Bitcoin's Future: Analyzing Trends and Expert Predictions

A Comprehensive Look at Bitcoin's Recent Performance, Key Market Influences, and What Lies Ahead for BTC in 2024 | That's TradingNEWS

Bitcoin's Recent Performance and Future Prospects

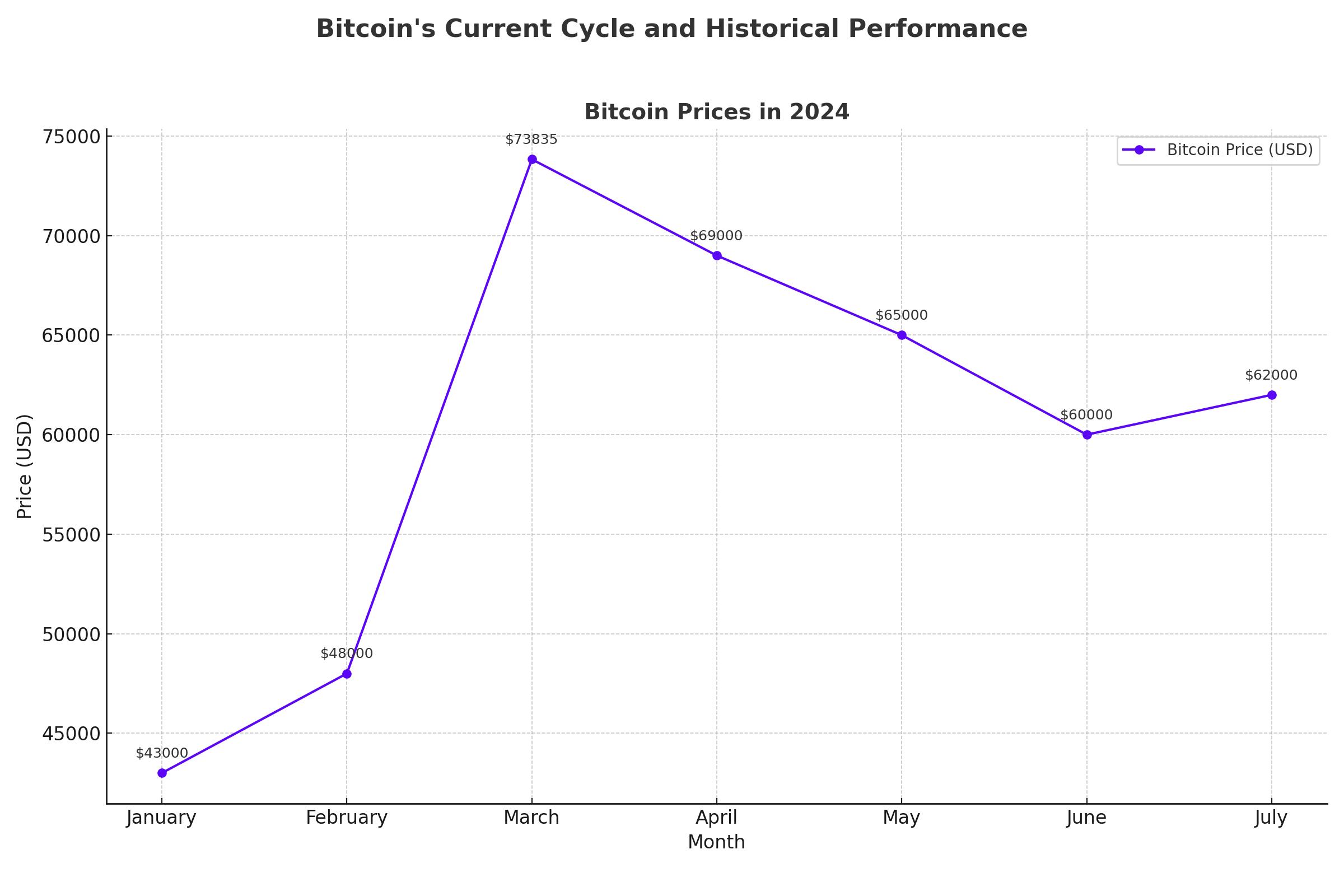

Despite a downturn in the past month, 2024 has been a notable year for Bitcoin (BTC), with its price hitting an all-time high of over $73,000 in mid-March. Prominent figures such as Tom Lee continue to forecast new impressive peaks, with Lee predicting a potential rally to $150,000 in the coming months. This optimism is based partly on the resolution of issues related to the now-defunct Mt. Gox exchange, which had suspended operations a decade ago and recently announced it will begin repaying users nearly $9 billion in assets.

Impact of Mt. Gox on Bitcoin

Mt. Gox, once a leading crypto exchange, lost approximately 850,000 BTC due to hacking and alleged mismanagement. The court-appointed trustee overseeing the exchange's bankruptcy proceedings has announced plans to distribute the recovered Bitcoin to creditors starting in July. Tom Lee believes that the elimination of this significant overhang could lead to a sharp rebound in Bitcoin's price, potentially reaching $150,000.

Market Sentiment and Technical Analysis

Bitcoin's market structure has shown signs of improvement, with sustained trading above $61,500 potentially leading to a test of the $65,000 area. After a recent dip to $58,500, Bitcoin quickly repositioned above $60,000 and has remained around $62,600. Despite being below its 50-day moving average, which casts doubt on the continuation of the bullish trend, the 200-day moving average remains upward-oriented, indicating long-term bullish momentum.

Recent Sell-offs and Their Impact

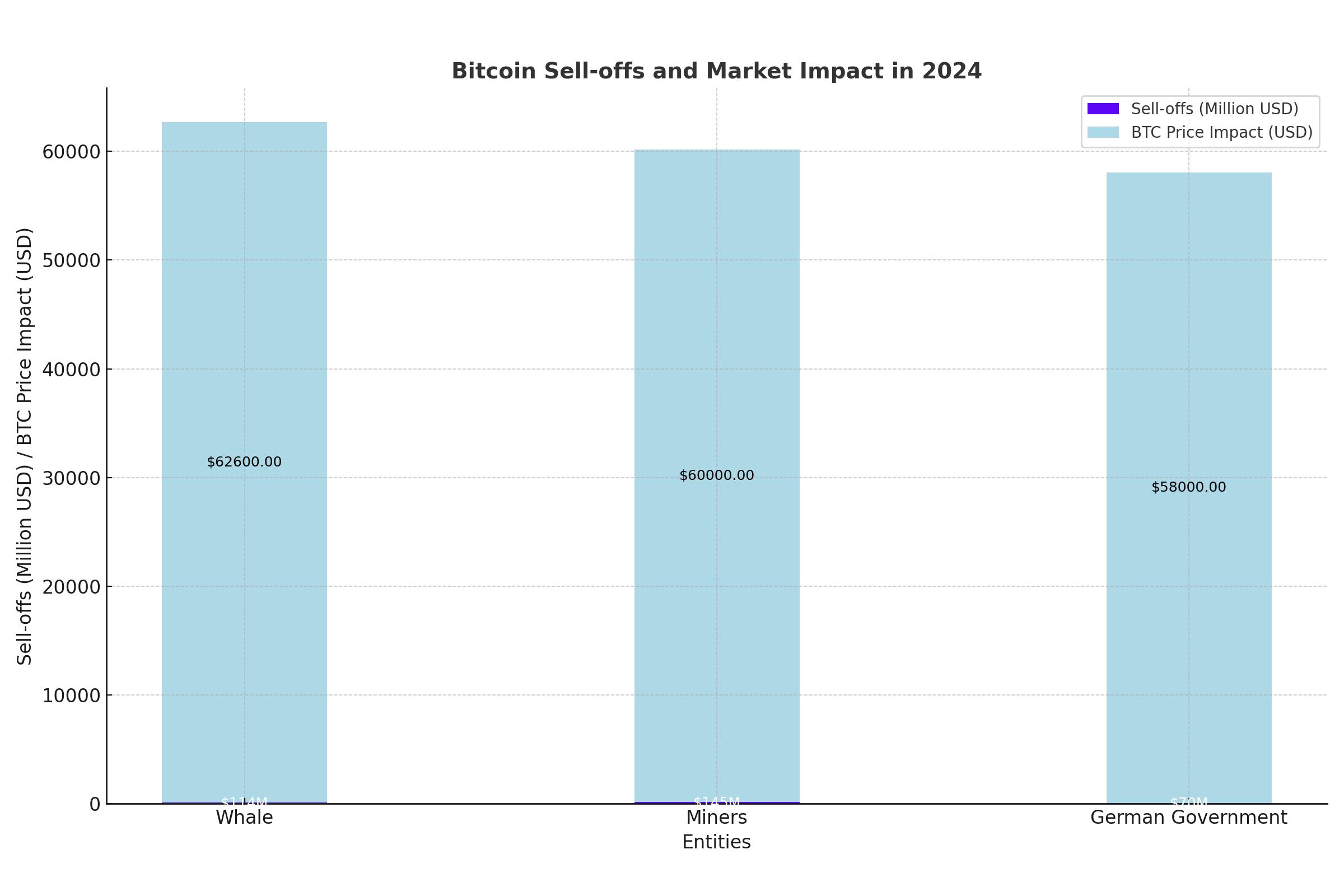

Market dynamics have been influenced by significant sell-offs from large holders and institutions. For instance, a Bitcoin whale recently offloaded $114 million worth of BTC to Binance, causing the price to drop. Additionally, Bitcoin miners and the German government have also been liquidating their holdings, adding to the selling pressure. Over the last 72 hours, miners sold over 2,300 BTC valued at approximately $145 million, contributing to the recent price decline.

Anticipation of Further Movements

Despite recent sell-offs, analysts like Ki Young Ju and Ali Martinez remain optimistic about Bitcoin's future. Historical data suggests that Bitcoin tends to rebound strongly in July after a negative June, with average returns of 7.98% and median returns of 9.60% during this month. This historical trend, combined with the current market sentiment, suggests potential gains in the near term.

Influences of Macro Factors

Bitcoin's performance is also influenced by broader macroeconomic factors, such as Federal Reserve policies and geopolitical risks. The Federal Reserve's potential interest rate cuts in September and December, along with ongoing geopolitical tensions, could offer support to Bitcoin prices. Additionally, comments from influential figures like Jack Dorsey, who suggested Bitcoin could eventually replace the US dollar, add to the market's bullish sentiment.

Long-Term Predictions

Looking ahead, Bitcoin bulls have reason to be optimistic. Despite a subdued performance in recent weeks, Bitcoin has historically performed well in July. The inflows into US-listed ETFs and positive sentiment among professional investors indicate a potential rebound. Analysts believe that continued institutional interest and favorable macroeconomic conditions could drive Bitcoin to new highs, with some predicting it could eventually replace gold as a global store of value.

Conclusion

The Bitcoin market remains dynamic and influenced by a variety of factors, including technical trends, institutional actions, and macroeconomic policies. While recent sell-offs have introduced volatility, the long-term outlook for Bitcoin remains positive, with potential for significant gains in the coming months. Investors should stay informed about market developments and consider both the risks and opportunities presented by this evolving asset class.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex