Bitcoin Market Analysis: Current Trends, Price Movements, and Future Projections

Examining Bitcoin's Price Stability, Technical Indicators, and Market Influences Amid Recent Volatility | Taht's TradingNEWS

Bitcoin Market Analysis: Current Trends, Price Movements, and Future Projections

Bitcoin Price Stability and Recent Movements

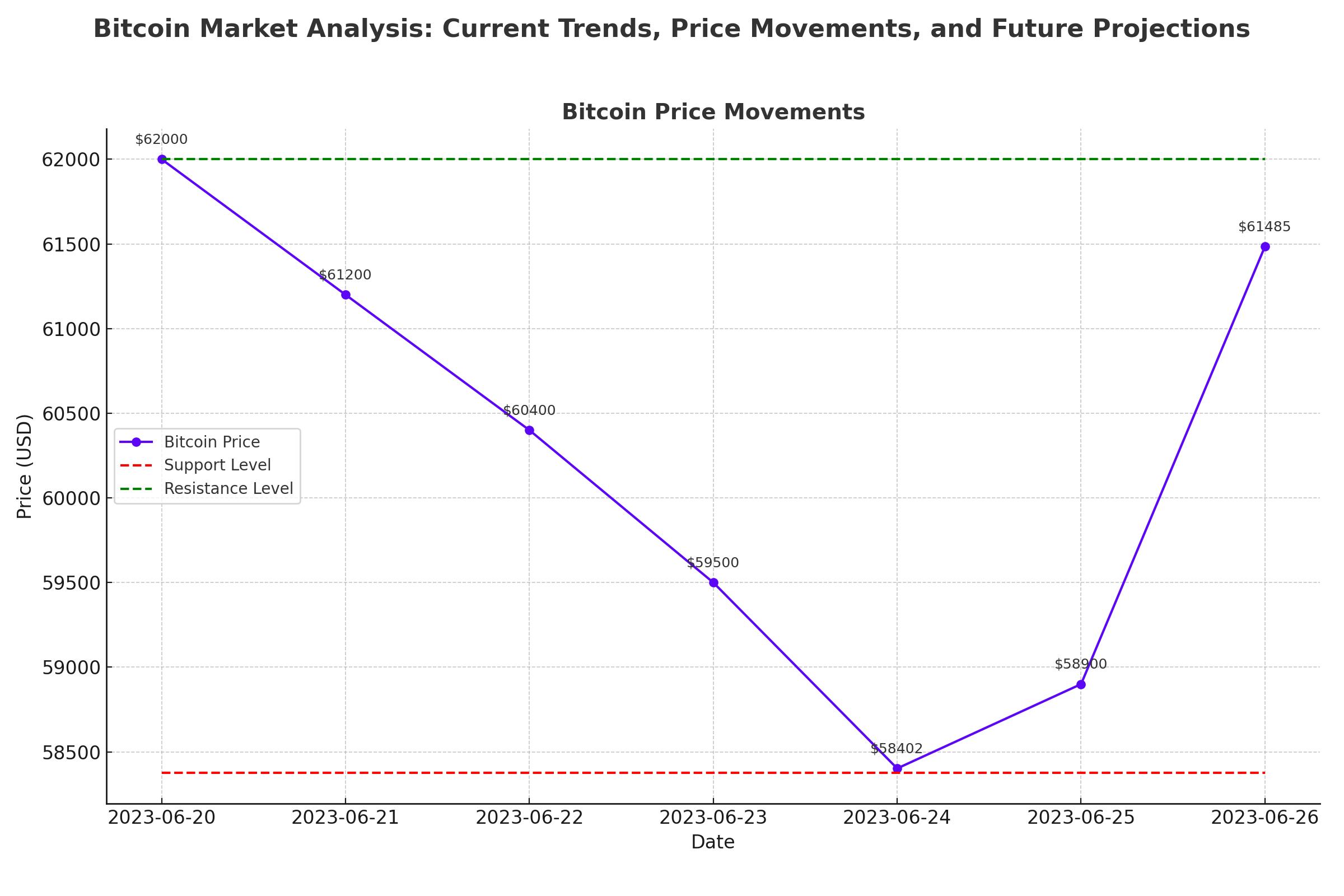

Despite a series of tumultuous trading days, Bitcoin (BTC) has managed to climb back above the critical $60,000 mark, currently trading around $61,485. This recovery follows a steep decline that tested the resilience of both traders and crypto enthusiasts. After hitting a low of $58,402 earlier this week, Bitcoin rebounded by 5.8%, signaling potential stabilization in the short term.

Technical Analysis: Key Support and Resistance Levels

Support and Resistance Dynamics

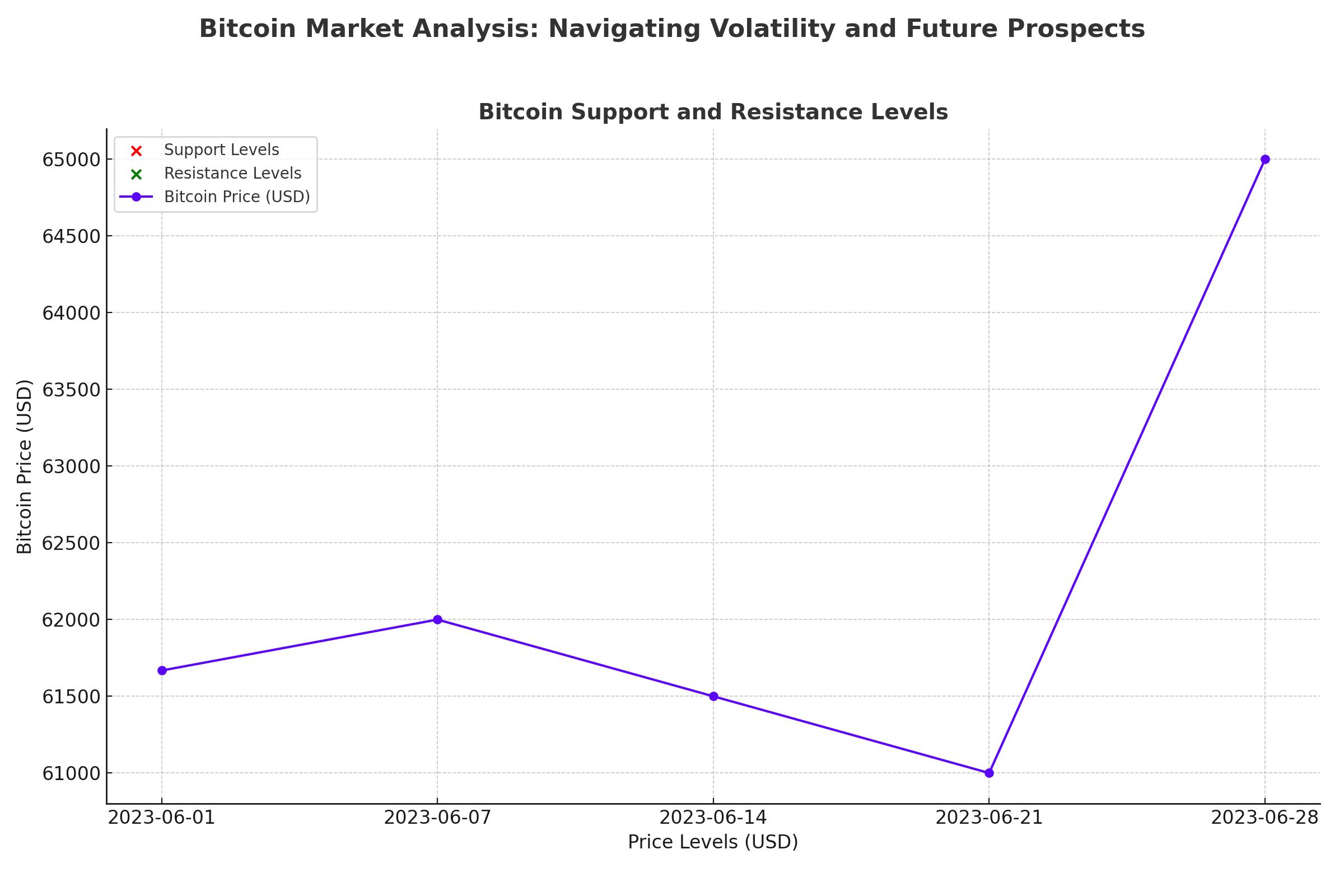

Bitcoin's price experienced significant volatility, breaking below the descending wedge on Monday, resulting in a sharp decline of 7.5% from its daily high of $63,369. The crucial support at $58,375 held, allowing for a recovery to just under $62,000. Key resistance levels to watch include:

- Lower boundary of the descending wedge: Approximately $62,000

- Daily resistance and upper boundary of the wedge: Near $63,956

- 61.8% Fibonacci retracement level and weekly resistance: At $66,631 and $67,147, respectively

A successful breakthrough above these resistance barriers could propel BTC towards retesting the next weekly resistance at $71,280.

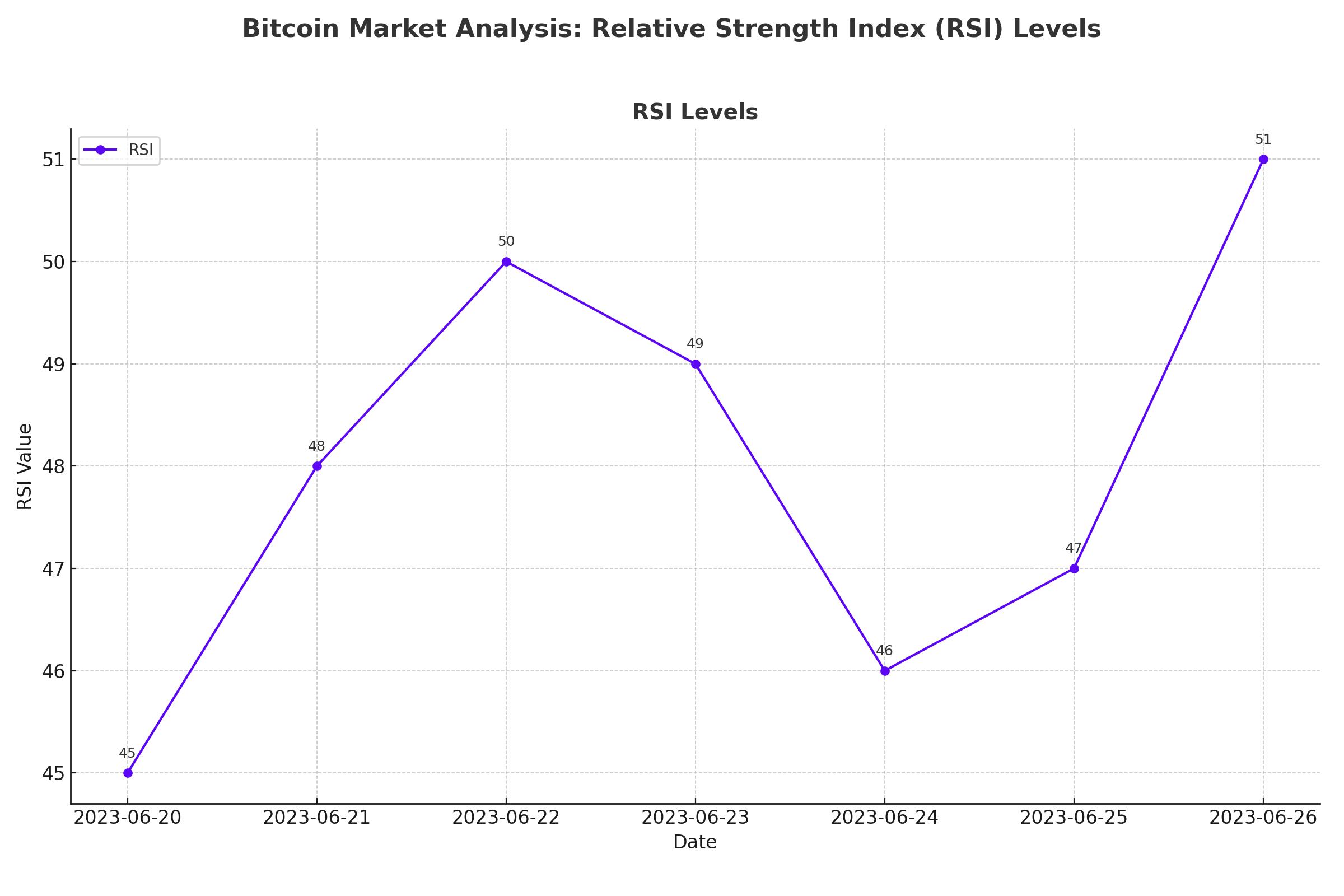

Relative Strength Index (RSI) and Momentum Indicators

The RSI on the daily chart is currently below 50, indicating that bulls need to sustain positions above this threshold to regain momentum. Similarly, the Awesome Oscillator (AO) must rise above zero to confirm bullish sentiment. A failure to hold above $58,375 could indicate persistent bearish sentiment, potentially triggering a decline towards $56,552.

Market Sentiment and Influences

Institutional Investments and ETF Movements

Recent data shows a net inflow of $31 million in U.S. spot Bitcoin ETFs, marking the first positive movement in two weeks. Fidelity’s FBTC fund saw the highest inflow of $49 million, while Grayscale’s GBTC fund recorded the highest outflow of $30 million. This shift in institutional sentiment coincides with Bitcoin’s price recovery, suggesting renewed confidence in the asset’s long-term prospects.

Impact of Mt. Gox Reimbursements

The upcoming reimbursements to Mt. Gox creditors have generated significant market speculation. While there were fears of a massive sell-off, experts believe that many claim holders may choose to hold onto their Bitcoin, considering its maturity and value growth since the exchange's collapse in 2014.

Geopolitical and Economic Factors

U.S. Treasury Yields and Federal Reserve Policy

Rising U.S. 10-year treasury yields, which hit a one-week high, have added pressure on Bitcoin. Strong economic data and hawkish comments from Federal Reserve officials have reduced the likelihood of multiple rate cuts this year. The current economic environment, characterized by robust housing prices and consumer sentiment, suggests that the Fed might maintain higher interest rates for a longer period, impacting non-yielding assets like Bitcoin.

Global Economic Indicators

Upcoming data releases, including U.S. New Home Sales and the Personal Consumption Expenditures (PCE) price index, are crucial for market participants. These indicators will provide further insights into the health of the economy and the Fed's future actions. A strong economic performance could lead to continued pressure on Bitcoin due to higher yields and a stronger dollar.

Short-Term and Long-Term Outlook

Short-Term Price Predictions

In the short term, Bitcoin needs to maintain its position above the $58,375 support level to avoid further declines. The market is likely to remain volatile with significant price movements expected around key economic data releases and geopolitical events. Traders should watch for potential spoofing and liquidity shifts in the order books.

Long-Term Prospects

Looking ahead, analysts are optimistic about Bitcoin's potential to reach new heights. The combination of technological advancements, regulatory changes, and broader economic shifts presents a compelling case for another major bull run. Bitomat’s recent market report projects that Bitcoin could reach between $130,000 and $220,000 by 2025, driven by factors such as Bitcoin halving and the approval of Bitcoin ETFs by U.S. regulators.

Conclusion

Bitcoin's recent price movements highlight the ongoing volatility and market dynamics that influence its value. While short-term fluctuations are expected, the long-term outlook remains bullish, supported by institutional investments, technological advancements, and favorable economic conditions. Investors should stay vigilant and informed, leveraging data-driven insights to navigate this complex and evolving market.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex