Unveiling the Future: Bitcoin's Path Ahead

In the intricate web of digital finance, Bitcoin stands as a colossus, continuously shaping the landscape of cryptocurrency investment. With the anticipated Bitcoin halving event on the horizon, the crypto community is abuzz with speculation and analysis. This analysis delves deep into the factors influencing Bitcoin's journey, exploring historical precedents, on-chain activities, and broader economic influences to provide a comprehensive outlook on its future trajectory.

The Halving Horizon: A Catalyst for Change

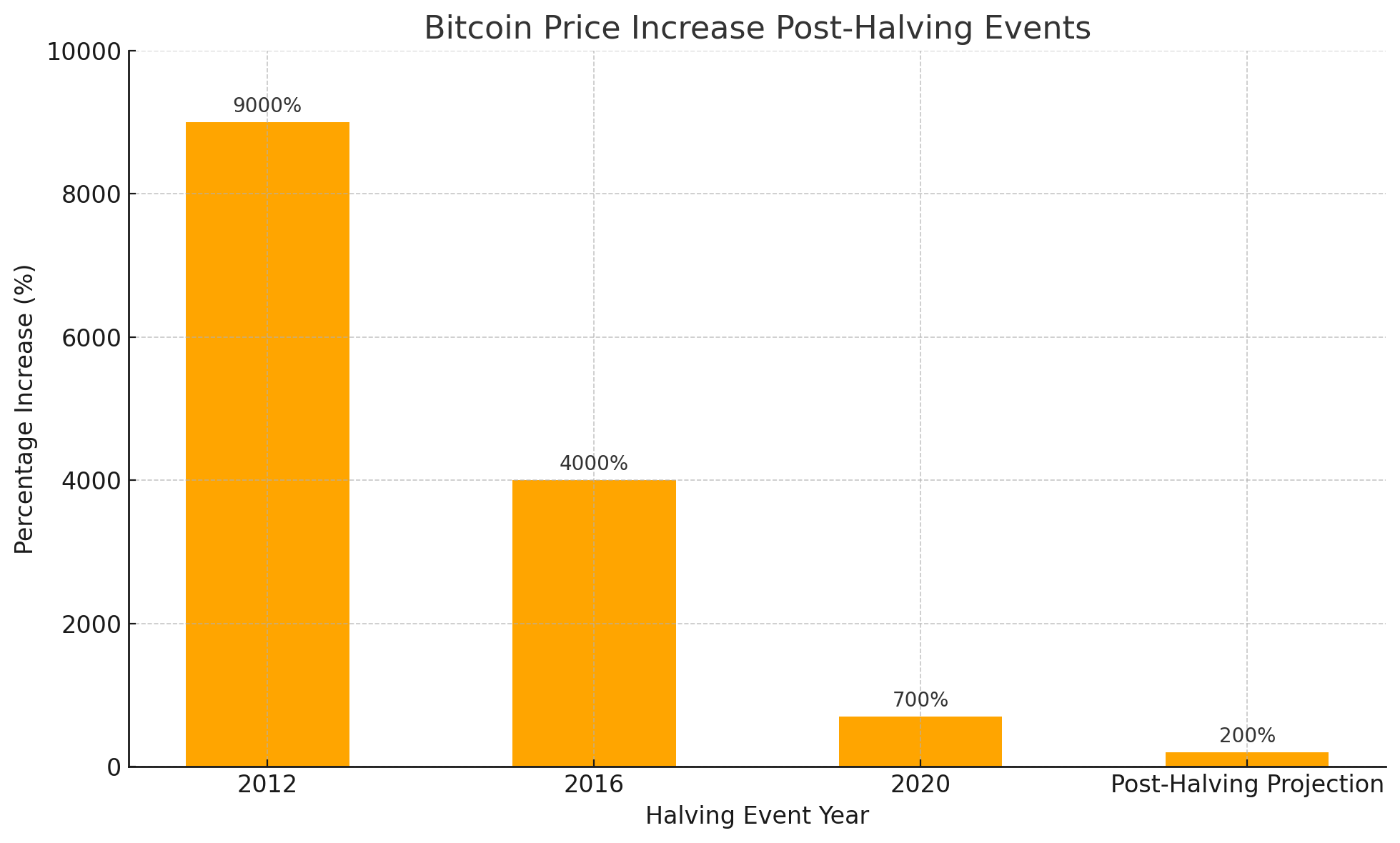

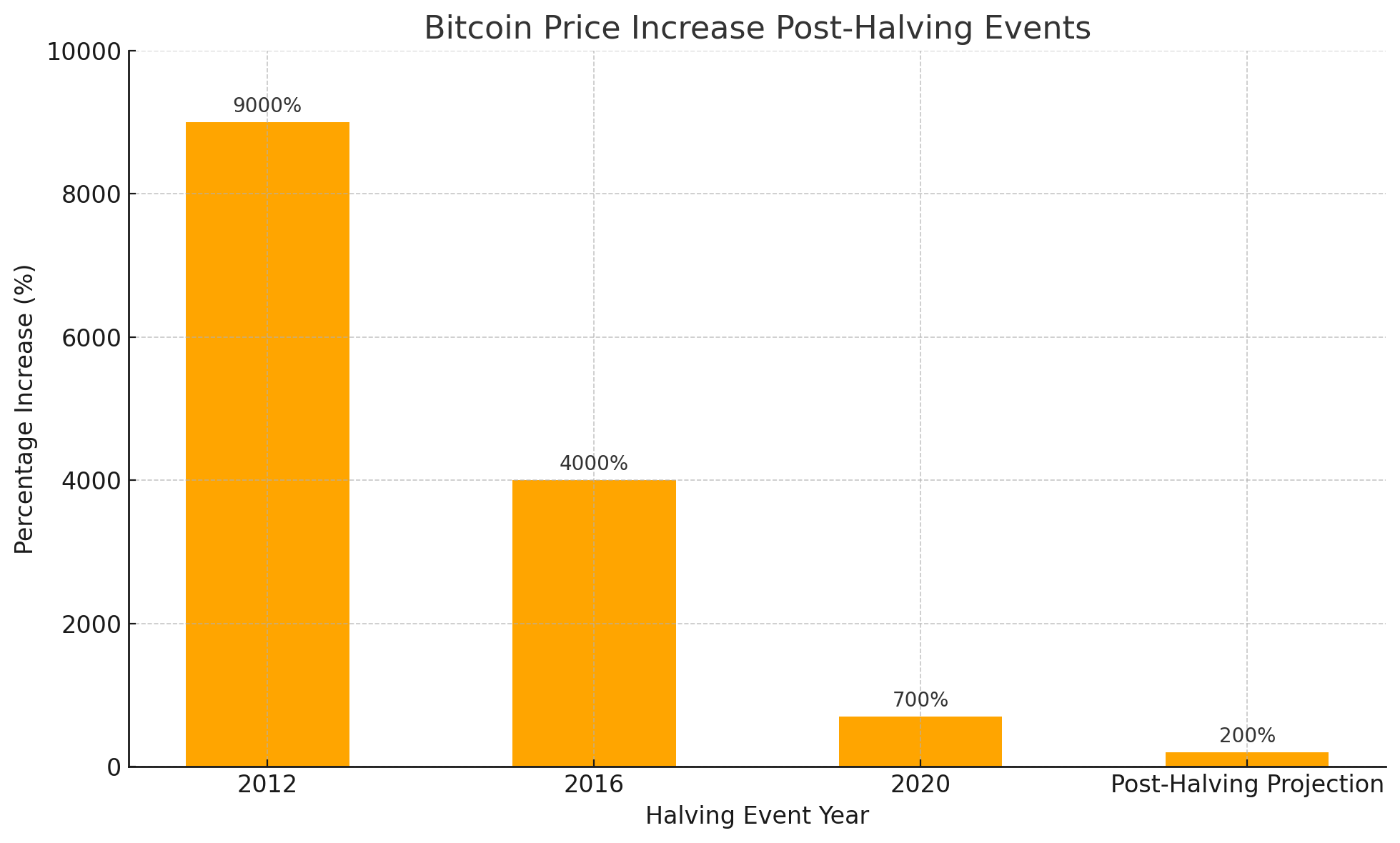

Scheduled to occur in a mere 15 days, the Bitcoin halving is a pivotal event in the cryptocurrency world, set to reduce miner rewards from 6.25 BTC to 3.125 BTC. Historically, this event has acted as a powerful bull run trigger, charting a course for new price peaks in the months that follow. Drawing from past halving events in November 2012, July 2016, and May 2020, Bitcoin witnessed monumental returns of 9,000%, 4,000%, and 700% respectively, within a year post-halving. While the exact outcome remains shrouded in uncertainty, projections suggest a potential 200% surge, a testament to the event's significant impact on Bitcoin's valuation.

The Pre-Halving Oscillation: A Precursor to Prosperity

In the lead-up to the halving, Bitcoin has entered a so-called "danger zone," characterized by notable price dips. This period of retraction is not merely a downturn but a setup for the ensuing phase of re-accumulation and dramatic uptrend, mirroring the cyclical nature of Bitcoin's market dynamics. Despite the mixed short-term impacts historically observed post-halving, the overarching trend points towards a bullish outcome, underpinned by the halving's constriction of new Bitcoin supply.

Beyond the Halving: External Economic Forces

While the halving is a significant driver of Bitcoin's price trajectory, it's not the sole factor at play. External macroeconomic elements, including U.S. Federal Reserve rate adjustments and the evolving landscape of Bitcoin ETFs, wield considerable influence. Notably, the emergence of spot Bitcoin ETFs has ushered in a new era of capital inflow from traditional finance sectors, broadening the investor base and potentially elevating Bitcoin's market position beyond analyst expectations. This confluence of factors suggests a complex interplay between Bitcoin's internal mechanisms and external economic pressures, shaping its path forward.

The Volatile Voyage: Short-Term Turbulence and Long-Term Optimism

Recent market activities have cast a spotlight on Bitcoin's volatility, with short-term investors experiencing significant losses amid price fluctuations. Despite a promising start to 2024, with a 50% price increase, recent downturns have led to over $5.2 billion in losses for short-term holders. Yet, amidst the turbulence, whale activities and the strategic movements of long-term investors offer a glimmer of hope for stability and growth, underscoring the nuanced dynamics of Bitcoin's ecosystem.

Analyzing On-Chain Activities: Whales and Market Sentiment

The behavior of Bitcoin whales and the shifting sentiments of the market, as evidenced by futures funding rates and CFTC data, provide crucial insights into the prevailing mood within the cryptocurrency domain. High funding rates signal a bullish stance among long-position traders, despite the potential for corrections reminiscent of the 2021 market downturn. Concurrently, hedge funds' record-high bearish bets hint at a strategic anticipation of price adjustments, illustrating the complex interplay of optimism and caution that defines Bitcoin's market sentiment.

The Verdict: Navigating Bitcoin's Complex Landscape

As we stand at the cusp of the Bitcoin halving, the confluence of historical data, on-chain analysis, and macroeconomic factors paints a picture of cautious optimism. The event is poised to catalyze significant market movements, yet its impact is intricately linked with broader economic trends and investor behaviors. For those navigating the volatile waters of Bitcoin investment, a balanced perspective that considers both the potential for unprecedented growth and the inherent risks of market fluctuations is essential. As the crypto community looks toward the halving with bated breath, the unfolding narrative of Bitcoin remains a compelling saga of innovation, speculation, and the relentless quest for digital asset supremacy.