Broadcom NASDAQ:AVGO - AI Revenue Surge and Future Growth Prospects

A Detailed Analysis of Broadcom’s Strategic Position, Financial Performance, and Market Potential | That's TradingNEWS

Broadcom Inc. (NASDAQ:AVGO) - Comprehensive Stock Analysis

Surging AI Revenue and Future Potential

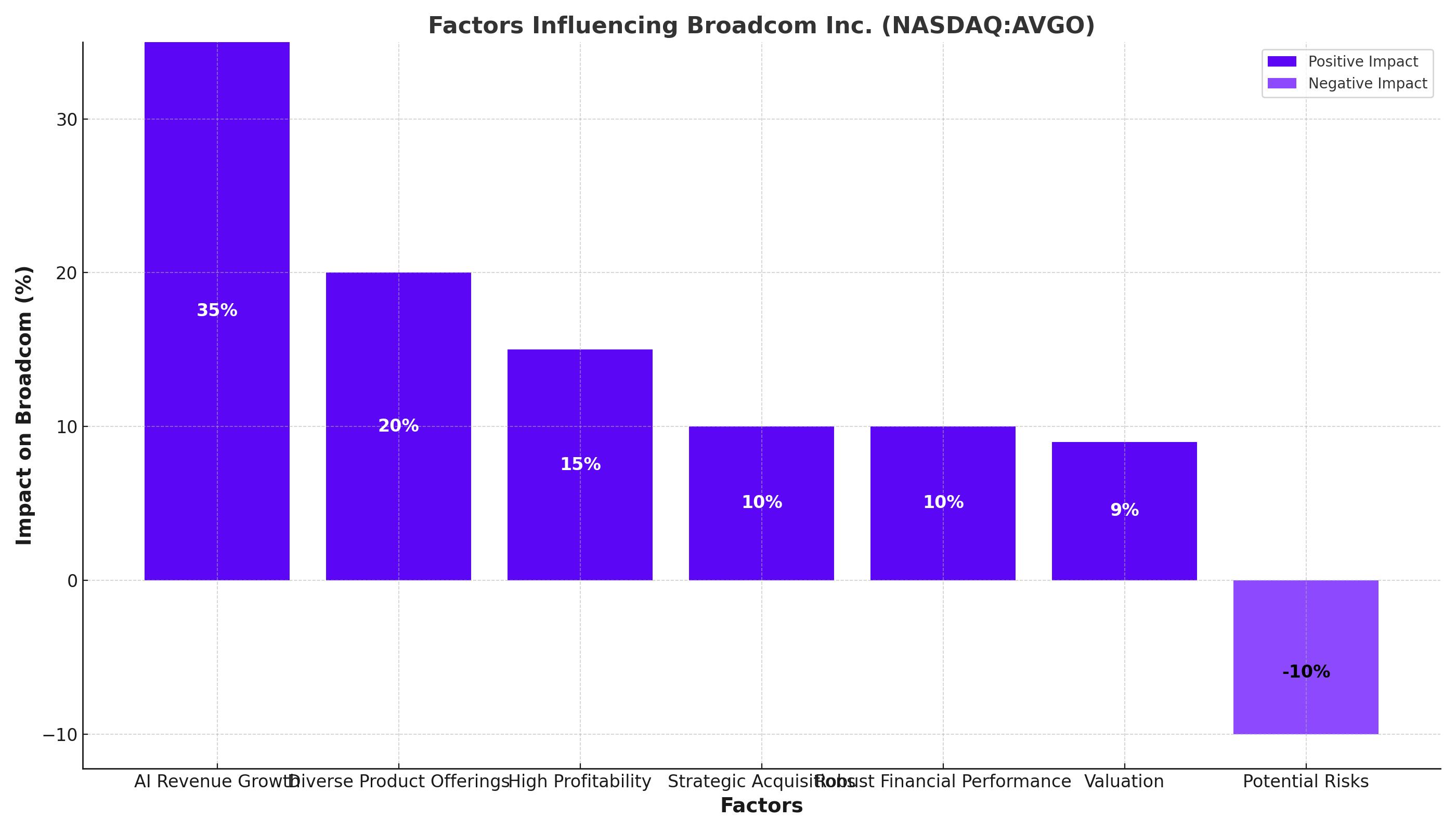

Broadcom Inc. (NASDAQ:AVGO) has seen a tremendous surge in AI-related revenue, which is projected to account for more than one-third of total revenue by the end of FY2024. This increase in AI revenue is not a coincidence but a result of the company’s strategic investments and diversified product offerings. The market has recognized Broadcom’s potential, with the stock price nearly tripling since January 2023. Despite the impressive run, the intrinsic value of Broadcom is still estimated to be 9% higher than its current market capitalization, indicating further upside potential.

Diverse Product Offerings and High Profitability

Broadcom's revenue streams are highly diversified, spanning various sectors including data centers, broadband access, telecom equipment, and smartphones. This diversification is underpinned by a vast intellectual property base and continuous investment in new technologies. The company’s profitability metrics are exceptionally high, highlighting its significant pricing power and the technological strength of its products. For example, Broadcom's free cash flow (FCF) margin is among the highest in the industry, underscoring its financial robustness.

AI Market Position and Technological Leadership

Broadcom is positioned as a cornerstone in the AI server market, essential for high-performance computing. The company’s products play a crucial role in connecting the various components within data centers, which are the brains of AI operations. The AI revenue is expected to reach 35% of total revenue by the end of FY2024, a significant increase from below 5% in FY2021. This growth is driven by accelerating global AI spending and Broadcom’s vital role in this trend. The company’s commitment to innovation is evident from its extensive patent portfolio, with over 910 patents pending and 15,400 already granted, ensuring a steady pipeline of advanced products.

Strategic Acquisitions and Business Expansion

Broadcom has strategically expanded its business through acquisitions, including CA Technologies, Symantec’s security division, and VMware. The acquisition of VMware for $61 billion is expected to balance Broadcom’s revenue streams, with software sales projected to reach up to 50% of total revenue in the medium term. This strategic shift reduces dependency on semiconductor sales and positions Broadcom to capture a larger share of the infrastructure software market.

Robust Financial Performance and Growth Prospects

Broadcom’s financial performance is marked by exceptional efficiency and profitability. The company’s EBITDA margin is one of the highest in the industry, and its aggressive R&D spending supports continuous innovation and market leadership. In Q2 FY24, Broadcom reported a 12% year-over-year growth in revenue, with AI sales driving much of this increase. AI chip sales grew by 35% YoY, reaching $3.1 billion in Q2, and are projected to hit $11 billion for the fiscal year, representing 25% of total sales.

Valuation and Intrinsic Value Calculation

Using a discounted cash flow (DCF) model, Broadcom’s intrinsic value is estimated to be nearly $800 billion, offering a 9% discount from its current market price. The model assumes a 10.7% weighted average cost of capital (WACC) and a 5% perpetual growth rate, justified by Broadcom’s historical revenue growth and significant potential in the AI market. Despite the high valuation, Broadcom remains attractive compared to peers like Nvidia (NVDA) and Advanced Micro Devices (AMD), with a lower price-to-earnings (P/E) ratio and strong growth prospects.

Potential Risks and Challenges

While Broadcom’s strengths are evident, potential risks include intense competition that could erode its high FCF margin and the challenge of sustaining innovation. The company’s substantial revenue from China also exposes it to geopolitical risks. Additionally, the significant goodwill from the VMware acquisition poses a risk if the investment does not yield expected returns, potentially leading to a multi-billion-dollar impairment charge.

Stock Performance and Future Outlook

Broadcom’s stock has risen 52% year-to-date, outperforming the S&P 500. The stock split on July 15 is expected to further boost investor interest. Analysts forecast strong growth in the coming years, with EPS expected to grow 13% in FY24, 26% in FY25, and 16% in FY26. Broadcom’s valuation remains reasonable given its forward growth prospects, making it one of the best AI plays in the market.

Conclusion

Broadcom Inc. (NASDAQ:AVGO) is a formidable player in the AI and semiconductor markets, with robust growth prospects and a well-diversified portfolio. The company’s strong financial metrics, strategic acquisitions, and innovative product offerings position it well for continued success. Despite potential risks, Broadcom’s valuation remains attractive, offering significant upside potential. The upcoming stock split and continuous investment in AI and IoT markets further enhance its appeal, making Broadcom a compelling investment opportunity.

That's TradingNEWS

Read More

-

SCHD ETF at $27.64: High Dividend, Low Multiple and a 2026 Comeback Setup

28.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR Trade Near Cycle Lows While $1.25B Flows and $1.87 XRP Position for Q1 2026

28.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Jumps From $3.47 to $3.88 as NG=F Tracks Cold Weather and LNG Flows

28.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY 2026 Price Forecast: Dollar–Yen Near 160.60 With BOJ Shift Threatening Carry Trade

28.12.2025 · TradingNEWS ArchiveForex