Coca-Cola NASDAQ:KO A Detailed Financial and Strategic Analysis

Unveiling Coca-Cola's Market Stability, Financial Health, and Strategic Direction Amid Evolving Industry Trends | That's TradingNEWS

Analyzing Coca-Cola's Financial and Market Dynamics

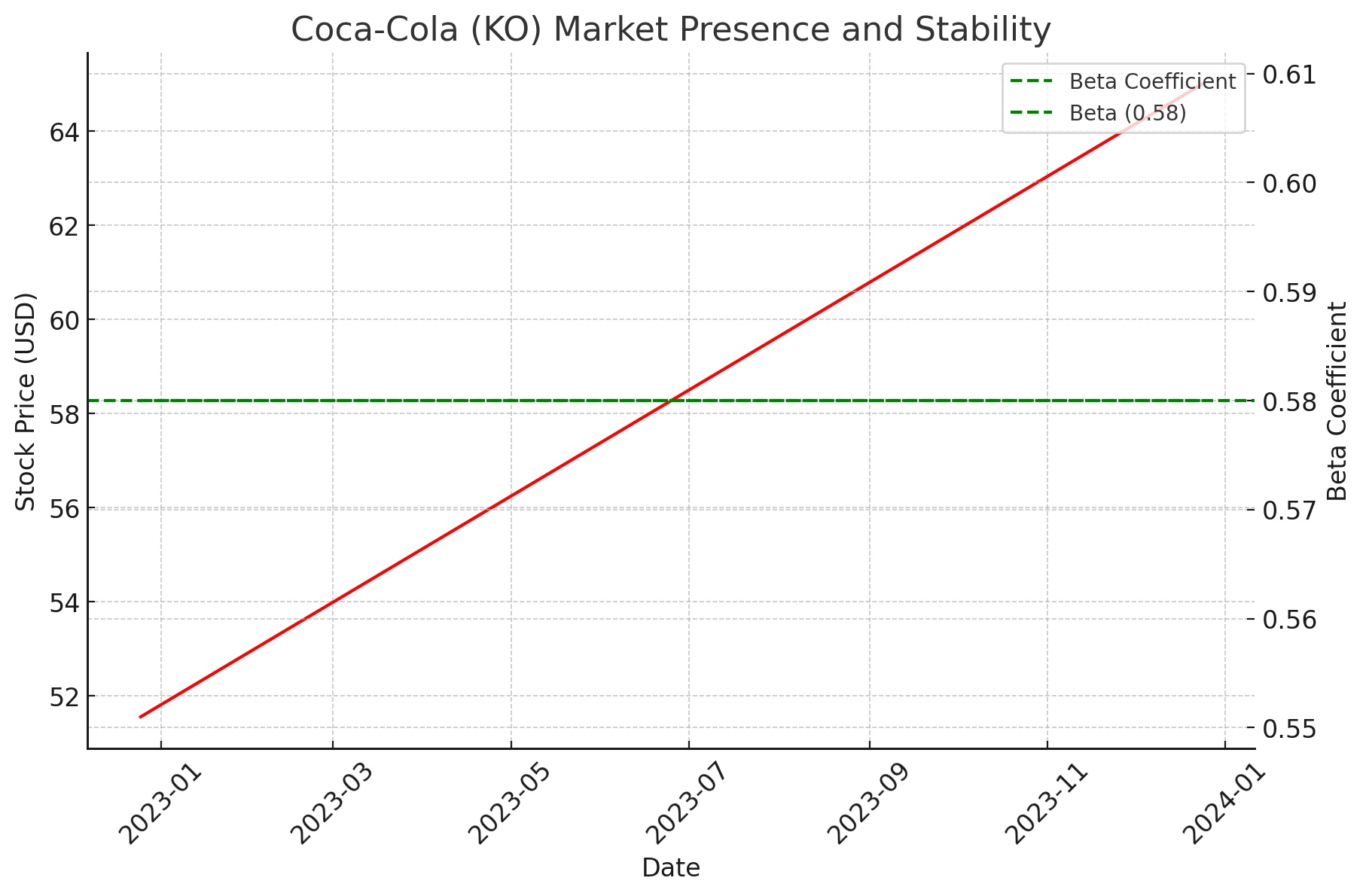

Market Presence and Stability

Coca-Cola (NASDAQ: KO) stands as a beacon in the beverage industry with a market capitalization of $253.853 billion, showcasing its significant impact on the NASDAQ. With a Beta of 0.58, the company manifests moderate market volatility. Coca-Cola's stock price oscillates between $51.55 and $64.99, reflecting an active engagement with market forces and investor sentiment.

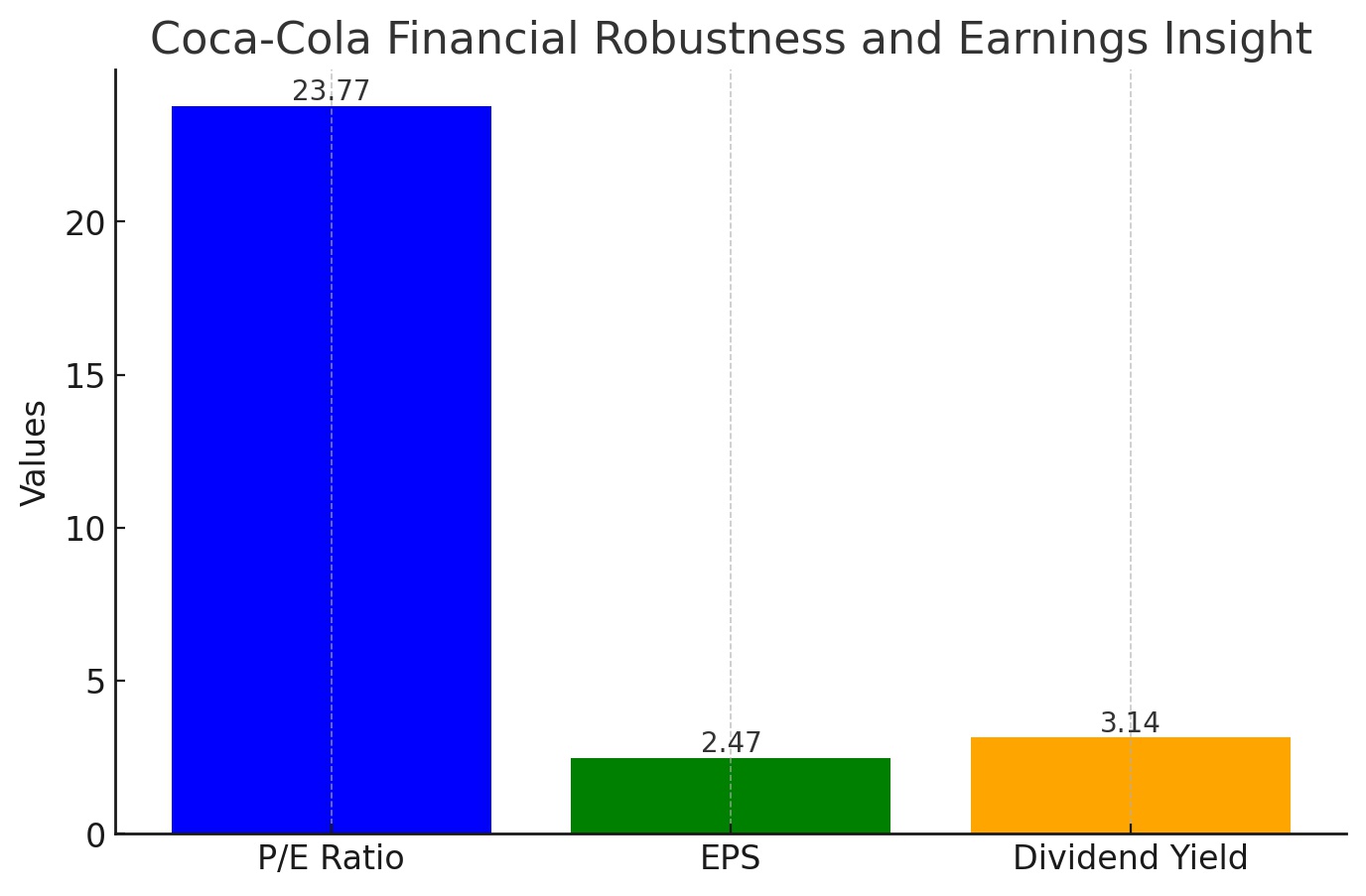

Financial Robustness and Earnings Insight

The financial health of Coca-Cola is illustrated by a trailing P/E ratio of 23.77 and an EPS of $2.47, indicative of strong profitability. The forward dividend yield of 3.14% emphasizes the company's strategic focus on sustainable growth along with shareholder value.

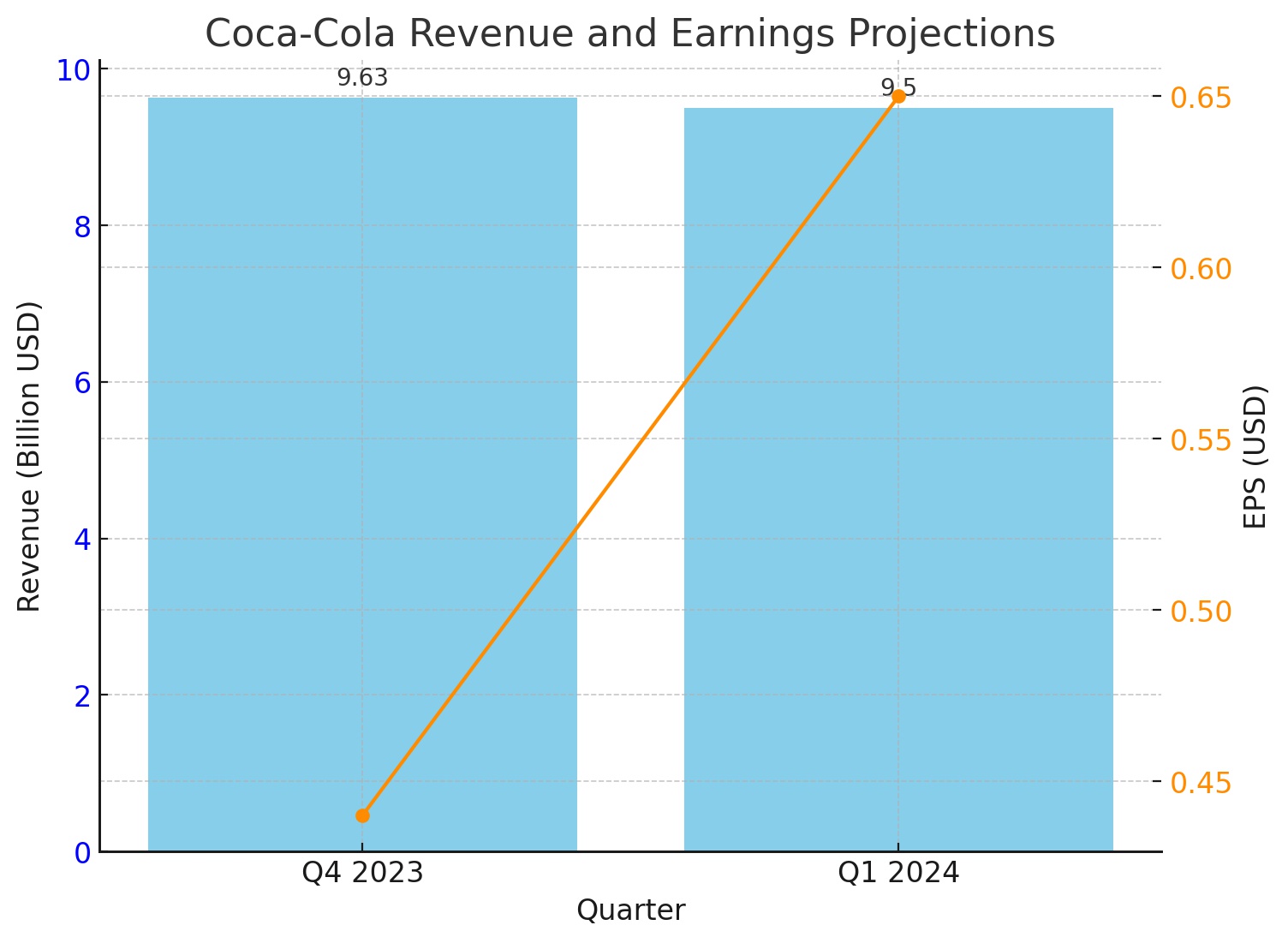

Revenue and Earnings Projections

Coca-Cola's near-term financial prospects suggest an EPS of $0.44 for the quarter ending December 2023 and $0.65 for the subsequent quarter, pointing to a fluctuating yet resilient earnings landscape. Revenue forecasts for the current quarter stand at $9.63 billion, with a slight reduction anticipated in the following quarter.

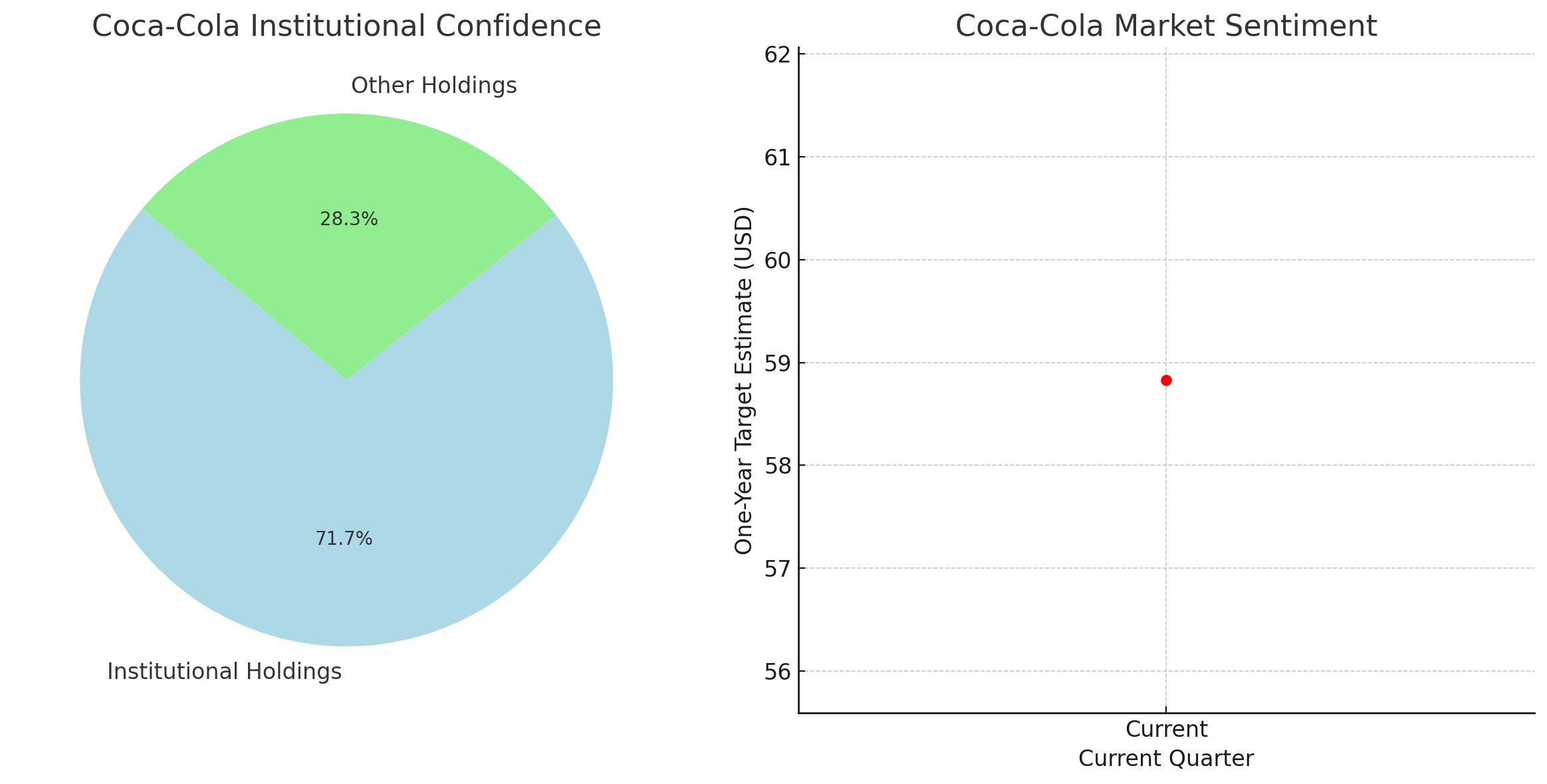

Institutional Confidence and Market Sentiment

The stock exhibits a robust backing with 71.73% held by institutions, underlining market confidence in Coca-Cola's strategic path. The one-year target estimate of $58.83 echoes a cautiously positive market outlook.

Trading Activity and Performance Metrics

Coca-Cola's market performance, while experiencing a 52-week change of -7.88%, remains vibrant in terms of trading activity, indicating its solid position in the market.

Profitability and Operational Efficiency

The company's profit margin stands at 23.92%, with an operating margin of 30.44%, signaling efficient management and strong profitability metrics. A return on equity of 41.22% further illustrates Coca-Cola's effective use of shareholder equity.

Growth Forecasts and Strategic Outlook for Coca-Cola (NASDAQ: KO)

Coca-Cola's growth trajectory presents a complex picture. Near-term projections indicate a potential dip in performance, likely a reflection of the current market volatilities and shifting consumer preferences. However, looking further into 2024 and beyond, there's an anticipation of recovery and expansion. This outlook suggests that Coca-Cola is poised to adapt and thrive in a beverage industry that is constantly evolving. The company's agility in strategy and innovation remains crucial as it navigates through these fluctuating market conditions.

Expanding Global Presence and Brand Strategy

Coca-Cola's global footprint is a testament to its enduring market relevance and strategic ingenuity. With a diverse portfolio that spans across multiple beverage categories, Coca-Cola has established a formidable presence in international markets. This wide-ranging geographic and product diversity not only cushions the company against market-specific risks but also provides a platform for growth in emerging markets. Coca-Cola's continued focus on innovation – whether through new flavors, health-conscious options, or eco-friendly packaging – is key to its ability to stay ahead in a highly competitive global market.

Addressing Industry Challenges and Competition

Coca-Cola is navigating a landscape riddled with challenges, ranging from the rising health consciousness among consumers to stiff competition within the beverage sector. To maintain its market lead, Coca-Cola is actively innovating, not only in its product lineup but also in its marketing and distribution strategies. The company's response to these challenges, particularly in addressing the demand for healthier options and sustainable practices, will be crucial in determining its future trajectory. Additionally, Coca-Cola’s ability to effectively compete with both established giants and emerging players in the industry will be pivotal in sustaining its market dominance.

Financial and Operational Resilience

Delving deeper into Coca-Cola's financials, the company has demonstrated resilience in maintaining robust profitability metrics. A profit margin of 23.92% and an operating margin of 30.44% underscore its efficiency in converting revenue into profit. Furthermore, Coca-Cola’s Return on Equity (ROE) of 41.22% is indicative of its effective capital management and profitability from shareholders' investments.

Investment in Digital Marketing and Product Innovation

Coca-Cola has notably increased its investment in digital marketing, allocating 60% of its total media spending to digital platforms in 2023, up from 30% in 2019. This strategic shift not only enhances brand engagement but also provides a more measurable return on investment. The company’s focus on product innovation, particularly in low or no-calorie segments, aligns with the global trend towards health and wellness. Products like Coke Zero symbolize Coca-Cola’s commitment to adapting to consumer preferences.

Revenue Growth Amidst Market Fluctuations

Coca-Cola's revenue performance, particularly the 8% increase to $11.95 billion in Q3 2023, surpassing analysts' expectations, is a strong indicator of the company's market resilience. This growth, fueled by innovative strategies and a strong global presence, has been achieved despite challenges such as currency fluctuations and evolving consumer tastes.

Adapting to Economic and Health Trends

Coca-Cola is also navigating broader economic trends, such as the fluctuation in consumer spending power due to inflation and interest rate changes. Additionally, the company is attuned to health trends, which are increasingly influencing consumer choices in the beverage industry. Coca-Cola’s approach to these macroeconomic and health-related factors will be crucial in shaping its future growth and market position.

Conclusion and Investor Considerations

Investors considering Coca-Cola's stock must weigh these multifaceted aspects. The company's strong fundamentals, global presence, and strategic adaptability present a solid investment case. However, the dynamic nature of the market and evolving consumer preferences call for a nuanced investment approach. For a comprehensive analysis and up-to-date insider transaction details, investors should refer to Coca-Cola's real-time chart and stock profile on TradingNews.com.

Read More

-

SCHD ETF Holds Ground With 3.6% Yield as Dividend Investors Eye Stability Over Growth

15.10.2025 · TradingNEWS ArchiveStocks

-

Ripple XRP (XRP-USD) Steadies at $2.43- SEC Shutdown Freezes ETF Decisions, Inflows Hit $61.6M

15.10.2025 · TradingNEWS ArchiveCrypto

-

NG=F Falls to $2.99 as Record Supply Outpaces Demand Despite 16.9 Bcf/d LNG Exports

15.10.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Weakens to 151.30 Amid Dollar Selloff

15.10.2025 · TradingNEWS ArchiveForex