Bitcoin’s Path to $64,000: Analyzing Market Drivers and Future Outlook

Analyzing Bitcoin’s Recent Surge to $64,000, Influences of Geopolitical Developments, Institutional Investment Trends, and Future Market Predictions | That's TradingNEWS

Bitcoin (BTC) Analysis: Comprehensive Review and Future Outlook

Bitcoin's Recent Surge and Market Dynamics

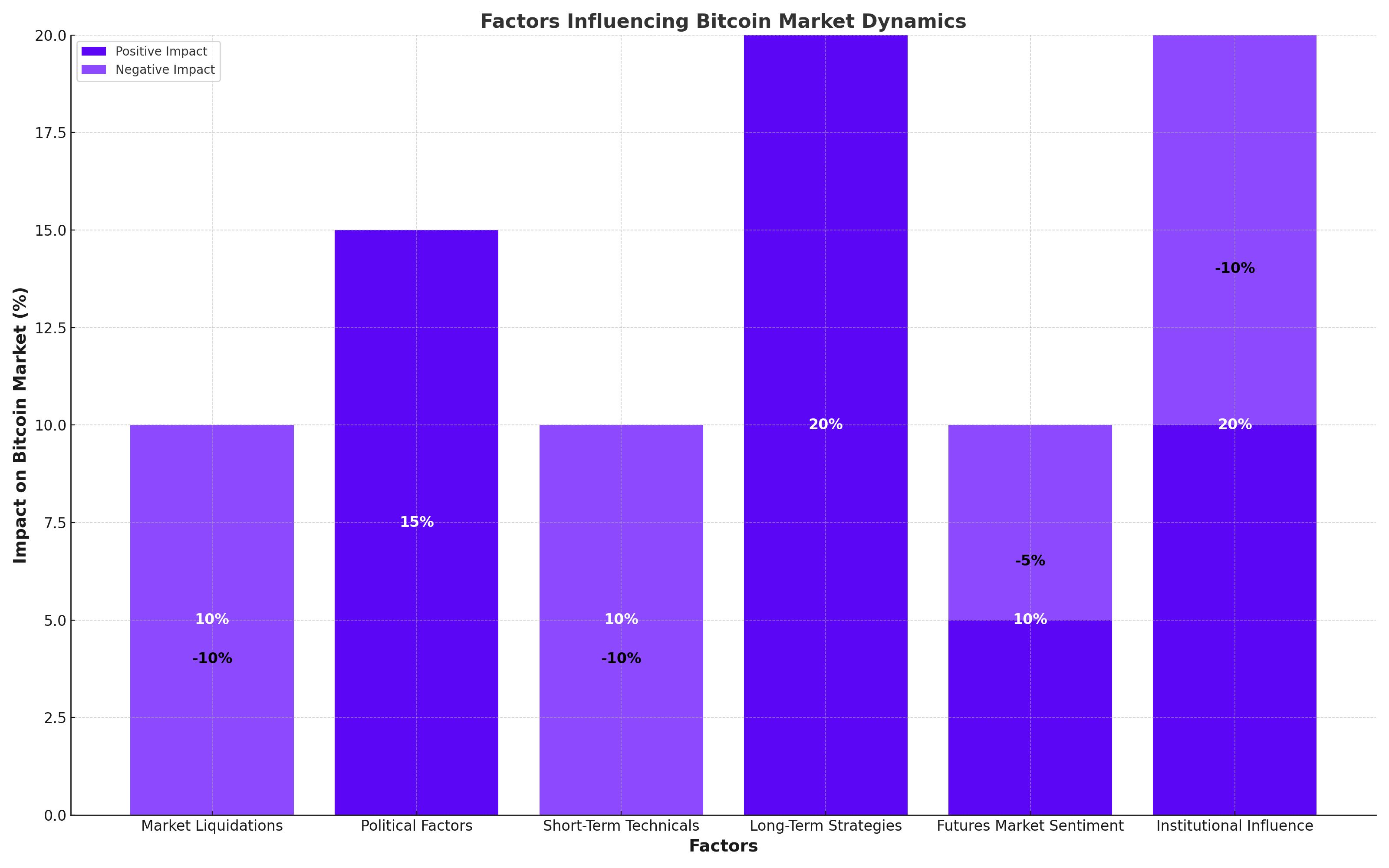

Bitcoin (BTC) has seen a significant resurgence, recently trading near all-time highs of approximately $64,000 per BTC. This dramatic recovery has been fueled by several key factors, each playing a vital role in shaping the current market dynamics.

The Trump Effect and Regulatory Environment

Former U.S. President Donald Trump’s recent statements have fueled optimism in the crypto market. Trump has suggested a more crypto-friendly regulatory environment if he wins the presidency in 2024. This has raised hopes among Bitcoin investors, as Trump's stance could lead to favorable regulatory changes. Trump is also expected to speak at the Bitcoin Conference in Nashville, which has spurred speculation about potential strategic moves regarding Bitcoin as a reserve asset.

Institutional Investments and ETF Influence

One of the primary factors contributing to Bitcoin's recent price surge is the influx of institutional investments. Notably, BlackRock's launch of the IBIT fund and other spot Bitcoin exchange-traded funds (ETFs) have attracted substantial capital inflows. These ETFs have become some of the fastest-growing in history, drawing comparisons to the surge in gold prices following the introduction of its first ETF. This institutional interest has provided strong support for Bitcoin's price, driving it closer to the $64,000 mark.

Market Movements and Price Predictions

Billionaire investor Mark Cuban has issued bold predictions about Bitcoin, highlighting its fixed supply cap of 21 million BTC. Cuban believes that if the U.S. dollar declines as the global reserve currency, Bitcoin could emerge as a global 'safe haven' and potentially a 'global currency.' This scenario, according to Cuban, could propel Bitcoin to unforeseen heights.

Exchange Withdrawals and Market Impact

Recent data reveals significant withdrawals from centralized exchanges, with $3.8 billion in BTC moved on July 5, 2024, and another $3.4 billion on July 16. These movements are interpreted as bullish signals, indicating that holders are moving their assets to non-custodial wallets, thereby reducing market selling pressure. This behavior typically signifies a willingness to hold BTC long-term, enhancing scarcity and supporting price increases.

Technical Indicators and Future Price Projections

Bitcoin's technical indicators also suggest bullish momentum. The Bollinger Bands, a measure of market volatility, are currently compressed, signaling potential for significant price movements. Historically, such compression has preceded major price increases. Analysts, like Julien Bittel, predict BTC could reach between $140,000 to $190,000 if past patterns repeat.

Market Reactions to Regulatory Developments

Mt. Gox Distributions and Market Concerns

Concerns about Bitcoin distributions from the defunct exchange Mt. Gox have also influenced the market. As wallets linked to Mt. Gox mobilized nearly $3 billion of tokens, fears of increased supply and selling pressure emerged. However, Bitcoin has shown resilience, rebounding from initial losses.

Broader Crypto Market Trends

The broader crypto market, including altcoins like Ethereum (ETH) and Ripple (XRP), has mirrored Bitcoin’s movements. While Ethereum faced resistance at $3,530, it shows potential for further gains if it holds key support levels. Ripple, following a 20% rally, may see additional increases if it maintains support at $0.480.

Global Geopolitical and Economic Influences

The global geopolitical landscape, particularly the U.S. presidential elections and economic policies, continues to exert significant influence on Bitcoin’s market dynamics. The recent political developments, including the potential withdrawal of Joe Biden from the presidential race and the increasing likelihood of Donald Trump securing a second term, are seen as bullish for the crypto market.

Bitcoin's price has reacted positively to these developments. For instance, after Trump’s recent surge in popularity following an assassination attempt at a campaign rally in Pennsylvania, Bitcoin's price climbed back up to $66,000 before settling around $64,000. The market's expectation is that a Trump presidency could lead to a more favorable regulatory environment for cryptocurrencies, which would be beneficial for Bitcoin and other digital assets.

Moreover, the anticipation of Trump speaking at the Bitcoin Conference in Nashville has spurred further speculation. Some market participants believe that Trump might declare Bitcoin a "strategic reserve asset," although this remains speculative. Such a move could significantly bolster Bitcoin's market standing, potentially driving prices even higher.

That's TradingNEWS

Read More

-

QQQ ETF Price Forecast - QQQ at $600.91: Nasdaq Growth Weighs Jobs Shock, High Yields and AI Productivity

12.02.2026 · TradingNEWS ArchiveStocks

-

XRPI And XRPR ETF Prices Lag At $7.74 And $11.44 While $1.23B XRP ETF Flows Test A Weak $1.38 Spot

12.02.2026 · TradingNEWS ArchiveCrypto

-

Gold Price Forecast: XAU/USD Guards $5,000 as Wall Street Maps Run Toward $6,100–$7,200

12.02.2026 · TradingNEWS ArchiveCommodities

-

EUR/USD Price Forecast: Can the Euro Clear 1.1900 as Dollar Momentum Fades Below 97?

12.02.2026 · TradingNEWS ArchiveForex