BlackRock (NYSE:BLK) Hits Record AUM, Paves Way for Growth Stock Soar 60% YTD

$11.5 Trillion in Assets and Strategic Deals Signal Big Moves Ahead for BlackRock | That's TradingNEWS

BlackRock (NYSE:BLK) Q3 Earnings and Growth Outlook: An In-Depth Look

Record AUM and Q3 Results Highlight NYSE:BLK’s Growth Potential

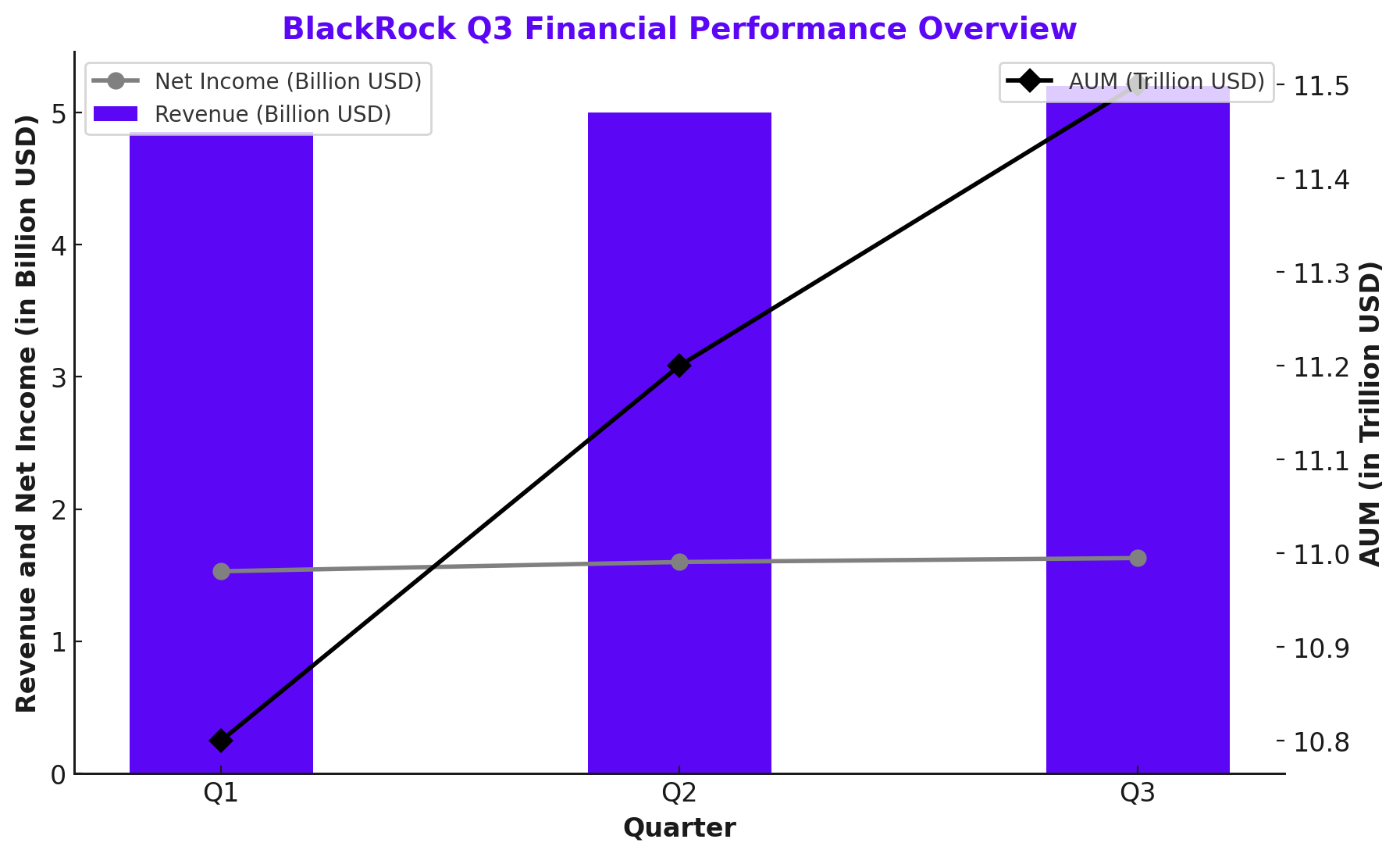

BlackRock, Inc. (NYSE:BLK) has once again set the bar high, reporting assets under management (AUM) of $11.5 trillion as of the latest quarter, breaking through previous records and reflecting a robust $221 billion in net inflows over just three months. Year-to-date, inflows total $360 billion, driven by increased institutional investments and BlackRock’s growing appeal amid global economic shifts. These inflows have not only fueled asset growth but also pushed BlackRock’s stock past the symbolic $1,000 mark, reaching a new high and underscoring its strength as the world's largest asset manager. For real-time data, see NYSE:BLKlive chart.

Strong Revenue and Earnings: A Consistent Track Record

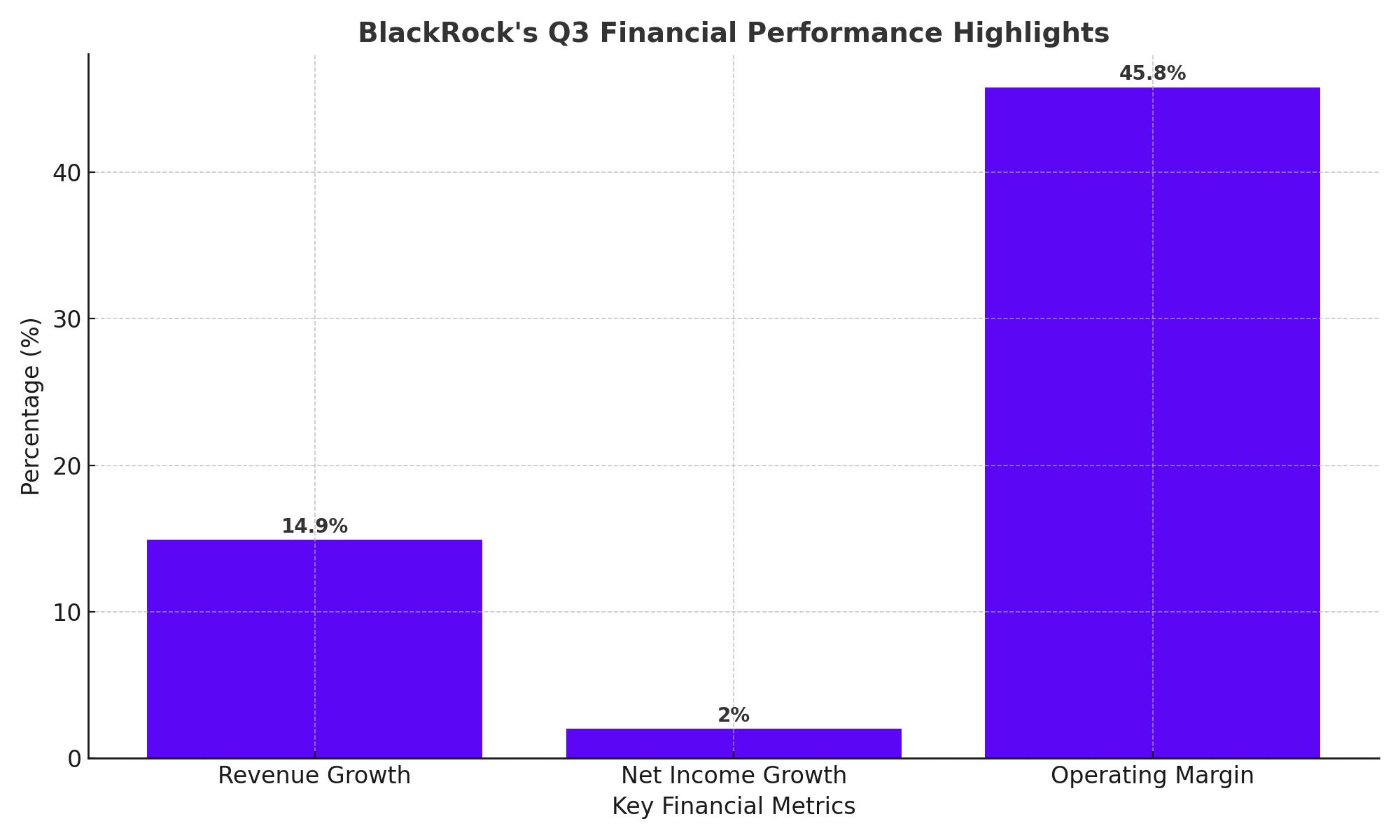

In Q3 2024, BlackRock reported an impressive 14.9% increase in revenue, reaching $5.2 billion and beating analyst expectations of $5.03 billion. Net income rose by 2% to $1.63 billion, translating to a diluted EPS of $10.90—again, ahead of forecasts. Notably, BlackRock’s operating margin climbed to 45.8%, up 350 basis points year-over-year, marking a milestone in profitability. This financial performance underscores BlackRock’s operational efficiency, driven by its scale and technological investments.

CEO Larry Fink remarked, “Our 45.8% operating margin is a testament to our strategic investments and global scale.” For the full fiscal year, analysts expect BlackRock to post an EPS of 41.73, further solidifying its growth trajectory in an evolving financial landscape.

Short Interest Dynamics: Market Sentiment and Peer Comparison

BlackRock’s short interest has surged by 8.13% since its last report, with 1.96 million shares currently sold short, amounting to 1.33% of the total float. With an average of 3.41 days to cover these short positions, this increase in short interest suggests a shift in market sentiment, with some traders potentially betting on a short-term pullback. However, BlackRock’s short interest remains notably lower than its peers, whose average is 3.68% of float, indicating relatively more confidence in BlackRock’s long-term performance among market participants.

Strategic Acquisitions Bolster Infrastructure and Private Markets Presence

A major highlight for BlackRock in 2024 has been its acquisition of Global Infrastructure Partners (GIP) for $12.5 billion, positioning it as a leader in infrastructure investment. The acquisition provides BlackRock with broader access to infrastructure equity, debt, and innovative financing solutions—a strategic move that aligns well with Fink’s vision of harnessing “generational investment” opportunities in infrastructure, especially around artificial intelligence (AI) and sustainable energy. Additionally, the planned acquisition of Prequin is expected to enhance BlackRock’s data and analytics capabilities, further strengthening its private markets allocations.

Financial Health and Performance: Key Ratios and Analyst Forecasts

BlackRock’s current financial metrics reflect its robust position in the market:

- Market Cap: $146.7 billion

- P/E Ratio: 25.09

- PEG Ratio: 1.94

- Beta: 1.30

As of October, the stock is trading near its 52-week high of $1,032. With a quick ratio and current ratio both at 5.06, and a debt-to-equity ratio of 0.37, BlackRock’s balance sheet showcases strong liquidity and minimal debt, allowing flexibility in future investments and shareholder returns. For insight into insider transactions, see BlackRock insider transactions.

Recent research from investment banks reflects optimism, with Morgan Stanley raising its price target from $1,150 to $1,245, TD Cowen adjusting from $960 to $1,077, and Barclays setting a new target at $1,120. This consensus from analysts, many of whom maintain “buy” ratings, points toward a potential 5-24% upside over the next 12 months.

BlackRock's Dividend Strategy and Enhanced Equity Dividend Trust Performance

BlackRock’s Enhanced Equity Dividend Trust (BDJ) continues to outperform, recently reaching a 52-week high at $8.81. The trust boasts a one-year return of 26.73% and yields 7.7%, appealing to income-focused investors seeking stability. Its low volatility and consistent dividend payments, which have been maintained for two decades, underscore BlackRock’s commitment to shareholder value and steady income, particularly during market volatility.

Larry Fink’s Forward-Looking Strategy and Market Positioning

BlackRock’s CEO, Larry Fink, remains focused on strengthening the firm’s capabilities across emerging markets, infrastructure, and ESG investments. At the Future Investment Initiative in Saudi Arabia, Fink expressed confidence in ongoing Fed rate adjustments, forecasting at least a 25 basis point cut this year and highlighting the need for cautious inflation management. Fink’s comments underscore BlackRock’s adaptive strategy to navigate interest rate fluctuations and maintain steady, long-term growth.

Market Sentiment and Future Outlook: A Moderate Buy Consensus

Analysts view BlackRock as a moderate buy with a consensus price target of $995.31, suggesting a possible minor correction from its current levels. However, estimates vary significantly, with optimistic targets reaching $1,245—a bullish case pointing to a 24% gain from current levels. Other forecasts, such as those from Wallet Investor and Coincodex, suggest that BlackRock’s price could reach $1,038 by 2029 and as high as $1,540.82 by 2030, although these long-term projections should be viewed with caution given macroeconomic uncertainties.

In conclusion, BlackRock (NYSE:BLK) stands as a formidable investment with a strong balance sheet, strategic acquisitions, and a promising infrastructure and private markets expansion. Although short interest suggests some bearish sentiment, BlackRock’s low debt, high liquidity, and diverse revenue streams provide stability. Its consistent performance and growth strategy in key sectors like ESG and AI align well with long-term investment themes, making (NYSE:BLK) a compelling asset for long-term investors.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex