Check Point NASDAQ:CHKP Future Trends and Financial Strength

Unveiling Check Point's Market Adaptation, Financial Health, and Strategic Growth in the Evolving Cybersecurity Landscape | That's TradingNEWS

1/7/2024 12:00:00 AM

Comprehensive Analysis: Check Point Software Technologies' Market Position and Financial Health

Check Point Software Technologies: A Financial Overview

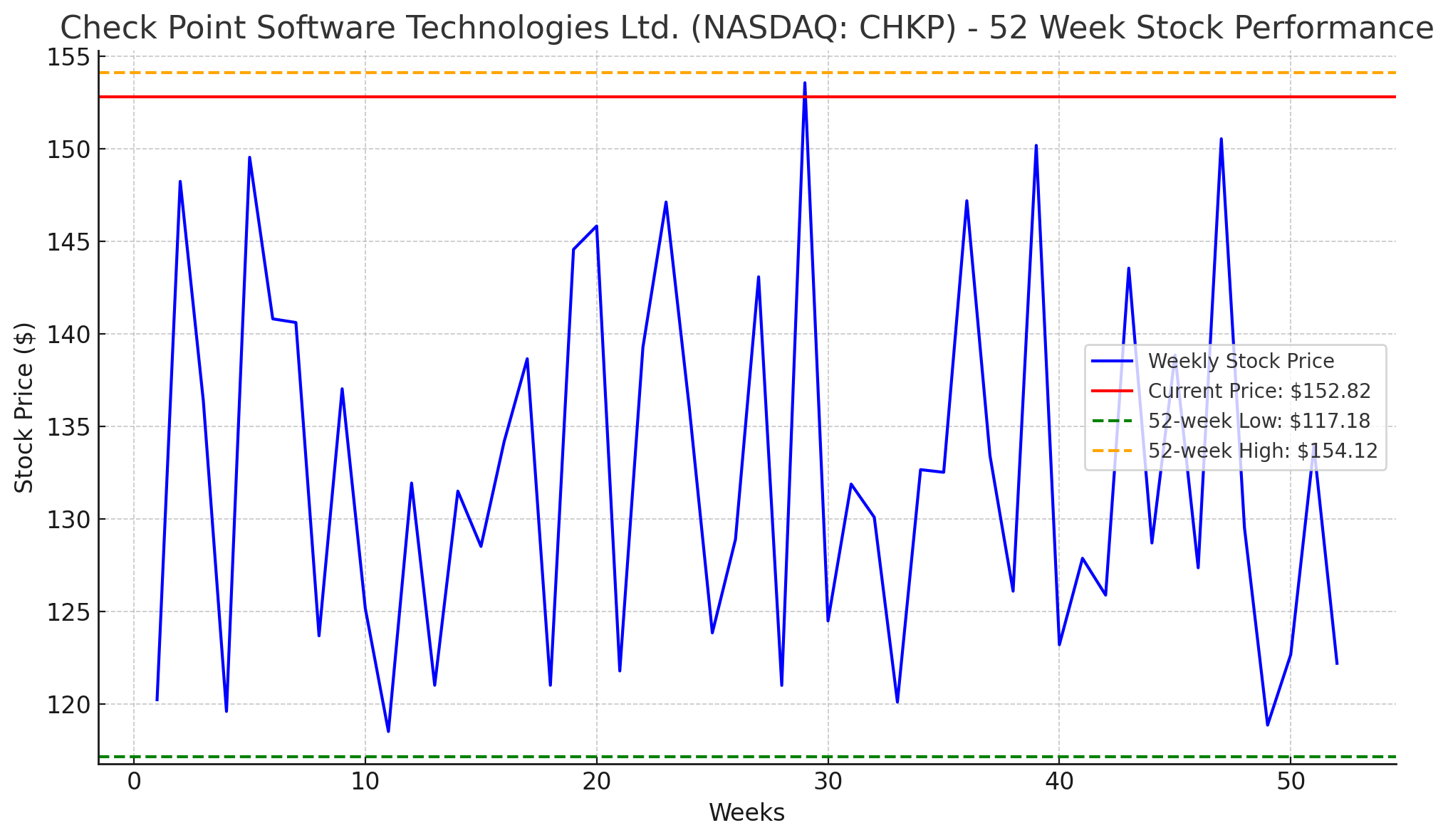

- Stock Performance: Check Point Software Technologies Ltd. (NASDAQ: CHKP) has seen a modest surge in its stock price, reaching $152.82 as of January 3, 2024. The company's performance over the 52-week period ranges between $117.18 and $154.12, with a notable year-on-year EPS increase of 12.55%.

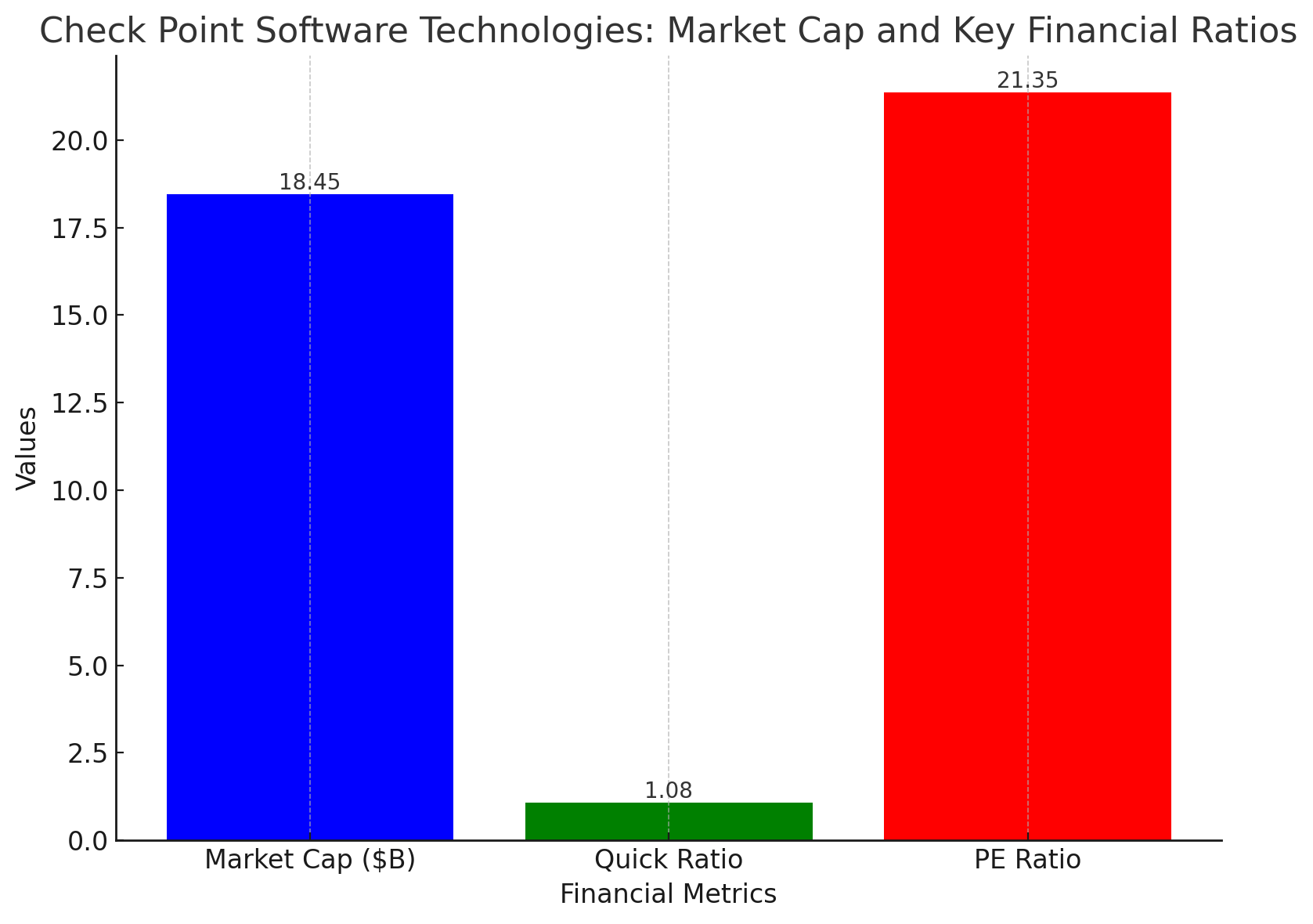

- Market Capitalization: Currently, the company stands at a market capitalization of approximately $18.45 billion, showcasing its significant presence in the Technology sector and Software – Infrastructure industry.

Growth and Profitability Metrics

- Sales and EPS Growth: Over the past five years, Check Point has exhibited consistent growth with a sales increase of 5.02% and an EPS growth of 5.22%.

- Financial Ratios: The company maintains a healthy Quick Ratio of 1.08 and a PE Ratio of 21.35, indicating strong financial health and efficient resource management.

- Profit Margins: The gross margin stands at an impressive +86.87%, with an operating margin of +37.95% and a pretax margin of +39.84%.

Ownership and Earnings

- Insider and Institutional Ownership: Insider ownership is marked at 20.63%, while institutional ownership is at 73.65%, reflecting a balanced distribution of stock control.

- Recent Earnings: For the last reported quarter on September 29, 2023, Check Point surpassed earnings predictions, posting an EPS of $2.07, which was $0.05 above the forecast.

Future Projections and Market Dynamics

- EPS Growth Forecast: Long-term forecasts predict an EPS growth of 8.53% over the next five years, indicating sustained profitability.

- Market Volatility: There has been a decrease in stock volatility, with average volume dropping from 0.81 million to 0.55 million, suggesting a more stable investment environment.

Strategic Developments and Product Innovations

- Product Launches: Check Point has introduced new products like Horizon Playblocks and Infinity Global Services, aimed at enhancing security operations and addressing the cybersecurity talent gap.

- Acquisitions: The company has been active in acquiring firms to bolster its product portfolio, with the $490 million acquisition of Perimeter 81 being a significant move to strengthen its position in the SASE market.

Financial Analysis and Revenue Streams

- Revenue Breakdown: The recent revenue increase to $596 million in Q3 reflects Check Point's growth in subscription services, particularly the Harmony and Infinity products.

- Gross Profit Margin Trends: While recovering from supply chain issues, the shift towards subscription revenue might present long-term margin challenges.

Operational Expenses and Business Strategy

- Rising Operational Costs: Operating expenses have risen by 9% YoY, primarily due to increased sales and marketing efforts, highlighting the company's aggressive customer engagement strategies.

- Business Evolution: The evolution towards subscription revenue necessitates a more aggressive sales approach, impacting the company's operational expenses.

Stock Analysis and Investor Sentiment

- Market Positioning: Check Point's stock is considered to be aligned with the market's expectations, given its moderate growth rate.

- Investor Outlook: While the current PE ratio is near the lower end of its historical range, potential growth reacceleration could offer upside to investors.

Check Point Software Technologies' Strategic Position and Market Outlook

Segment Performance and Revenue Diversification

- Segment Breakdown: Check Point's revenue composition is varied, with subscription services like Harmony Email Security and Infinity showing notable strength. This diversification is critical in understanding the company's market resilience.

- Revenue Growth by Segment: Subscription revenue, for instance, saw a 15% year-over-year increase, signaling a strategic shift towards more stable, recurring income streams.

Gross Profit Margin and Operational Efficiency

- Gross Profit Trends: Despite recovering from the pandemic's impact, the gradual shift to subscription revenues might bring new challenges to gross profit margins, necessitating strategic adaptations.

- Expense Management: The 9% year-over-year rise in operating expenses, driven by investments in cloud infrastructure, marketing, and travel, reflects Check Point's commitment to expanding its market reach and enhancing service offerings.

Strategic Acquisitions and Market Expansion

- Perimeter 81 and SASE Market: The acquisition of Perimeter 81, which offers services like secure internet access and zero-trust connectivity, highlights Check Point's strategy to strengthen its foothold in the lucrative SASE market.

- Competitive Landscape in SASE: While the SASE market is crowded with formidable players like Fortinet and Palo Alto Networks, Check Point's strategic acquisitions and innovative product offerings position it as a strong competitor.

Recent Financial Performance and Stock Analysis

- Revenue and Earnings Performance: The company's revenue in Q3 grew to $596 million, and the Q4 forecast suggests continued growth, potentially towards the higher end of the guided range.

- Check Point Revenue Growth: The growth in subscription revenue, particularly from products like Harmony and Infinity, is a key driver, offsetting declines in product revenue.

Market Trends and Future Projections

- Evolving Market Dynamics: The cybersecurity market is experiencing shifts, with trends like remote work and increased cyber threats driving demand for advanced solutions.

- Check Point's Market Adaptation: Check Point's product launches and acquisitions are well-aligned with these market trends, positioning it for sustained growth.

Investment Considerations and Market Sentiment

- Investor Perspective: Given the company's strong cash balance and its strategic position in the cybersecurity market, Check Point remains an attractive stock for investors seeking stability and growth potential.

- Stock Valuation: The current PE ratio, being at the lower end of its historical range, could be seen as an opportune entry point for long-term investments.

Summary: Positioning for Future Growth

- Check Point's Strategic Direction: The company's focus on subscription services, strategic acquisitions, and innovation in products like Horizon Playblocks and Infinity Global Services, positions it well to capitalize on the growing cybersecurity market.

- Market Outlook: While there are challenges in terms of increased operational costs and a competitive SASE market, Check Point's consistent performance, strong financials, and strategic market moves suggest a promising future.

Final Thoughts: Evaluating Check Point's Prospects

As Check Point Software Technologies navigates the evolving cybersecurity landscape, its strategic initiatives, combined with a robust financial foundation, position it as a potentially lucrative investment. The company's ability to adapt to market demands, along with its innovative product portfolio, makes it a key player to watch in the cybersecurity domain. For more detailed stock information and the latest insights, investors can refer to Check Point's stock profile for comprehensive data and analysis.

That's TradingNEWS

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex