Citigroup NYSE:C Challenges Seizing Opportunities and Financial Analysis

Unveiling Citigroup's Strategic Moves and Market Position: An Insightful Look into the Banking Giant's Financial Health and Growth Prospects | That's TradingNEWS

Analyzing Citigroup Inc. (NYSE:C): A Multifaceted Financial Perspective

Overview: Citigroup's Position in the Banking Sector

Citigroup (NYSE:C) has long been viewed as the underperformer among its peers, a perception reflected in its share price. However, current market dynamics and strategic initiatives are positioning Citigroup as a potential favorite among value investors.

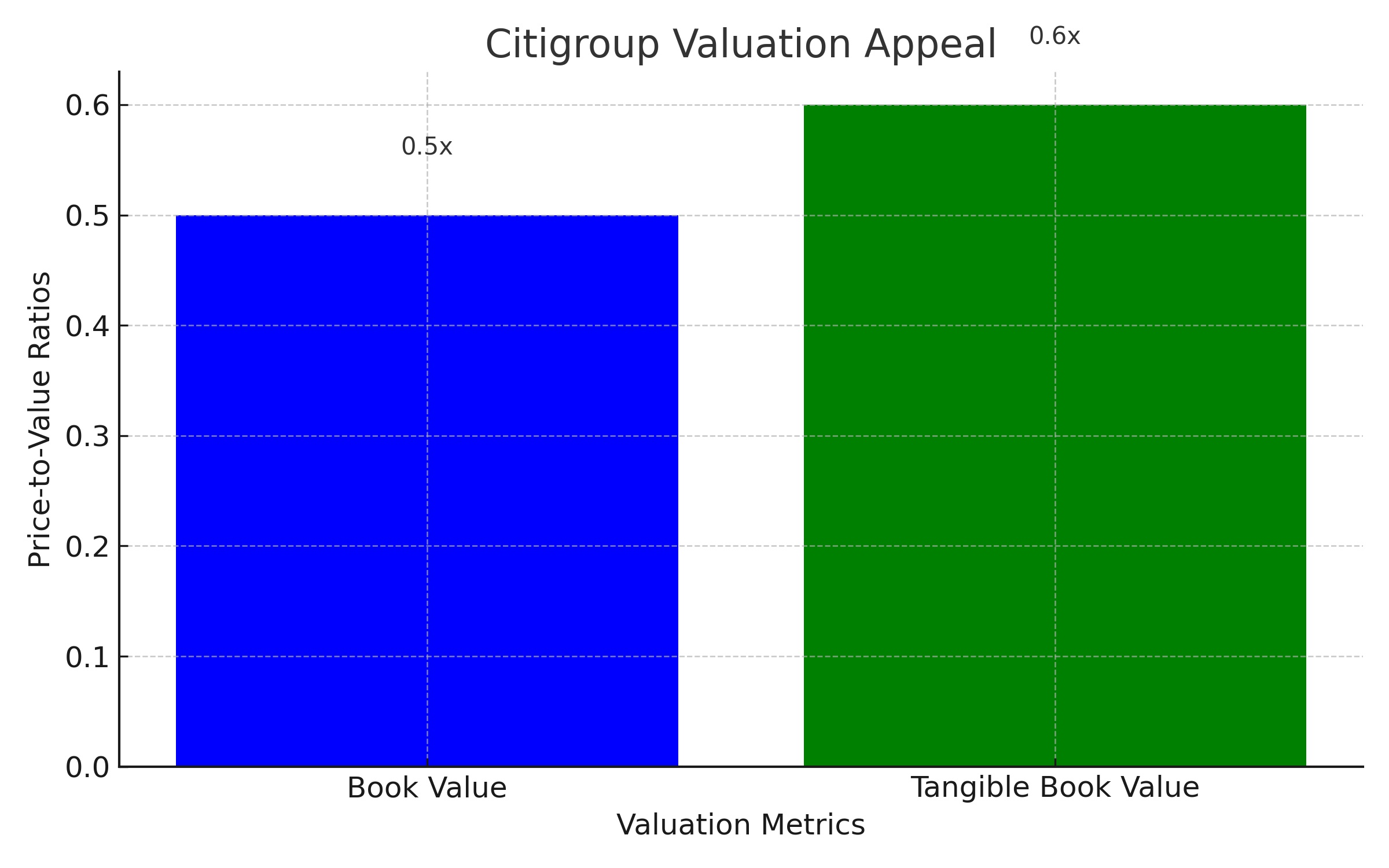

Citigroup's Valuation Appeal

Currently, Citigroup's stock is trading at a significant discount, approximately 0.5x its book value and 0.6x its tangible book value. This undervaluation, coupled with the support from major investors like Berkshire Hathaway, underscores a growing interest in the bank’s potential for recovery and growth.

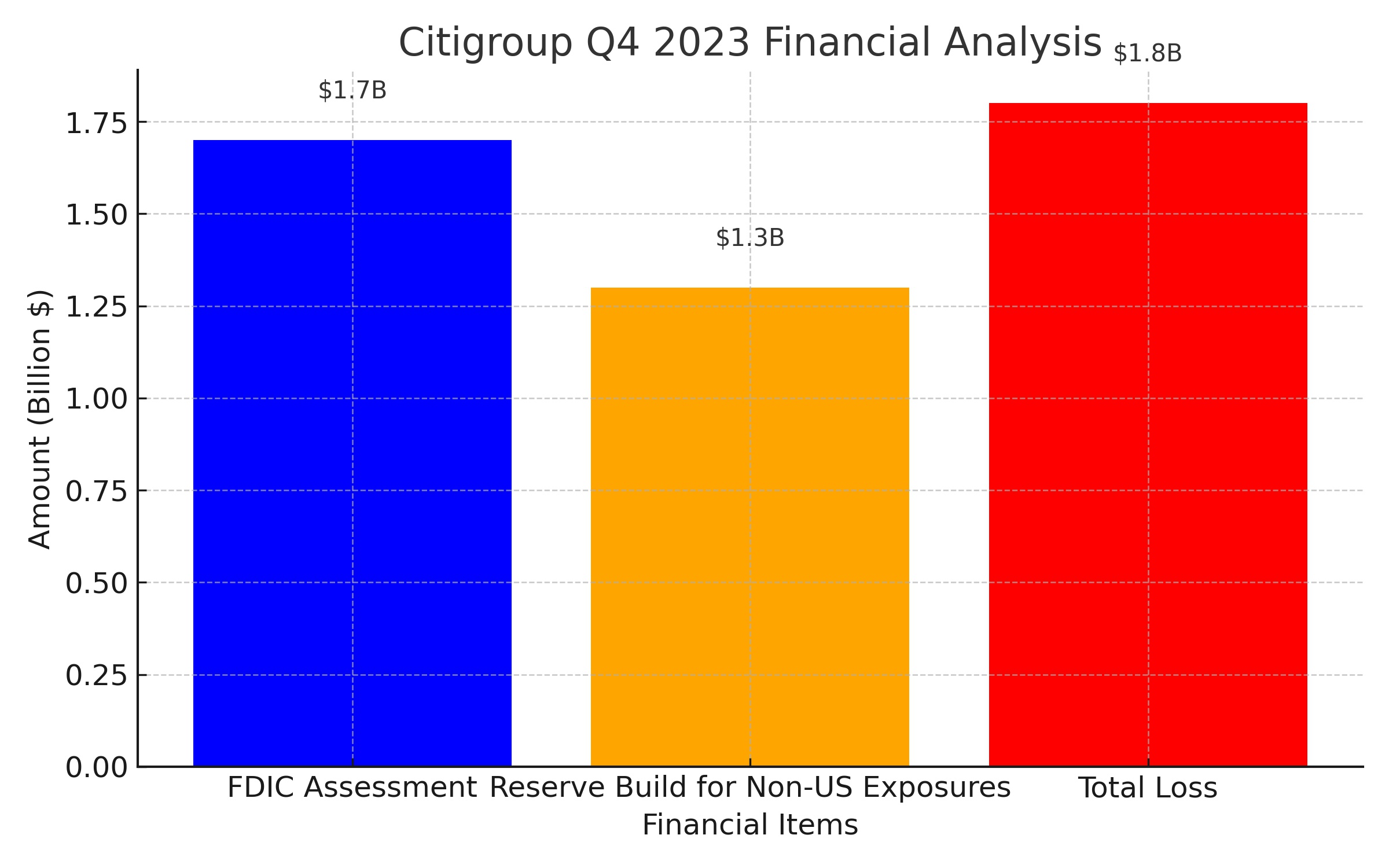

The Fourth Quarter Analysis: Challenges and Opportunities

Citigroup’s Q4 2023 results were marred by several non-recurring charges leading to a notable $1.8 billion loss. Major hits included a ~$1.7 billion FDIC assessment and a ~$1.3 billion reserve build for non-US exposures. Despite these setbacks, Citigroup’s commitment to a mid-term expense target of $51-53 billion (against ~$54 billion ex-one-offs) reflects a robust cost-management strategy.

Strategic Cost Management Initiatives

Citigroup is in the midst of a major reorganization, focusing on expense management and operational efficiency. The bank aims to streamline operations, with anticipated savings of $2-2.5 billion post-2024. This strategy aligns with their goal of achieving an 11-12% ROTCE by 2026.

Basel III Endgame and Its Implications

The Basel III regulatory framework presents both challenges and opportunities for Citigroup. Modifications to the Basel III Endgame could significantly benefit Citigroup’s capital management strategy, particularly in terms of share buybacks, given the bank’s current valuation discount.

Investment Perspective: Buffett's Endorsement and Market Outlook

Warren Buffett’s recent endorsement of Citigroup’s CEO Jane Fraser and her restructuring plans highlights the bank’s potential for a successful turnaround. Citigroup's stock, with a 40% rally off its 52-week low, still shows room for growth, supported by its inexpensive valuation and above-average dividend yield.

CLO Market Dynamics and Citigroup's Role

Citigroup's resumed activity in buying Collateralized Loan Obligations (CLOs) indicates a strategic move to capitalize on high-quality fixed-income assets. This trend is seen across major banks, including JPMorgan and Bank of America, as they navigate the changing landscape of the leveraged loan market and private credit.

Analyst Outlook and Shareholder Confidence

With a Moderate Buy consensus rating and a target price suggesting an 11.75% upside potential, analysts remain cautiously optimistic about Citigroup's future. The confidence shown by value investors like Edgar Wachenheim III, whose firm Greenhaven Associates increased its stake in Citigroup, further underlines this sentiment.

Citigroup’s Dividend Attractiveness

Citigroup’s dividend yield stands at an attractive 3.9%, outpacing its peers and the broader S&P 500. This, combined with a conservative dividend payout ratio, positions it as a solid dividend play in the banking sector.

Looking Ahead: Citigroup’s Prospects in the Banking Landscape

While Citigroup faces various challenges, including a potential interest rate cut by the Fed, its ongoing restructuring efforts, cost management initiatives, and Basel III leverage position it for potential re-rating in the stock market. The bank’s approach to navigating regulatory changes and capitalizing on market opportunities will be crucial in determining its trajectory in the upcoming years.

For real-time insights and detailed insider transaction information, interested parties can refer to Citigroup’s stock profile and insider transactions on Trading News.

This analysis refrains from a definitive conclusion as it aims to provide a comprehensive overview of Citigroup's current financial position, market perception, and future potential based on the latest available data and market trends.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex