Bitcoin Faces Critical Moment as Prices Drop Below $59,000

Regulatory Pressures, Institutional Retreat, and Whale Sell-Offs Create Uncertainty for Bitcoin's Future | That's TradingNEWS

Institutional Moves and Whale Sell-Offs Create Market Jitters for Bitcoin (BTC)

Bitcoin (BTC) has entered a period of heightened volatility, with prices plunging below the critical $59,000 mark. This decline has sent shockwaves through the market, fueled by a combination of regulatory pressures, institutional sell-offs, and significant whale activity. As of the latest data, Bitcoin is trading at approximately $59,339, marking a drop of 5.36% in just 24 hours, with the broader cryptocurrency market following suit.

Regulatory Scrutiny and Institutional Retreat Impact Bitcoin's Price

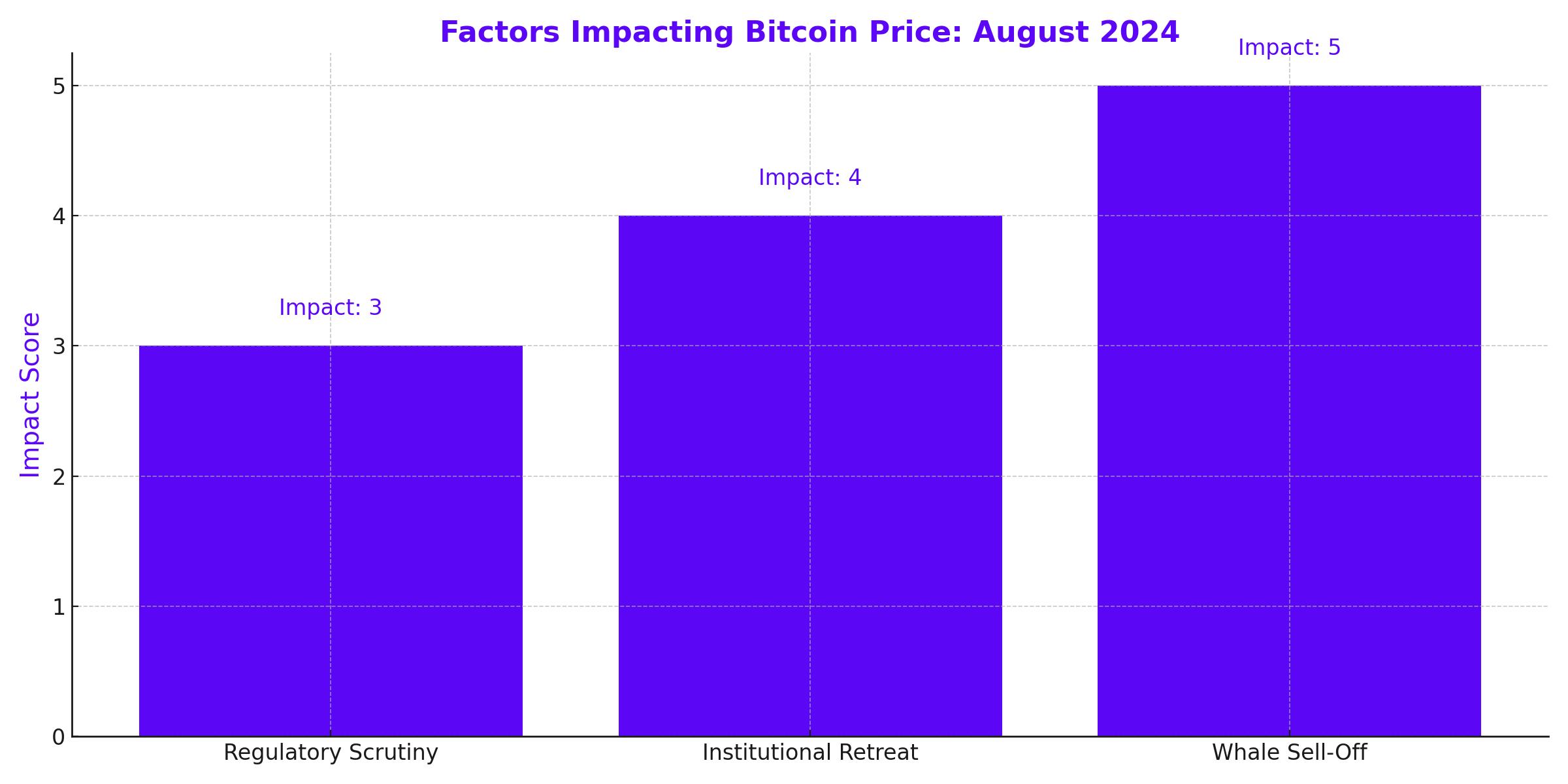

Bitcoin's recent slump can largely be attributed to increasing regulatory scrutiny, particularly from U.S. authorities, which has created a cloud of uncertainty around the cryptocurrency. This regulatory environment has led to a noticeable retreat among institutional investors, who are wary of the potential for stricter regulations and the implications for their portfolios.

The broader macroeconomic landscape is also playing a crucial role. The anticipation of Federal Reserve interest rate cuts, initially seen as a bullish signal for Bitcoin, has not provided the expected support. Instead, the market has reacted with caution, as investors weigh the potential economic slowdown that rate cuts could indicate. The result has been a decline in demand for Bitcoin, reflected in both its price and its hash rate, which have seen downward pressure in recent weeks.

Whale Activity Triggers Additional Downside Pressure

A significant factor exacerbating Bitcoin's decline was the recent activity of a large Bitcoin holder, often referred to as a whale. This whale moved 2,300 BTC, worth approximately $141.81 million, to the Kraken exchange. Such large transfers are often interpreted by the market as a precursor to substantial sell-offs, and this move was no exception. The potential for a large-scale sell-off triggered widespread concern among traders, leading to increased selling pressure that drove Bitcoin's price further down.

Despite this sell-off, the whale in question still holds 18,141 BTC, valued at over $1.07 billion. This remaining holding raises the possibility of further market impact if additional sales occur. The market's reaction to such moves highlights the significant influence that large holders can have on Bitcoin's price, particularly in times of broader market uncertainty.

Bitcoin Futures Market Reflects Heightened Volatility

The volatility in Bitcoin's spot market has been mirrored in the futures market, where open interest has dropped by 7% to $31.09 billion. This decline in open interest suggests that traders are closing their positions, likely due to the increased uncertainty and potential for further price declines. Additionally, over $26.35 million in Bitcoin was liquidated in the past hour alone, indicating that many traders are being forced out of their positions as prices continue to fall.

The futures market has also seen a significant increase in trading volume, which surged by 46% to $41.62 billion. This spike in volume suggests that traders are actively repositioning themselves in response to the recent price movements, either by taking profits or by setting up for potential further declines.

Technical Analysis: Critical Levels to Watch

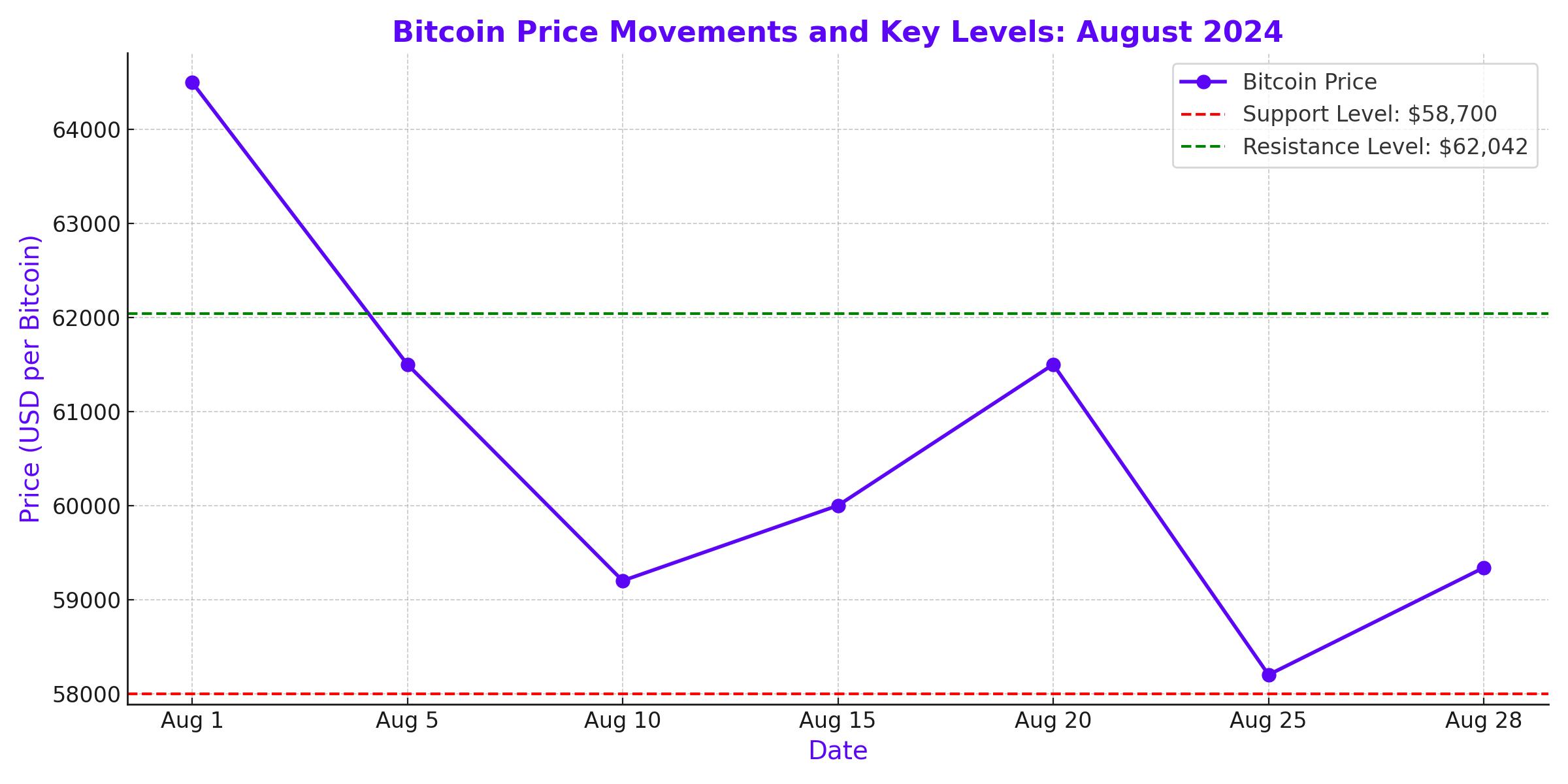

From a technical perspective, Bitcoin has been trading within a descending channel since early July, with prices consistently failing to break out of this pattern. The recent crossing of the 50-day moving average below the 200-day moving average, commonly referred to as a death cross, has further reinforced the bearish sentiment. This technical indicator is often seen as a precursor to prolonged downtrends, and its formation has added to the negative outlook for Bitcoin.

Currently, Bitcoin is struggling to stay above the $59,000 level. If the price fails to hold this support, the next significant level to watch is $57,500. A break below this could open the door to further declines, potentially bringing Bitcoin down to $53,000, a level where some buyers might step in to provide support. However, if this support fails to hold, the market could see a more dramatic drop toward $47,000, a level that sits around 20% below the recent closing prices.

On the upside, any sustained move above $62,000 could signal a reversal in the current downtrend. If Bitcoin can clear this level, it could target $64,000, with further resistance likely around $68,500 and $72,000. These levels correspond to previous peaks and could act as significant hurdles for any bullish attempts to regain momentum.

Market Dominance and Broader Cryptocurrency Trends

Despite the recent downturn, Bitcoin's market dominance has risen to 56%, indicating that it remains the leading cryptocurrency in terms of market share. This increase in dominance comes amid growing interest from institutional players, with major financial firms like BlackRock and Fidelity showing increased engagement in the cryptocurrency space. However, this rise in dominance has not been without consequences for the broader market. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has seen its market share drop from 18.1% to 14.6% over the past eight months, reflecting a shift in investor focus toward Bitcoin.

The broader cryptocurrency market has mirrored Bitcoin's struggles, with major altcoins also experiencing significant declines. Ethereum, for instance, has dropped 3.5% to $2,527, while other leading cryptocurrencies like Solana (SOL) and Cardano (ADA) have fallen by 4.2% and 5%, respectively. These declines highlight the interconnectedness of the cryptocurrency market, where Bitcoin's movements often set the tone for the rest of the sector.

Outlook and Key Factors to Watch

Looking ahead, Bitcoin's performance will likely be influenced by a combination of technical factors and broader market developments. The upcoming U.S. PCE inflation data and the earnings reports from major tech companies, particularly Nvidia, will be closely watched by investors as potential catalysts for Bitcoin's next move. If these events trigger a broader market rally, Bitcoin could see a recovery toward its recent highs. However, continued regulatory scrutiny and further institutional withdrawals could keep the pressure on, leading to additional declines.

Investors should remain vigilant and closely monitor the critical support and resistance levels mentioned above, as these will likely determine Bitcoin's near-term trajectory. Whether Bitcoin can bounce back from its current lows or continues to slide will depend on how these factors play out in the coming days.

Conclusion

Bitcoin's recent drop below $59,000 underscores the ongoing volatility and uncertainty in the cryptocurrency market. With multiple factors at play, including regulatory pressures, institutional moves, and significant technical indicators, Bitcoin's path forward remains uncertain. Investors should brace for continued volatility and be prepared for both potential rebounds and further declines as the market navigates these challenging conditions.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex