2025, this period presents an optimal opportunity for investors to allocate into BTC. Historically, Bitcoin rallies have followed halving events, with new all-time highs predicted by early next year.

Profits and Losses: The State of Bitcoin Holders

Bitcoin holders are split between short-term resilience and long-term profitability concerns. While short-term holders are showing stability, long-term holders have seen their profits decline. This shift suggests that Bitcoin’s rally has primarily benefited more recent entrants, while long-term investors are holding onto positions but waiting for new momentum.

The balance between short-term and long-term holders is a crucial factor in assessing Bitcoin’s overall market health. The increasing dominance of new whales signals that there is still plenty of bullish sentiment surrounding Bitcoin, even if the market remains volatile in the near term.

Conclusion: What’s Next for BTC?

As the market gears up for the Fed’s rate cuts and new liquidity injections, Bitcoin is set to benefit exponentially. Whether through institutional investments, ETF inflows, or the gradual adoption of decentralized assets globally, Bitcoin is in a prime position to break through resistance levels. With a dovish Fed policy and favorable Q4 seasonality trends, Bitcoin’s trajectory remains bullish, with $64,000 and even $100,000 in sight.

Investors should stay prepared for short-term volatility, but the overall outlook for Bitcoin remains strongly bullish as we move toward the end of 2024.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex