Bitcoin's Fortunes: Unraveling the 2024 Crypto Market Shifts

Exploring the Impact of ETFs, Market Corrections, and Whale Movements on Bitcoin and Crypto Stocks – An In-Depth Analysis | That's TradingNEWS

Bitcoin's Volatile Journey: Analyzing the Recent Market Dynamics

The Recent Pullback and Its Impact

Bitcoin's recent descent to the $40,000 level marks a notable shift in its market dynamics. Following a period of relative stability, this decline, reaching a nadir of $40,601.37, signifies the lowest point since mid-December. This downward movement isn't isolated to Bitcoin alone; Ethereum, despite recent gains, also experienced a 3% drop to $2,448.41. This trend resonates across the broader cryptocurrency market, with a general downtrend observed.

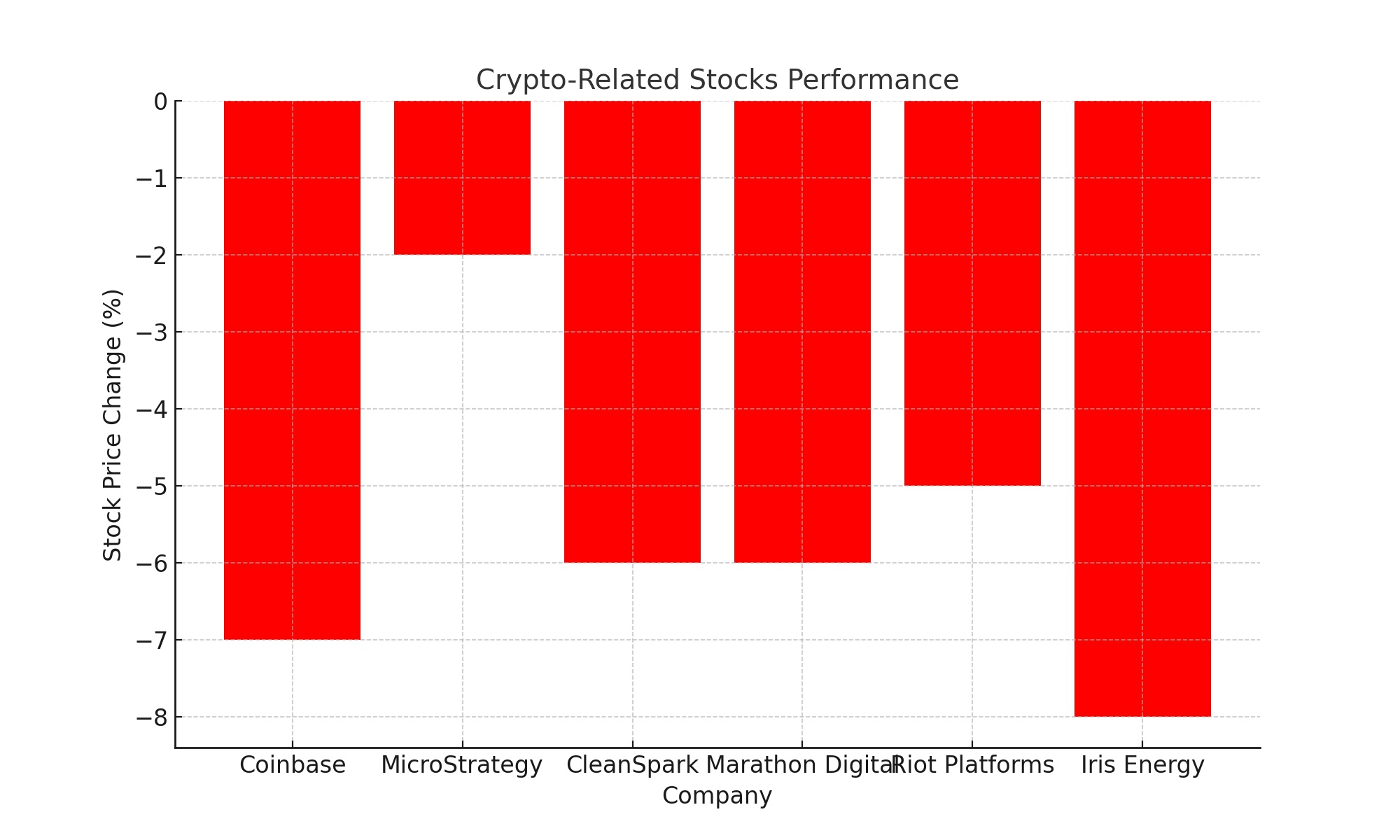

Ripple Effects on Crypto-Related Stocks

This decline in Bitcoin's value has a tangible impact on associated stocks. Key players like Coinbase and MicroStrategy witnessed a decline of 7% and 2% respectively. Mining companies such as CleanSpark and Marathon Digital weren't spared either, each losing over 6%. Similarly, Riot Platforms and Iris Energy saw a decrease of 5% and 8%.

Insider Perspectives on Market Corrections

Julio Moreno, a leading researcher in the crypto sphere, attributes this trend to a correction phase post-ETF launch. He notes that significant selling activities by short-term traders and major Bitcoin holders, coupled with a risk-off attitude, are key contributors. Moreno points out that unrealized profit margins haven't dipped sufficiently to indicate a market bottom.

Bitcoin ETFs and Market Dynamics

Since the SEC's greenlight for Bitcoin ETFs in the U.S., Bitcoin has dropped approximately 12%. This shift suggests a possible correlation between the introduction of ETFs and market volatility. Notably, JPMorgan's analysis reveals a substantial outflow of $1.5 billion from the Grayscale Bitcoin Trust GBTC, indicating a trend of profit-taking and market exit rather than a shift to more cost-effective spot Bitcoin ETFs.

The Whale Factor and Market Movements

An intriguing analysis by James Van Straten of CryptoSlate highlights the potential impact of a single Bitcoin whale's actions on market dynamics. The sale of a significant BTC position, amounting to a $100 million profit, may have catalyzed a market frenzy, contributing to Bitcoin's price fluctuations.

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex