BlackRock (NYSE:BLK) Targets $1,023: Bold Tech Investments Drive Stock Surge

With AI partnerships, $100B data center projects, and innovative growth strategies, BlackRock is pushing towards a $1,023 valuation. Here's what’s fueling its rise | That's TradingNEWS

BlackRock (NYSE:BLK): A Powerhouse of Asset Management and Technology Transformation

Asset Management Giant Shifting Towards Tech Dominance

BlackRock (NYSE:BLK), the world’s largest asset manager, has been making significant strides in transitioning from a traditional financial services firm into a technology and data powerhouse. With over $9 trillion in assets under management (AUM) as of the latest earnings report, BlackRock’s core asset management business remains strong, but it is the firm's aggressive push into technology-driven services that is catching investor attention. This transformation comes at a time when the company is also positioning itself to capitalize on large-scale infrastructure opportunities and alternative investments.

Financial Performance: Record Revenue and Margins Amid Market Volatility

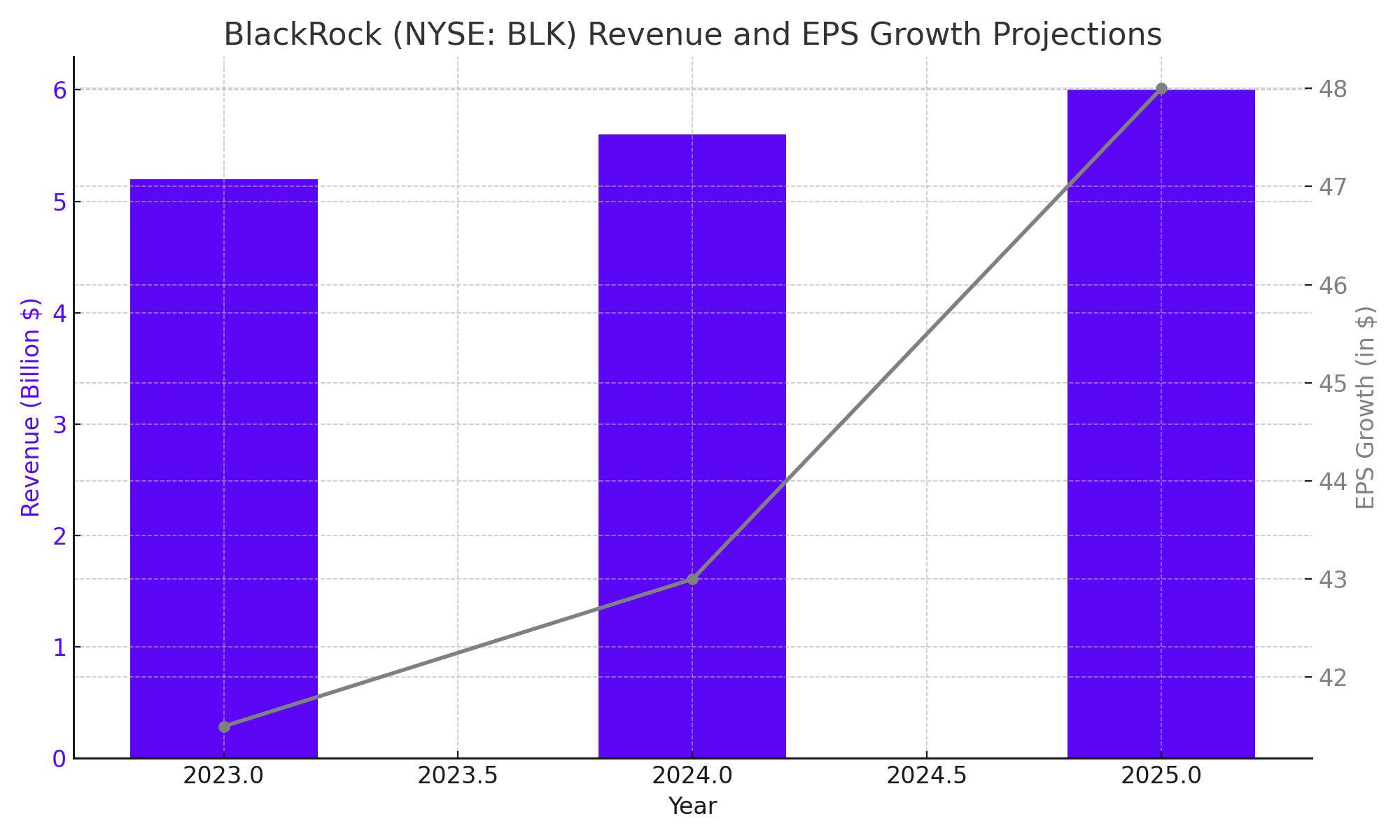

BlackRock's financial performance continues to impress, driven by robust growth across multiple segments. In its most recent earnings report, BlackRock posted $5.20 billion in revenue, a year-over-year increase of 14.9%, beating expectations of $5.03 billion. Net income reached $11.46 per share, exceeding analysts' estimates by $1.04. The firm’s return on equity (ROE) of 15.44% and a net margin of 32.36% further demonstrate its operational efficiency despite market volatility.

BlackRock’s stock (NYSE:BLK) has been a top performer, gaining approximately 18% year-to-date, almost in line with the S&P 500’s 20% rise. The firm's current market capitalization sits at $146.19 billion, and its P/E ratio of 25.01 remains justified given its growth trajectory. The company’s 12-month price range reflects its strong market positioning, with a low of $596.18 and a high of $1,032.00.

Aladdin: BlackRock’s Tech Jewel

Central to BlackRock’s push into technology is its proprietary Aladdin platform (Asset, Liability, Debt, and Derivative Investment Network). Originally developed as an internal risk management tool, Aladdin has grown into a platform used by over 250 institutional clients globally, ranging from banks to insurers and pension funds. Aladdin contributes significantly to BlackRock’s recurring revenue stream, generating high-margin contracts that add stability to its overall earnings.

The Aladdin platform continues to expand, and with a projected 10-15% year-over-year revenue growth rate, BlackRock’s technology segment is expected to top $1.5 billion in sales for 2024. The integration of Aladdin with the private markets-focused data provider Preqin is expected to further bolster its tech offering, enabling BlackRock to offer indices and benchmarks for private market assets—a crucial need for institutional investors navigating illiquid markets.

Growth in Alternatives and Infrastructure Investment

Another key growth driver for BlackRock is its focus on alternative investments, particularly infrastructure. Recently, the firm announced a partnership with Microsoft and MGX to fund a massive $100-130 billion data center build-out. This project will see $30 billion in equity raised, with the remainder financed through debt. This move allows BlackRock to tap into the rapidly growing AI and data infrastructure markets, areas that promise multi-trillion-dollar opportunities in the years to come.

The firm’s $12.5 billion acquisition of Global Infrastructure Partners (GIP) will add $115 billion in AUM, further solidifying its standing in alternative markets. BlackRock’s management fees in infrastructure investments typically range from 100 to 125 basis points, making this a highly lucrative segment.

Insider Transactions: Strategic Movements

Insider transactions within BlackRock remain a focal point for market observers. Recently, CEO Laurence Fink sold 29,450 shares at an average price of $843.25, bringing in $24.83 million. This sale followed the liquidation of positions by other insiders, including Director Pamela Daley, who sold 1,531 shares at an average price of $842.08, valued at $1.29 million. While these transactions are closely watched, they do not indicate a lack of confidence in the company’s future. Rather, they reflect normal course adjustments in ownership stakes.

For a closer look at insider activity, investors can monitor BlackRock’s insider transactions via this link.

Earnings Outlook and Valuation Projections

BlackRock’s earnings outlook remains positive. Analysts predict full-year EPS of $41.73, up from $41.50 in the prior year, reflecting steady growth. Wall Street remains bullish on the stock, with a consensus target price of $995.31, based on a blend of earnings and AUM growth. Notably, firms such as JPMorgan Chase & Co. and Deutsche Bank have issued price targets of $914 and $937, respectively, reaffirming their confidence in the company's prospects.

In addition to its asset management strength, BlackRock’s strategic investments in technology, data, and infrastructure offer substantial upside. With a projected forward EPS for 2024 of $43 and 2025 of $48, BlackRock’s current price-to-earnings ratio remains attractive, particularly given its anticipated growth in high-margin segments. My updated valuation model places BlackRock’s implied target price at $1,023, suggesting nearly 5% upside from current levels.

Risks and Considerations

While BlackRock’s growth potential is impressive, several risks warrant attention. The company’s reliance on AUM exposes it to market fluctuations, and a sustained downturn could impact its fee revenue. Furthermore, BlackRock’s transformation into a tech and infrastructure powerhouse comes with execution risks. The integration of Preqin and the massive data center initiative will require careful management, particularly in a competitive environment where traditional asset managers and fintech firms are vying for market share.

Moreover, regulatory challenges, such as the recent Federal Deposit Insurance Corp’s (FDIC) scrutiny of asset managers' influence on banks, could add uncertainty to BlackRock’s operations. The FDIC’s proposal to limit asset managers’ stakes in banks, if implemented, could impact BlackRock’s investments in financial institutions.

Investor Takeaway: A Clear Path Forward

BlackRock (NYSE:BLK) remains one of the most dynamic companies in the asset management space. With its evolving business model focusing on technology and infrastructure investments, BlackRock is well-positioned to benefit from long-term growth trends in AI, data, and alternative markets. Its strategic partnerships, expanding Aladdin platform, and multi-billion-dollar infrastructure projects offer exciting growth prospects, and its high-margin tech-driven services will likely become a more significant portion of its revenue mix in the coming years.

For long-term investors, BlackRock offers a compelling combination of traditional asset management strength and cutting-edge technology-driven growth. With a fair target price of $1,023, BlackRock is positioned to outperform in the years ahead, making it a solid buy for those looking to capitalize on its unique growth trajectory.

Investors can track the real-time stock performance of BlackRock here: NYSE:BLK

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex