Bitcoin Price TradingNEWS - Analyzing Fed's Rate Decision

Unpacking Bitcoin's sharp decline in the wake of expected U.S. Federal Reserve rate hikes—what it means for investors and the future of cryptocurrency investments | That's TradingNEWS

Detailed Breakdown of Bitcoin’s Recent Price Tumble

Immediate Effects of Anticipated Federal Reserve Actions

Bitcoin's recent price collapse to about $57,300 marks its lowest since February and represents a sharp 22% fall from the March high of $73,000. This significant decline reflects growing concerns among investors about the Federal Reserve's upcoming interest rate decision, expected to maintain a higher rate for an extended period. As the Fed prepares to announce its policy on May 1, the broader anticipation has triggered a sell-off, with the market bracing for rates to stay elevated to combat persistent inflation, overshadowing other economic signals.

Insights from Market Data and Analyst Observations

Market Data shows a notable decline in Bitcoin demand, particularly among longstanding holders and significant investors. This shift saw permanent holders decrease their accumulation by over 50%, dropping from an increase of 200,000 BTC in March to just 96,000 BTC. Similarly, demand among major investors, or "whales," saw their growth rate halve from 12% to 6% in the same period. These trends point to a broad expectation of a market downturn, further substantiated by a significant reduction in buying from U.S.-based Bitcoin ETFs.

Miner Selling Activity and Its Market Impact

April saw an increase in Bitcoin sales from miners, with levels reaching the highest since January. This rise often signals miners' needs to manage cash flow or realize profits, contributing to downward price pressure. Despite the Bitcoin halving in April—a usually bullish event that reduces the rate at which new coins are created—the price continued to drop by an additional 15%, indicating that the event could not mitigate the broader economic factors and selling pressure affecting the market.

Performance of Bitcoin ETFs and Market Response

The performance of Bitcoin ETFs in both the U.S. and Hong Kong has been lackluster. Notably, BlackRock’s iShares Bitcoin Trust experienced a day with zero inflows for the first time since its launch, highlighting investor hesitancy. In Hong Kong, the newly listed Bitcoin and Ether ETFs did not meet the market’s expectations, with trading volumes significantly below the anticipated $100 million, reflecting a cautious or bearish outlook from global investors towards cryptocurrencies.

Global Economic Influences on Bitcoin

The global economic environment, particularly U.S. economic policies, plays a significant role in shaping Bitcoin's market dynamics. Recent U.S. economic data showing stronger-than-expected growth and persistent inflation has reduced expectations for a near-term interest rate cut. This situation is exacerbated by geopolitical tensions that indirectly influence investment strategies across various asset classes, including cryptocurrencies, by fostering a risk-averse sentiment among investors.

Prospective Market Trends and Strategic Considerations

Looking forward, the path for Bitcoin remains highly uncertain. Historical patterns suggest a possibility for seasonal price declines, which might present buying opportunities if Bitcoin approaches support levels around $55,700 to $51,000. However, the forthcoming Federal Reserve decisions and key economic indicators will be crucial in shaping the market's direction, potentially intensifying or easing the current bearish trend.

Strategic Buying Opportunity in Bitcoin’s Price Dip

Assessment of Recent Price Adjustments

Bitcoin's fall to around $57,300 represents a substantial drop from its peak, a 22% decrease from the high of $73,000 observed in March. This sharp decline, precipitated by anticipation of the Federal Reserve's interest rate decision, might be seen as a reactionary pullback rather than a long-term trend. Historically, significant pullbacks have often presented buying opportunities for investors looking for entry points into the cryptocurrency market at a perceived discount.

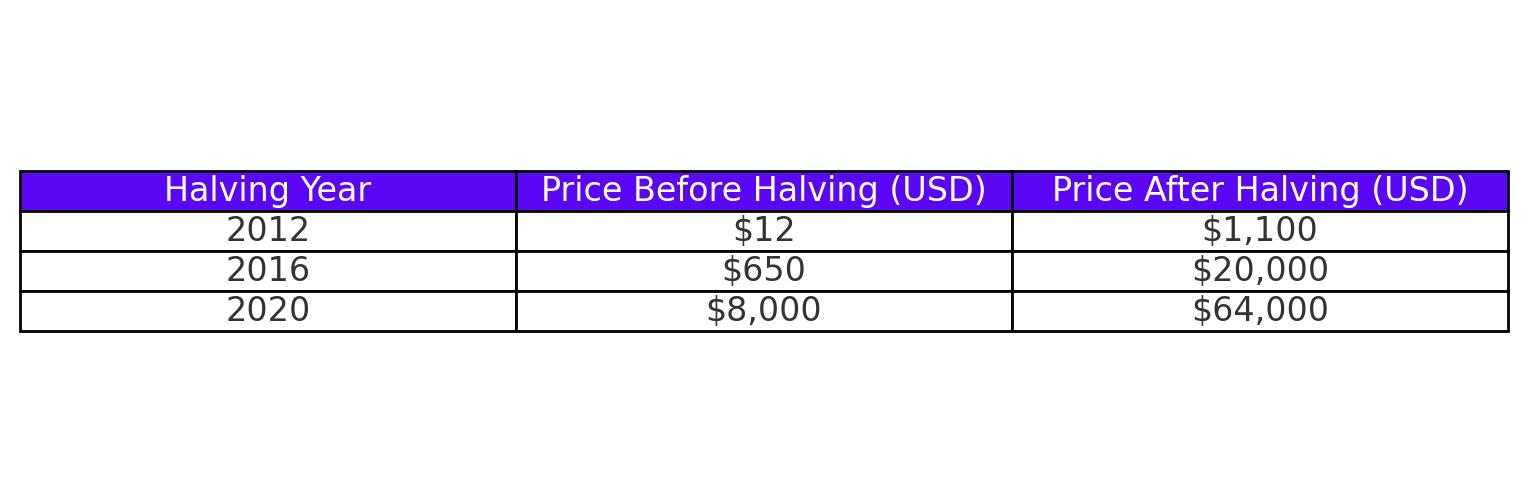

Historical Performance Post-Halving

Despite the post-halving price drop, historical trends following previous Bitcoin halvings suggest potential for recovery and gain. Typically, halving events, which reduce the rate at which new bitcoins are created, have led to bullish market cycles in the 12-18 months following the adjustment. The recent decline might therefore set the stage for future appreciation once market sentiment stabilizes and the effects of reduced coin production kick in.

Miner Selling Pressure and Market Stabilization

The increase in Bitcoin selling by miners is often a temporary response to fulfill liquidity needs or capitalize on prevailing market prices. As this selling pressure eases, the reduced supply post-halving and stabilization of miner sales could support a price recovery. Additionally, if the price drops further towards the support levels around $55,700 to $51,000, it may trigger increased buying activity from those waiting on the sidelines.

Macroeconomic Factors and Institutional Interest

The broader macroeconomic context, including U.S. monetary policy and inflationary pressures, influences Bitcoin prices. While higher interest rates generally increase the attractiveness of holding fiat currencies, they also underscore the potential of Bitcoin as a hedge against inflation. Furthermore, any shifts towards a more accommodative policy in the future could enhance Bitcoin's appeal against traditional safe-haven assets.

ETFs and Institutional Adoption

The slowdown in inflows to Bitcoin ETFs may reflect a temporary cautious stance among institutional investors. However, the establishment of these funds has broadened Bitcoin’s investor base and integrated it more deeply into the traditional financial ecosystem. This could lead to increased demand as market conditions stabilize, particularly if the ETFs begin to attract new inflows following an adjustment in market sentiment.

Conclusion: Why It’s a Potential Buy

Considering the combination of Bitcoin's reduced price, historical post-halving gains, potential easing of miner selling pressure, and macroeconomic factors, the current market conditions might be viewed as a strategic entry point. For investors with a long-term perspective, buying during a downturn could align well with broader investment strategies aimed at capitalizing on cyclical financial movements and Bitcoin’s established role in diversifying investment portfolios.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex