Black Sea Deal- Commdities Market, Wheat Corn Soybean ETFs

Geopolitical Moves and Climate Conditions on Commodity Markets and ETFs Wheat Corn Soybean Votality with black Sea Deal | That's TradingNEWS

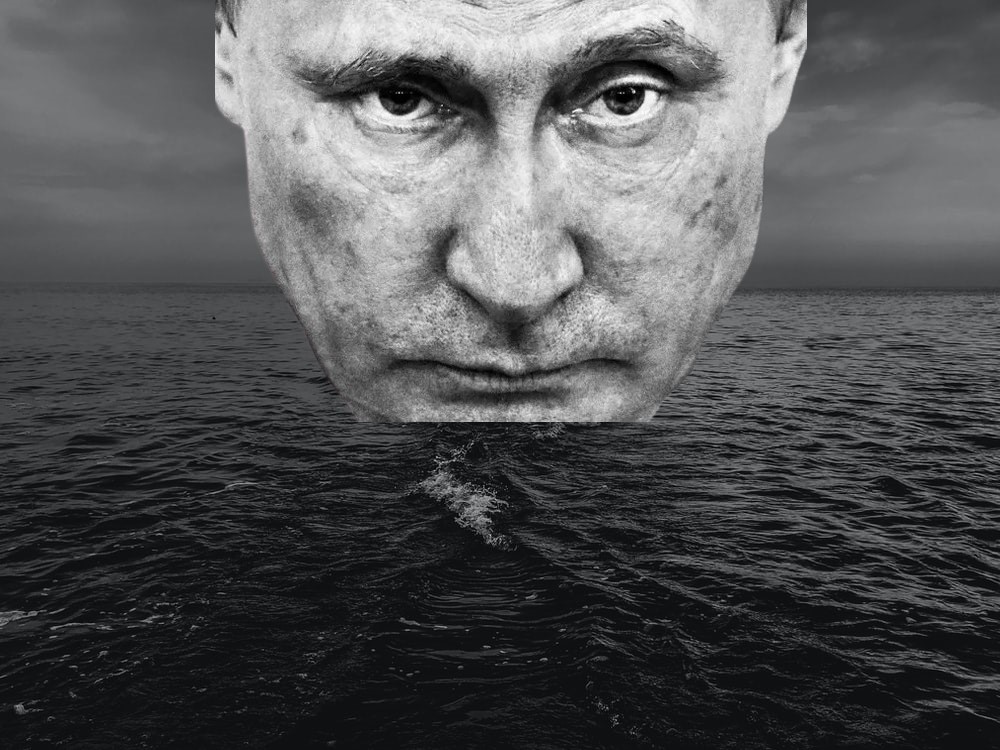

The future of wheat and corn markets faced significant changes with the announcement of Russia's decision to withdraw from a deal that has facilitated Ukraine's export of crops through the Black Sea. Despite initial gains, these commodities futures reversed their trend, taking a dip on the news. This came as a surprise to many, as Russia has historically threatened to leave the agreement over disputes regarding the ease of export regulations for Russian food and fertilizer. Analysts suggest that the deal may still have a chance at renewal, with the possibility of Russia reentering the pact if its demands are met. However, for now, Russia's assurance for safe navigation through the Black Sea has been revoked.

The Chicago Board of Trade reported a 1.5% decrease in corn for December delivery, with it closing at $5.06 per bushel. September wheat fell 1.2%, ending at $6.53 3/4 per bushel. In contrast, soybeans for November delivery saw a modest increase of 0.5%, closing at $13.78 per bushel. These changes will inevitably impact various ETFs, including NYSEARCA:CORN, NYSEARCA:WEAT, NYSEARCA:SOYB, DBA, and MOO.

Doug Bergman from RCM expressed that the cooling off of wheat prices was expected, saying "It's the market saying we are not surprised by this," while highlighting the threat of tighter supplies in the absence of a deal. The volatility in the wheat and corn markets surged as Russia announced its exit from the Black Sea export deal. This agreement, brokered by the United Nations and Turkey in July 2022, was originally established with the aim of alleviating the global food crisis. Despite this blow, there are whispers of optimism, with Sherman Newlin, an analyst for Risk Management Commodities, suggesting that the agreement may be more "suspended" than over.

Meanwhile, weather-related phenomena, such as the confirmed El Niño conditions, are poised to impact these commodities markets even further. The National Oceanic and Atmospheric Administration confirmed that El Niño conditions are likely to strengthen, leading to a likely increase in extreme weather events and potential disruption in grain production globally. Specifically, Australia, the world's second-largest wheat exporter, is expecting to see a 34% decline in wheat production in 2023/24 due to the unfolding El Niño. Consequently, if Australia reduces its wheat exports, Asian buyers will need to source this commodity from elsewhere, thus affecting global wheat market dynamics.

In the United States, the U.S. Department of Agriculture (USDA) reported an increase in the nation's soybean crop condition, now standing at 55% in good-excellent condition. This exceeded analysts' expectations, which had been set at 53%. As for the U.S. corn crop, the USDA rated it as 57% good-excellent, which is in line with expectations.

Turning our attention to the ETF market, a noticeable development comes from the Teucrium Wheat ETF (NYSEARCA:WEAT). Despite the decline in wheat prices, this ETF is being upgraded to a buy position. This strategy is fueled by the expectation of a price surge in wheat due to the El Niño led drought conditions in North America and potential disruption in global grain production. Similarly, the Teucrium Corn ETF (NYSEARCA:CORN) provides an alternative to investors seeking exposure in corn without getting involved in the highly leveraged and margined futures arena.

In the soybean market, fluctuations in soybean prices are significantly influenced by China, the world's largest consumer of the commodity. Reports suggest a record import level of 12 million metric tons, hinting at a possible growth in demand. However, disappointments in reaching anticipated import figures could negatively affect the market.

The aforementioned shifts in global commodities futures are likely to have a ripple effect on related ETFs. The WEAT ETF, despite a year-to-date (YTD) daily total return of -17.79% as of its last close, has been recommended as a "buy" due to anticipated price surges in wheat. On the other hand, the CORN ETF, with a YTD daily total return of -14.00%, offers an investment alternative for those looking for exposure in corn. Meanwhile, the Teucrium Soybean Fund (NYSEARCA:SOYB) ETF has seen a modest YTD daily total return of -0.88%.

With the state of commodities futures in flux, investors and traders alike will be closely monitoring these market developments. The resolution of Russia's decision and the impact of El Niño conditions on crop yield are likely to have significant implications on the futures of these commodities and the ETFs associated with them.

So How Black Sea Deal Impacts Commdities Marekt?

Russia has decided to suspend its involvement in a United Nations-brokered agreement that allows Ukraine to export grain via the Black Sea, which will expire by the end of the day. This pact was created to ease the global food crisis by letting Ukrainian grain exports continue despite the ongoing Russia-Ukraine conflict.

This is significant as Ukraine is a key player in grain and oilseeds production, and disruption to its exports due to war significantly impacted global food prices. Under this agreement, Ukraine contributed 2.2% of the supplies sent via this route for the UN's World Food Programme (WFP), benefiting countries like Ethiopia, Somalia, and Yemen.

The suspension will likely cause an increase in grain and oilseeds prices, consequently driving up the cost of staple foods. In 2022, an unprecedented number of people faced acute hunger due to the escalating food prices.

The global corn supply, which had been at a six-year low, saw an increase in prices with Russia's invasion of Ukraine, a major corn exporter. However, exports from Brazil have managed to replenish the supply. The US Department of Agriculture predicts that by the end of 2023/24, global corn stock will reach a five-year high, whereas global wheat stock will be at an eight-year low.

The WFP, which buys millions of tonnes of food commodities annually, of which about 75% are grains, could face significant challenges due to this development. Ukraine, its primary source, provided 20% of the total supplies in 2021. As a result of this, the WFP might need to source from elsewhere, potentially at a higher cost.

Through the creation of a safe shipping channel, Ukraine has been able to export significant amounts of agricultural products, including corn and wheat. However, with Russia withdrawing from the pact, these exports could be jeopardized.

Russia claims that their withdrawal is due to unfulfilled commitments to ease restrictions on Russian food and fertiliser exports. This includes demands like reconnection of Russian Agricultural Bank to the SWIFT payment system and lifting restrictions on certain supply chains and financial transactions.

The Black Sea corridor's operation without Russia's participation remains uncertain, considering the increased insurance premiums and the reluctance of shipowners to allow their vessels into the war zone.

Ukraine's grain exports are anticipated to decline in the 2023/24 season due to reduced farming activities caused by the war. The fall in exports, alongside the potential difficulties in exporting the reduced volumes through the EU, may further exacerbate the global food crisis.

Though Ukraine has been exporting substantial grain volumes via eastern EU countries since the onset of the conflict, several challenges persist, including logistical issues and discontent among local farmers due to undercut local supplies. The EU has hence allowed certain countries to ban domestic sales of Ukrainian grain commodities, while permitting transit for exports. This ban will gradually phase out by mid-September.

Russia's withdrawal from the Black Sea Grain Initiative jeopardizes Ukraine's ability to continue to export critical food supplies amidst the ongoing conflict, with potential severe impacts on global food security.

That's TradingNEWS

Read More

-

GPIQ ETF Price Forecast: Can a 10% Yield at $52 Survive the Next Nasdaq Selloff?

09.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Price Forecast: XRPI at $8.32, XRPR at $11.86 as $44.95M Inflows Defy BTC and ETH Outflows

09.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Forecast: Will The $3.00 Floor Hold After The $7 Winter Spike?

09.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Back Under 50K While S&P 500 and Nasdaq Push Higher as Gold Reclaims $5,000

09.02.2026 · TradingNEWS ArchiveMarkets

-

USD/JPY Price Forecast: Can Bulls Clear 157.5 Without Triggering a 160 Intervention Line?

09.02.2026 · TradingNEWS ArchiveForex