Caesars Entertainment NASDAQ:CZR Challenges to a Prosperous Future

Unveiling the Journey of CZR: From Strategic Missteps to Market Dominance and Digital Innovation in Gaming and Hospitality | That's TradingNEWS

Caesars Entertainment, Inc. (NASDAQ:CZR): A Comprehensive Analysis

Historical Context and Strategic Missteps

Caesars Entertainment (NASDAQ:CZR), a titan in the gaming and hospitality industry, has traversed a remarkable journey marked by both strategic missteps and bold moves. Reflecting on its history, the decision to forgo a Macau presence in the early 2000s, when the CZR brand was at its pinnacle in Asia, is often cited as a glaring oversight. This move, or lack thereof, has since become a classic example in business school discussions of missed opportunities.

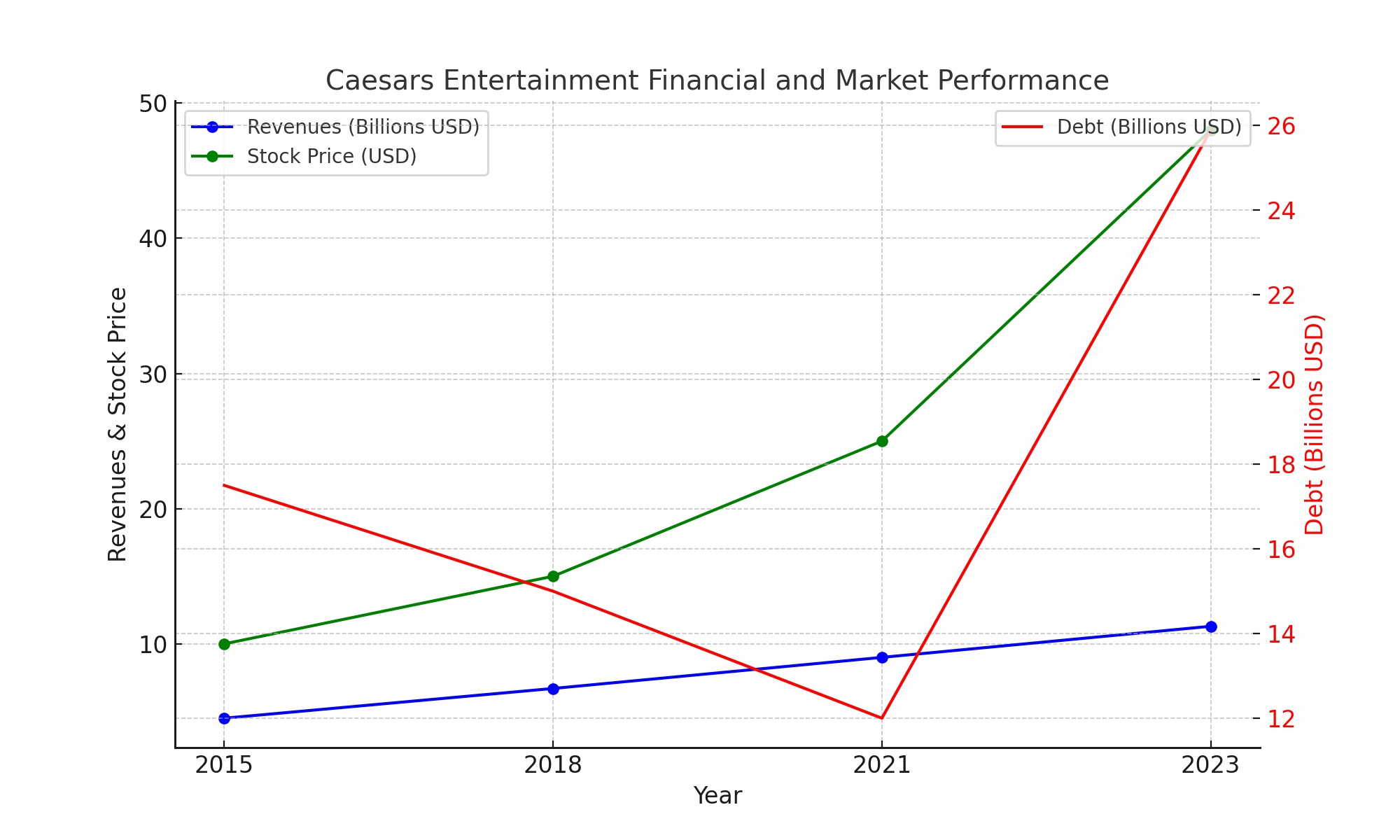

The later acquisition by Apollo Global in 2008, which saddled CZR with a staggering $17.5 billion debt, culminated in a bankruptcy filing in 2015. This period was characterized by tumultuous financial challenges, despite high-profile exits yielding substantial gains for some involved.

Post-Covid Resurgence and Financial Performance

Under the leadership of CEO Tom Reeg, CZR has charted a post-Covid growth trajectory, focusing on aggressive asset allocation and sales growth. With a reported 15% rise in revenues and return on equity (ROE), CZR is demonstrating a commendable recovery. The third quarter of 2023 was particularly notable, with revenues approximating $3 billion, surpassing estimates by $58 million. Earnings stood at $0.31 per share, with a 4-cent beat. Despite a net income of negative $899 million, the company's progress in offsetting post-Covid repercussions and its heavy debt burden is evident.

Market Performance and Competitor Comparison

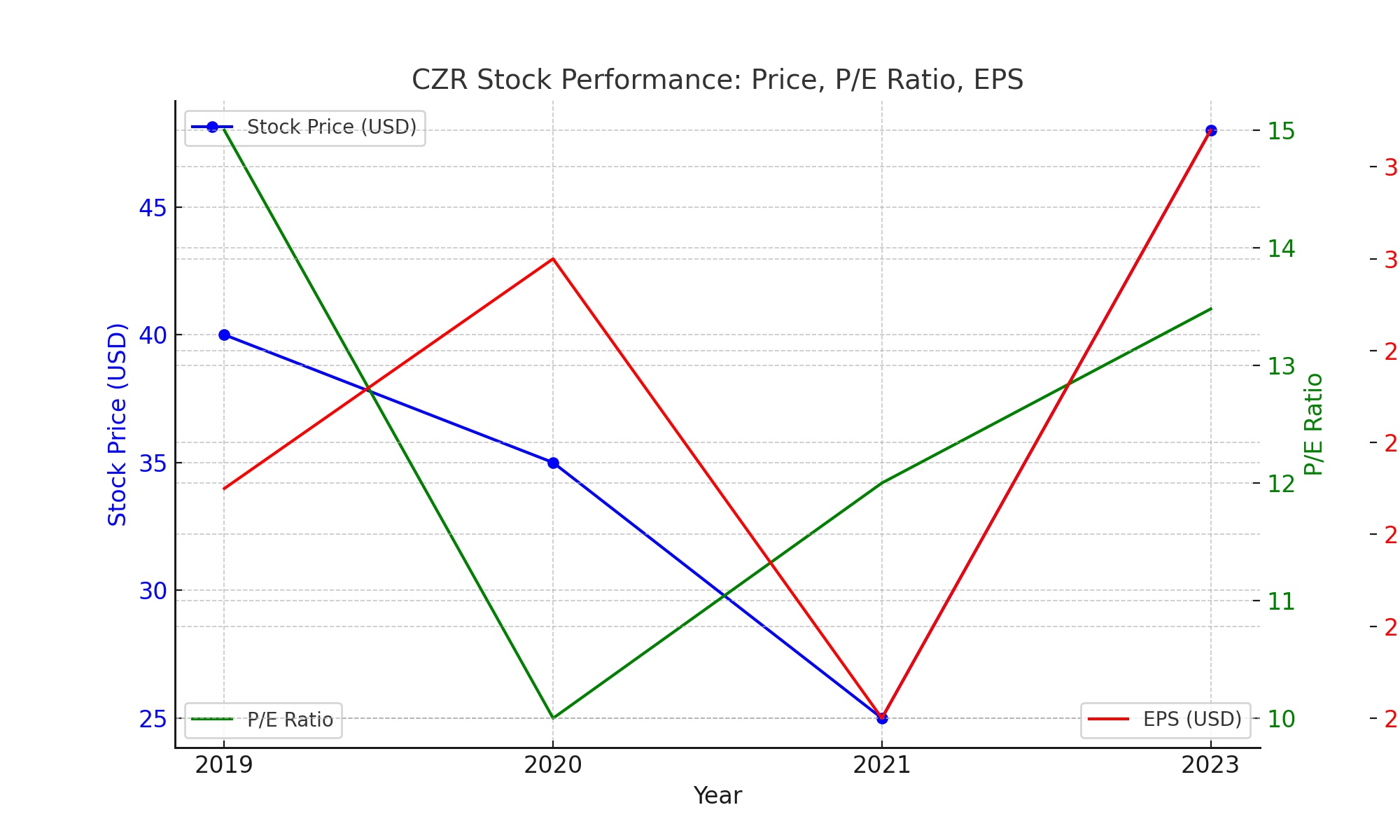

CZR's stock performance has been a rollercoaster, with notable swings in valuation. Despite lagging behind the S&P 500 in terms of valuation growth, mid-year 2023 saw a marked improvement. The company's revenue growth of 8.81% year-over-year surpasses the sector median of 5.24%, reflecting its strong market position. However, CZR's lack of a significant Asian or global presence has somewhat stifled its growth compared to its peers like Wynn Resorts Ltd., MGM Resorts International, and Las Vegas Sands.

Debt Management and Operational Efficiency

The El Dorado Resorts' acquisition of CZR and the subsequent purchase of UK online gaming giant William Hill have heavily influenced CZR's financial strategy. The lease-adjusted net leverage ratio now stands at 4.7X. Despite concerns regarding its long-term debt, the company's strategic approach to managing its obligations, along with a strong portfolio of brands like Caesars Palace, Horseshoe, and Harrah's, positions it favorably in the market.

Digital Footprint and Future Prospects

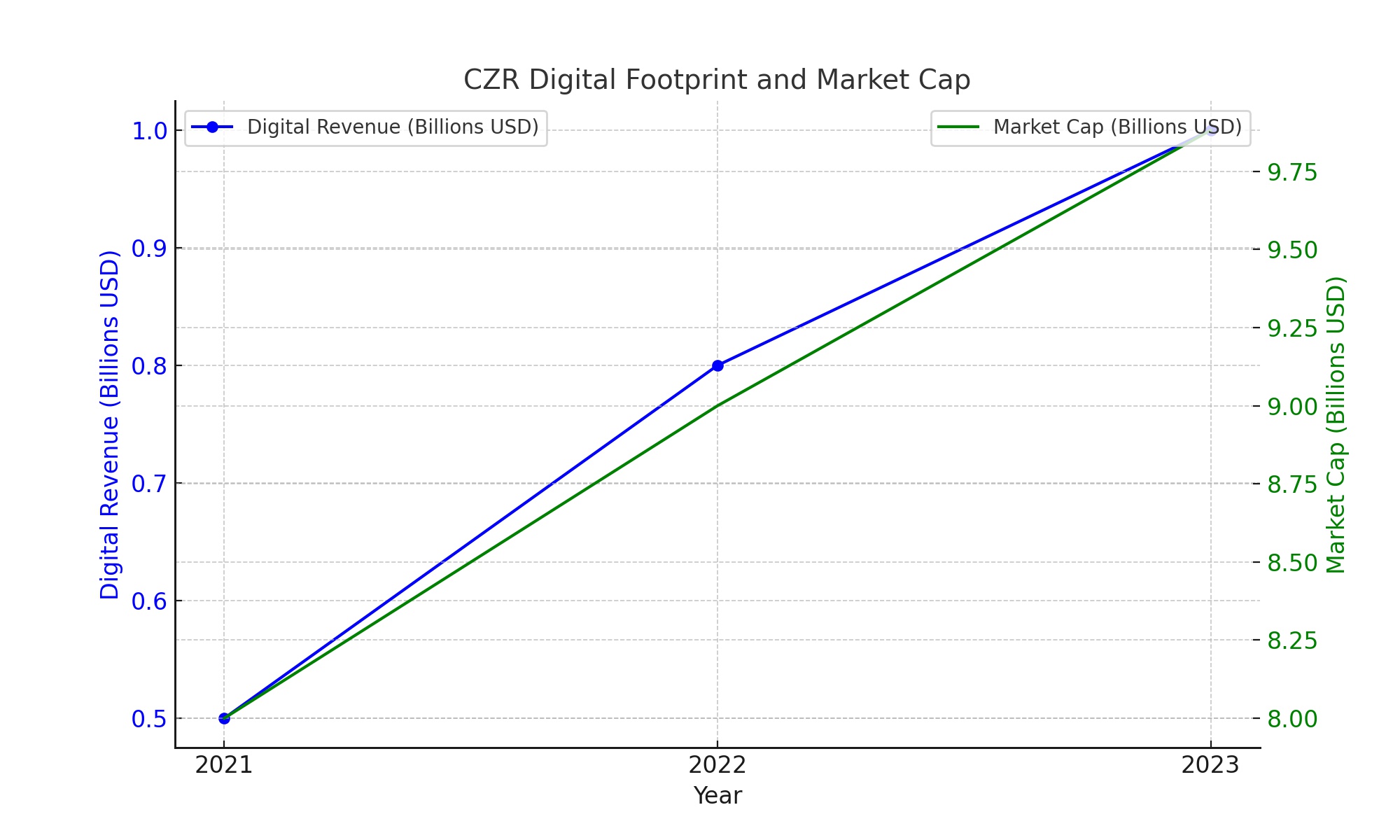

CZR's foray into online sports betting, though currently holding a modest market share, is a strategic move reflecting the industry's evolving landscape. The acquisition of William Hill's US operations underlines this commitment. With anticipated revenues nearing $1 billion in 2023 for its sportsbook, CZR is positioning itself as a significant player in digital gaming.

Investor Perspective and Stock Valuation

From an investor's viewpoint, CZR presents a compelling value proposition at its current stock price of around $48. The company's vast geographic presence in the US market, coupled with its extensive Caesars Rewards membership program, enhances its market attractiveness. Despite certain reservations due to its debt profile and lack of significant Asian market presence, CZR's overall financial and operational strength make it an intriguing option for potential investors.

Insider Transactions and Stock Outlook

Insider transactions, such as the recent purchase of 15,000 shares by Director Michael E. Pegram, reflect confidence in the company's future prospects. With a market capitalization of $9.882 billion and an evolving strategy, CZR is well-positioned to capitalize on the growth opportunities in the gaming and hospitality sector.

Financial Stability and Growth Potential

Managing Debt and Improving Liquidity

CZR's financial health, particularly its approach to debt, is crucial for investors. The company's total debt, as of the most recent reporting, stands at approximately $25.89 billion. However, CZR has shown a proactive stance in debt reduction, repaying $600 million year-to-date. This action demonstrates management's commitment to enhancing corporate health and financial stability. The company's total cash position is notable, with around $841 million reported, offering a cushion for operational and strategic initiatives.

Revenue Streams and Profitability

Diving deeper into CZR's revenue streams, the company has showcased diversity in its income sources. For the third quarter of 2023, CZR reported revenues from various segments: Las Vegas properties contributed $3.3 billion, regional properties $4.4 billion, and digital revenue approximated $669 million. This distribution highlights CZR's robust presence across different gaming and hospitality domains.

Market Share and Competitive Edge

CZR's market share is a significant factor in its valuation. As a predominantly US-based operator (except for one property in Canada), CZR holds roughly a 20% share of the US commercial gaming market. This statistic is particularly impressive considering the absence of an Asian footprint, unlike some of its competitors. CZR's valuation, in comparison to the S&P 500, has fluctuated, but mid-year 2023 figures showed CZR at +28.70% versus the S&P's 16.99%, indicating strong market performance in certain periods.

Stock Performance Insights

Analyzing CZR's stock performance, the company has experienced varied trends. As of the latest data, the stock opened at $44.09 with a 52-week range of $38.33 to $60.27, demonstrating the volatility and potential growth opportunities within this stock. The company's P/E ratio stands at 13.48, with an EPS of 3.28, indicating reasonable valuation in the current market context.

Institutional Interest and Analyst Perspectives

Institutional interest in CZR is significant, with 91.32% of the company's stock owned by institutional investors and hedge funds. Analysts have varied views on CZR, with target prices ranging from $51.00 to $70.00, reflecting differing assessments of the company's future potential.

Operational Efficiency and Strategic Moves

CZR's operational efficiency and management effectiveness are key indicators of its potential. The company's return on assets stands at 4.86%, and return on equity at 16.73%, signaling strong management performance. Strategic acquisitions, such as the purchase of William Hill's US operations, further bolster CZR's position in the evolving gaming landscape.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex