Bitcoin Falls Below $94,000: Will DOJ’s $6.5 Billion Sale Drive Prices to $90,000?

With Bitcoin slipping 5% this week and ETF outflows spiking, can BTC rebound from $93,500, or is a deeper correction ahead? | That's TradingNEWS

Bitcoin Price Faces Pressure Amid Market Uncertainty

BTC-USD Dips Below $94,000: Will DOJ Liquidation Trigger Further Declines?

Bitcoin’s price continues its downward spiral, dropping to $93,500 today and marking a 5% loss for the week. The cryptocurrency's struggles highlight a complex mix of market forces, including institutional sell-offs, weakening demand, and external regulatory developments that may shape its trajectory in 2025.

Institutional Outflows Signal Weakness

Institutional demand for Bitcoin appears to be waning, with U.S. spot Bitcoin ETFs seeing a $568 million outflow on Wednesday alone. This marks the largest single-day outflow since December 2024 and underscores bearish sentiment among institutional investors. Alongside these outflows, Binance’s stablecoin reserves have decreased sharply, dropping from $13 billion on December 5 to just $310 million by January 8. The dwindling stablecoin inflows suggest weakened purchasing power, raising the likelihood of further declines in Bitcoin’s price.

Technical Indicators Paint a Bearish Picture

Bitcoin’s technical chart reveals a grim outlook. The cryptocurrency closed below the 38.2% Fibonacci retracement level at $92,493, drawn from the November low of $66,835 to the December high of $108,353. This breach signals a possible extension of the decline toward the psychological support at $90,000. The Relative Strength Index (RSI) has dropped to 43, pointing to persistent bearish momentum, while the Moving Average Convergence Divergence (MACD) indicator reflects a clear sell signal.

DOJ’s Bitcoin Holdings Could Shake the Market

Adding to the pressure, the U.S. Department of Justice has received court approval to liquidate 69,370 BTC, worth approximately $6.5 billion, seized during the Silk Road investigation. While the timeline for the sale remains uncertain, such a significant influx of BTC into the market could further depress prices. Historical data supports this concern: in 2024, a German government liquidation of 40,000 BTC triggered a steep drop from $70,000 to $56,000.

Will Trump’s Crypto Policies Reverse the Trend?

As President-elect Donald Trump prepares to take office, speculation is mounting about the potential impact of his administration’s crypto-friendly stance. Trump’s campaign promises included the creation of a U.S. Bitcoin reserve, a move that could inject renewed confidence into the market. However, market participants remain skeptical, with some analysts warning that policy shifts may not materialize quickly enough to offset current bearish pressures.

BTC’s Path to Recovery: Resistance and Support Levels

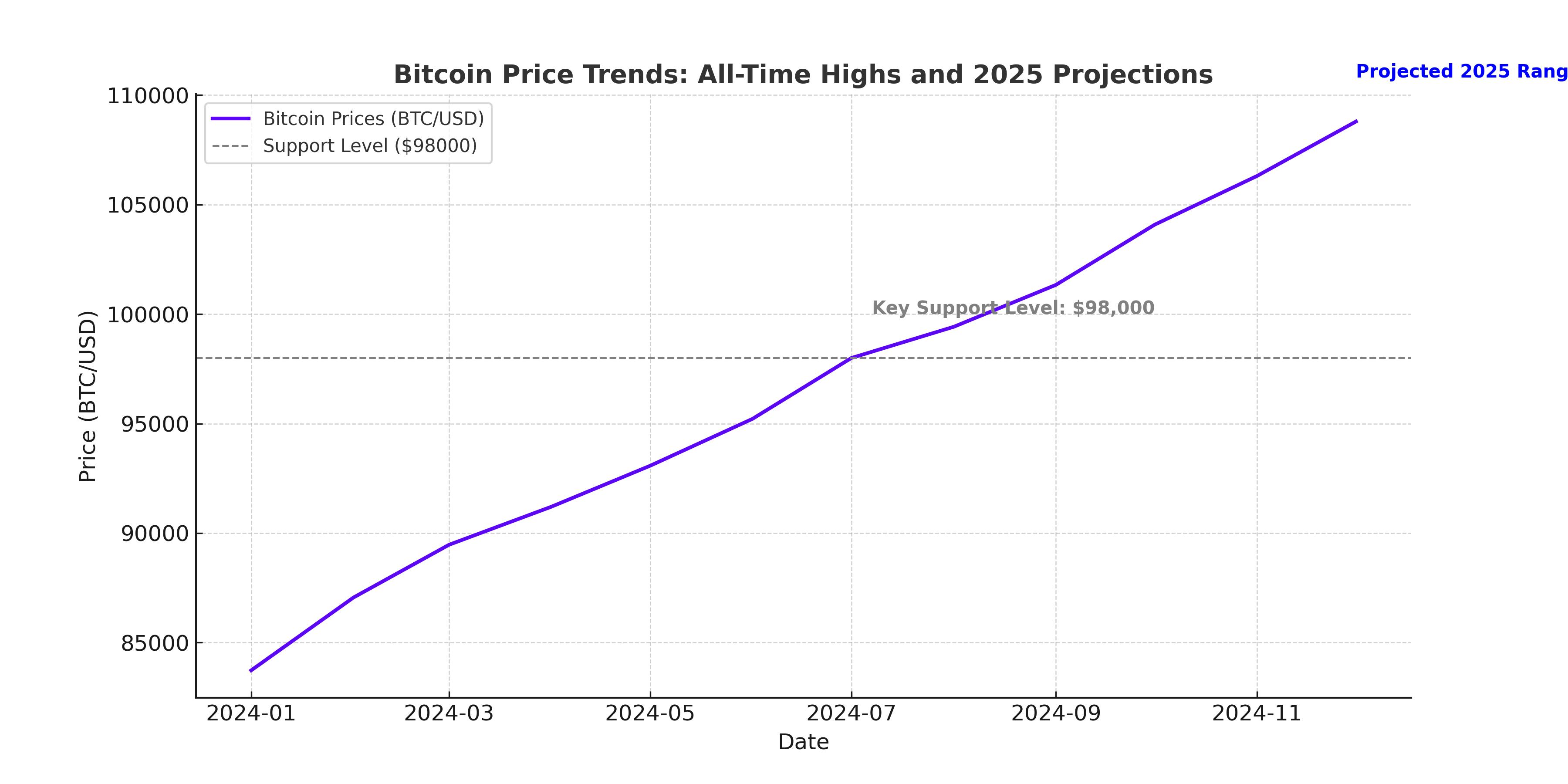

To reverse its current trajectory, Bitcoin must first reclaim and sustain levels above $100,000, a psychological threshold that could reinvigorate bullish sentiment. A successful close above this mark might pave the way for a retest of December’s all-time high of $108,353. On the downside, failure to hold above the $90,000 support level could open the floodgates for a deeper correction, with $85,000 and $80,000 emerging as critical zones to monitor.

Market Sentiment: Mixed Signals from Derivatives

Despite bearish indicators, Bitcoin’s derivatives market offers a glimmer of hope. Daily trading volume has surged to $85 billion, reflecting robust activity even amid declining spot prices. Open interest also climbed by 2%, suggesting that traders remain engaged. However, the Long/Short ratio of 1.0243 indicates neutral sentiment, with neither bulls nor bears firmly in control.

Potential Impact of Stablecoin Dynamics

Stablecoin flows continue to play a pivotal role in Bitcoin’s price action. As stablecoin reserves dwindle, liquidity constraints could exacerbate selling pressure. However, analysts point out that an eventual stabilization of stablecoin reserves might help restore some buying power, particularly if macroeconomic conditions improve.

Can Bitcoin Achieve a 5x Rally Under Trump’s Presidency?

Some market watchers remain optimistic about Bitcoin’s long-term prospects, citing the possibility of a 5x rally under Trump’s administration. Proponents argue that favorable regulatory policies, institutional adoption, and Bitcoin’s status as a hedge against inflation could drive its price to $200,000 or beyond. However, this bullish scenario hinges on the resolution of near-term challenges, including regulatory uncertainties and liquidity constraints.

Key Question: Can Bitcoin Sustain Above $90,000 Amid Market Challenges?

The critical question for investors and analysts remains whether Bitcoin can hold the $90,000 support level in the face of mounting pressures. The answer will likely depend on a combination of technical resilience, macroeconomic developments, and the actions of key stakeholders, including institutional investors and government regulators.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex