Bitcoin Tumbles to $55,300 Amid ETF Outflows and Market Jitters

As ETF withdrawals persist and macroeconomic concerns loom, Bitcoin faces critical support levels with analysts predicting further downside risks | That's TradingNEWS

Bitcoin (BTC) Faces Heightened Market Volatility Amid ETF Outflows and Economic Uncertainty

Price Movement and Technical Support Levels

Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, has experienced a turbulent ride in recent weeks. As of Friday morning, Bitcoin dropped to lows of just over $55,300, representing a 3% decline from the previous day. This drop reflects broader market jitters and diminishing investor risk appetite, as traders brace for the release of key economic data, including the August U.S. jobs report. The report is anticipated to influence the Federal Reserve's upcoming interest rate decisions, which could have a significant impact on Bitcoin’s trajectory.

BTC has oscillated within a well-defined range since peaking in March at around $73,800. Over the past several months, the price has been trapped between critical support levels at $53,000 and $47,000, while resistance points remain at $65,000 and $68,500. On Friday, Bitcoin was trading near the lower bound of this channel, hovering around $55,000, with experts predicting further downside risks if key levels are breached.

Bitcoin ETF Outflows Add Pressure

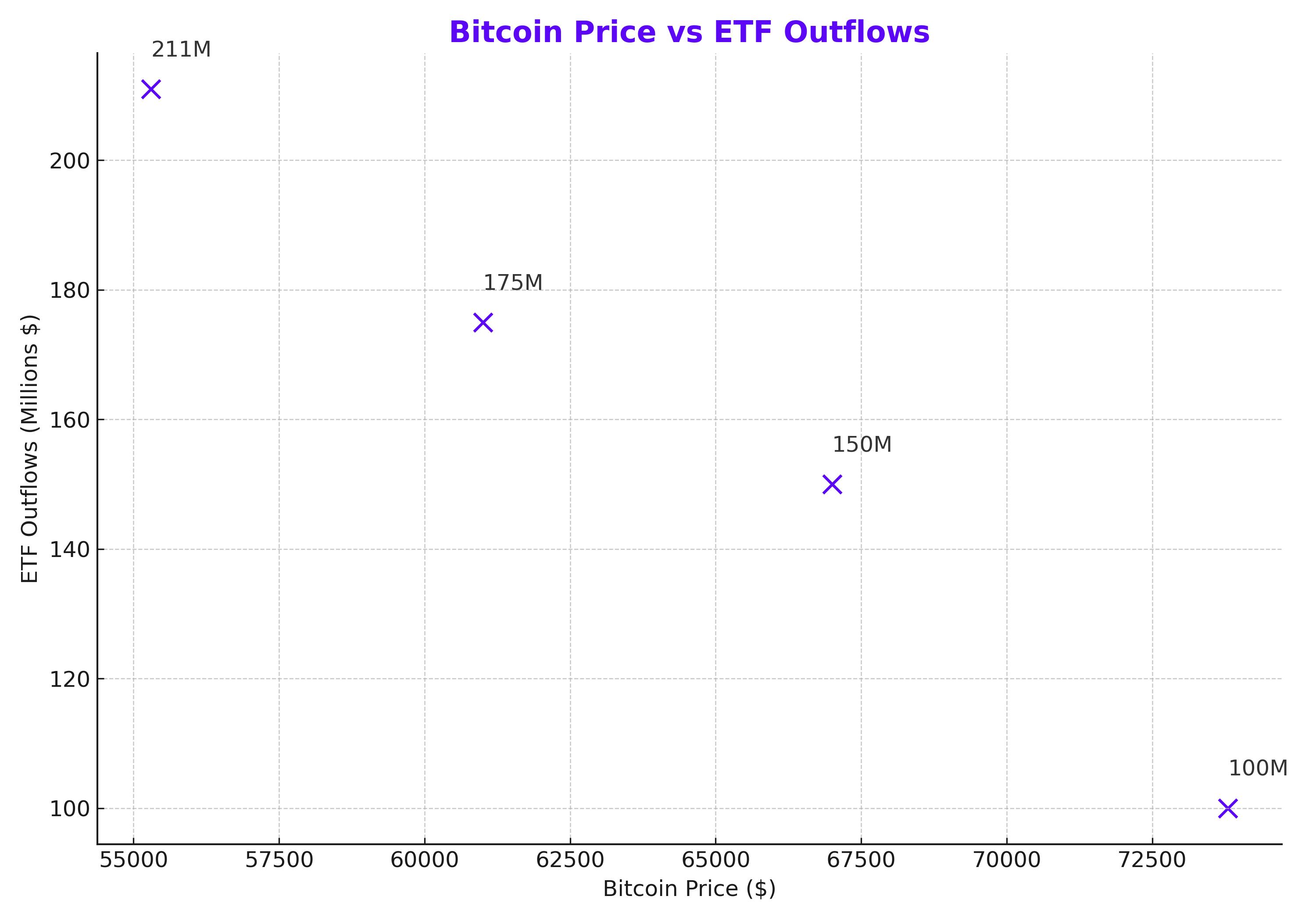

One of the primary factors driving Bitcoin's recent decline is the ongoing outflow from cryptocurrency ETFs, particularly Bitcoin spot ETFs. On September 5, spot ETFs saw a total net outflow of $211 million, marking the seventh consecutive day of withdrawals. Fidelity’s Bitcoin ETF (FBTC) led the pack with outflows totaling $149.5 million. The cumulative outflow streak has raised concerns among market participants, as this represents the longest withdrawal run since June 2024. Notably, Grayscale Bitcoin Trust (GBTC) also experienced significant outflows of $23.2 million, further exacerbating the bearish sentiment.

Bitcoin ETFs had been seen as a major catalyst for BTC’s growth earlier in the year, with assets under management (AUM) peaking above $50 billion. However, the recent trend of outflows has eroded some of the bullish optimism, contributing to the crypto market’s volatile performance.

Macro Factors and the Fear Index

Investor sentiment has grown increasingly cautious, as evidenced by the Crypto Fear and Greed Index, which recently dropped to a reading of 22—indicating "extreme fear" in the market. This shift in sentiment is driven by a mix of macroeconomic concerns, including the Federal Reserve’s monetary policy and the broader slowdown in global economic growth.

On top of this, recent liquidations have contributed to Bitcoin's price instability. Over $98.58 million in positions were liquidated in the last 24 hours, with long positions accounting for 76% of the total. The extent of these liquidations suggests that traders are now positioning for further downside movement, reinforcing the prevailing bearish outlook.

Key Support and Resistance Levels to Watch

Technically, Bitcoin is at a critical juncture. If it continues to decline, the $53,000 level will be the next key support. Should BTC break below this mark, traders are eyeing $47,000 as the next potential target. This zone, situated just above the January swing high, could act as a buffer to prevent a more substantial fall.

On the upside, should Bitcoin manage to rebound, the $65,000 resistance level presents the first major challenge. A move above this area would signal renewed bullish momentum, but it remains to be seen whether Bitcoin can muster the strength to push past both the 200-day moving average and recent price peaks.

Market Analysis and Sentiment

Several factors continue to weigh heavily on Bitcoin. Recent ETF outflows highlight reduced institutional interest, while macroeconomic uncertainty has left investors hesitant to commit to riskier assets like cryptocurrencies. Moreover, the broader market is contending with significant liquidations, further dampening enthusiasm for long positions.

Arthur Hayes, former CEO of BitMEX, has publicly announced his short position on Bitcoin, forecasting a decline to sub-$50,000 levels over the weekend. Similarly, veteran trader Peter Brandt has identified a "megaphone" pattern in Bitcoin's price chart, suggesting that BTC could test the lower boundary at around $46,000 if the pattern plays out.

Despite these bearish outlooks, some traders remain cautiously optimistic, noting that Bitcoin has historically shown resilience in the face of extreme volatility. As of now, Bitcoin remains under pressure, with the broader market closely monitoring key support levels.

Outlook: A Potential Buy or Sell?

With Bitcoin trading near its recent lows, the market is divided on whether this represents a buying opportunity or a signal to sell. While some believe that the current price levels offer a discounted entry point for long-term holders, others warn of further downside risks, particularly if the ETF outflows continue and macroeconomic headwinds persist.

For now, Bitcoin remains in a precarious position. Traders should closely monitor developments in the ETF market, the Federal Reserve's next rate decision, and key support levels at $53,000 and $47,000. Given the current market dynamics, caution is warranted, and investors may want to wait for clearer signs of a reversal before making significant moves.

Conclusion: Is Bitcoin a Buy or Sell?

Given the current macroeconomic uncertainty, ETF outflows, and technical analysis pointing to further downside risks, the short-term outlook for Bitcoin appears bearish. While long-term holders may see this as an opportunity to accumulate, shorter-term traders should proceed with caution, keeping a close eye on critical support and resistance levels.

For now, Bitcoin remains a hold for those already invested, but potential buyers may want to wait for more favorable conditions before entering the market. The coming weeks will likely determine whether Bitcoin can regain its upward momentum or if it will continue to face downward pressure.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex