Bitcoin (BTC-USD): Navigating Key Price Levels Amid Market Volatility

Current Price Trends: BTC’s Retreat from $108,000 to Sub-$96,000

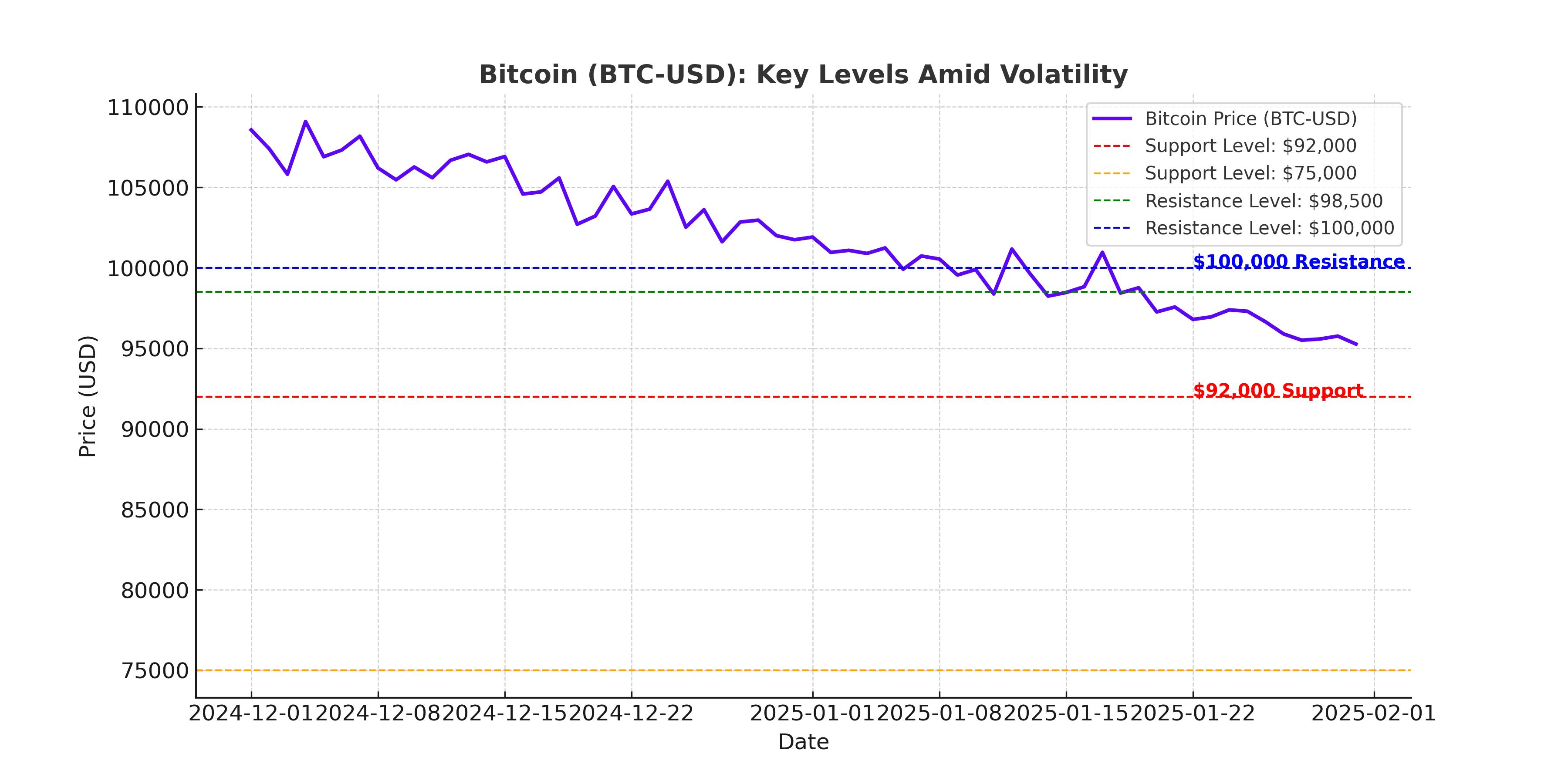

Bitcoin (BTC-USD) recently experienced a sharp downturn, dropping over 11% from its December high of $108,000 to trade below $96,000. This decline marked a significant correction after BTC briefly crossed the $100,000 psychological barrier. At its current level of approximately $95,800, Bitcoin has shed over 5% in a single day, prompting concerns among investors.

The broader cryptocurrency market has followed suit, with Ethereum (ETH-USD) falling 7% to $3,355 and altcoins like Solana (SOL-USD) and Dogecoin (DOGE-USD) posting declines exceeding 8%. These movements align with a shift in macroeconomic sentiment, driven by stronger-than-expected U.S. economic data and the Federal Reserve's hawkish stance on interest rates.

Macroeconomic Headwinds: The Fed’s Impact on Bitcoin Prices

Bitcoin's retreat has been heavily influenced by macroeconomic factors. The Federal Reserve’s slower-than-anticipated pace of rate cuts in 2025 has spurred fears of prolonged tight liquidity, which is historically unfavorable for speculative assets like cryptocurrencies. Recent job openings and PMI data have bolstered expectations that inflation could remain sticky, delaying monetary easing.

Additionally, the U.S. Dollar Index (DXY) demonstrated unexpected resilience, breaching long-term resistance levels. A stronger dollar reduces Bitcoin’s appeal as an alternative asset, adding pressure to its price action.

Institutional Sentiment and Market Dynamics

Institutional activity in Bitcoin markets has shown signs of cooling. Spot Bitcoin ETFs, which recorded inflows exceeding $978 million earlier this week, saw reduced investments of $52 million on Tuesday. This drop suggests waning enthusiasm among institutional players, at least in the short term.

Moreover, data from Coinglass revealed a substantial $694 million in crypto liquidations over the past 24 hours, with Bitcoin accounting for $125 million. The sharp increase in liquidations, coupled with CryptoQuant’s negative Net Taker Volume on Binance, underscores rising selling pressure.

Key Technical Levels for Bitcoin (BTC-USD)

Bitcoin’s technical indicators reveal a bearish momentum. The Relative Strength Index (RSI) stands at 47, below the neutral 50 level, signaling potential further downside. Meanwhile, BTC hovers near its 38.2% Fibonacci retracement level at $92,493, a crucial support zone drawn from its November low of $66,835 to the December high of $108,353.

Resistance levels are clearly defined at $98,500 and $100,000. A breakout above $100,000 could reignite bullish momentum, targeting the December high of $108,000. Conversely, failure to hold the $92,000 support could lead to a deeper correction, potentially testing the $75,000 range, as highlighted by bearish analysts.

Market Outlook and Predictions

Despite current challenges, Bitcoin’s long-term trajectory remains promising. Institutional adoption, regulatory clarity, and technological advancements continue to bolster its position. Analysts project a potential rally to $126,000 in the latter half of 2025, supported by increased global liquidity and anticipated fiscal stimulus under the Trump administration.

However, short-term risks, including geopolitical instability, U.S. Treasury debt concerns, and potential delays in crypto-friendly legislation, could introduce volatility. Notably, BitMEX co-founder Arthur Hayes anticipates a liquidity-driven surge in Q1 2025, followed by a correction if regulatory progress falls short of expectations.

Market Sentiment and Broader Crypto Trends

The cryptocurrency market's total capitalization has shed $400 billion in 36 hours, reflecting widespread risk aversion. Altcoins like Ethereum and Solana continue to track Bitcoin’s price movements, amplifying market-wide losses.

Regulatory developments remain a double-edged sword. While SEC-approved Bitcoin ETFs have boosted adoption, delays in broader policy reforms could dampen sentiment. In the long term, Bitcoin’s unmatched monetary properties, including its deflationary nature and decentralization, make it a cornerstone of the emerging digital financial system.

Is Bitcoin a Buy, Hold, or Sell at $95,800?

Bitcoin’s current price of approximately $95,800 presents a mixed opportunity for investors. For long-term holders, the ongoing correction offers an attractive entry point, supported by strong institutional interest and robust on-chain metrics. However, traders should remain cautious, as near-term volatility could push BTC lower before it regains its upward momentum.

The decision ultimately depends on the investor's horizon. For those seeking generational wealth, Bitcoin’s scarcity and integration into corporate treasuries and sovereign reserves underscore its potential as a store of value. For short-term speculators, market conditions suggest caution, with key levels to watch at $92,000 for support and $98,500 for resistance.

Conclusion

Bitcoin’s current price dynamics reflect a complex interplay of macroeconomic factors, institutional sentiment, and technical indicators. While short-term volatility poses challenges, the cryptocurrency’s long-term prospects remain robust. Investors should weigh their strategies carefully, considering both the risks and rewards associated with BTC’s transformative role in the global financial ecosystem.