Bitcoin Halving 2024 - Comprehensive Market Impact Analysis

From Historical Trends to Future Possibilities: Analyzing Bitcoin's Potential Post-Halving Surge | That's TradingNEWS

Bitcoin's Market Dynamics Post-Halving: A Detailed Analysis

Understanding Bitcoin Halving

Bitcoin halving is a scheduled event in Bitcoin's blockchain protocol that reduces the block reward for miners by 50%. This mechanism is a part of Bitcoin's design to control inflation and extend the distribution of new bitcoins over a longer period. The next, and fourth, halving will decrease the reward from 6.25 BTC to 3.125 BTC per block.

Predicted Impact on Bitcoin's Price

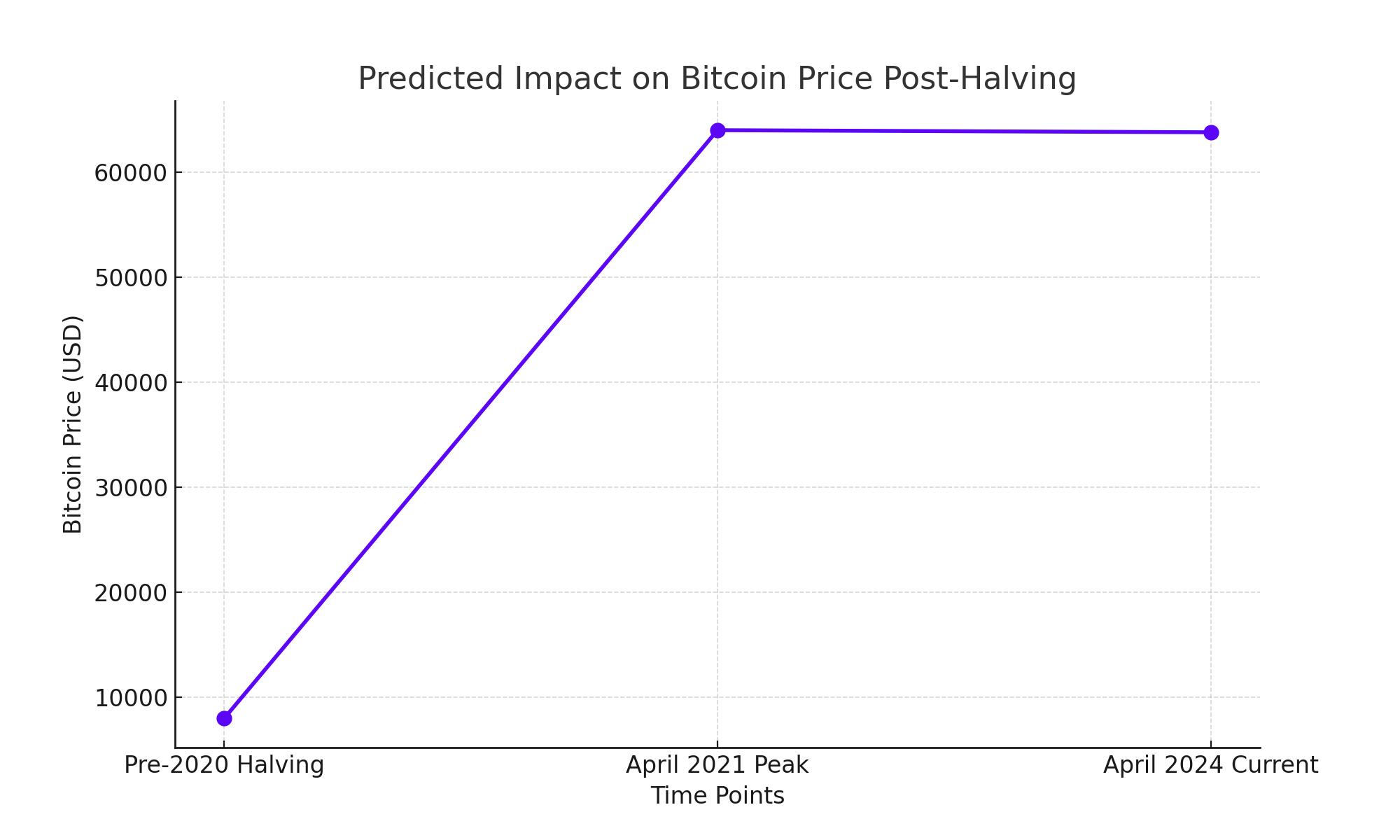

The halving typically leads to a reduction in the supply of new bitcoins entering the market, creating potential upward pressure on the price. Previous halvings have significantly influenced Bitcoin's market value. For instance, after the 2020 halving, Bitcoin's price surged from about $8,000 to over $64,000 in April 2021. However, as of April 2024, Bitcoin trades around $63,802, with market dynamics suggesting a possibly less dramatic post-halving price movement due to already high baseline prices.

Historical Price Movements and Future Projections

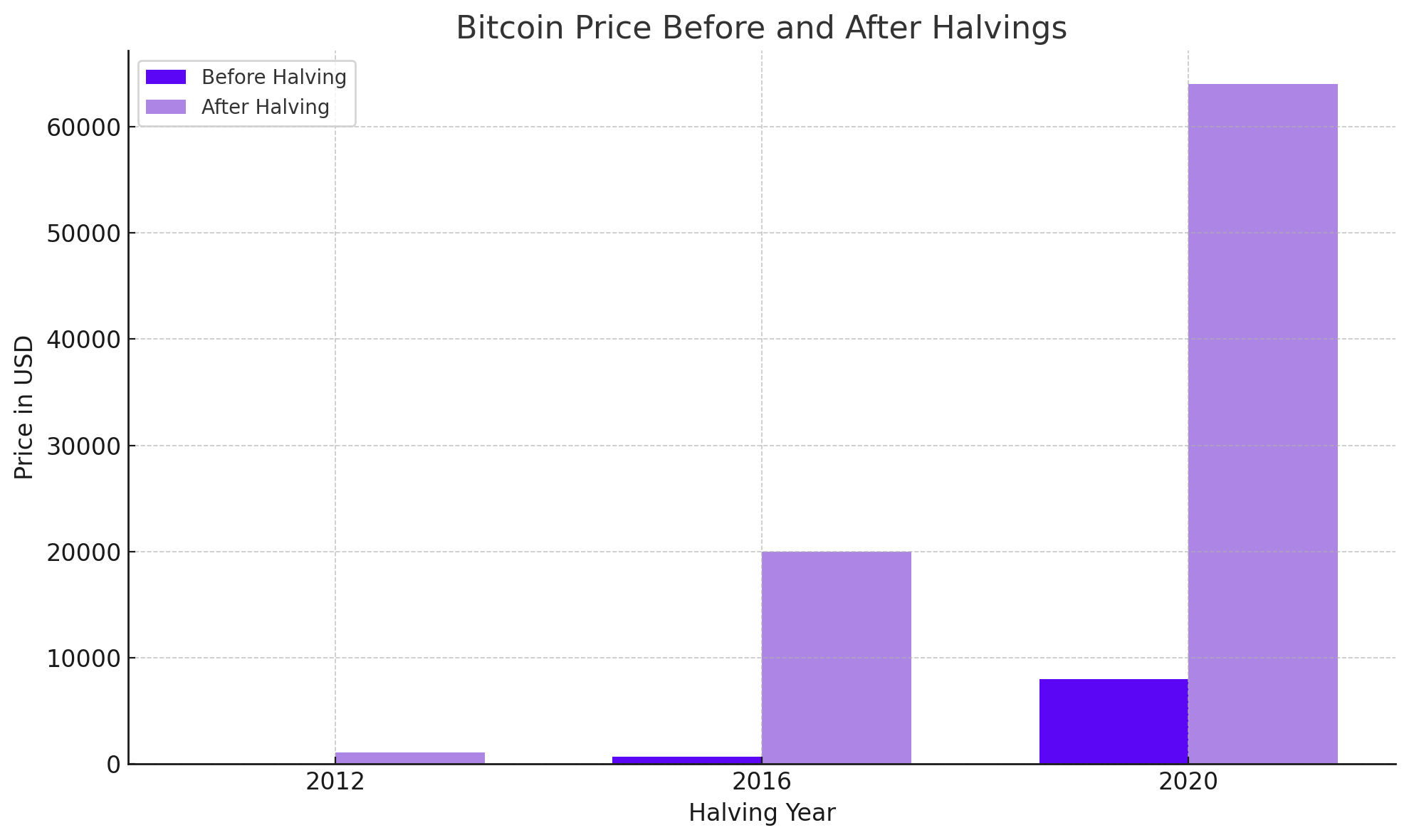

Analyzing the pattern from the past three halvings:

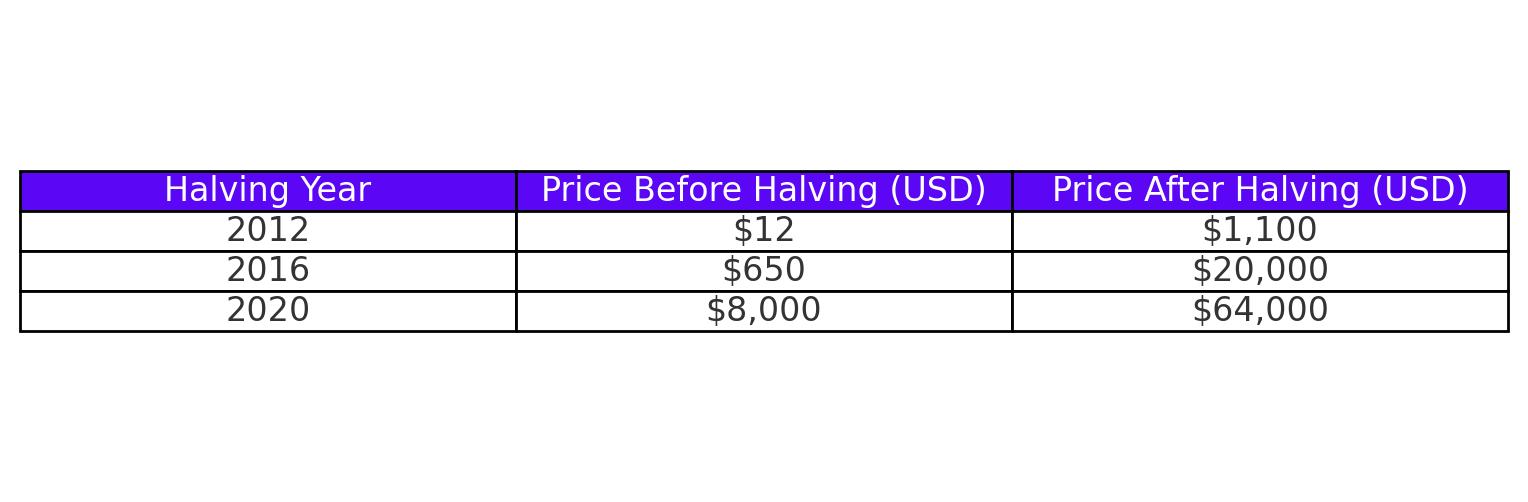

- The 2012 halving saw Bitcoin increase from approximately $12 to over $1,100.

- The 2016 event witnessed a rise from $650 to around $20,000 in late 2017.

- In 2020, the price jumped from around $8,000 pre-halving to a peak of $64,000 in 2021.

Given these historical data points, the market has often expected substantial gains post-halving. However, current expectations are tempered by higher interest rates and robust previous growth, suggesting potential price increases but within a more compressed cycle.

Market Sentiment and Investor Actions

Recent market activities indicate a strong interest in Bitcoin with significant movements of BTC away from exchanges—6,767 BTC on a single day in April 2023, the highest since January of that year. This could suggest that investors are preparing for a post-halving price increase by securing their bitcoins in less accessible, more secure storage.

Economic and Regulatory Influences

The broader economic environment, particularly the policies of the U.S. Federal Reserve regarding interest rates, significantly affects Bitcoin's appeal as an investment. With the current high-interest rates to combat inflation, traditional interest-yielding assets are more attractive, potentially dampening enthusiasm for Bitcoin.

Regulatory changes also play a critical role. The introduction of Bitcoin ETFs in various jurisdictions has provided a more regulated and potentially safer investment avenue, influencing both retail and institutional investor participation.

Comparison with Other Assets

When compared to traditional investments like real estate, Bitcoin offers a different value proposition. For example, over the last decade, the average price increase for a London home has been about 65%, whereas Bitcoin has seen growths exceeding 9,000% in similar periods, demonstrating its higher, though riskier, potential returns.

The Role of Technological Advancements

Looking forward, the integration of Bitcoin with technologies such as artificial intelligence could revolutionize trading strategies and security protocols, enhancing its utility and possibly its market value.

Conclusion

As the Bitcoin market approaches the fourth halving, investors should weigh historical price surges against the current economic backdrop and personal investment goals. While the past suggests a bullish outlook, the unique conditions of today's market, such as regulatory developments and economic policies, could influence the actual impact of the halving on Bitcoin's price trajectory.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex