Brent Oil Prices Set to Drop Into the $60s as Demand Slows and Supply Surges

Analysts Cut Oil Price Forecasts Amid Global Demand Concerns and OPEC’s Struggle to Maintain Market Balance | That's TradingNEWs

Oil Market Outlook: Analyzing the Supply-Demand Imbalance and Price Predictions

Morgan Stanley Cuts Brent Price Forecast Again

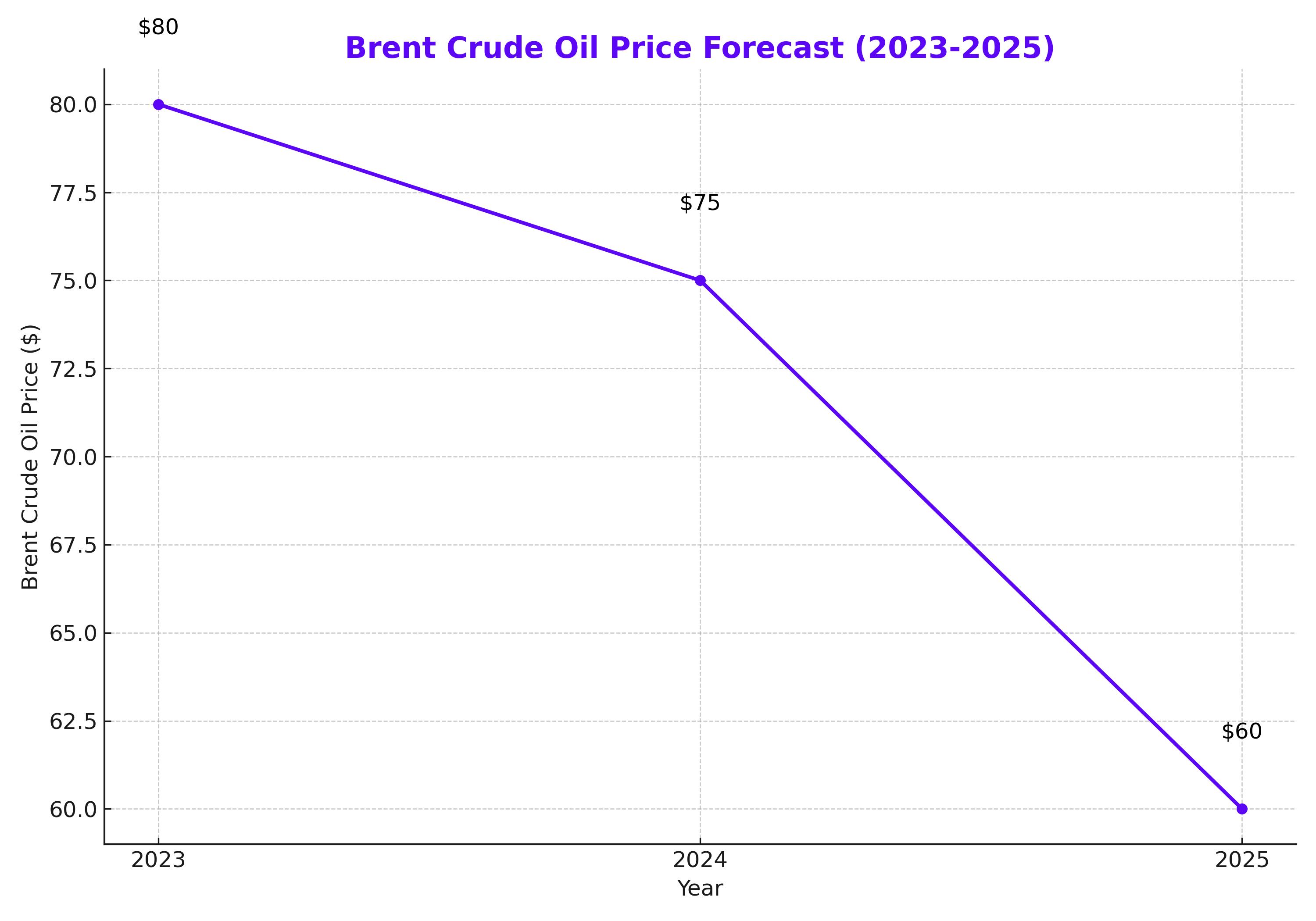

Morgan Stanley has revised its Brent oil price forecast for the fourth quarter of 2024, lowering it from $80 to $75 per barrel. This marks the second reduction in just two weeks, reflecting growing concerns about global demand, particularly from China, and a persistent oversupply of oil. The bank's analysts highlight that the market’s trajectory mirrors periods of significant demand weakness, raising alarms about potential inventory surpluses. While Morgan Stanley doesn't yet forecast a recession, the recent price trend hints at deeper headwinds than previously anticipated.

China’s Sluggish Demand and Impact on Oil Prices

The bearish sentiment around Brent crude (ICE:CB) stems largely from weaker-than-expected demand out of China. Once projected to drive global consumption growth, China is now facing an economic slowdown, pushing major financial institutions, including Goldman Sachs and Citi, to lower their price targets. Goldman Sachs reduced its forecast to a range of $70-$85 per barrel, citing higher inventories and the sharp rise in U.S. shale production as contributors to this shift.

According to Citi, oil prices could plummet to $60 per barrel in 2025 if OPEC+ fails to implement deeper production cuts to counteract slowing demand. This view underscores the challenge OPEC faces in maintaining price stability amidst rising output from non-OPEC producers.

OPEC’s Dilemma: Production Cuts and Market Share

OPEC's recent decision to extend its voluntary production cuts by two months to the end of November highlights the delicate balance between stabilizing prices and maintaining market share. The planned 180,000 barrels per day (bpd) output increase for October has now been delayed to December, reflecting OPEC’s cautious approach amid the bearish outlook.

Key industry experts, such as Torbjörn Törnqvist, chairman of Gunvor, believe that OPEC is avoiding a full-fledged price war but faces a strategic dilemma in managing both price levels and market share. OPEC’s influence is being tested as U.S. shale and other non-OPEC producers, such as Petrobras (BME: XPBR) in Brazil, continue to ramp up production, further complicating the supply landscape.

Market Dynamics: Supply Overhang and Shale Production

The recent downturn in oil prices also reflects a global supply overhang. Despite OPEC's cuts, the oil market is awash with supply, driven by increased production from non-OPEC countries. West Texas Intermediate (NYSE:WTI) has hovered around $67 per barrel, up slightly amid fears of a potential hurricane disrupting U.S. Gulf Coast production. But even this modest recovery is overshadowed by the broader narrative of oversupply and weakening demand.

Industry heavyweight Ben Luckock, Global Head of Oil at Trafigura, expects Brent crude prices to fall into the $60s range in the near future. However, he cautions that the market remains volatile, with geopolitical risks capable of disrupting any bearish momentum. The Libyan National Oil Corporation (NOC) recently declared force majeure on several crude cargoes, further complicating the supply picture as political instability in oil-producing regions persists.

U.S. Shale: A Growing Contributor to Global Supply

The U.S. shale industry continues to expand its market presence, with major players like ExxonMobil (NYSE: XOM) and Chevron (NYSE: CVX) leading the charge. Shale's flexibility allows for rapid production increases, and with global demand slowing, the U.S. is positioned to capitalize on the oversupply scenario. This has been a significant factor in keeping prices suppressed, despite OPEC's attempts to tighten supply.

Jeff Currie, Chief Strategy Officer of Energy Pathways at Carlyle, notes that large oil companies' involvement in shale production has reduced the likelihood of a repeat of the price war seen in 2015, where smaller producers drove prices lower. The major players are now more disciplined, but the market still faces a surplus that threatens to push prices further down unless demand rebounds.

China’s Economic Slowdown: A Drag on Global Oil Demand

China’s economic woes have been a primary driver of the recent weakness in oil prices. The country’s demand for crude, which once grew at an average annual rate of 700,000 barrels per day (bpd) from 2010-2019, is now expected to rise by just 380,000 bpd in 2024. This slowdown reflects broader economic challenges, including a struggling property market and the shift toward electrification in transportation.

Ben Luckock pointed out that while geopolitical tensions and supply disruptions in Libya and the Middle East should theoretically support higher prices, the overriding factor in today’s market is China’s soft demand. This disconnect between geopolitical risks and demand-driven fundamentals has created a confusing signal for traders.

OPEC’s Role and the Outlook for 2025

Looking ahead, OPEC’s spare capacity continues to act as a price ceiling in most scenarios. According to Daan Struyven, Head of Oil Research at Goldman Sachs, OPEC will likely resume gradual production increases over the coming quarters to balance market cohesion with demand support. However, Struyven emphasizes that any significant price recovery depends on OPEC's ability to manage production increases without flooding the market.

The forecast for Brent crude in 2025 remains grim unless OPEC can execute further cuts. With Citi projecting prices as low as $60 per barrel next year, and non-OPEC producers continuing to expand, OPEC’s influence over the market is waning. Yet, some analysts remain cautiously optimistic, pointing out that long-term fundamentals, such as underinvestment in new production, could eventually support a price rebound.

Conclusion: Navigating the Complex Oil Market

In conclusion, the current oil market is dominated by a precarious balance of supply and demand forces. Brent crude is likely to remain under pressure, with prices dipping into the $60s range in the near term due to China’s sluggish demand and rising supply from non-OPEC sources. Morgan Stanley’s revised forecast of $75 per barrel for the fourth quarter underscores the bearish sentiment that is currently shaping the market. With OPEC reluctant to engage in a full-scale price war and geopolitical risks looming, the future of oil prices remains uncertain. The key question is whether demand can recover quickly enough to prevent a prolonged price slump.

That's TradingNEWS

Read More

-

IVV ETF Price Forecast: Is $684 Still Worth Paying For S&P 500 Exposure?

14.02.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI at $8.09 and XRPR at $11.60 as XRP-USD Rebounds Toward $1.47

14.02.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price Holds Around $3.20 as Storage Tightens and Winter Premium Fades

14.02.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast: Yen Strength Turns 152 into a Make-or-Break Level

14.02.2026 · TradingNEWS ArchiveForex