Bitcoin Price Analysis: Key Drivers and Future Prospects for BTC

Understanding Bitcoin's Recent Performance and Anticipating Future Market Movements | That's TradingNEWS

Bitcoin Price Movement and Regulatory Impact

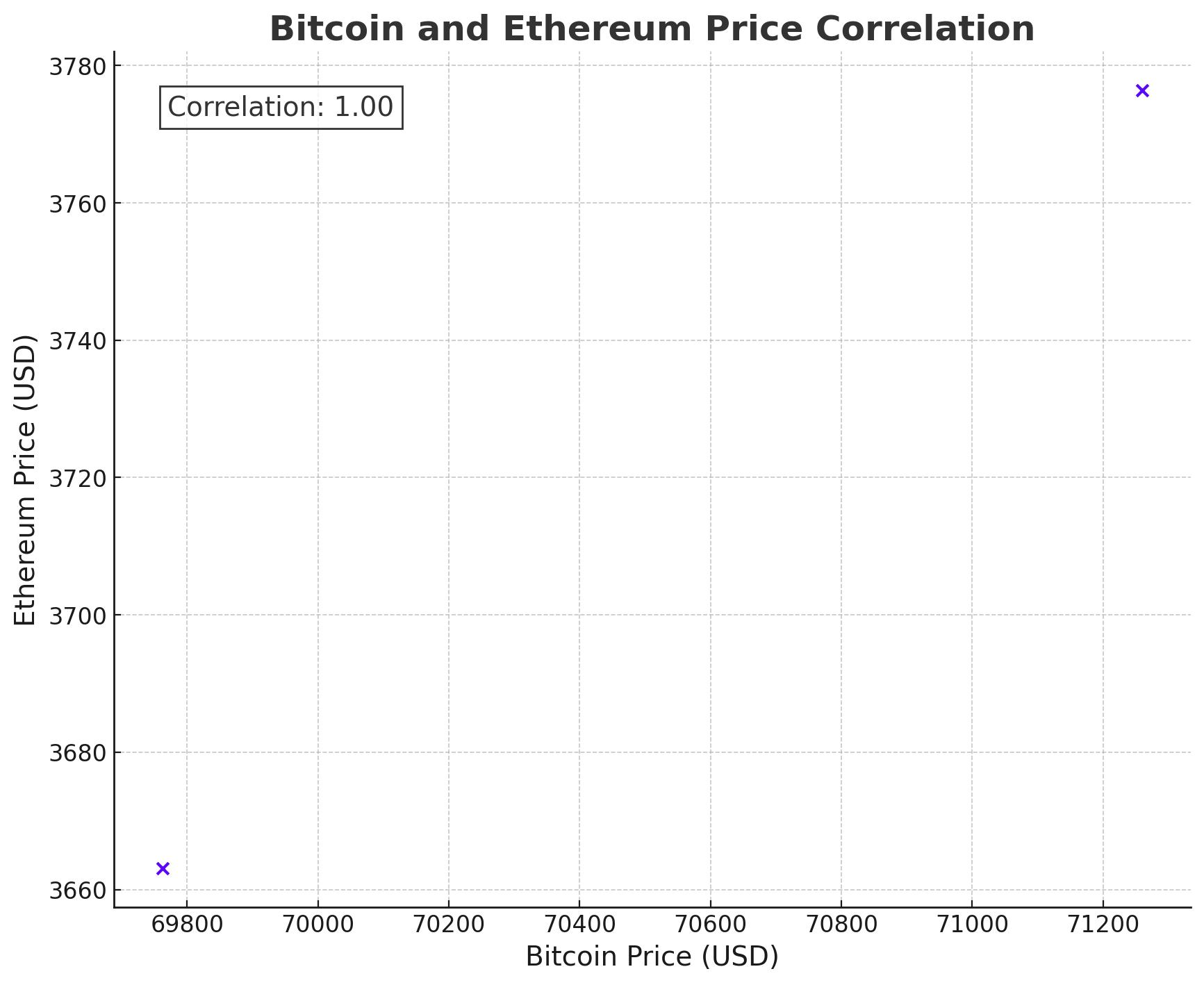

Bitcoin's recent price drop of 2.1% to $69,763 over the past 24 hours highlights the ongoing volatility in the cryptocurrency market. This decline comes as traders take profits from recent gains amid anticipation of U.S. interest rate cues. The Securities and Exchange Commission (SEC) is expected to decide on the approval of spot Ether ETFs, which has significantly influenced market sentiment.

Ethereum’s Influence and SEC Decision

Ethereum (ETH) saw a 3% decrease to $3,663.08 after reaching a two-month high. The recent surge, driven by reports of progress towards spot Ether ETF approvals, showcases the potential impact of regulatory decisions on cryptocurrency prices. Analysts believe the SEC’s move to ask exchanges to refine their filings indicates a higher likelihood of ETF approval, which could catalyze further market rallies similar to those observed with spot Bitcoin ETFs earlier this year.

Federal Reserve’s Role in Crypto Market Sentiment

Bitcoin reached a peak of $71,000 before retreating into the $60,000 to $70,000 trading range. Persistent concerns over U.S. interest rates have tempered optimism, as several Federal Reserve officials emphasized the need for more evidence of declining inflation before reducing rates. The minutes from the Fed’s late-April meeting will be crucial for understanding the central bank's future monetary policy and its impact on high-risk assets like cryptocurrencies.

Altcoin Market Reaction

The broader altcoin market mirrored Bitcoin’s movements, with Solana (SOL) down 1.6%, XRP falling 2.3%, and meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) each dropping 2.8%. Despite the dip in altcoin prices, Ethereum continues to attract interest due to its anticipated ETF approval, which underscores the regulatory influence on crypto market trends.

Institutional Inflows and ETF Impact

BlackRock’s (NYSE:BLK) Bitcoin ETF, IBIT, recorded significant inflows of over $290 million, marking the highest single-day inflow since April. This activity has pushed IBIT’s total holdings to over $19 billion, reflecting renewed institutional interest in Bitcoin. Similarly, WisdomTree’s approval to list crypto exchange-traded products (ETPs) on the London Stock Exchange (LSE) indicates growing institutional adoption and regulatory acceptance of crypto assets.

Political Shifts and Crypto Market Outlook

Recent political developments in the U.S. have also influenced Bitcoin’s market dynamics. A shift in the Democratic stance towards crypto, potentially leading to SEC’s favorable decisions on Ethereum ETFs, highlights the political interplay in crypto regulation. Galaxy Digital CEO Mike Novogratz expects this political sea change to drive crypto prices higher, emphasizing the importance of regulatory and political factors in market performance.

Bitcoin Technical Analysis and Future Predictions

Bitcoin’s technical indicators suggest potential further gains. A positive funding rate, which recently hit 0.0187%, indicates a bullish sentiment among traders. The inverse head-and-shoulders pattern on Bitcoin’s four-hour chart signals a trend reversal from bearish to bullish, with analysts predicting continued upward momentum. Additionally, fractal analysis comparing current price movements to the 2017 bull run suggests Bitcoin could mirror past rallies, potentially reaching new highs.

Institutional ETF Flows and Market Implications

Institutional inflows into Bitcoin ETFs have shown positive trends, with significant net inflows recorded over the past two weeks. These inflows have been a critical component of Bitcoin’s recent rally, highlighting the role of institutional investment in driving market trends. Continued positive ETF flows are likely to support Bitcoin’s price, reinforcing the importance of institutional participation in the crypto market.

Conclusion

With a strong regulatory outlook, positive institutional inflows, and bullish technical indicators, Bitcoin presents a compelling investment opportunity. The cryptocurrency market's response to upcoming SEC decisions and global economic policies will be pivotal in shaping future price movements. Investors should stay informed about these developments to make strategic investment decisions in the dynamic crypto market.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex