Bitcoin Outlook: Navigating Through U.S. Politics and ETF Influences

Uncover how upcoming U.S. political events and ETF trends are set to reshape the Bitcoin investment landscape in 2024 | That's TradingNEWs

Analysis of Current Bitcoin Market Dynamics and Future Predictions

Market Overview and Bitcoin’s Volatility Analysis

As of the latest data, Bitcoin (BTC) trades around $67,500, significantly higher than its estimated production cost of $43,000. JPMorgan analysts suggest that despite Bitcoin's current valuation seeming robust, it is significantly inflated when adjusted for volatility, especially when compared to traditional assets like gold. Gold, adjusted for volatility, would be priced around $53,000, indicating that Bitcoin might be overvalued and could experience a correction towards this comparative baseline.

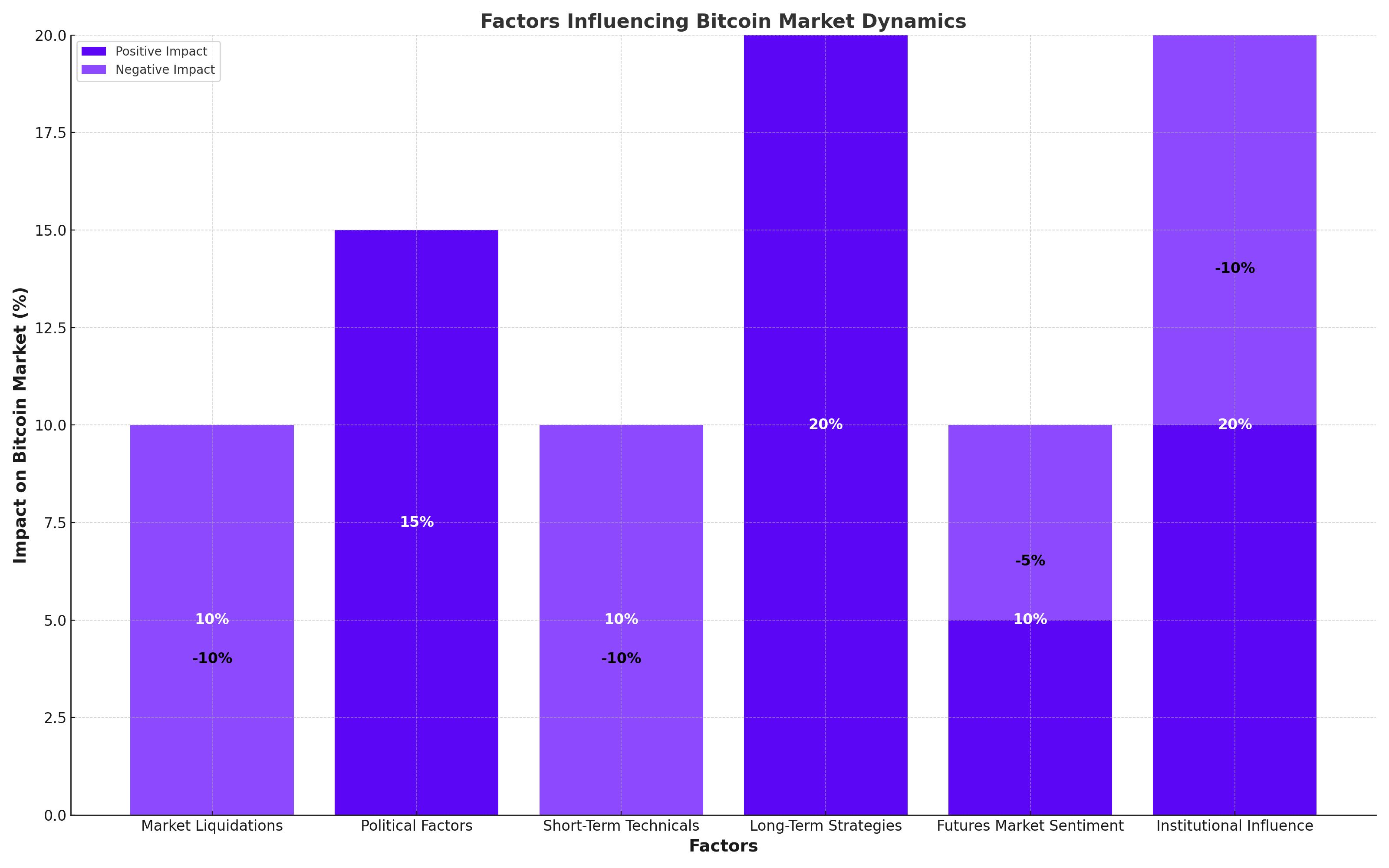

Impact of Market Liquidations and Political Factors on Bitcoin

Recent market behaviors show Bitcoin futures contracts being impacted by significant liquidations. These include financial moves by major entities such as creditors of Gemini and Mt. Gox, and the selling of seized assets by the German government. These are seen as temporary setbacks with expectations set on a market recovery by August.

Further, the potential political shifts in the U.S. with Donald Trump’s possible return to the presidency are perceived as favorable for cryptocurrencies and gold. Trump’s administration might foster a more crypto-friendly atmosphere which could invigorate market sentiment and drive diversification of reserves in emerging markets towards gold and potentially Bitcoin.

Short-Term Technical Outlook on Bitcoin

In the short term, Bitcoin faces significant resistance at the $67,000 to $68,000 zone. Overcoming this with a secure daily close above could see the next resistances testing between $72,000 and $74,000. Conversely, failure to break above could see BTC prices retracting to major support levels around $63,000 to $64,000. A dip below $63,000 might confirm a bearish reversal, especially if correlated with a bullish reversal in the DXY (U.S. Dollar Index), which remains bearish for now.

Long-Term Strategic Perspectives

Strategically, Bitcoin's resilience in reclaiming levels above $65,000 after touching base near $56,000 indicates strong market momentum. However, the presence of a bearish divergence on the RSI over shorter timeframes suggests that caution is warranted. This could result in short-term pullbacks before any potential rally to new highs.

Futures Market Sentiments and Institutional Influence

The cooling down of the futures market, as indicated by lower funding rates compared to previous highs, suggests a more sustainable rally could be forthcoming. However, massive inflows into Bitcoin ETFs, such as the recent $526 million into BlackRock’s iShares Bitcoin Trust, historically precede sell-offs, presenting a cautious narrative.

Conclusion: Navigating Bitcoin's Complex Market Landscape

Investors should closely monitor these intersecting factors—technical resistance levels, market sentiment influenced by geopolitical and economic developments, and institutional activities for insightful trading and investment decisions. While the current market presents bullish signals, underlying risks from political uncertainties and market speculations suggest a balanced approach towards Bitcoin investment strategies in the upcoming months.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex