Bitcoin's TradingNEWS - Economic Shifts and Regulatory Impact

A detailed look at Bitcoin's performance amidst ETF outflows, regulatory challenges, and shifting global economic conditions | That's TradingNEWS

Detailed Analysis: Bitcoin's Market Resilience Amidst Challenges

Current Market Scenario for Bitcoin

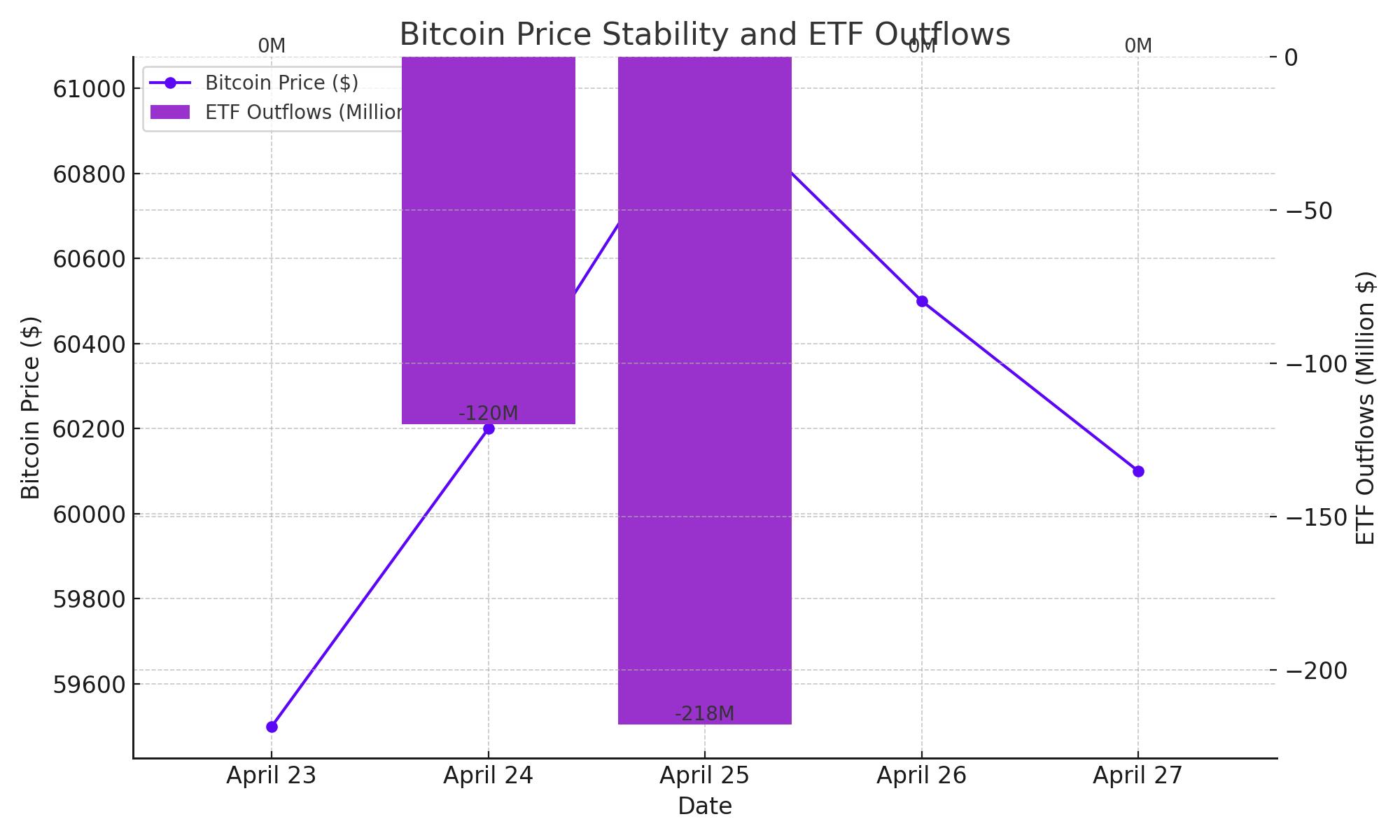

As of April 27, Bitcoin has managed to sustain its value above the $60,000 mark despite a series of adversities that could potentially dampen investor sentiment. These challenges include a substantial outflow from U.S.-based spot Bitcoin exchange-traded funds (ETFs), regulatory warnings, and scrutiny from U.S. policymakers regarding cryptocurrency transactions linked to illicit activities.

Significant Outflows and Regulatory Challenges

The cryptocurrency market observed significant capital movements with Bitcoin ETFs experiencing a net outflow of $218 million on April 25, followed by a $120 million outflow the previous day. These outflows were primarily isolated incidents as Franklin Templeton recorded inflows, indicating a selective rather than a widespread retreat from Bitcoin investments.

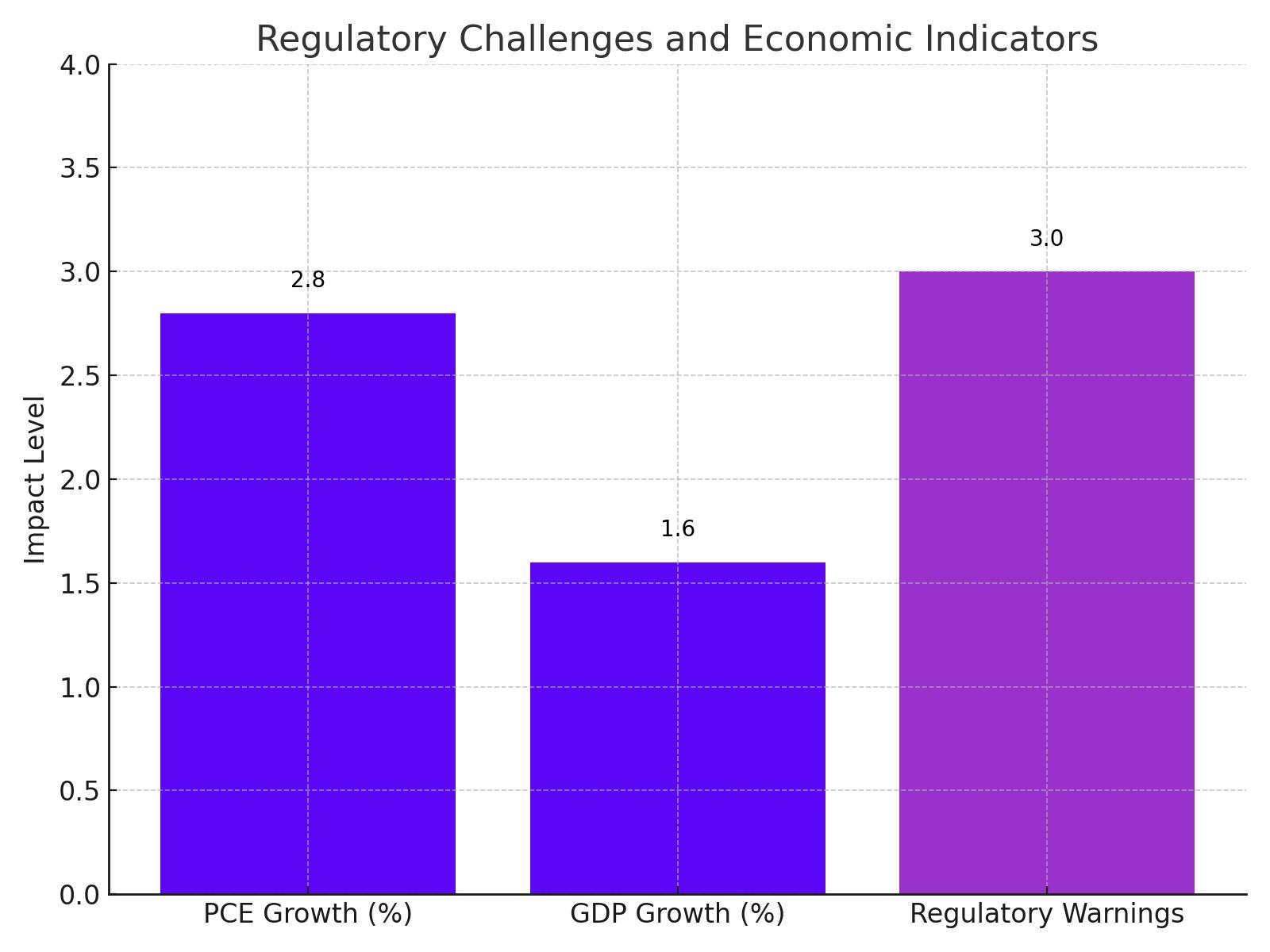

Amid these financial movements, regulatory scrutiny has intensified. U.S. Senators Elizabeth Warren and Bill Cassidy have inquired about measures to curb pseudonymity in cryptocurrency transactions, especially those funding illicit activities like child abuse material. This request for stricter regulations underscores the increasing attention and potential regulatory pressures on cryptocurrency operations.

Economic Indicators and Bitcoin’s Outlook

Despite these hurdles, Bitcoin’s resilience is also influenced by broader economic conditions. Recent U.S. economic data revealed a 2.8% year-over-year increase in Personal Consumption Expenditures (PCE) for March, surpassing the Federal Reserve's inflation targets. This inflationary pressure coincides with a weaker-than-expected U.S. GDP growth rate of 1.6% for the first quarter, suggesting prolonged higher interest rates to combat inflation.

Such economic indicators have led to a cautious stance from investors, as higher interest rates could dampen economic growth, affecting investment returns across various asset classes, including cryptocurrencies.

Global Economic Factors

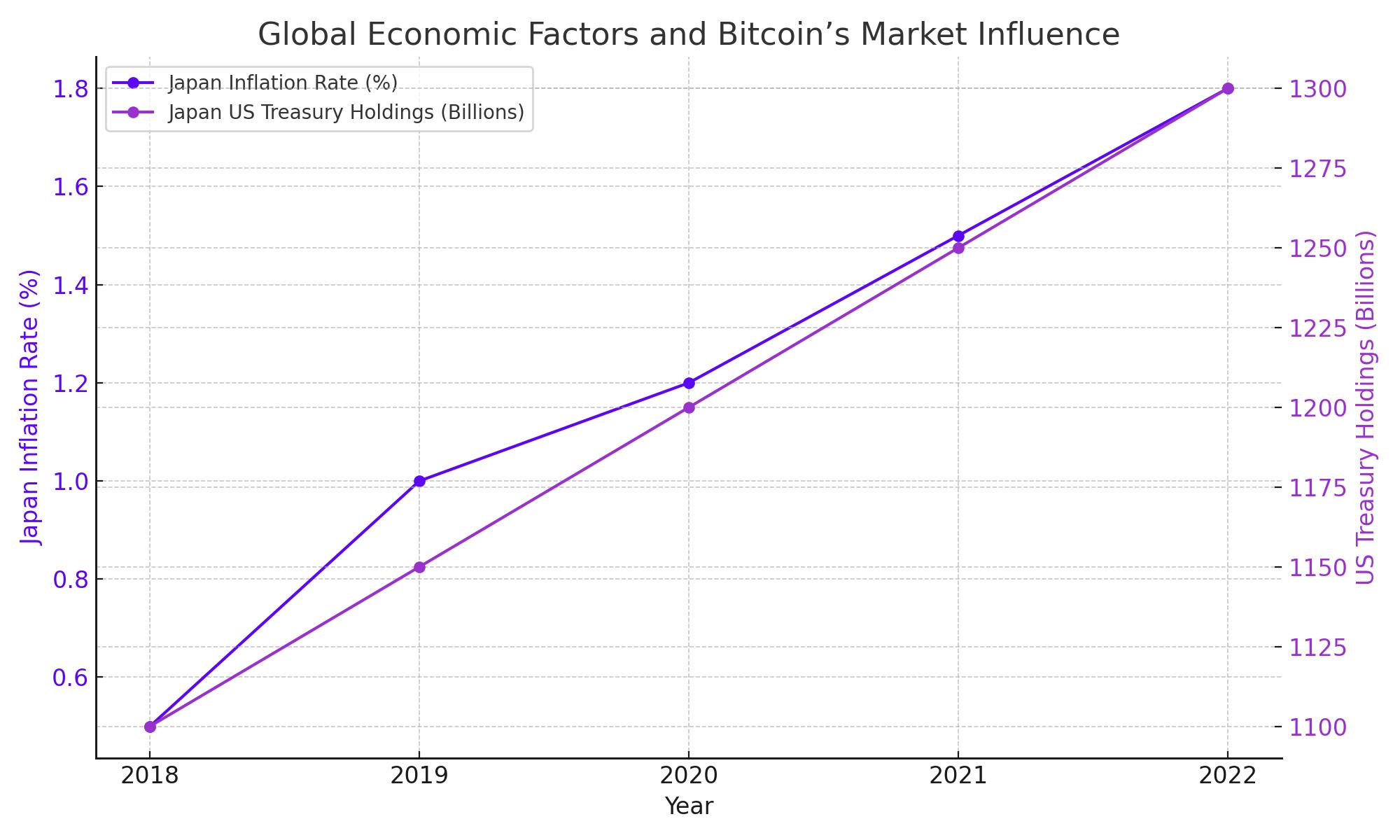

The global economic environment also presents challenges and opportunities for Bitcoin. For instance, Japan’s currency devaluation to its lowest since 1990 and a lower-than-expected inflation rate of 1.8% might weaken consumer spending but could potentially increase Japan’s export competitiveness. As Japan holds a significant amount of U.S. Treasuries, any major shift in its investment strategy could impact global economic dynamics, indirectly affecting Bitcoin.

Overview of Bitcoin Halving

Bitcoin's network underwent its latest halving event on April 19, a significant occurrence that happens approximately every four years (or every 210,000 blocks mined). During this event, the reward for mining new Bitcoin blocks was halved from 6.25 to 3.125 bitcoins per block. This mechanism is an integral part of Bitcoin's design to curb inflation and extend the distribution of new bitcoins until around the year 2140.

Impact on Bitcoin's Inflation Rate

Prior to the halving, Bitcoin's annual inflation rate was approximately 1.7%. Following the halving, this rate has been adjusted downward to roughly 0.85%, marking a significant reduction. This new inflation rate is even lower than gold's, historically around 1-2% per year, which solidifies Bitcoin's proposition as 'digital gold'. The halving effectively limits the supply of new bitcoins, enhancing its scarcity as a digital asset.

Historical Price Performance Post-Halving

Historical data from previous Bitcoin halvings illustrates a pattern of price increases following these events. The first halving in 2012 saw Bitcoin’s price increase from about $12 to over $1,100 within a year. Similarly, the 2016 halving preceded a bull run that pushed prices from around $650 to just under $20,000 by the end of 2017. The 2020 halving also saw a substantial price surge, with Bitcoin climbing from about $8,000 to an all-time high near $64,000 in April 2021.

Supply and Demand Dynamics

The reduction in block rewards leads to a decreased rate of new Bitcoin entering circulation, directly impacting the supply side of the market. With a reduced supply growth rate and assuming demand remains constant or increases, economic theory suggests a potential price increase. The anticipated scarcity tends to attract new and existing investors, driving market prices up due to competition for a limited asset.

Market Anticipation and Speculative Activity

In the months leading up to a halving, speculative activity often increases as traders and investors anticipate the event's impact on prices. This speculation can lead to heightened market volatility and price fluctuations. For instance, in the six months preceding the 2020 halving, Bitcoin’s price saw an increase of approximately 40%, underscoring the significant market anticipation and speculative interest surrounding these events.

Long-term Considerations

While the immediate aftermath of a halving can be influenced by speculative trading, the long-term effect is more aligned with Bitcoin's perceived value as a scarce asset. As the available supply growth diminishes with each halving, Bitcoin's deflationary aspect becomes more pronounced, potentially enhancing its appeal as a store of value over time.

Current Market Context

Post-halving, the market continues to assess the broader impacts of reduced Bitcoin supply against a backdrop of economic factors such as inflation rates, monetary policy changes, and geopolitical events. These elements can either amplify or mitigate the typical post-halving price movements observed historically.

In summary, Bitcoin halving events are pivotal moments that not only affect the internal economy of the Bitcoin network by reducing the rate at which new bitcoins are minted but also play a significant role in influencing global market dynamics through their impact on supply and demand.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex