Bitcoin Eyes $65,000 as MicroStrategy Leads Institutional Inflows

MicroStrategy’s Massive $1.11 Billion Bitcoin Purchase Adds Fuel to the Bullish Rally. This incorporates MicroStrategy's role in the current market and makes the content compelling while also SEO-optimized.

Bitcoin Price Nearing Crucial Levels: Key Drivers Behind the Surge

Spot ETFs and Market Dynamics

Bitcoin (BTC) has experienced significant momentum recently, with prices trending upwards, closing the past seven days with a 10.57% gain. Currently hovering around $58,000, BTC has benefited from several macroeconomic factors and critical market events. Notably, Bitcoin ETFs in the U.S. saw an inflow of $39.02 million on September 12, signaling a renewed investor interest. This contrasts sharply with Ethereum, which saw negative inflows of $20.14 million. The significance of this surge in Bitcoin-related investment is underscored by the fact that the average cost basis for ETF investors is approximately $62,000. At the current BTC price, many ETF holders are still underwater, but the recent influx could be the precursor to a new rally.

Key Price Targets: Aiming for $65,000

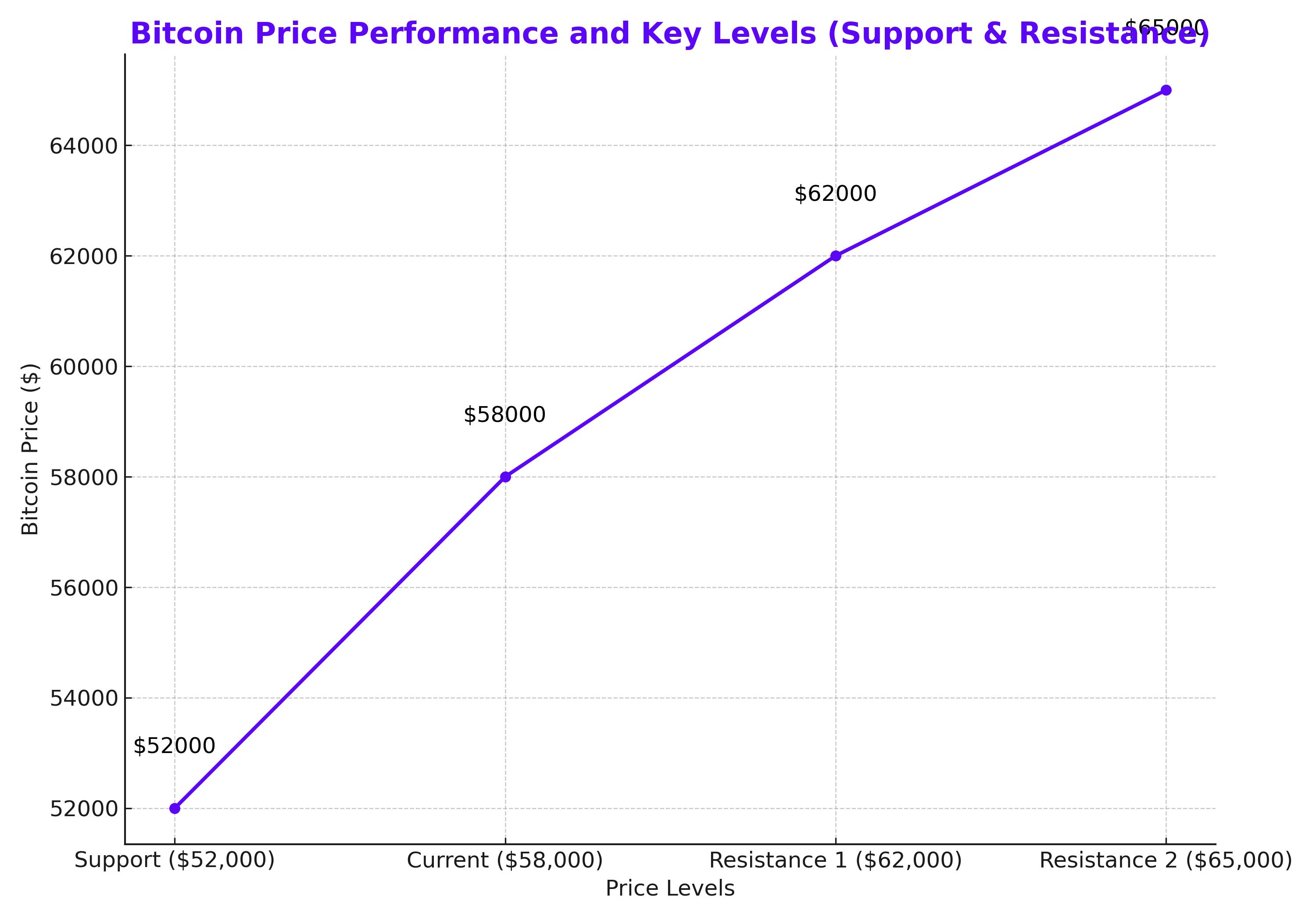

The technical picture for Bitcoin has also strengthened considerably. A potential breakout above $65,000 is supported by the formation of an inverted head and shoulders pattern, a classic bullish indicator. BTC must first break above the $59,500 neckline, a critical resistance level, before challenging the $62,000 mark. Should this resistance be breached, Bitcoin could see a swift rally to $65,000, potentially reaching new highs. However, it's essential to note that price could fall back into the range if momentum wanes before confirmation above this level.

A failure to break through $65,000 would likely lead to a price retracement, potentially back to the $52,000 support zone. But, if the $65,000 barrier is surpassed with high volume, Bitcoin could enter a new price discovery phase, with analysts suggesting the next target could be near $90,000.

Macroeconomic Influences and Risk Factors

The broader macroeconomic landscape has also played a crucial role in BTC’s recent price action. U.S. non-farm payroll data outperformed expectations, easing concerns around a potential economic slowdown. This positivity, combined with anticipation around the upcoming Federal Open Market Committee (FOMC) meeting on September 18, has led to increased market confidence. Investors are speculating whether the Federal Reserve will maintain or cut interest rates, a decision that could further drive BTC prices higher.

However, the strength of the U.S. dollar continues to be a headwind. Following a stronger-than-expected CPI inflation reading, Bitcoin gains were limited as the dollar strengthened. Additionally, the crypto market is delicately balanced, and any unexpected negative news could result in short-term volatility. For instance, a softer-than-anticipated interest rate cut by the Fed could dampen sentiment for risk-on assets like Bitcoin.

MicroStrategy’s Aggressive Accumulation

One of the most significant factors driving Bitcoin demand comes from institutional buyers, particularly MicroStrategy, which has once again made a major Bitcoin acquisition. Between August 6 and September 12, the company purchased an additional 18,300 BTC for $1.11 billion, averaging $60,408 per Bitcoin. This purchase brings their total holdings to a staggering 244,800 BTC, worth roughly $14 billion.

MicroStrategy’s aggressive accumulation strategy has solidified its position as one of the most prominent corporate Bitcoin holders globally. With an average purchase price of $38,585 per BTC, the company’s long-term bullish stance on Bitcoin is clear. Michael Saylor, MicroStrategy’s founder, has reiterated the firm’s strategy to use equity offerings to fund more Bitcoin purchases, signaling confidence in BTC’s future value.

Bitcoin and Broader Market Correlations

Interestingly, Bitcoin’s price movements have recently mirrored gains in technology stocks, particularly companies involved in artificial intelligence (AI). Nvidia (NASDAQ: NVDA) CEO Jensen Huang’s positive remarks about AI demand contributed to a rally in tech stocks, indirectly boosting Bitcoin. This suggests a broader correlation between Bitcoin and technology equities, with both benefiting from renewed optimism in high-growth sectors.

Nevertheless, Bitcoin remains entrenched within a broad $50,000 to $60,000 trading range, where it has spent most of the year. The token has struggled to decisively break above $60,000, with minimal positive cues to drive sustained upward momentum. Furthermore, the potential for regulatory scrutiny, especially surrounding corporate Bitcoin purchases, could introduce additional volatility.

Political Landscape and Regulatory Uncertainty

Political developments, such as the outcome of the recent U.S. presidential debate, have also impacted Bitcoin sentiment. Vice President Kamala Harris emerged with stronger odds for a 2024 presidency, climbing to 57 cents on online prediction markets, while pro-crypto candidate Donald Trump’s odds slipped to 47 cents. Harris is expected to maintain the Biden administration’s cautious approach to cryptocurrency regulation, particularly concerning fraud within the industry. This has already led to high-profile crackdowns by the Securities and Exchange Commission (SEC), which could continue if Harris remains in the political spotlight.

Trump, on the other hand, has shown more support for the crypto industry but has avoided discussing it during mainstream political events. The ongoing regulatory uncertainty in the U.S. remains a crucial factor for Bitcoin, as tighter regulations could limit institutional adoption and dampen investor enthusiasm.

Market Sentiment and Long-Term Outlook

Bitcoin’s market dominance has remained relatively steady at 53.8%, with its market cap reaching $1.147 trillion. The circulating supply of Bitcoin currently stands at 19.753 million, with 94.06% of the total supply already mined. While Bitcoin has struggled to maintain a decisive upward trajectory, many analysts remain bullish on its long-term prospects.

Several key indicators, such as the MVRV Z-score, suggest that Bitcoin is still in “bull market territory.” The MVRV Z-score, which compares market cap to its cost basis, stood at 1.6 at the end of August, above the mean of 1.42. This score has historically marked the dividing line between bull and bear markets. If Bitcoin can maintain its current levels and break above critical resistance zones, a new bull market phase could be on the horizon.

Institutional Inflows and Liquidity Dynamics

Institutional activity continues to be a driving force behind Bitcoin’s price fluctuations. The cumulative net inflows into Bitcoin ETFs have reached $17 billion, demonstrating strong interest from institutional investors. However, some of these participants are now facing unrealized losses due to Bitcoin’s price trading below their cost basis.

Moreover, liquidity dynamics have played a significant role in Bitcoin’s recent price action. Whales have been accumulating Bitcoin during periods of price weakness, absorbing liquidity from retail traders. This activity has provided underlying support, preventing a deeper correction. The liquidity structure of the market suggests that as Bitcoin approaches key resistance levels, we could see additional liquidity hunts before a decisive move to the upside.

Conclusion: Where Is Bitcoin Headed?

Bitcoin's current price action suggests a critical period ahead. With institutional demand rising, ETF inflows gaining momentum, and macroeconomic factors aligning in Bitcoin's favor, the stage is set for a potential rally towards $65,000. However, significant resistance remains at $62,000 and $65,000, which could lead to short-term retracements. The political landscape, regulatory environment, and broader market sentiment will play a pivotal role in shaping Bitcoin's trajectory.

For now, Bitcoin appears well-positioned for growth, with multiple catalysts on the horizon. Institutional accumulation, combined with favorable macroeconomic conditions, indicates that Bitcoin may have a strong bullish case in the near to mid-term. However, as always, investors should remain cautious and prepared for potential volatility in this rapidly evolving market.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex