Bitcoin's Dramatic Dip: Causes Behind Its Slide Under $50K

Delve into the intricate dynamics of Bitcoin's market, exploring the significant liquidations and the role of negative funding rates in shaping its current valuation and future potential | That's TradingNEWS

Bitcoin's Recent Plunge: Analyzing Market Dynamics and Future Prospects

Bitcoin (BTC) has experienced a significant downturn, with its price falling below $50,000 for the first time since February. This steep decline has been influenced by a confluence of economic, technical, and market sentiment factors.

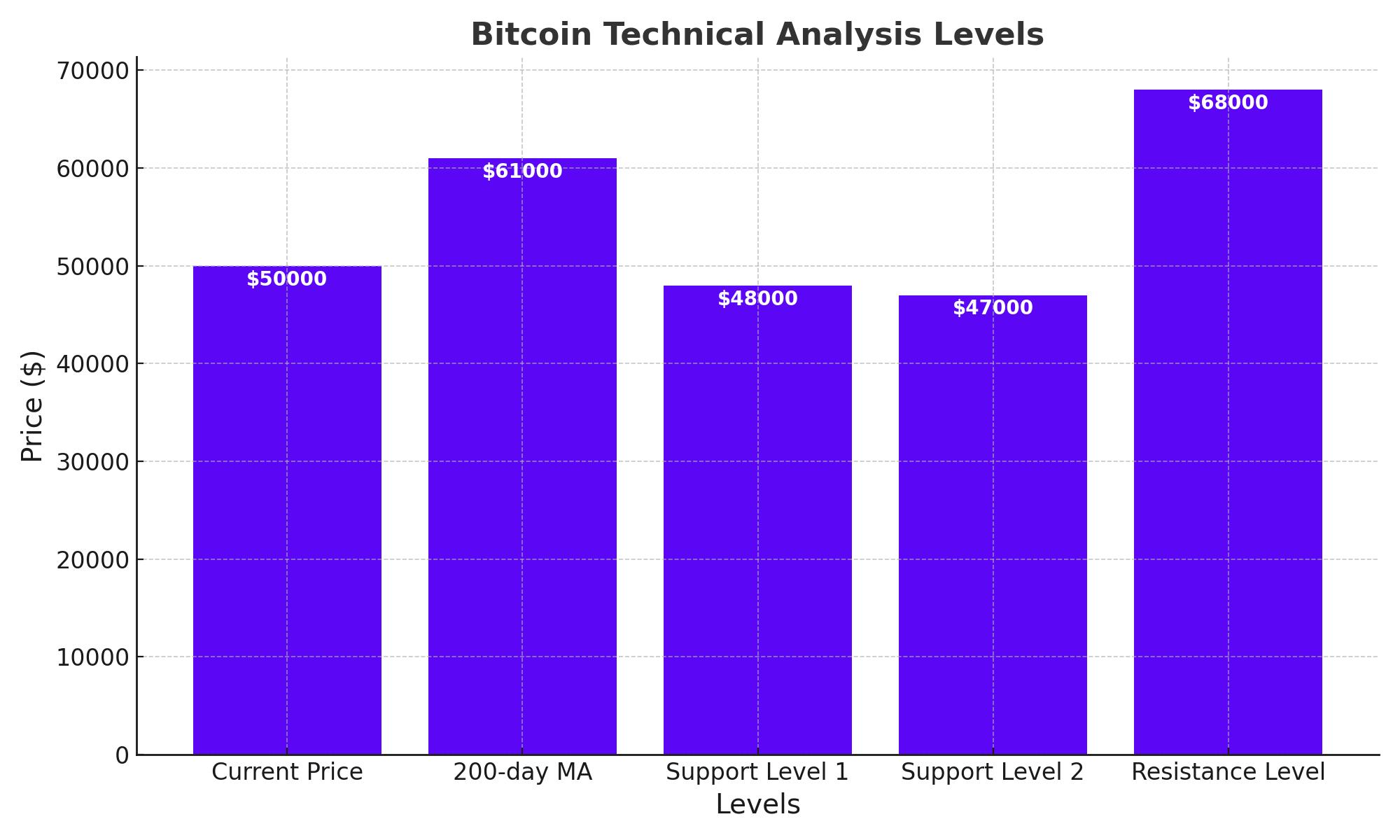

Technical Analysis

Daily Chart Perspective

Bitcoin's inability to break above the critical $68,000 resistance level has led to a continuous downtrend. The cryptocurrency broke through the $60,000 mark and the 200-day moving average around $61,000. Currently, BTC is trading near $50,000 and is approaching the $48,000 support level. The Relative Strength Index (RSI) indicates oversold conditions, suggesting a possible bottom formation in the near term.

4-Hour Chart Insights

The 4-hour chart shows a sharp decline since Bitcoin broke the $60,000 support level. The breakdown has created a bearish market structure, with the $54,000 July low already breached. The RSI on this timeframe also shows oversold conditions, hinting at a potential consolidation above the $48,000 support level in the short term.

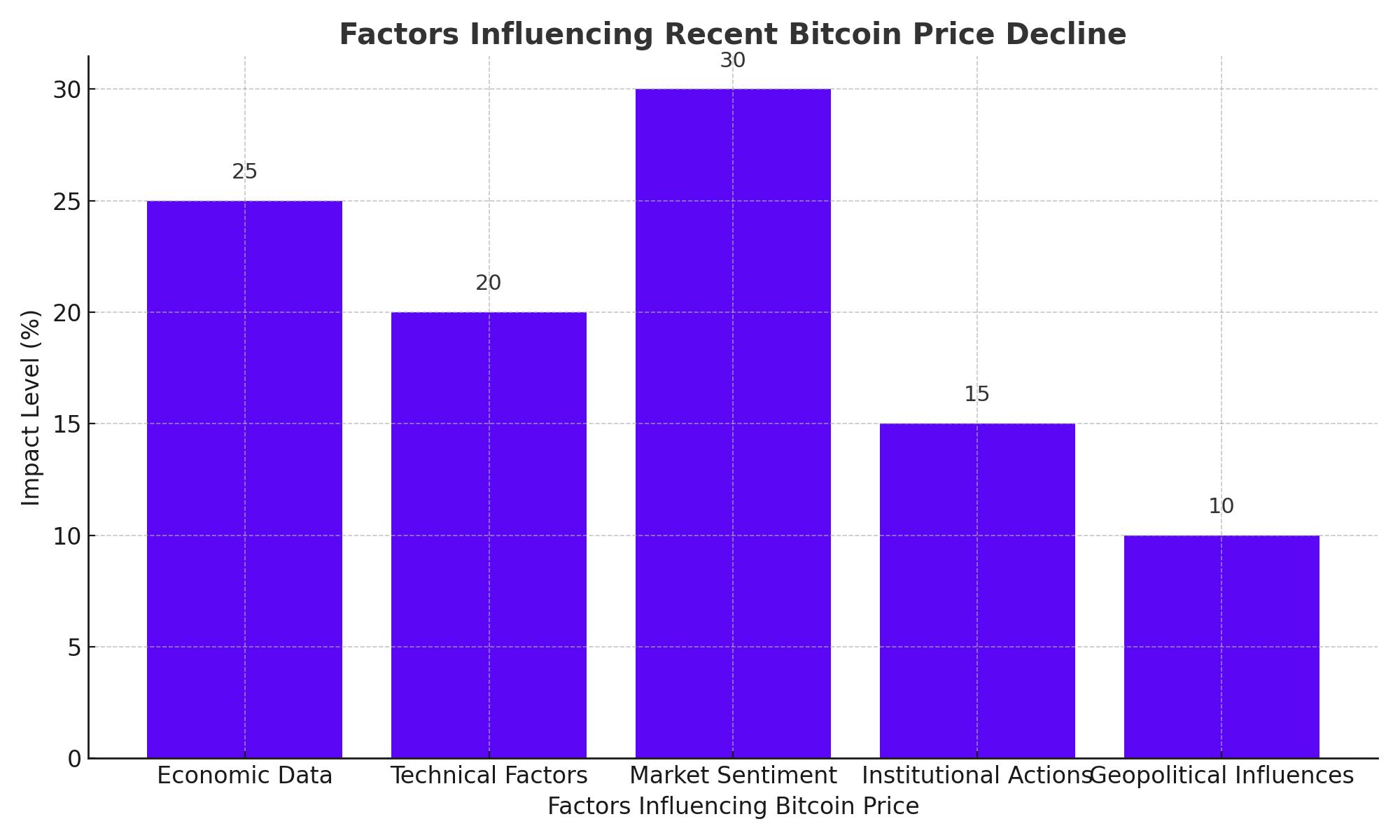

Market Sentiment and Economic Factors

Funding Rates and Liquidations

The futures market has significantly impacted Bitcoin's decline due to a massive long liquidation cascade. The Funding Rates metric shows the most negative values seen in 2024, indicating aggressive selling pressure. This scenario could lead to a short liquidation cascade and a potential v-shaped recovery.

Understanding Funding Rates and Their Impact

Funding rates are periodic payments exchanged between long and short positions in the futures market, designed to keep futures prices close to the spot price of the underlying asset. When funding rates are positive, long positions pay short positions, indicating a bullish sentiment. Conversely, negative funding rates mean that short positions pay long positions, reflecting bearish sentiment.

As of 2024, Bitcoin's funding rates have reached their most negative values, signaling a significant shift in market sentiment towards extreme pessimism. This negative funding environment suggests that sellers are overwhelmingly dominant, pushing the price downward with sustained pressure. The data highlights a stark contrast to the generally positive funding rates seen during Bitcoin's bullish runs, underscoring the severity of the current market conditions.

Impact of Economic Data

The broader financial markets have also experienced declines driven by fears of a U.S. economic slowdown. Recent weak economic data, such as the July jobs report showing only 114,000 jobs added (far below the expected 175,000), has heightened recession fears. This has led to a sell-off in risk assets, including cryptocurrencies. The unemployment rate rose to 4.3%, the highest since November 2021, further adding to market concerns.

Cryptocurrency Market Dynamics

Crypto Market Liquidations

The recent market downturn has led to significant liquidations in the crypto futures market. Over the past 24 hours, Bitcoin futures have recorded $421 million in liquidations, while Ethereum futures have seen $375 million. This widespread liquidation affected over 275,000 traders, with the majority of these positions being long. This massive sell-off underscores the heightened volatility and the precarious nature of leveraged trading in the cryptocurrency market.

Broader Market Impact

The cryptocurrency market's decline has mirrored significant losses in the equity markets, with major indices such as the Nasdaq and S&P 500 experiencing sharp declines. For instance, the Nasdaq dropped by 3%, while the S&P 500 fell by 2.7%. Bitcoin, often considered a risk-on asset, has been particularly impacted by this trend, as its price tends to correlate with broader market sentiment. This has led to Bitcoin trading around $50,300, down significantly from its recent highs.

Regulatory and Geopolitical Influences

Regulatory Uncertainty

Uncertainty surrounding U.S. regulations has heavily impacted the crypto market. Recent polling data indicating that Democratic frontrunner Kamala Harris is closing the gap with Republican nominee Donald Trump has added to market anxiety. Additionally, the U.S. government’s mobilization of approximately $2 billion worth of tokens for potential sale has further fueled bearish sentiment. This regulatory uncertainty creates a challenging environment for investors, who are wary of potential adverse policy changes.

Geopolitical Tensions

Rising geopolitical tensions, particularly in the Middle East, have also played a significant role in shaping market sentiment. The ongoing conflict in the region has driven investors towards safe-haven assets such as the Japanese yen and gold, both of which have seen increased demand. In contrast, this shift has led to reduced interest in speculative assets like Bitcoin, exacerbating its price decline. As a result, Bitcoin's price has dropped to levels not seen since early 2023, trading around $49,443.

Institutional Movements

Impact of Institutional Actions

Institutional actions have significantly influenced the recent sell-off in the cryptocurrency market. Reports indicate that Jump Trading has been offloading Ethereum and other assets, contributing to the downward pressure on prices. Moreover, there have been substantial outflows from Bitcoin exchange-traded funds (ETFs). Notably, on August 2, Bitcoin ETFs experienced their largest outflows in approximately three months, signaling waning institutional confidence. This mass exodus has further compounded the market's bearish outlook, with Bitcoin and Ethereum struggling to regain their footing.

Future Outlook and Key Levels

Technical Levels to Watch

In the midst of continued selling pressure, Bitcoin (BTC) investors should closely monitor several critical technical levels. The $56,000 mark, which previously acted as a support, now serves as a significant resistance level. Failure to reclaim this level could lead to further declines. Specifically, Bitcoin could drop to $47,000, where it may find support near its January peak.

If the bearish trend persists, the next major support level to watch is $40,000. This level has historically provided strong support and could act as a critical juncture for the price. Should the sell-off intensify beyond this point, Bitcoin might decline further to around $35,000. This level represents a crucial support from a period of consolidation between late October and mid-November of the previous year, shortly after Bitcoin climbed back above the 200-day moving average.

Investment Insights

Despite the recent downturn, Bitcoin's long-term fundamentals remain robust. Several factors suggest that Bitcoin could rebound and continue its upward trajectory over time. The ongoing economic instability, marked by fluctuating markets and recession fears, often drives investors towards safe-haven assets like Bitcoin. As a decentralized digital currency, Bitcoin offers an alternative store of value during times of economic turmoil.

The potential for the Federal Reserve to implement rate cuts could positively impact Bitcoin. Lower interest rates typically weaken the US dollar, making Bitcoin more attractive to investors seeking to hedge against fiat currency devaluation.

Rising geopolitical tensions, such as conflicts in the Middle East or strained international relations, can enhance Bitcoin’s appeal as a non-sovereign asset. Historically, such conditions have driven demand for Bitcoin as a form of "digital gold."

Given these factors, the current decline might present a strategic buying opportunity for long-term investors. For those considering entry points, monitoring Bitcoin’s ability to consolidate above key support levels like $47,000 and $40,000 will be crucial.

Conclusion

While Bitcoin faces significant short-term pressures, the long-term outlook remains cautiously optimistic. Investors should stay vigilant and closely watch the key levels of $56,000, $47,000, $40,000, and $35,000. These levels will provide critical insights into potential support and resistance points. Additionally, considering the broader economic and geopolitical context will be essential for making informed investment decisions. By understanding these dynamics, investors can better navigate the volatile Bitcoin market and identify strategic opportunities amidst the fluctuations.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex