Bitcoin Price Drop Post-Ethereum ETF Approval

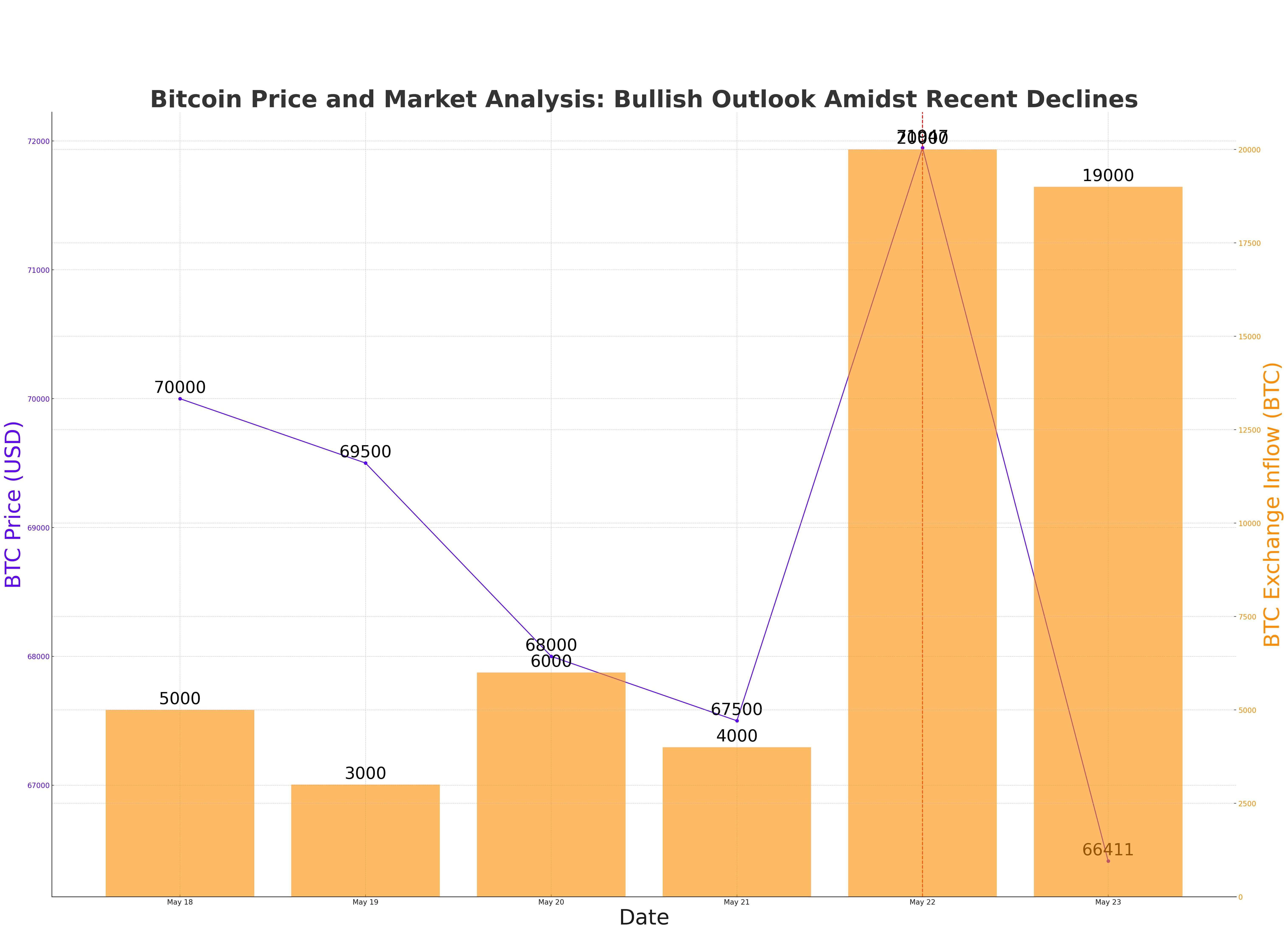

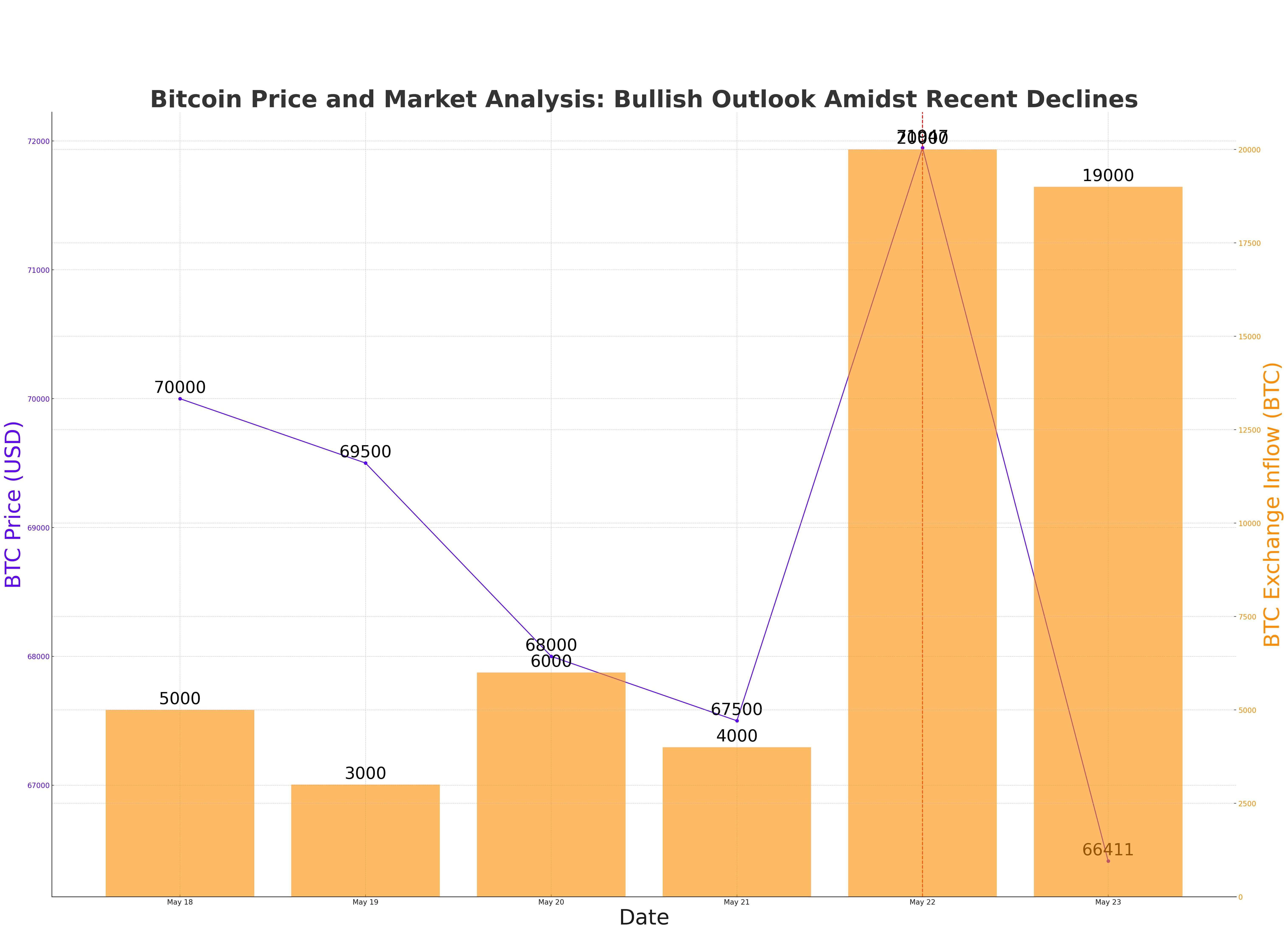

Bitcoin (BTC) price tumbled to $66,411 on May 23, marking an 8% decline from its weekly peak. This drop followed the US Securities and Exchange Commission (SEC) approval of Ethereum spot ETFs. The news triggered a strategic move by investors, with 19,000 BTC transferred to exchange wallets, likely for profit booking. As a result, technical indicators now suggest that Bitcoin bulls must defend the $65,000 support level to prevent over $1 billion in long liquidations.

Impact of Ethereum ETF on Bitcoin

Bitcoin's price, which rose to a 60-day peak of $71,947 on May 22, began to decline immediately after the SEC's approval of Ethereum ETFs. This downturn reflects market speculation that Ethereum ETFs could potentially cannibalize Bitcoin ETFs. Ethereum’s Proof of Stake (PoS) protocol offers approximately 4% annual yield, making it an attractive alternative for investors and fund managers. If large Bitcoin ETF participants convert their BTC holdings to ETH, it could create further downward pressure on Bitcoin prices.

Institutional Moves and Market Trends

Recent on-chain data indicates significant movement of Bitcoin into exchanges. Since the announcement of the Ethereum ETF approval, Bitcoin exchange reserves have increased by 17,869 BTC, worth about $1.2 billion. This influx suggests that investors are preparing for potential short-term selling opportunities. If this trend continues, Bitcoin prices might face further declines, with swing traders likely avoiding long positions in the near-term.

Bitcoin's Technical Outlook and Support Levels

Bitcoin is currently trading at $67,200, down 8% from its weekly peak. The Bollinger Band indicator shows a bearish outlook, with BTC prices falling below the upper limit of $71,330. The next critical support level is at the 20-day SMA of $64,949. Failure to hold this level could see prices drop to as low as $58,566. Conversely, if the Ethereum ETF approval attracts fresh investments into crypto rather than cannibalizing BTC ETFs, Bitcoin could rise toward new all-time highs above $75,000.

Strengthening US Dollar and Economic Indicators

The US dollar has strengthened recently due to positive economic data, reducing the likelihood of a Federal Reserve rate cut in September. This has pressured the crypto market, including Bitcoin. Key data points include:

- FedWatch Tool: The probability of unchanged rates in September rose from 41.9% to 48.4% on May 23.

- US Initial Jobless Claims: Fell by 8,000 to 215,000 for the week ending May 18.

- PMI Data: Manufacturing PMI increased to 50.9 in May, Services PMI rose to 54.8, and Composite PMI jumped to 54.4, all surpassing expectations.

These factors make crypto investments like Bitcoin less appealing due to higher opportunity costs.

Bitcoin Options Expiry and Market Impact

Approximately $1.4 billion in Bitcoin options contracts will expire on May 24. The max pain point for these options is $67,000. The outcome of this expiration could impact Bitcoin prices, with a significant number of calls at higher strike prices indicating bullish sentiment. However, the market impact is usually muted due to the distribution of these contracts.

Conclusion

Bitcoin's current price action suggests a bearish outlook as it trades below key support levels. The influx of BTC into exchanges, coupled with the strengthening US dollar and robust economic indicators, adds to the bearish sentiment. However, regulatory changes and the approval of Ethereum ETFs could potentially alter this outlook. Investors should closely monitor these developments to gauge future price movements accurately.