Bitcoin Surges Past $62,000: Is a Rally to $66,000 Next?

Institutional Investors Fuel Bullish Momentum as Short-Term Traders Take Risks and Long-Term Holders Cash Out | That's TradingNEWS

Bitcoin (BTC) Breaks Resistance, Eyes Further Upside

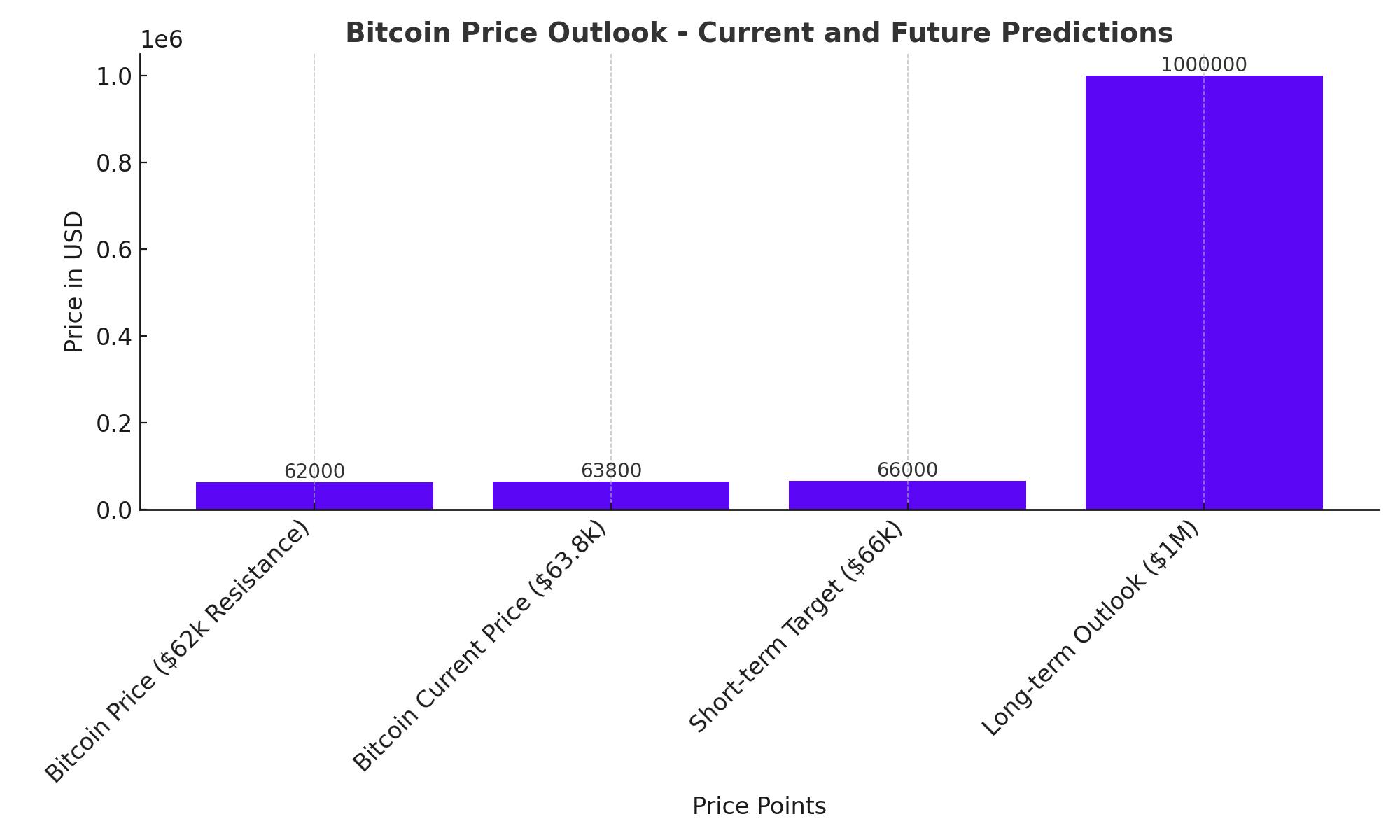

Bitcoin's recent surge has propelled the price past the critical $62,000 resistance level, signaling a potential continuation of the bullish momentum. Over the past few days, Bitcoin has seen significant support around its 200-day Exponential Moving Average (EMA), which is currently sitting at $60,000. This support level has helped BTC gain approximately 3.5%, with trades now hovering above $63,600.

The breaking of the $62,125 resistance level is a positive sign for Bitcoin’s outlook. Should this level hold, the next target for Bitcoin would likely be the psychological resistance at $66,000. The Relative Strength Index (RSI) is currently at 56, which is above its neutral level of 50, indicating that bullish momentum could continue to dominate.

However, if Bitcoin fails to maintain support at $62,125, we could see a retracement back to the 200-day EMA at $60,000, which could serve as a key pivot point for traders looking for short-term entry or exit strategies.

Institutional Investors and Bitcoin ETFs: A Shift in Market Dynamics

One of the most notable recent developments in the Bitcoin market is the rise of institutional investment through Bitcoin ETFs. Despite a slight dip at the start of October, which saw Bitcoin ETFs experience over $300 million in outflows, institutional interest remains robust. As of now, Bitcoin ETFs control around 4.68% of the circulating supply, holding total net assets valued at approximately $57.73 billion.

The introduction of these ETFs has brought a new wave of capital into the Bitcoin market, stabilizing it in a way that was previously unseen. Wall Street’s involvement, via these spot Bitcoin ETFs, has transformed the cryptocurrency from a volatile asset into something more akin to a traditional financial product, such as an index or bond fund. This shift has led to a smoother trading environment, but it may also limit the wild price swings Bitcoin was once known for.

Short-Term Holders Increase Risk Exposure

While long-term holders (LTHs), those who have held Bitcoin for more than 155 days, have been reducing their exposure, short-term holders (STHs) are stepping in to fill the gap. Recent data from on-chain analytics shows a $6 billion decrease in the realized cap of long-term holders, signaling profit-taking or the closing of buying positions. Conversely, short-term speculators have increased their exposure by $6 billion, indicating heightened risk-taking as Bitcoin approaches new highs.

This dynamic between long-term holders and short-term speculators reflects a shift in market sentiment. Long-term holders appear to be locking in profits, perhaps in anticipation of increased volatility, while short-term traders are taking advantage of Bitcoin’s price momentum, betting on continued upside.

Technical Indicators: Potential for a Short-Term Correction

Despite the bullish sentiment, there are indications that Bitcoin’s momentum may face short-term resistance. The realized price of Bitcoin over the past week is nearly identical to the current spot price at $62,080, signaling a potential stall in the rally. This close interaction between the realized price and spot price may suggest that momentum is weakening, leading to a possible correction.

Bitcoin's 200-day Simple Moving Average (SMA) has started to turn bearish, raising concerns about a potential decline to $40,000. This week alone has seen a 7.1% drop in BTC’s price, suggesting that traders should remain cautious.

Geopolitical Risks and Macro Factors Influencing Bitcoin

The global economic and political landscape plays a critical role in Bitcoin’s price action. With rising geopolitical tensions, particularly in the Middle East, Bitcoin’s narrative as "digital gold" and a safe-haven asset becomes more relevant. Investors looking for a hedge against uncertainty are increasingly turning to Bitcoin as an alternative to traditional assets like gold.

Moreover, recent actions by central banks, including rate cuts by the U.S. Federal Reserve, have further solidified Bitcoin’s appeal. The Fed’s 0.50% rate cut, the first in four years, has sparked a 25% rise in Bitcoin’s price in September. With the Fed’s dot plot suggesting 2.5 percentage points of rate cuts by 2026, risk assets like Bitcoin stand to benefit as lower interest rates tend to push investors toward higher-risk, higher-reward opportunities.

Bitcoin’s Long-Term Outlook: $1 Million Predictions and Beyond

Several high-profile figures in the financial world have made bold predictions about Bitcoin’s long-term value. Ark Invest’s Cathie Wood continues to project Bitcoin could reach $1 million by 2030. Meanwhile, Michael Saylor, CEO of MicroStrategy, has suggested that Bitcoin could hit as high as $13 million by 2045.

While these predictions may seem extreme, Bitcoin’s historical performance cannot be ignored. As of October 2024, Bitcoin has already increased 45% year-to-date and remains one of the best-performing assets in the market. With an ever-growing institutional base, increasing adoption, and the shift toward digital currencies, the upside potential for Bitcoin appears significant.

Bitcoin as a Hedge Against Economic and Geopolitical Risks

Bitcoin’s role as a hedge against inflation, currency devaluation, and geopolitical risks continues to gain traction. As the world grapples with inflationary pressures, particularly in emerging markets, Bitcoin is increasingly seen as a store of value that can protect against the erosion of purchasing power. Central banks in countries like China and India are looking to diversify away from the U.S. dollar, and Bitcoin is becoming a key component of this strategy.

Even billionaire hedge fund managers are increasing their exposure to Bitcoin, albeit cautiously. Recommendations from Fidelity Investments suggest that a 2-5% portfolio allocation could be appropriate for aggressive investors. Cathie Wood, on the other hand, believes that allocations could go as high as 19.4%.

Bitcoin Price Forecast and Investor Sentiment

From a valuation standpoint, Bitcoin’s current price around $63,800 has potential upside but faces challenges. The combination of institutional interest, geopolitical risks, and macroeconomic factors all point to a robust long-term future for Bitcoin. However, in the short-term, Bitcoin may face corrections, especially if long-term holders continue to take profits.

With predictions ranging from moderate growth to astronomical price targets, Bitcoin remains a key asset for investors seeking both long-term gains and protection against broader economic risks. As the global economy continues to evolve, Bitcoin’s role as a financial asset is set to expand, making it a valuable part of any diversified portfolio.

Is Bitcoin a Buy, Sell, or Hold?

Given the current market dynamics, Bitcoin presents a strong buy for long-term investors, especially those looking for exposure to a unique asset that can thrive in both inflationary and deflationary environments. However, short-term traders should remain cautious, as profit-taking by long-term holders could result in volatility. For now, Bitcoin’s upside potential, combined with its role as a hedge against macroeconomic risks, makes it an attractive option for those willing to weather short-term fluctuations.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex